But it's the advantages of being in your 30s and 40s — the ability to secure credit, the professional influence, a work experience that can reduce the small-business learning curve — that makes starting a real estate career at this time an often perfect choice. This all depends on what your exact financial goals are.

Is it too early to talk to a realtor?

In many ways, there's no specific time to start your real estate search. If you have your financing worked out and a firm idea of exactly where you want to look, you may be able to begin working with an agent just a few weeks before you're ready to make a deal.

What months are best for real estate?

January has the lowest median sales price at closing and stays on the market the longest = the best time to buy a home. February is also a great time to buy a house as well. Conversely, June is the worst month to buy a property due to its highest median sales price at closing and shortest days on market.

What is the busiest time of year for realtors?

As we've talked about, the summer months are busiest for real estate and they usually have the highest units sold on the market. The sale prices are the highest in the summertime and the house prices start to go down in fall and pick back up in the next spring.

Is 30 too old to start real estate?

You're never too old for a new beginning! You'll find that the real estate world is full of people who are willing to help you reach your goals. We also have plenty of resources that are geared toward helping you get started. Click here to read our blog that outlines how to network with other real estate agents.

How does a beginner invest in real estate?

You can invest $10,000 dollars in real estate by flipping houses, becoming a landlord, crowdfunding sites, REITs, and more. Most real estate investing platforms require less than $10,000 to start investing in single-family rental properties, individual properties, and venture funds.

If you can't afford the payment on a 15-year, fixed-rate mortgage, you can't afford the house.

— Dave Ramsey (@DaveRamsey) April 29, 2022

If an agent is trying to convince you to buy a home you can't afford, you need a new agent.

Get in touch with one that my team TRUSTS to treat you right. https://t.co/69cGgbcV44

How to invest $5,000 dollars in real estate?

Below are 7 strategies you can use to actively invest in real estate with $5,000.

- Buy an inexpensive primary residence.

- Find a property with seller financing.

- Buy property with a partner.

- Find a hard money lender.

- Borrow money from friends and family.

- Become a wholesaler and bring buyers and sellers together.

How much money should I save before investing in real estate?

A good number to shoot for when saving for a house is 25% of the sale price to cover your down payment, closing costs and moving expenses. (This amount is separate from saving up 3–6 months of your typical living expenses in a fully-funded emergency fund—which I recommend you do first, before saving up for a home.)

How do you organize a real estate office?

How to Stay Organized as a Real Estate Agent

- Get rid of all the clutter.

- Make a habit of documenting everything.

- Never forget to make a paper copy and a digital copy.

- Use a good quality CRM.

- Use technology to your advantage.

- Organize your time effectively.

How do you build a real estate client base?

How to Build Your List of Real Estate Clients

- Ask Your Friends and Family. Of course, you know people, but no one you know needs or is selling a house.

- Invest in Direct Mail Marketing. Direct mail marketing isn't dead.

- Create a Website.

- Get Listed.

- Focus on Your Former Clients.

- Network.

- Be a Referral Source.

- Be Thankful.

Is it better to rent or buy when first moving out?

There is no definitive answer as to whether renting or owning a home is better. The answer depends on your own personal situation—your finances, lifestyle, and personal goals. You need to weigh out the benefits and the costs of each based on your income, savings, and how you live.

What happens to your mortgage when you sell your house and don t buy another?

The biggest point to remember when considering what happens to your mortgage when you sell your house is that the debt doesn't disappear when you sell the home. You'll still owe the money, even if you're planning on using the proceeds from the sale of your home to pay off the mortgage.

Should I sell my house before moving abroad?

If you sell your home, you'll get a lump sump of cash that you can use to buy a home in your new country. It's challenging for foreigners to get a mortgage in many other countries, so being able to pay cash will greatly expand your options.

Is it smarter to rent or buy?

If you and your family do not plan to stay where you are longer than 3 years, you would be better off renting for now according to most experts. If you are not sure, the pointer still leans toward renting. If you are committed to at least 3 to 5 years or more, it's probably in your interest to look into buying.

What is the meaning of in-house sale?

In-house Sale is a sale where there is only one broker involved in the transaction. There is no outside broker involved, as in a cooperative sale.

Can you sell a house as is in Maryland?

