At what point is commission traditionally considered earned? When a ready, willing, and able buyer is found. This is meant to mean when the buyer has agreed to all sellers terms or the seller has agreed to the buyers counter offer.

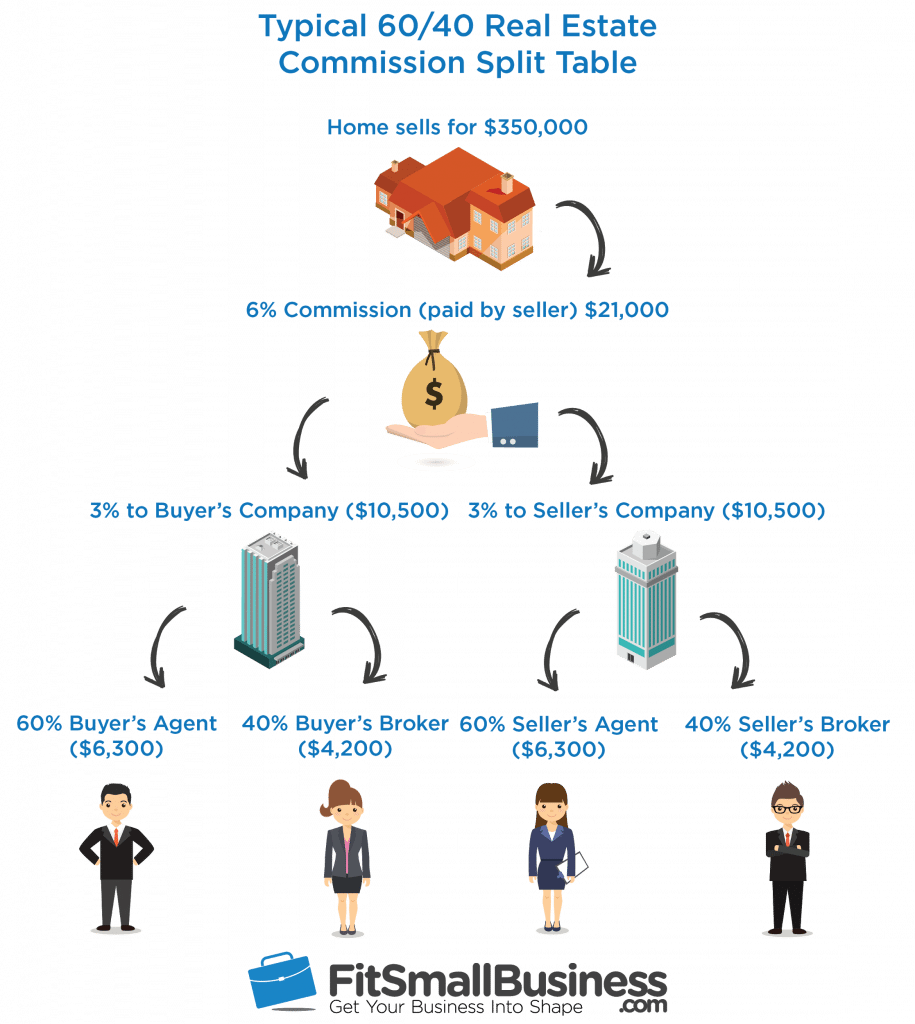

What is the 60 40 commission split?

For example, a 60/40 pay mix would be a 60/40 base to commission split, which means that 60% of OTE compensation is fixed base salary, and 40% of OTE compensation is Target Incentive (TI), or variable pay.

What type of clause allows a broker to collect a commission for some period of time after the listing expires?

Safety protection clause

– A safety clause, also known as a safety protection clause or extender clause, is a provision in a listing agreement that allows the listing broker to still receive their commission fees if the property sells to a buyer they procured within a specified period after the listing expires.

Which clause allows a broker to sue for a commission?

Safety protection clause

A safety protection clause entitles a real estate broker to a commission if a sale occurs after the listing agreement expires. This protects the broker from collusion between sellers and buyers to save the seller the cost of real estate commission.

What is the rule of commission?

Rules of the commission means any and all rules, regulations, policies, procedures, public notices and orders of the Commission that are in effect at the time an action, event or matter in question occurs.

What to do after passing GA real estate exam?

6 steps to take after you pass your real estate exam

- Step 1: Find a sponsoring broker who is a good fit.

- Step 2: Engage in professional real estate organizations.

- Step 3: Build your professional profile.

- Step 4: Set a timeline for yourself.

- Step 5: Budget for future plans.

Since when do tenants get a right of reply to landlords / real estate agents putting them on secret blacklists? https://t.co/Sv7gfArfDe

— kristin (she/her) (@kristin8X) September 22, 2023

What to do after passing NJ real estate exam?

New Jersey

Congratulations on passing the state real estate licensing exam. Start interviewing with New Jersey Managing Brokers right away. You'll also need to schedule fingerprints for a background check. At this point, you'll have less than one year to be hired and submit your license application.

How many people pass GA real estate exam first try?

The passing rate for the Georgia Real Estate Salesperson Exam is 72%. This test is purposefully difficult, but not impossible.

