California's Real Estate Law (also known as the license law) is contained in sections 10000 to 10580 of the Business and Professions Code. The purpose of the law is to regulate the real estate profession and protect the public from incompetent, unethical, or dishonest real estate agents.

What is the main purpose of the real estate law quizlet?

- The basic purpose of the Real Estate law is to prevent fraud. - It is primarily based upon English Common Law (Community Property laws were guaranteed by the Treaty of Guadalupe Hidalgo between the U.S. and Mexico).

Which of the following is a legally required element of a valid and enforceable real estate contract?

A real estate contract must meet four essential criteria to be considered valid: First, it must include a valid home purchase agreement in writing. Second, the contract must contain an offer from the buyer and an acceptance from the seller. Third, the purpose of the contract must be legal.

What is the definition of property law quizlet?

Anything (physical or intangible) that can be owned by a person or entity. Property law represents the legal rules governing human interactions as they relate to various identifiable things (property).

What does in law mean in real estate?

An in-law suite is the most common name for a small, apartment-like space on the same property as, or even attached to, a single-family home. These dwellings are living spaces usually equipped with a bedroom, bathroom, kitchen and a separate entrance from the primary residence.

How do you calculate mortgage tax deduction?

Mortgage Interest Deduction Calculator

Divide the maximum debt limit by your remaining mortgage balance, then multiply that result by the interest paid to figure out your deduction.

Crash study weekend #1 today at SNHU for the state portion of the real estate exam. My practice score - 78! At least it was passing!

— Jenny Caouette (@JennyCaouette) November 16, 2013

How do you calculate taxable income from rental property?

Any net income your rental property generates is taxable as ordinary income on your tax return. For example, if your net rental income is $10,000 for the year and you fall into the 22% tax bracket, you would owe $2,200 in taxes. That's the short version of how rental income tax works.

How much will a tax deduction save me?

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

What is a protection period clause in real estate?

Definition. A safety protection clause entitles a real estate broker to a commission if a sale occurs after the listing agreement expires. This protects the broker from collusion between sellers and buyers to save the seller the cost of real estate commission.

How do I buy tax delinquent property in Ohio?

Every county in Ohio has tax defaulted property auctions. Some hold tax deed sales and some hold tax lien sales. You can contact the treasurer's office to find out which sale that county holds. If you contact that office, you should also ask about the rules for the auction.

