How to Prepare for Math on the Real Estate Exam. While details vary by state, you can generally expect to encounter between 150 and 200 multiple choice questions on the real estate exam. Of those, roughly 10-15% involve math, which translates to between 15 and 30 questions per exam.

Is the Oklahoma real estate exam multiple choice?

Exam Info. Sales Associate: The exam costs $60 and is administered on a computer in multiple choice format. There are 130 scored questions and 5-10 pre-test questions that do not affect your score.

What type of math is on the Texas real estate exam?

The National portion of the State exam includes 13 questions on 'real estate calculations'. Most of the math questions you will see involve basic algebra.

Is the Arizona real estate exam hard?

Is the Arizona real estate exam hard? Around 23% of Arizona students fail the test and have to retake it in order to pass. Upon follow up after the test, most do not consider the exam "easy." The best way to alleviate your nerves and pass the test is to work hard and prepare as much as possible.

Is the math hard on real estate exam?

To put it in plain terms, yes, the California Real Estate Exam contains math - but very little. And the level of math involved may not be as extensive or intimidating as you might think. On average, there are only a small number of questions that focus on mathematical problems.

Where is the most cheapest house?

10 Cheapest Housing Markets to Buy a House in the US

- West Virginia. With a Zillow Home Value Index of $155,148, West Virginia is the most affordable state to buy a house in the US.

- Mississippi.

- Oklahoma.

- Arkansas.

- Louisiana.

- Kentucky.

- Iowa.

- Kansas.

There are three kinds of skills in the world:

— Jon Acuff (@JonAcuff) August 16, 2023

1. Hard skills.

2. Soft skills.

3. The stuff Liam Neeson can do.

I can’t help you with that third type. Those are very particular.

But what I do have today is a few thoughts about that second category.

A hard skill is a specific…

What is the cheapest type of house to buy?

Prefabricated homes, container homes, and monolithic dome homes are just some of the most affordable new homes. Keep in mind that you'll need to add additional costs for land purchase, a foundation, taxes, transportation, and permits.

What state is the cheapest to live in?

Mississippi

The cheapest states to live in are Mississippi, Oklahoma, Kansas, Alabama, Georgia, Missouri, Iowa, Indiana, West Virginia, and Tennessee. Mississippi is the cheapest state to live in in the US, with a cost of living index of 85. The second cheapest state to live in is Oklahoma, with a cost of living index of 85.8.

Is real estate agent a growing industry?

The Bureau of Labor Statistics projects 5.3% employment growth for real estate agents between 2021 and 2031. In that period, an estimated 23,100 jobs should open up. Real estate agents buy, sell or rent properties on behalf of their clients.

What state has the most successful realtors?

Best States for Real Estate Agents to Grow and Succeed

- Texas. Texas is the largest state in both area and population and has a lot of room for growth.

- Florida. Florida is a great place to sell real estate because it has a large population and home sales.

- New Jersey.

- Illinois.

- 5. California.

- Colorado.

- Arizona.

How do realtors get seller leads?

Pro Tips for Identifying More Seller Opportunities

- Leverage your existing network to ask for referrals.

- Build your personal brand using social media.

- Share custom local market updates with your existing seller leads.

- Display a call to action (CTA) to request a home valuation on your website.

How do I get more seller leads?

WRITTEN BY:

- 1 Invest in Lead Generation Software.

- 2 Request Referrals From Past Clients & Your Professional Network.

- 3 Be Active on Social Media.

- 4 Build Trust & Authority with a Real Estate Website.

- 5 Capture Real Estate Seller Leads With Specialized Landing Pages.

- 6 Target a Farm Area with Direct Mail.

How to get free leads for real estate?

Relationships will always be the best source of free real estate leads

- Introduce yourself to the people in your social circle.

- Exchange names with the people who provide you with services.

- Reach out to past clients.

- Write or contribute to articles, podcasts, and publications.

- Knock on doors.

How do Keller Williams agents get leads?

Build a Database: The first law of lead generation is to build a database. This means that you need to create a list of potential leads, including their contact information and other relevant details such as their interests, location, and stage of the buying or selling process.

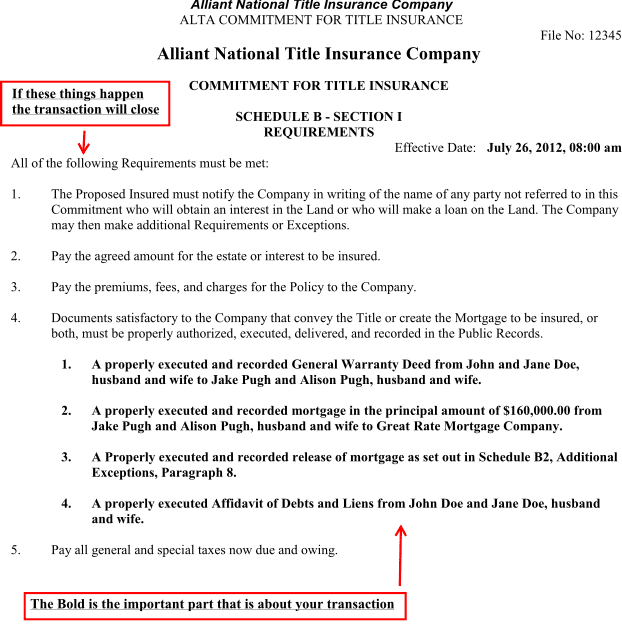

How do I report the sale of a second home on my tax return?

