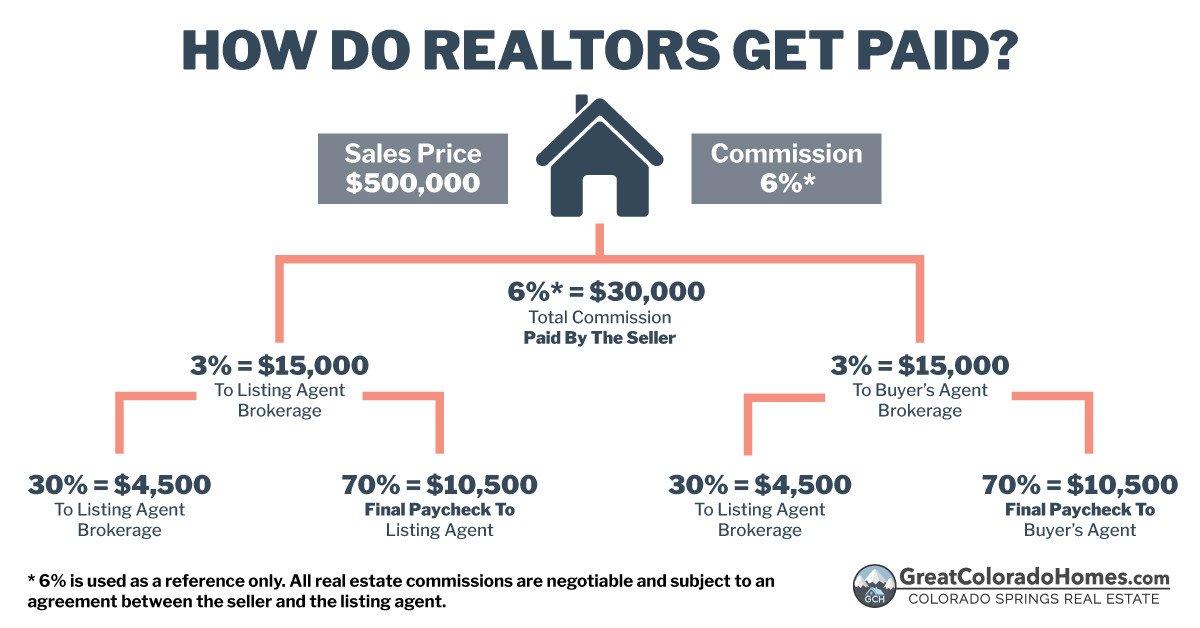

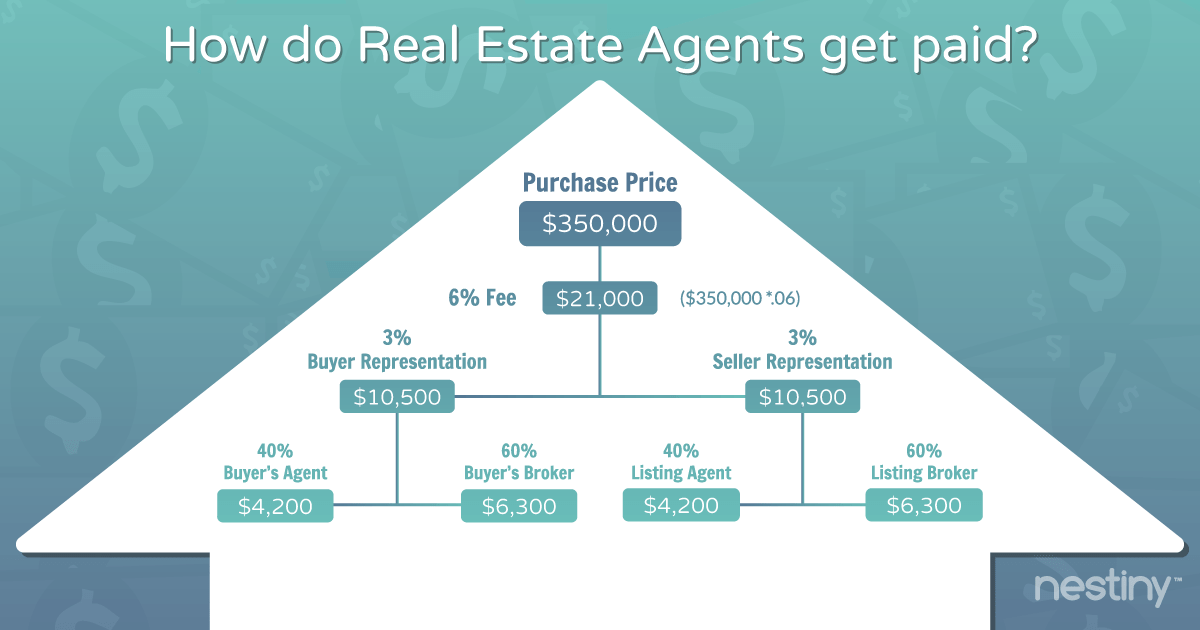

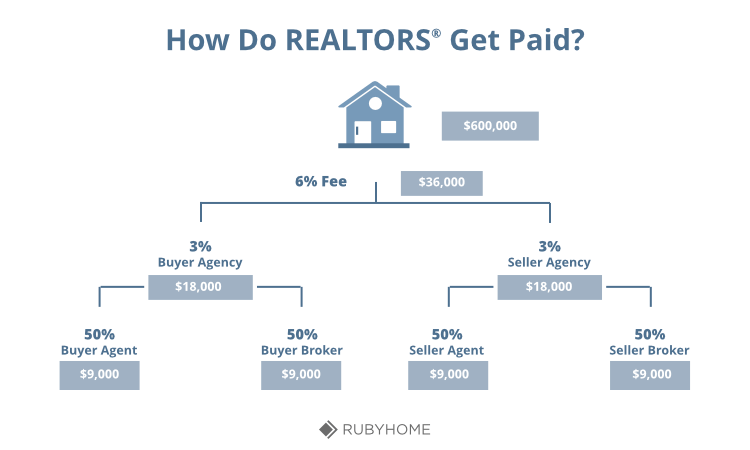

In effect, property owners pay all Realtor fees when selling. That total compensation or real estate commission rate is then split between the listing agent and the agent or broker that brings the buyer to the transaction (sometimes referred to as the cooperating broker).

Do buyers pay realtor fees in Pennsylvania?

Once the sale is final, both realtors will split a commission fee which is calculated by the purchase price of the home. This fee is paid by the seller, but it is calculated into the overall cost of the home. So, once you make the transaction on the home or property sale, you've done your part in “paying” the agents.

Do buyers pay realtor fees in Indiana?

In Indiana, home sellers pay real estate commission fees out of the final sale proceeds for both agents involved in a deal. Offering to pay for the buyer's agent's commission is an incentive for agents to show your home to their clients.

Do buyers pay realtor fees in Virginia?

Generally in Virginia the seller pays. When the real estate agent and the seller sit down at the table and they discuss a listing agreement, they will also discuss the real estate fees that will be paid both to the buyer brokerage as well as to the listing brokerage.

Can a seller refuse to pay buyers agent in Massachusetts?

While the traditional practice in Massachusetts is for the seller to pay both the listing agent and the buyer's agent commissions, there may be room for negotiation.

How much is it to get a real estate license in California?

How Much Does It Cost To Get A California Real Estate License?

| Course Tuition | $100 - $400+ |

| Background Check | $40 |

| Salesperson License Fee | $245 |

| Examination Fee | $60 |

| Total | $445 - $745 |

|---|

You should own your home, NOT let it own you. A mortgage payment should be no more than 25% of your take-home pay.

— Dave Ramsey (@DaveRamsey) December 10, 2021

If you're ready to buy, get in touch with a TRUSTED real estate agent that will respect your budget.https://t.co/iALxU36AZD

How much is the real estate exam in Kentucky?

$100

Here are the costs associated with obtaining your Kentucky real estate salesperson license. State Exam Fee: $100. License Application Fee: $130. Total Cost: $664.25.

How hard is California real estate exam?

