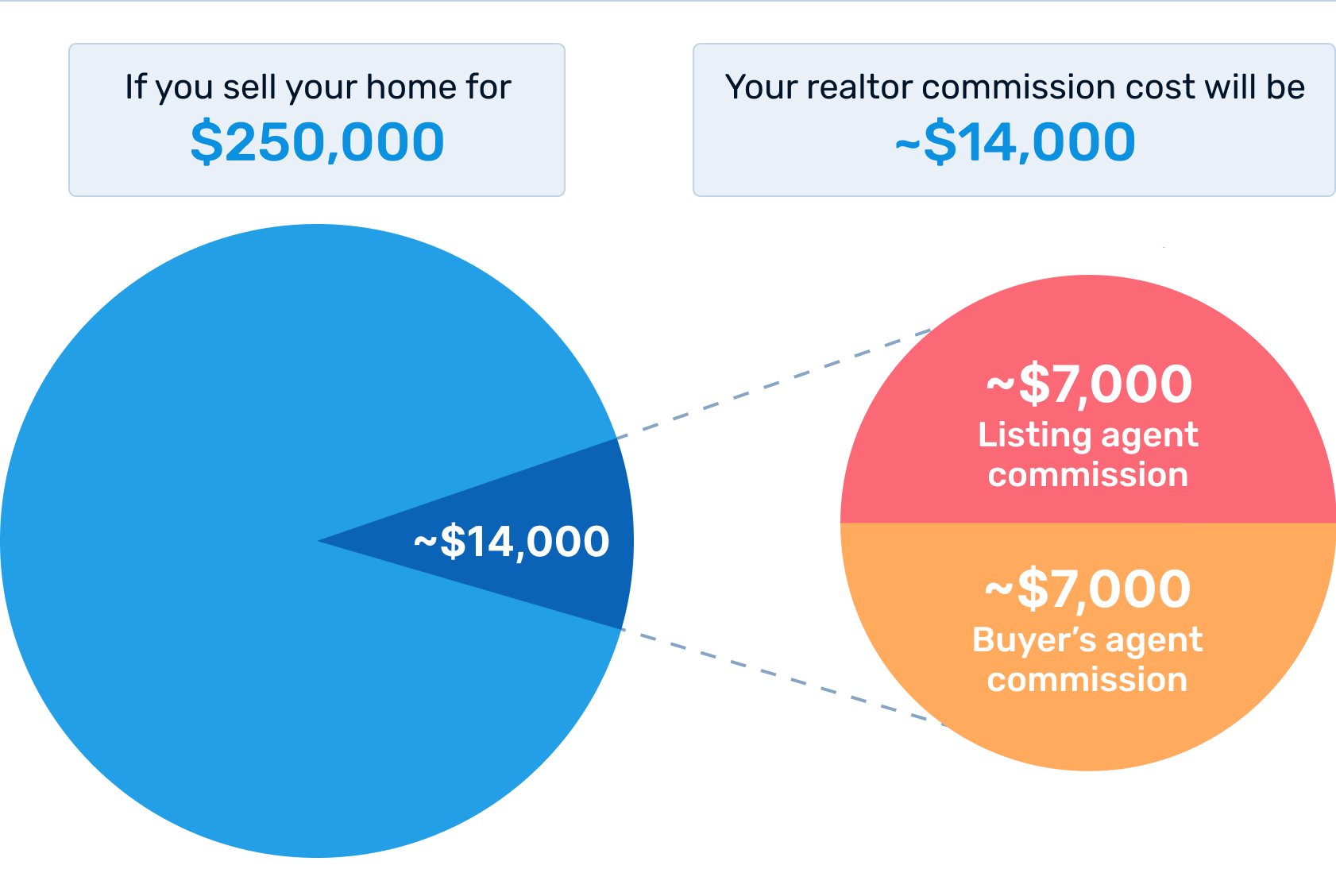

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

Is 6% normal for realtor?

Negotiate the commission rate.

Just because 5–6% is common, it doesn't mean that's what you have to accept. Ask your real estate agent if they're willing to take less.