Whether you choose to list “as is” with a real estate agent or work with a direct home buyer, a home doesn't have to be in perfect condition to sell — so long as you provide disclosures as necessary, set the right price, and know what to expect going in.

Can you sell a house as is in Illinois?

Illinois still requires the seller to disclose material defects even if the house is being sold “as-is.” However, an “as-is” sale indicates that, while the seller is disclosing defects, they will not be fixing, remodeling, or remediating the defects as part of the negotiation process.

Can you get a loan on a house that is as is?

So, to qualify for most mortgage loans, a home must meet what's known as minimum property requirements (MPRs). MPRs are standards that determine whether a house is safe to live in at the time of purchase. “As-is properties may not qualify for government-insured loans like FHA or VA,” cautions Brook.

What is an example of an in house sale?

A transaction where the closing occurs within the home being sold. Kim represented the buyer and Tim represented the seller in the same transaction. Kim and Tim work for the same brokerage.

How do I sell my house by owner in Michigan?

To sell your house yourself in Michigan, opt for a Flat Fee MLS company. Flat Fee MLS companies list your home on the MLS and help you sell your house by owner. Check out our rankings for the best MichiganFlat Fee MLS companies.

How do I sell my house by owner in Wyoming?

How To Sell A House In Wyoming (Without A Realtor)

- Scope Out the Competition (Be A Nosey Neighbor)

- Give Wyoming Buyers What They Want.

- Analyze Wyoming's Real Estate Market Data for a Correct Listing Price.

- Make Sure Your Real Estate Photographs Don't Suck.

- Your Secret Weapon (Wyoming Flat Fee MLS Listing Companies)

Can I sell my house without a realtor in NJ?

Deciding to sell your home without an agent in New Jersey means you won't have to pay the average New Jersey listing commission of 2.63%. This works out to $12,950 on a typical New Jersey home. However, selling your home on your own, also known as selling for sale by owner (FSBO), can be an overwhelming task.

How do I sell my house by owner in Ohio?

Steps to sell a house by owner

- Prepare your house for sale.

- Do the homework necessary to set a competitive price.

- Photograph your home.

- Create a detailed, compelling listing.

- List your home online.

- Market your home.

- Manage showings.

- Evaluate offers and negotiate a deal.

Does the seller pay closing costs in Michigan?

In Michigan, sellers typically pay for the title and closing service fees, transfer taxes, and recording fees at closing. Optional costs for sellers include buyer incentives, pro-rated property taxes, or for an attorney. Buyers, on the other hand, pay for things like mortgage, appraisal, and inspection fees.

How do I make a good real estate company?

Have good time management.

- Get a CRM. At the end of the day, a business is a system.

- Craft your ideal personal plan.

- Write a real estate business plan.

- Build a consistent marketing plan.

- Get a website.

- Prospect consistently.

- Nurture leads.

- Have good time management.

How do I make my real estate company stand out?

Here are some practical tips that you can work with to achieve this goal:

- Find Your Niche.

- Create an Influential Online Presence.

- Be Realistic with Your Clients.

- Identify Your Uniqueness.

- Advertise and Promote Yourself with Creativity.

- Become a Community Leader.

- Final Thoughts Standing Out as a Real Estate Agent.

What are 3 good things about real estate?

- You Could Earn Passive Income.

- You May Enjoy Tax Benefits.

- Your Property May Appreciate In Value.

- You Have The Potential To Build Capital.

- You Could Have More Protection From Inflation.

- You May Be Able To Finance Your Property.

- You May Be Able To Choose Your Level Of Involvement.

How would you like to run a real estate company?

How to start a real estate business

- Get necessary licenses and certification.

- Create a business plan.

- Conduct market research.

- Organise your finances.

- Choose the most suitable legal entity.

- Get business insurance.

- Choose your business location.

- Develop a marketing plan.

