The Florida Real Estate Commission (FREC)

The Florida Real Estate Commission (FREC) regulates education requirements for real estate agents in Florida. The Florida Department of Business and Professional Regulation (DBPR) oversees the FREC and takes care of the licensing and registration of real estate agents.

Who licenses realtors in California?

The California Department of Real Estate

The California Department of Real Estate exists to serve the real property market and protects the transactions occurring in the real estate field. The DRE grants licenses to Real Estate Brokers and Salespersons.

Who licenses real estate agents in New York?

The New York State Department of State

People who sell real estate in New York need a license. This license is from the New York State Department of State (NYSDOS).

How do I get my VA real estate license?

To earn your real estate license in Virginia, you must be at least 18 years of age, complete 60 hours of approved education, pass the Virginia real estate salesperson licensing exam, complete fingerprinting and a background check, and apply for a state license.

How do I get my real estate license in Florida?

The Florida Real Estate Commission (FREC) requires completion of the following steps in order to receive a Real Estate Salesperson License in Florida.

- Complete 63 Hours of Approved Education.

- Pass the Course Final Exam.

- Submit Fingerprints.

- Complete the Licensing Application.

- Pass the Florida Real Estate Exam.

How do I get people to invest in my real estate?

1. Communicate Effectively

- Implementing well-designed email campaigns to educate your potential investors.

- Consistent posts on social media promoting your business.

- Regular insights on the changing market trends.

- Periodic financial reports of the ongoing deals.

- In-time information about the upcoming real estate deals.

Invest some time finding the right real estate agent and make sure to always check their license status at https://t.co/nKJGkfTTVF.

— California Department of Real Estate (@CA_DRE) October 16, 2023

Find more homebuying tips through First Home - California at https://t.co/lOssbBDzWa pic.twitter.com/6uQi8CgldS

Who are the best real estate investors?

The 8 Biggest Real Estate Investors in America

- Donald Bren. Net Worth. In the first quarter of 2021, Donald Leroy Bren's net worth was $12.4 billion.

- Stephen Ross. Net Worth.

- Sun Hongbin. Net Worth.

- Leonard Stern. Net Worth.

- Neil Bluhm. Net Worth.

- Igor Olenicoff. Net Worth.

- Jeff Greene. Net Worth.

- Sam Zell. Net Worth.

What are 3 ways real estate investors make money?

Let's dive in and see how you, too, can become a lucrative real estate investor.

- Leverage Appreciating Value. Most real estate appreciates over time.

- Buy And Hold Real Estate For Rent.

- Flip A House.

- Purchase Turnkey Properties.

- Invest In Real Estate.

- Make The Most Of Inflation.

- Refinance Your Mortgage.

What is the common reason a property fails to sell?

The most common reason why a house fails to sell is because the asking price is too high for the current market or for what the home offers. If your asking price is unreasonable and doesn't compare favorably to similar properties, it's unlikely your house will sell.

Why is no one viewing my house?

Let's get straight to the biggest issue: In almost every case, the reason your house isn't getting showings is because it's priced too high. Again, the lack of interest has nothing to do with your home. It has to do with the price of the home compared to similar properties within your market.

What expenses can I write off on an investment property?

The nine most common rental property tax deductions are:

- Mortgage Interest.

- Property Taxes.

- Insurance Premiums.

- Real Estate Depreciation.

- Maintenance and Repairs.

- Utilities.

- Legal and Professional Fees.

- Travel and Transportation Expenses.

What qualifies for investment expense deduction?

If you itemize your deductions, you may be able to claim a deduction for your investment interest expenses. Investment interest expense is the interest paid on money borrowed to purchase taxable investments. This includes margin loans for buying stock in your brokerage account.

How much investment loss can you write off?

$3,000

If your net losses in your taxable investment accounts exceed your net gains for the year, you will have no reportable income from your security sales. You may then write off up to $3,000 worth of net losses against other forms of income such as wages or taxable dividends and interest for the year.

What happens if my expenses are more than my rental income?

If your rental expenses exceed rental income your loss may be limited. The amount of loss you can deduct may be limited by the passive activity loss rules and the at-risk rules. See Form 8582, Passive Activity Loss Limitations, and Form 6198, At-Risk Limitations, to determine if your loss is limited.