What percentage of sales do most realtors make?

While realtor commission fees vary regionally, the average seller can expect to pay between 4.45% to 6.34% of the home's final sale price, according to our research. The U.S. average is currently 5.37%. The listing agent usually receives 2.72% of the proceeds.

What do the top 1% of realtors make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

What is the 80 20 rule for realtors?

The rule, applicable in many financial, commercial, and social contexts, states that 80% of consequences come from 20% of causes. For example, many researchers have found that: 80% of real estate deals are closed by 20% of the real estate teams. 80% of the world's wealth was controlled by 20% of the population.

How do you calculate profit after selling a house?

You calculate your net proceeds by subtracting the costs of selling your home and your remaining mortgage balance from the sale price. For example, if your sale price is $1,000,000, your remaining mortgage balance is $350,000, and the total closing costs are $60,000, then your net proceeds would be $590,000.

Excited to share the latest addition to my #etsy shop: 12 Vintage Christie's Auction Catalogs Furniture sculpture porcelain and decorative objects Antiques. https://t.co/xh7t0o8eWZ #booksandzines #book #christies #auctioncatalog #antiques #art #cassandraeckert pic.twitter.com/WEMtMPxbU8

— Cassandra Eckert Realtor USN Veteran (@CassandraEckert) October 29, 2018

What is the sale proceeds minus sale expenses?

Net proceeds are the amount the seller takes home after selling an asset, minus all costs and expenses that have been deducted from the gross proceeds. The amount that constitutes the net proceeds could be marginal or substantial, depending on the asset that has been sold.

What is the tax that you pay when making a profit from selling a house?

In California, capital gains from the sale of a house are taxed by both the state and federal governments. The state tax rate varies from 1% to 13.3% based on your tax bracket. The federal tax rate depends on whether the gains are short-term (taxed as ordinary income) or long-term (based on the tax bracket).

How much do top selling real estate agents make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

How much does a new Real Estate Agent make in Florida?

How much does a First Year Real Estate Agent make in Florida? As of Oct 8, 2023, the average annual pay for a First Year Real Estate Agent in Florida is $64,209 a year. Just in case you need a simple salary calculator, that works out to be approximately $30.87 an hour.

How to make $100,000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

What realtors make the most money?

The 6 Highest Paying Real Estate Careers with Good Salaries

- Home Inspector. If you already have a good main job and are looking for a part-time gig to maximize your income, you can work as a home inspector.

- Real Estate Lawyer.

- Real Estate Broker.

- Commercial Real Estate Agent.

- Property Manager.

- Corporate Real Estate Manager.

Is it hard to get rich in real estate?

Sure, we've seen real estate boom-and-bust cycles in recent decades, but over time, owning real estate has made thousands of people rich in every part of the United States. All in all, it took me 51 years to be a real estate millionaire. But it only took me 11 years from the day I bought my first home!

Do buyers pay realtor fees in Pennsylvania?

Once the sale is final, both realtors will split a commission fee which is calculated by the purchase price of the home. This fee is paid by the seller, but it is calculated into the overall cost of the home. So, once you make the transaction on the home or property sale, you've done your part in “paying” the agents.

Do buyers pay realtor fees in Maryland?

Real Estate Broker Fees

In Maryland, buyers do NOT have to pay any commissions. If you're hiring a buyer's agent who wants to charge you a commission, you might want to think twice and ask why you're being asked to pay this fee.

Do buyers pay realtor fees in NY?

The Seller Usually Pays Realtor Fees In New York

In New York, like every other U.S. real estate market, the homeowner/seller pays the realtor fees out of the proceeds from the sale of the property. This means that they are paying for their agent as well as the agent of the Buyer.

Do buyers pay realtor fees in North Carolina?

In North Carolina, the seller is responsible for paying commission per their agreement, as well as preparation of the deed and revenue stamps per the standard Offer to Purchase and Contract.

Does the seller pay closing costs in PA?

Both the seller and the buyer each pay their share of closing costs in Pennsylvania, as they do in all states. Often, sellers pay more in closing costs than buyers because they typically cover real estate commissions, which can run up to 6 percent of the final sale price.