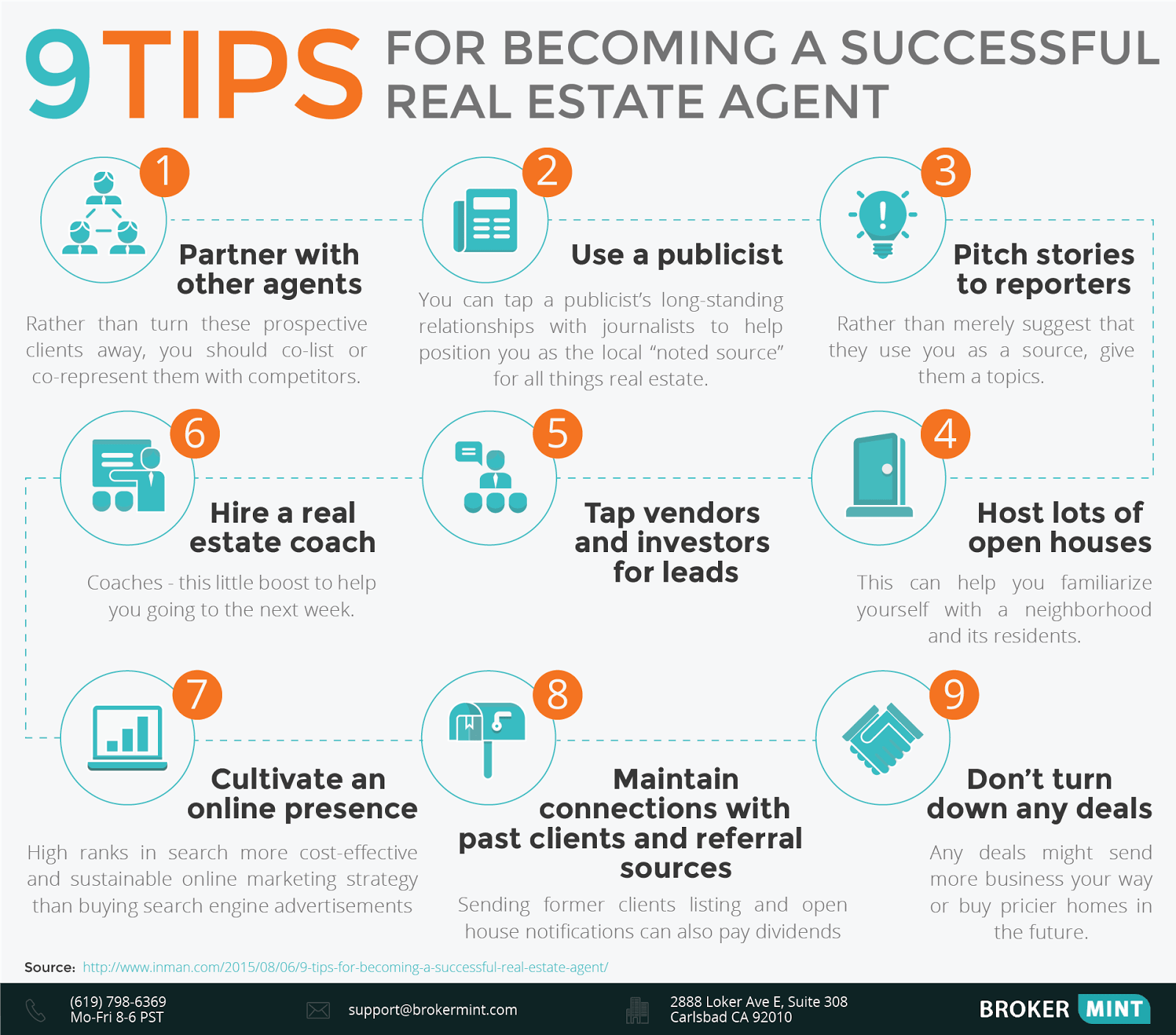

How can I improve myself as a real estate agent?

How To Become A Successful Real Estate Agent In 10 Steps

- Be Available.

- Set Goals.

- Have a Marketing Plan in Place.

- Become an Expert in Your Market.

- Build Relationships.

- Ramp Up Your Social Media Efforts.

- Implement Small Business Systems.

- Don't Only Focus On Selling.

How do I manage my rental property from afar?

Table of Contents

- Find trustworthy tenants.

- Enforce strict lease terms.

- Establish clear communication.

- Make friends with local service providers.

- Insure your remote rental property.

- Inspect your remote rental property.

- Learn local laws and regulations.

- Set up an automated payment system.

How do you break even rental property?

In finance, the break-even ratio compares your property's gross income to its total expenses. It tells you the rental occupancy rate you need to have in order to break even on your investment, and it lets lenders and other investors assess the ability of the property to cover expenses, service debt, and offer a profit.

How do I manage a short term rental from afar?