How do you calculate tax basis in real estate?

To find the adjusted basis:

- Start with the original investment in the property.

- Add the cost of major improvements.

- Subtract the amount of allowable depreciation and casualty and theft losses.

How do you calculate capital gains tax on the sale of a home?

Capital gain calculation in four steps

- Determine your basis.

- Determine your realized amount.

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference.

- Review the descriptions in the section below to know which tax rate may apply to your capital gains.

What is the role of the real estate commissioner?

The Real Estate Commissioner, who is appointed by the Governor, is the chief executive of the Department of Real Estate. To facilitate the administration and enforcement of the Real Estate Law and the Subdivided Lands Law, the Commissioner is empowered by law to issue regulations.

What is the main purpose of the DRE?

DRE Mission Statement

To safeguard and promote the public interests in real estate matters through licensure, regulation, education and enforcement.

What regulatory authority does the Washington Real Estate Commission have?

Every firm must have a designated broker. What regulatory authority does the Washington Real Estate Commission have? The Washington Real Estate Commission has NO regulatory authority. Instead, it serves to provide industry-specific advice to the DOL and to assist in implementing licensing rules & regulations.

What is the role of the real estate commissioner quizlet?

The law is enforced by the chief officer of the DRE, the Real Estate Commissioner. The Real Estate Commissioner's job is to implement and enforce the provisions of the Real Estate Law in a way that will provide the maximum protection possible to members of the public who deal with real estate licensees.

How would you calculate the transfer tax?

California's Revenue and Taxation Codes calls for the payment of a County Documentary Transfer Tax on the value of all real property of which ownership is being transferred. All counties have the same tax amount, which is 0.11% of the value. The value is rounded up to the nearest $500 and then the percentage applied.

How is NYS real estate transfer tax calculated?

The combined NYC and NYS Transfer Tax for sellers is between 1.4% and 2.075% depending on the sale price. Sellers pay a combined NYC & NYS Transfer Tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less.

What is an example of a transfer tax?

Examples of such taxes include some forms of stamp duty, real estate transfer tax, and levies for the formal registration of a transfer. In some jurisdictions, transfers of certain forms of property require confirmation by a notary.

What is a transfer tax quizlet real estate?

Transfer Taxes. Taxes imposed upon the gratuitous disposition of private property. Estate Tax. Tax levied on the transmission of properties from a decedent to his heirs. The tax is measured by the value of the property AT THE TIME OF DEATH.

What is the formula for transfer cost?

Transfer Price = Outlay Cost + Opportunity Cost

The cost of making one hat is $2. That division can sell the hat in the marketplace for the market price of $5. Therefore, the opportunity cost of selling the hat internally instead of externally is $3. The transfer price would then be $5.

How do I sell my house by owner in Ohio?

Steps to sell a house by owner

- Prepare your house for sale.

- Do the homework necessary to set a competitive price.

- Photograph your home.

- Create a detailed, compelling listing.

- List your home online.

- Market your home.

- Manage showings.

- Evaluate offers and negotiate a deal.

How do I sell my house by owner in Michigan?

To sell your house yourself in Michigan, opt for a Flat Fee MLS company. Flat Fee MLS companies list your home on the MLS and help you sell your house by owner. Check out our rankings for the best MichiganFlat Fee MLS companies.

How do I sell my house by owner in Iowa?

How To Sell A House In Iowa (Without A Realtor)

- Scope Out the Competition (Be A Nosey Neighbor)

- Give Iowa Buyers What They Want.

- Analyze Iowa's Real Estate Market Data for a Correct Listing Price.

- Make Sure Your Real Estate Photographs Don't Suck.

- Your Secret Weapon (Iowa Flat Fee MLS Listing Companies)

Can I sell my house without a realtor in NJ?

Deciding to sell your home without an agent in New Jersey means you won't have to pay the average New Jersey listing commission of 2.63%. This works out to $12,950 on a typical New Jersey home. However, selling your home on your own, also known as selling for sale by owner (FSBO), can be an overwhelming task.

Can you sell your house without a realtor in Ohio?

You can sell your own home without hiring a real estate agent. Ohio law allows you to buy and sell your own real estate without hiring an agent. You can market it yourself, put it on a listing service through a flat fee brokerage, create flyers and distribute those as you desire.

Is $2000 a month enough for an apartment?

How much do you need to earn to afford $2,000 rent each month? Say you stick to the 30% rule or 40x the monthly rent, you would need to earn at least $80,000 annually to afford $2,000 per month in rent. “Typically, 30% of gross income is considered to be the boundary of affordability.

How much should you spend on monthly rent?

Use the 30% Rule

The 30% rule states that you should try to spend no more than 30% of your gross monthly income on rent.

Is $1,000 a month too much for rent?

It's a bit over the recommended 30% of your income. If your rent includes utilities you might be ok. If you're having to pay for heat, internet, etc on top of the rent it could be really tight. Sit down and list all your expenses for the month and see how much excess you have that can be put in savings.

Is $1,500 rent too much?