The difficulty of the real estate exam varies by state, but the California real estate exam is known to be one of the most difficult. In fact, the pass rate for the California real estate exam in the last two years was under 50%, which means it's incredibly competitive and difficult to pass.

When you sell a house do you get it all at once?

In most cases, you won't pocket all of the sale price when you close. You'll usually have some expenses that need to be paid before you can take home your profits. Fortunately, you don't have to worry about writing a bunch of checks and making sure all the right people get paid.

How much money should I keep after buying a house?

Many financial experts suggest that new homeowners should be aiming to save at least six to 12 months' worth of expenses in liquid savings account for rainy days.

Are the sellers likely to pay closing costs?

Do Sellers Pay Closing Costs? Sellers pay fewer expenses, but they may actually pay more at closing. Typically, sellers pay real estate commissions to both the buyer's and the seller's agents. That generally amounts to average closing costs of 6% of total purchase price or 3% to each agent.

Who generally prepares closing statements?

Closing statements are prepared by closing agents, who help facilitate the sale of a property to a buyer. Typically, closing agents are real estate attorneys, title companies or escrow officers.

Which of the following closing cost fees is commonly charged on a loan?

Common closing fees or charges may include: Appraisal fees. Tax service provider fees. Title insurance.

What is the most seller can pay in closing costs?

Conventional Loans

- If your down payment is less than 10%, the seller can contribute up to 3%.

- If your down payment is 10 – 25%, the seller can contribute up to 6%.

- If your down payment is more than 25%, the seller can contribute up to 9%.

Who pays most of the closing costs?

Buyer

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

Who makes money in a real estate transaction?

Most real estate agents make money through commissions. A single commission is usually split four ways—between the agent and the broker for the seller and the agent and the broker for the buyer. The commission split depends on the agreements the agents have with their sponsoring brokers.

What is usually paid by the seller of a home?

Typically, sellers pay real estate commissions to both the buyer's and the seller's agents. That generally amounts to average closing costs of 6% of total purchase price or 3% to each agent.

Who determines how the expenses in a real estate transaction will be allocated?