How are funds disbursed at closing?

The most common ways are by cashier's check or wire transfer. You can take payment by check in person at the closing or have it mailed to you or your REALTOR®.

What is the best way to receive money from the sale of a house?

Wire transfers are the most common way that sellers get paid after closing. If you choose a wire transfer, your closing agent will send the money directly to your bank within 24–48 hours of closing.

When you sell a house do you get all the money at once?

The full amount of the home's final price doesn't go right into your pocket. In fact, all in all, you might only realize only 60 to 70 percent of the home's value in net proceeds. Let's look at where the money goes, and how much you get to keep when you sell a home.

How long after closing is money wired?

A wire transfer can take between 24 to 48 hours to process but is usually available in your account within one business day. Meanwhile, a paper check could be available right at the time of closing but will need to be deposited and cleared, and a bank can often hold that deposit for up to seven days.

How are those funds disbursed?

'Disbursed funds' is referring to getting money from point A to point B, whether that point is an individual or an institution. With regards to consumer finance, this involves the transfer of money from the lender or bank to the merchant. The money is expected to be delivered within a fixed timeframe.

Who generally prepares closing statements?

Closing statements are prepared by closing agents, who help facilitate the sale of a property to a buyer. Typically, closing agents are real estate attorneys, title companies or escrow officers.

Why is the buyer usually responsible for the largest portion of closing costs?

The Bottom Line

Closing costs include various fees due at the closing or settlement of a real estate transaction. Buyers are responsible for most of the costs, which include the origination and underwriting of a mortgage, taxes, insurance, and record filing.

How much are closing costs on a $300000 house in Florida?

So What Is The Average Closing Cost? The simple overarching answer is that the average closing cost in Florida is 1.98% of whatever the final purchase price is. Since the average house in Florida is currently in the $200,000 to $300,000 range, that means the average range of closing costs is going to be $3960 to $5940.

Who usually pays closing costs in Texas?

Buyers and sellers

Who pays closing costs in Texas? Buyers and sellers both have closing costs to cover in Texas (as is the case in all states). Sellers absorb the bulk of the costs in most cases, including covering the commissions for both real estate agents involved in the sale.

Who typically prepares the closing statement at the closing of a real estate transaction?

A detailed cash accounting of a real estate transaction prepared by a broker, escrow officer, attorney or other person designated to conduct the closing, showing all cash received, all charges and credits made and all cash paid out in the transaction.

Can you sell real estate in Arizona without a license?

It is ok, for someone to sell their own property, it is ok for a buyer to buy that property, that is perfectly legal. What is not legal is those who represent themselves as being able to sell Real Estate in Arizona without a Real Estate License or Brokers License.

Do you need a real estate license to sell new homes in Colorado?

Do i need a real estate license in Colorado? A real estate license is required if you represent a seller or buyer of real property as an agent and earn a commission in the process. Note that you do not need a real estate license to buy or sell your own home.