Let's take a look at 12 ways to manage vacation rentals remotely:

- Create a Lockdown Plan.

- Get Vacation Rental Management Software.

- Automated check-in and check-out.

- Home Automation Systems.

- Home Security.

- Keep a List of Quality Contractors.

- Find a reliable housekeeper or cleaning service.

- Consider Hiring a Property Manager.

What is the 1 rule for rental property?

How the One Percent Rule Works. This simple calculation multiplies the purchase price of the property plus any necessary repairs by 1%. The result is a base level of monthly rent. It's also compared to the potential monthly mortgage payment to give the owner a better understanding of the property's monthly cash flow.

How much rental income to break-even?

Lenders typically prefer a break-even ratio of 85% or less in order to provide a reasonable financial cushion for the borrower should expenses increase or the property's occupancy rate fall unexpectedly.

How do you report the sale of a house on your tax return?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

How do I avoid capital gains on sale of primary residence?

Eligibility: To be eligible for the exclusion, you must have owned and used the property as your primary residence for at least 2 of the 5 years preceding the sale.

How does IRS know you sold property?

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

How does IRS verify cost basis?

How Does the IRS Verify Cost Basis in Real Estate? In real estate transactions, the IRS can verify the cost basis by looking at the closing statement of when the property was purchased, or any other legal documents associated with the property, such as tax statements.

Is the sale of a house considered taxable income?

Capital gains taxes can apply to the profit made from the sale of homes and residential real estate. The Section 121 exclusion, however, allows many homeowners to exclude up to $500,000 of the gain from their taxable income. Homeowners must meet certain ownership and home use criteria to qualify for the exemption.

Can I claim rent I pay to my parents?

Short answer is yes to the first question. Income Tax Act does not prohibit payment of rent to one's parents. You can pay the rent to them to claim HRA. To avoid any income tax issues, deal with the same as you would deal with a third party landlord.

At what point does the IRS consider a residence is rented?

Rental Property / Personal Use

You're considered to use a dwelling unit as a residence if you use it for personal purposes during the tax year for a number of days that's more than the greater of: 14 days, or. 10% of the total days you rent it to others at a fair rental price.

Is sharing living expenses considered income?

If you are charging rent for the apartment, then it would be income to you. Thanks - for it to be rental income, he would pay you a fixed amount and for any utilities, etc. But, if you are both paying the expenses, shared, it is just personal expenses.

Is rental income from a personal residence taxable?

If you rent part of your main home, you must claim any rental income. As with renting a second home, rental income includes any amount a tenant pays you. However, deducting expenses for partially renting your home can be a bit trickier.

Do I have to report rental income from a family member IRS?

Thus, you would have to report all of the rent you receive in income, but none of your expenses for the home would be deductible.

Which Pennsylvania commission administers and enforces laws regarding licensed real estate activities?

The Real Estate Commission

The Real Estate Commission grants and renews licenses to persons who bear a good reputation for honesty, trustworthiness, integrity and competence to transact the business of broker, salesperson, cemetery broker, cemetery salesperson, campground membership salesperson, time-share salesperson, builder-owner salesperson ...

What are the continuing education requirements for real estate license in Florida?

Real Estate Licensees are required to complete 14-hours of approved Continuing Education courses and end of course exams (distance Education Courses only). Unlike the Pre and Post Licensure course content, the Continuing Education requirements for Sales Associates, Brokers and Broker Associates are identical.

What are the continuing education requirements for PA real estate commission?

The Pennsylvania Real Estate Commission requires 14 hours of continuing education for salespersons' first, second, and subsequent renewals, as well as for brokers' renewals. When it's time to renew your salesperson or broker real estate license, Kaplan Real Estate Education is the best real estate school to choose.

What is the Arkansas Real Estate Commission post license classroom hour requirement for a new salesperson or broker?

18 classroom hours

Post-License Guidelines

The AREC post-license requirement for a new salesperson is 18 classroom hours and must be taken by the end of the month six (6) months* after the date the individual was initially licensed.

Which entity enacts rules addressing professional conduct and standards of practice for real estate licensees in Tennessee?

Created in 1951, The Tennessee Real Estate Commission licenses, registers and regulates real estate brokers and affiliate brokers, real estate firms, rental location agents, time-share salespersons and developments, vacation clubs and vacation lodging services.