Which of the following fees must be paid by real estate seller?

Sellers often pay real estate agent commissions, title transfer fees, transfer taxes and property taxes.

Are the sellers likely to pay closing costs?

Do Sellers Pay Closing Costs? Sellers pay fewer expenses, but they may actually pay more at closing. Typically, sellers pay real estate commissions to both the buyer's and the seller's agents. That generally amounts to average closing costs of 6% of total purchase price or 3% to each agent.

Do sellers pay closing costs in NY?

While you and the buyer can be liable to pay the closing costs, it is almost always the buyer who pays it. In New York, closing costs for sellers range from 8% to 10%, although this is if you have paid the 6% agent commission. Your closing costs are also typically higher than that of buyers.

What is the seller fee?

Seller Fees means: (a) for a Service Contract, the fixed fee agreed between a Buyer and a Seller; and (b) any bonuses or other payments made by a Buyer to a Seller.

What is the most seller can pay in closing costs?

For a conventional loan, sellers can pay your closing costs up to 3% of the property's purchase price if your down payment is less than 10%. If your down payment is 10% or more, the seller credit increases to 6% of the purchase price.

How much does a beginner real estate agent make in Texas?

Salaries by years of experience in Texas

| Years of experience | Per year |

|---|---|

| 1 to 2 years | $75,972 |

| 3 to 5 years | - |

| 6 to 9 years | - |

| More than 10 years | $99,681 |

How much do realtors make in Texas?

The average salary for a real estate agent in Texas is $34,500 per year. Real estate agent salaries in Texas can vary between $17,000 to $118,500 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

How do real estate agents get paid in New York?

Real estate agents work solely on commissions. Those commissions are typically split between the buyer's agent and the seller's agent. The broker overseeing the transactions also gets a split of the commissions. New York real estate agents can increase their income potential by earning their NY broker license.

How to make $1 million as a real estate agent?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

What is the average salary for a realtor in Delaware?

The average salary for a real estate agent in Delaware is $34,500 per year.

What is the highest paid real estate agent?

The highest-paid real-estate agent is a luxury broker.

Luxury brokers earn an average salary of $142,000 per year with commissions reaching up to $10M annually. As a luxury broker, you would specialize in multimillion-dollar deals and work closely with developers, architects, and designers.

What percentage do most realtors take?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

Do you pay a real estate agent if you are the buyer in Texas?

Who Pays the Real Estate Agent Commissions When You Buy a New Home? The good news is that the seller often pays all agent commissions (including your buyer agent's fees) in Texas! However, at times closing contract could stipulate that the buyer must pay the fees for their REALTOR®.

Do buyers pay realtor fees in Virginia?

Generally in Virginia the seller pays. When the real estate agent and the seller sit down at the table and they discuss a listing agreement, they will also discuss the real estate fees that will be paid both to the buyer brokerage as well as to the listing brokerage.

How is a buyer’s agent usually compensated quizlet?

14. B A buyer's agent is typically compensated through a commission split, receiving half of the brokerage commission paid by the seller.

Why do realtors make so much?

They charge a lot because it takes work and money to market, it is hard to get licensed and become a real estate agent, they have to pay for dues and insurance and real estate agents usually have to split their commissions with their broker. The biggest reason real estate agents make so much money is they are worth it!

How to invest $20 000 dollars in real estate?

Now, let's look at eight different ways to invest in real estate with only $20,000.

- #1. Low down payment purchase.

- #2. Seller carryback.

- #3. Fix-and-flip.

- #4. Wholesale real estate.

- #5. Rent-to-own.

- #6. Buy shares in single-family rental property.

- #7. Real estate crowdfunding.

- #8. Real estate ETFs and REITs.

How to invest $100 000 dollars in real estate?

How to Invest $100k in Real Estate

- Residential Property for Long-Term Renters.

- Short-Term Rental Property.

- Flipping a House or Condo.

- Multi-Family Rentals.

- Commercial Property.

- Stocks in Real Estate Companies.

- REITs.

- Joint Ventures.