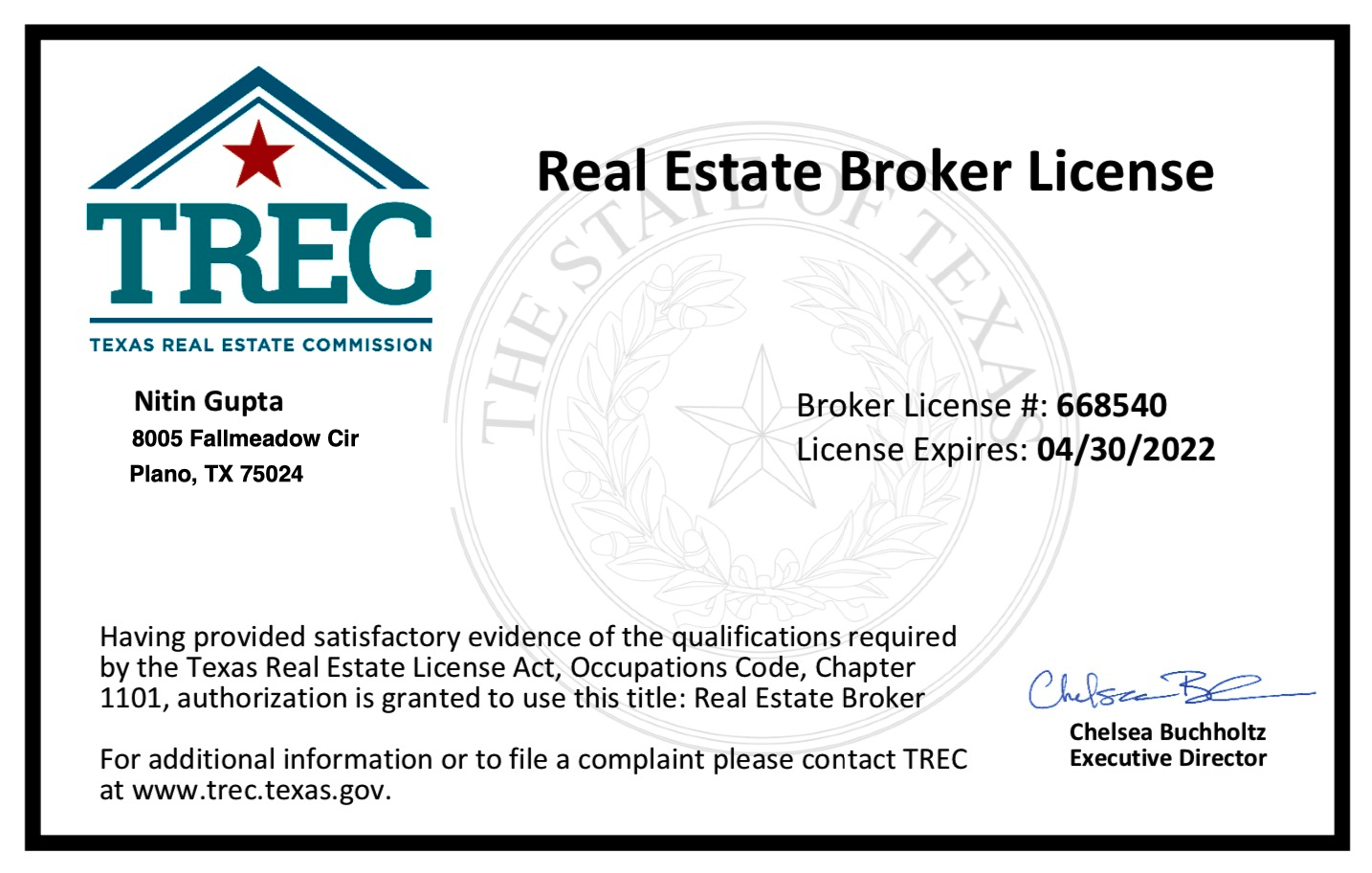

Do you have to be a licensed real estate broker or sales agent to sell real estate in Texas?

Whether you want to be a real estate agent or broker, if you want to buy and sell real estate in Texas, you'll need one of these real estate licenses.

Can I be my own real estate agent in Texas?

A real estate agent cannot work independently and must always sign up with a licensed brokerage to jumpstart their career.

Can you sell a house in Arizona without a realtor?

Can you sell a house without a realtor in Arizona? To sell your house yourself in Arizona, opt for a Flat Fee MLS company. Flat Fee MLS companies list your home on the MLS and help you sell your house by owner. Check out our rankings for the best Arizona Flat Fee MLS companies.

What are the biggest closing costs usually paid by buyers?

Origination fee (or service fee)

Most lenders charge an origination fee to cover service and administrative costs. This is typically the largest fee you pay to close your mortgage.

What are fees and charges associated with the purchase of a property?

Closing-cost fees when buying a house include appraisal and inspection fees, loan origination fees and taxes. There are also some potential ongoing fees associated with a home loan, like interest, private mortgage insurance and HOA fees.

Who typically pays closing costs in Florida?

Buyers

The costs can include fees for the title search, appraisal, and other services. They may also include charges for loan origination, document preparation, and insurance. In Florida, buyers are typically responsible for paying the closing costs. However, in some cases, the seller may agree to pay a portion of the costs.