Just before escrow is closed, both the buyer and the seller receive a closing statement from the escrow officer, which lists the purchase price and all the expenses associated with buying the property and how those expenses will be allocated between the buyer and the seller.

How do you calculate net profit from selling a house?

The simplest way to calculate net proceeds is to deduct all of the seller's closing costs, expenses and the mortgage balance from the final sale price of the home. Generally, you can expect to pay between 7 percent and 10 percent of your home's value in fees.

How much profit do you make from selling a house?

If I sell my house, how much do I keep? After selling your home, you must pay any outstanding mortgage, agent commissions, and closing fees. You keep the remaining money after settling these costs. After all the deductions, you have 60 to 85 percent of the house's total sale.

How do you calculate seller’s net sheet?

The seller's net sheet is calculated by taking the home sale price or an offer and then subtracting any encumbrances on the property (outstanding mortgage being the most common), closing costs and miscellaneous fees.

How much equity will I get if I sell my house?

To calculate your home equity, you'll need to determine the current market value of your home. This can be obtained by getting a professional appraisal or using an online home value estimator. Then, subtract how much you owe on your mortgage; this residual value is your equity position.

How do you calculate net profit from closing capital?

Profit is calculated from the fluctuations in the capital at the starting and end of the year and by adding the drawings and subtracting the amount introduced into capital at the end of the year. Also read: Trading and Profit and Loss Account. Difference Between Fixed Capital Account and Fluctuating Capital Account.

How do you calculate net proceeds on a sale?

The formula for calculating the net proceeds is the total cost of selling a good or service minus the cost of selling the goods or services at the final purchase price.

How do you calculate profit from a real estate sale?

To calculate Gross Profit: Gross Profit is the difference between the original purchase price and subsequent selling price, not taking into consideration buying costs and selling expense. Example: You purchased a home for $65,000 and subsequently sold it for $100,000. Gross profit is $100,000 - $65,000 = $35,000. 4.

What is net selling price of a property?

What is Net Selling Price? Net Selling Price (NSP) is the contract sale price of a property minus some of the standard closing costs.

How to calculate closing costs?

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Is net proceeds the same as profit?

Proceeds are any cash a company or individual earns when selling goods or services. They are similar to profits, except that profit is the total amount of cash flow a business earns minus expenditures, while proceeds measure the amount earned from specific sales.

What is the amount of a broker’s commission usually?

Between 5% to 6%

Real estate agents and brokers buy and sell homes, but have different licensing requirements. Real estate commissions are negotiable but tend to range between 5% to 6% of the sale price.

How is the broker’s commission usually paid out?

The commission is split between the seller's agent and buyer's agent right down the middle. Usually, the commission is paid directly to the brokerage, who distributes it to the agent.

What is the difference between a broker commission and a fee?

Typically, a commission is only for trading and the fee covers administrative tasks before and after the trade, order routing and trade settlement. The fee can be variable or fixed, while a brokerage fee can be for trading or non-trading purposes and may be fixed or variable.

What percentage do most brokers take from agents?

The brokers then split their commissions with their agents. A common commission split gives 60% to the agent and 40% to the broker, but the split could be 50/50, 60/40, 70/30, or whatever ratio is agreed by the agent and the broker.

What is the difference between a broker and an agent?

Differences between agents and brokers

Because brokers represent their clients, they have a duty to provide impartial advice and act in the buyers' best interest. Agents, on the other hand, are motivated to sell the products that the insurers they represent offer.

Are closing costs on the buyer or seller?

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

Who pays closing costs Illinois?

The buyer

In Illinois, the buyer usually pays the closing costs, which are around 3-4% of the home's price. The buyer pays for things like title insurance, fees to get the mortgage, and taxes.

Who pays closing costs in MN?

The seller and the buyer both pay closing costs in Minnesota. In Minnesota, real estate transactions are usually closed by title companies or attorneys.

Who pays closing costs in NY?

While you and the buyer can be liable to pay the closing costs, it is almost always the buyer who pays it. In New York, closing costs for sellers range from 8% to 10%, although this is if you have paid the 6% agent commission. Your closing costs are also typically higher than that of buyers.

Can you make $1000000 a year in real estate?

For some real estate agents, a $1 million year may sound like a pipe dream. But here's the breakdown: $1 million gross commission income is equal to 100 transactions at $10,000 average commission, based on the national average of $400,000 sale price.

How to make $100,000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

Do realtors make good money in Texas?

As of Oct 9, 2023, the average annual pay for an Entry Level Real Estate Agent in Texas is $83,550 a year. Just in case you need a simple salary calculator, that works out to be approximately $40.17 an hour. This is the equivalent of $1,606/week or $6,962/month.

How much does a beginner real estate agent make in Texas?

Salaries by years of experience in Texas

| Years of experience | Per year |

|---|---|

| 1 to 2 years | $75,972 |

| 3 to 5 years | - |

| 6 to 9 years | - |

| More than 10 years | $99,681 |

Is it hard to get rich in real estate?

Sure, we've seen real estate boom-and-bust cycles in recent decades, but over time, owning real estate has made thousands of people rich in every part of the United States. All in all, it took me 51 years to be a real estate millionaire. But it only took me 11 years from the day I bought my first home!