Your second residence (such as a vacation home) is considered a capital asset. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets to report sales, exchanges, and other dispositions of capital assets.

How do you report the sale of a house on your tax return?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

How do you record the sale of a second home?

A second home, or a timeshare, used as a vacation home is a personal use capital asset. A gain on the sale is reportable income, but a loss is NOT deductible. If you receive Form 1099-S Proceeds from Real Estate Transactions for the sale of your vacation home, you need to report it in the TaxAct program on Form 1099-B.

Where do I report sale of second home on TurboTax?

- Open your TurboTax account > Wages & Income.

- Scroll to Investment Income > Select Stocks, Mutual Funds, Bonds, Other > Start or Update.

- Select the type of sale (see image below)

- Enter the details of the property sold - Select Second Home from the dropdown continue to enter your information.

- Continue to finish your sale.

Is the sale of a second home considered income?

When you sell a vacation home, rental, fix-and-flip, or any second property that is not your primary residence, you will typically be responsible for paying capital gains taxes on any profits you make, at a rate of up to 20%, depending on your tax bracket. But you may be able to mitigate those taxes.

How do I access local MLS listings?

MLS access is generally restricted to licensed real estate agents, so if you want to view MLS listings, your best bet is to find a great local realtor. Your agent can set you up with MLS access through a private online portal, and they'll also set up instant MLS alerts when new homes go up for sale.

How do you find the listing price of a house?

Determining a good list price is typically based on a variety of important considerations, including your home's location, the final sale price of comparable homes in your area and also the current market conditions. Another consideration that factors into establishing a list price is the condition of your home.

How do I get MLS access in Texas?

Once you become a member of a local real estate board or association participating in the TREIS, you can access an MLS system. This can typically be done through a website or a software program the local council or association provides.

How can I see how many views my real estate listing has?

The listing traffic report shows the number of views that your property got in a period of time, daily/weekly/monthly or custom time in Zillow+Trulia/HAR and Realtor.com websites.

Is the MLS the same as Zillow?

If you are able to view the MLS in your area online directly, you will only see properties that are currently active on the market. This makes the MLS more accurate than Zillow, which frequently keeps properties listed as available long after they have been taken off the market.

What are the fiduciary duties of a real estate agent in Florida?

In a single agent relationship, wherein the real estate licensee represents either the buyer or seller, the single agent's duties include the following: dealing honestly and fairly; loyalty; confidentiality; obedience; full disclosure; accounting for all funds; skill, care and diligence in the transaction; presenting ...

What happens if a seller does not disclose Florida?

Withholding information or giving a false disclosure statement can give the buyer legal grounds to either back out of the contract or, in the case the purchase goes through, sue the seller for damages.

What is an ethical violation in real estate?

Common real estate ethics complaints can include: Not acting in the best interests of clients. Revealing private or confidential information. Advertising a listed property without disclosing their Realtor status.

What is the statute 475.278 in Florida?

Florida Statute 475.278 requires a specific type of disclosure that must be made to the buyer — the disclosure of the kind of relationship and duties that exists between the buyer and the real estate agent.

What are the three 3 fiduciary duties of an agent?

Specifically, fiduciary duties may include the duties of care, confidentiality, loyalty, obedience, and accounting.

What IRS forms do I need when I sell my house?

File the following forms with your return:

- Federal Capital Gains and Losses, Schedule D (IRS Form 1040 or 1040-SR)

- California Capital Gain or Loss (Schedule D 540) (If there are differences between federal and state taxable amounts)

Does sale of house need to be reported to IRS?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

Who sends a 1099 when you sell a house?

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return.

How does IRS know you sold property?

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

Who is responsible for filing a 1099S after closing?

Who files the Form 1099 for a real estate sale? According to the IRS, the person who must file the Form 1099-S reporting the sale is the person responsible for closing the transaction.

How do I prepare for my first rent?

Follow this first apartment essentials checklist for renters to help you prepare to successfully rent your first apartment.

- Know Your Budget and Save Up.

- Find Out What You Need to Rent an Apartment.

- Consider Parking and Commuting.

- Search in the Winter.

- Give Yourself Enough Time.

- Make a List of Questions to Ask.

How do you get landlords?

Attend Auctions to Meet Landlords

These events attract scores of landlords and are an obvious channel to take advantage of. The more properties a landlord has, the more challenging things may be for them, so you could come to rescue and manage a whole string of homes on their behalf.

How to rent out a house in Florida?

How to Rent Your House in Florida

- Figure Out What Renters Want.

- Follow State and Local Laws and Restrictions.