Take rent for example. The traditional advice is simple: Spend no more than 30% of your before-tax income on housing costs. That means if you bring in $5,000 per month before taxes, your rent shouldn't exceed $1,500.

Can you live on $1000 a month after rent?

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

Where do real estate brokers make the most money?

Real estate agents in high cost of living cities such as New York and San Francisco tend to be the highest earners.

What is the best location for real estate agent?

5 Best Cities for Real Estate Agents

- Austin, Texas. Austin is Texas' trendy capitol city, bustling with suburban and urban areas for young professionals.

- Las Vegas, Nevada.

- Tampa, Florida.

- Raleigh, North Carolina.

- Phoenix, Arizona.

What is the best major for a real estate broker?

Popular majors for future real estate agents include marketing, finance, accounting, psychology, and business. Even though going to college isn't required, you may find it helpful to complete a degree or certificate program to gain knowledge that would help you succeed as a real estate agent.

What state has the most successful realtors?

Best States for Real Estate Agents to Grow and Succeed

- Texas. Texas is the largest state in both area and population and has a lot of room for growth.

- Florida. Florida is a great place to sell real estate because it has a large population and home sales.

- New Jersey.

- Illinois.

- 5. California.

- Colorado.

- Arizona.

What is the #1 best paying job?

Get Matched!

- Anesthesiologist. #1 in Best Paying Jobs.

- Oral and Maxillofacial Surgeon. #2 in Best Paying Jobs.

- Obstetrician and Gynecologist. #3 in Best Paying Jobs.

- Surgeon. #4 in Best Paying Jobs.

- Orthodontist. #5 in Best Paying Jobs.

- Physician. #6 in Best Paying Jobs.

- Psychiatrist. #7 in Best Paying Jobs.

- Nurse Anesthetist.

Why do you want to be in real estate?

If you enjoy helping people and seeing them make positive changes in their lives, this profession may be suitable for you. Real estate agents provide homebuyers and sellers with the knowledge and insight to make informed decisions regarding their financial conditions and livelihood.

What are 3 good things about real estate?

- You Could Earn Passive Income.

- You May Enjoy Tax Benefits.

- Your Property May Appreciate In Value.

- You Have The Potential To Build Capital.

- You Could Have More Protection From Inflation.

- You May Be Able To Finance Your Property.

- You May Be Able To Choose Your Level Of Involvement.

What makes you passionate about real estate?

Are you passionate about homes, people, sales, building relationships, marketing, digital marketing, changing people's lives or even math, statistics, and the news? All of these make up a career in real estate.

Why do you want to be a real estate agent essay?

I want to become a real estate agent because I have a passion for helping people and pointing them in the right direction. I want to help them with everything from inspections, property analysis, repairs, moving, cleaning, packing, everything involved in a sales transaction, I want to help people with it.

What are the 4 benefits of real estate?

Key Takeaways

- Real estate investors make money through rental income, appreciation, and profits generated by business activities that depend on the property.

- The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage.

Where do realtors get most of their leads?

20 Places to Find Real Estate Leads for New Agents

- Reach Out to Friends and Family.

- Attend Chamber of Commerce Events.

- Get Active on Social Media.

- Research Instagram Hashtags.

- Reach Out to FSBO's.

- Reach Out to FRBO's.

- Give a Free Seminar.

- Host an Open House.

How to generate real estate leads for free?

How to build streams of (almost) free real estate leads:

- Networking and referrals.

- The neighbor's Sphere of Influence.

- Phone duty.

- Real estate video marketing.

- Reviews.

- Blogging, SEO and inbound.

- Niche sites.

- Targeted postcards and mailers.

Why am I getting no leads in real estate?

You Are Not Investing In Your Lead Follow Up Strategy

Real estate leads go through a long sales cycle. In order to ensure that a lead converts into your customer, you need to invest in a follow-up strategy that works. Fliers and mailers are obsolete techniques and do not have any real impact on retaining leads.

How to generate real estate leads in 2023?

You don't want to end up collecting leads and then not properly utilizing them!

- Work on building a brand.

- Email marketing for realtors.

- Host open houses.

- Never stop networking.

- Video marketing for realtors.

- Search engine optimization.

- Paid search.

- Social media advertising.

Are Zillow leads worth it?

Paying for leads on Zillow gives an agent more exposure to potential buyers, as most home buyers start their search online. A good lead generator can send you a steady flow of clients, saving you time and helping you sell more. These are the arguments Zillow makes to convince realtors to sign up for their service.

How long do you have to reinvest capital gains from home sale?

Within 180 days

Frequently Asked Questions about Capital Gains Tax

You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

How do I avoid capital gains tax on profit from home sale?

If you have lived in a home as your primary residence for two out of the five years preceding the home's sale, the IRS lets you exempt $250,000 in profit, or $500,000 if married and filing jointly, from capital gains taxes. The two years do not necessarily need to be consecutive.

When you sell your house does the profit count as income?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

What should I do with large lump sum of money after sale of house?

Depending on your financial circumstances, it might make sense to pay down debt, invest for growth, or supplement your retirement. You might also consider purchasing products to protect yourself and your loved ones, including annuities, life insurance, or long-term care coverage.

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.