Who typically pays closing costs in Arizona?

Sellers

Do sellers pay closing costs in Arizona? Yes, sellers pay their share of closing costs in Arizona (and in all states). In fact, sellers typically pay much more than buyers, because sellers are responsible for paying the real estate agents' commission fees.

What is the most expensive part of closing costs?

Buyers pay a long list of closing fees, all of which are itemized on the standard Loan Estimate you'll get from any lender. But the main (most expensive) fees to be aware of are: Loan origination fee or broker fee (0-1% of loan amount): A fee the lender or broker charges for its services.

Who pays taxes based on their property?

Property owners pay property tax calculated by the local government where the property is located. Property tax is based on the value of the property, which can be real estate or—in many jurisdictions—also tangible personal property. Improvements in water and sewer use the assessed taxes.

Are property taxes based on purchase price or assessed value in Florida?

The taxable value is the assessed value minus exemptions and is the value the tax collector uses to calculate the taxes due. The homestead exemption can result in exempting up to $50,000 of your home's assessed value from tax liability.

How are Texas property taxes calculated?

Texas levies property taxes as a percentage of each home's appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.

How are property taxes determined in New York?

Tax rates are calculated by local jurisdictions

The total amount of revenue is subtracted from the budget. The remainder is the amount that must be raised from all property owners within the municipality. This amount is referred to as the Tax levy.

Are taxes collected from owned property or real estate?

Real estate taxes are the same as real property taxes. They are levied on most properties in America and paid to state and local governments. The funds generated from real estate taxes (or real property taxes) are typically used to help pay for local and state services.

How do I prepare for a broker interview?

Showing up to the interview and with a warm, friendly personality will go further than you might think. You don't need the experience to become a real estate agent, so showing the brokerage that you're able to abide by the brokerage style, culture, and values will help you pass the interview.

What questions should I ask a real estate interviewer?

Interview Questions

- I am interested in Real Estate Sales (or Property Management).

- Is the company independent, corporate owned or a franchise?

- What is your market share?

- How many offices do you have?

- How many total agents?

- What kind of management & systems support do you have?

How do you introduce yourself in real estate interview?

How To Tell Your Own Story in a Real Estate Interview. Overall, the “Tell me about yourself” question is really an opportunity for you to tell your story, how you got to where you are today, why you're a great fit for the role, and where you hope to help the company go in the future.

What should I wear to a real estate broker interview?

For your interview, that means professional interview attire. Men will need to wear a well-fitting suit in a conservative color, white, or pastel shirt, conservative tie, dark socks, and dress shoes. Women can choose between a pant or skirt suit, blouse (not low cut), hosiery, and closed-toe pumps.

What questions are asked at a brokerage officer interview?

Interview Questions for Brokers:

- Describe a time when you advised a difficult client.

- How do you manage to keep up-to-date with information for clients?

- How do you build trust with your clients?

- How do you assist a client in deciding what is best for him or her?

What is a good budget for an apartment?

Try the 30% rule. One popular rule of thumb is the 30% rule, which says to spend around 30% of your gross income on rent. So if you earn $3,200 per month before taxes, you should spend about $960 per month on rent.

What is the average apartment rent in the US?

The average rent for an apartment in the U.S. is $1,702. The cost of rent varies depending on several factors, including location, size, and quality.

How much is a New York apartment?

Average Manhattan, New York Apartment Prices (Condo)

The average sale price for a condo ranges from $967,979 for a studio apartment to $10,620,414 for 4+ bedroom apartments. Meanwhile, the average price per square foot ranges from $1,380 for a studio to $2,959 for 4+ bedroom apartments.

Where are rent prices highest?

The most expensive rental market in the US remains to be New York. The average monthly rent for a one-bedroom is roughly $3,260. This is about a $500 decrease from 2021, however as demand continues to increase prices are likely to follow.

Is $2000 too much for an apartment?

Say you stick to the 30% rule or 40x the monthly rent, you would need to earn at least $80,000 annually to afford $2,000 per month in rent. “Typically, 30% of gross income is considered to be the boundary of affordability.