- Make Sure You Have a Well-Drafted Lease.

- Get Your Property Rent Ready.

- Don't Forget that Renting Is a Business.

- Want to Rent Your House in Florida?

How to rent out your house in Texas?

How to Become a Landlord in Texas Step-by-Step

- Check Local Requirements for Landlord License. In the state of Texas, getting a landlord license is not required.

- Find the Right Property.

- Prepare Your Property.

- Advertise Your Property.

- Screen Potential Tenants.

- Sign the Lease Agreement.

How much money should you have saved before renting?

Now, the big question: How much money do I actually need to set aside for an apartment? Based on the above categories, you should save an amount equal to at least 3-4 months' rent. That will cover paying rent for the first month, security deposits and last month's rent.

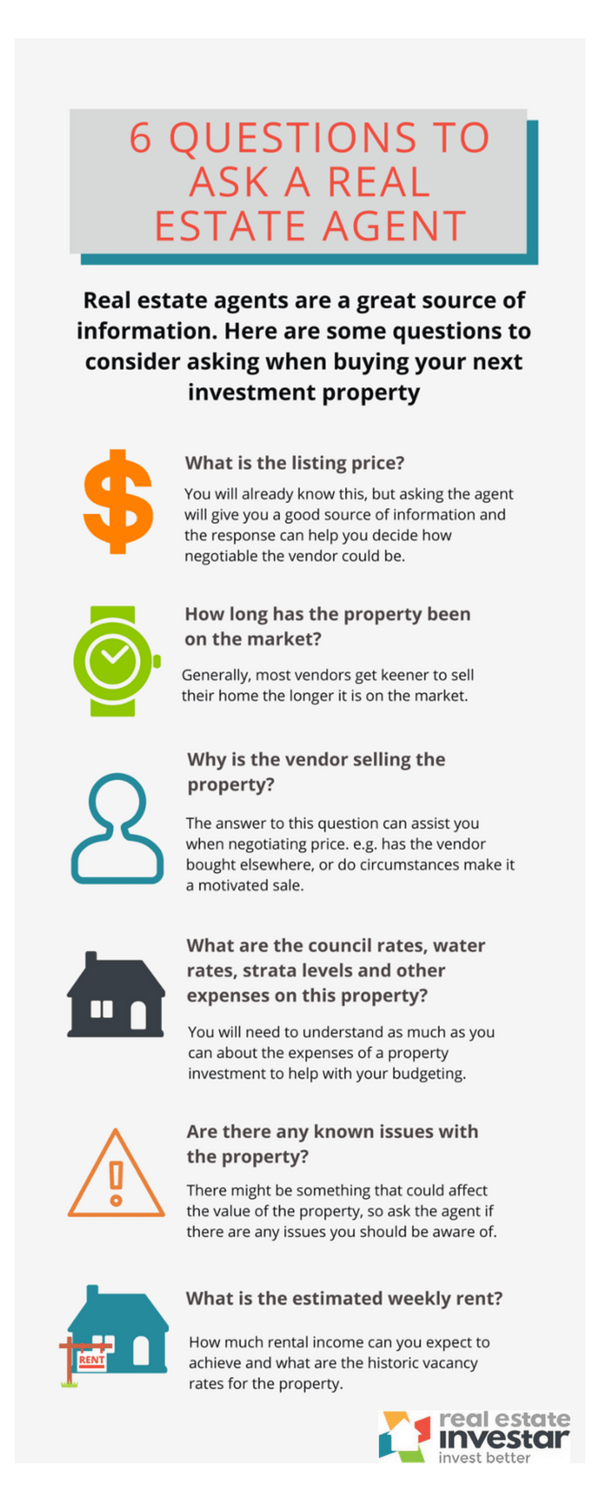

What are the most important duties of a real estate agent?

Real Estate Agent Responsibilities:

Negotiate prices or other sales terms. Compare a property with similar properties that have recently sold to determine its competitive market price. Appraise property values. Advise clients on market conditions, prices, mortgages, legal requirements, and related matters.

What is one of the sellers agents duties?

Under the seller's agency, a real estate agent agrees to promote the seller's best interests exclusively. Agents must disclose all pertinent information to a seller when a buyer makes an offer. Further, real estate agents must keep confidential any information about why an owner is selling their property.

What not to tell your real estate agent?

- 10: You Won't Settle for a Lower Price. Never tell your agent you won't reduce the sale price on your house.

- 6: You are Selling the Home Because of a Divorce.

- 5: You Have to Sell Because of Financial Problems.

- 2: You're Interested in a Certain Type of Buyer.

- 1: Anything -- Before You've Signed an Agreement.

How do you represent a seller?

Representing Sellers

- Establishing Agency.

- Determining Market Value and Listing Price.

- Gathering Listing Data.

- Inspection and Recommendations.

- Marketing Strategy.

- Staging and Showing.

- Negotiating Offers.

- Overseeing Home Inspection and Appraisal.

What are the three most important things in real estate as an agent?

I believe the three most important things when it comes to real estate are "location, timing, and circumstances," and here's why.