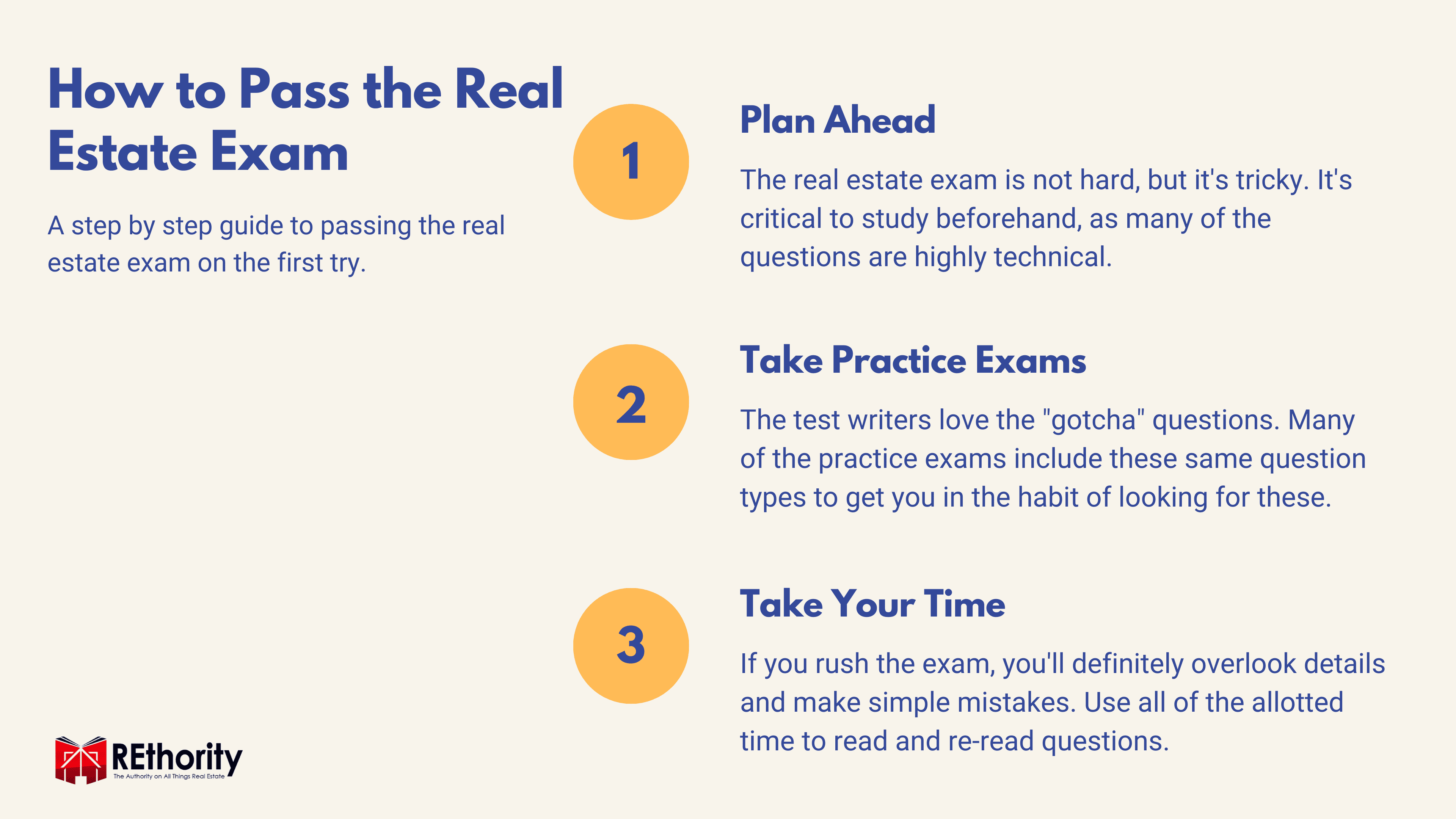

What score do I need to pass Colorado real estate exam?

What score do I need to pass the Colorado real estate exam? In order to pass the Colorado real estate examination, students will need at least a 75% on the National portion and a 71.5% or higher on the State portion.

What score do I need to pass Texas real estate exam?

What Score Do You Need to Pass the Texas Real Estate Exam? In order to pass your test, you will need to get a score of 70% or higher. This means you will need to answer 56 out of the 80 questions correctly.

What is the pass rate for the Missouri real estate exam?

The passing rate for the Missouri Real Estate Salesperson Exam is 70%.

How many times can I fail Colorado real estate exam?

How many times can you retake real estate exam in Colorado? You can take the state broker license exam as many times as necessary to pass both the national and state portions. The fee to retake both sections or a single section is $42.50.

What not to tell a real estate agent?

Here are the 7 most important things to not tell your realtor when selling.

- What you think your home is worth.

- Your need to sell quickly.

- Plans for upgrades before selling.

- Non-mandatory legal information about your property.

- You're okay with an inflated history of dual agency.

- Your lowest acceptable selling price.

How do you interview a real estate agent?

Covering the basics when interviewing a real estate agent. The beginning of the call is the best place to get to know the agent's business and how well they know the area. You're listening for things that signal experience, knowledge of the area, and workload.

Are estate agents untrustworthy?

Second, estate agents are often seen as being dishonest and untrustworthy. There have been many instances of estate agents exaggerating the value of properties or hiding defects in order to make a sale.

What scares a real estate agent the most?

1) Fear of rejection.

This is often the first thing to come to mind when realtors are asked to share their biggest fear, especially for those agents who are new to the industry. It's a scary thing to put yourself out there—to go door-knocking or cold-calling.

What is the biggest mistake a real estate agent can make?

7 Common Mistakes from Rookie Real Estate Agents

- Failing to Communicate with Clients.

- Neglecting Their Education.

- Not Turning Down Overpriced Listings.

- Failing to Prepare a Business Plan.

- Poor Financial Planning.

- Not Finding Their Niche.

- Poor Time Management.

How much of your paycheck should go to rent?

Use the 30% Rule

The 30% rule states that you should try to spend no more than 30% of your gross monthly income on rent.

How do you tell if you can afford to live somewhere?

Like I mentioned earlier, your monthly house payment (including principal, interest, insurance and HOA fees) should be no more than 25% of your take-home pay. So if your house payment is $2,000, your take-home pay should be about $8,000 a month or $96,000 a year.

How do you calculate 2.5 times the rent?

I Need to Calculate 2.5x Rent

For example, if the monthly rent is $1,000, you should multiply it by 2.5. According to the 2.5x rent rule, this means the tenant should be earning at least $2,500 per month in gross income.

Can I afford to live on my own?

A common rule of thumb is to have your cost of living not to exceed 30% of your net income, also known as your take-home pay. For instance, if I brought home $2,000 a month after taxes and contributions, I would need to find a place below $600.

Is $1,500 rent too much?

Take rent for example. The traditional advice is simple: Spend no more than 30% of your before-tax income on housing costs. That means if you bring in $5,000 per month before taxes, your rent shouldn't exceed $1,500.

How are funds disbursed at closing?

The most common ways are by cashier's check or wire transfer. You can take payment by check in person at the closing or have it mailed to you or your REALTOR®.

What does funding mean at closing?

Mortgage closing and funding are the final chapters in the mortgage loan process. Closing occurs when all parties sign loan documents at the title company. Funding occurs when the title company confirms receipt of the lender's funds.

Why am I getting money back at closing?

Cash back at closing occurs when a buyer agrees to pay more for a property than its market value. It was so a buyer could borrow more money than the home was worth. Then the seller would give the buyer actual “cash back”—the difference between the sale price and the loan amount—after the title transfer.

Does seller financing go on your credit?

While a seller might not report payment activity to credit bureaus, negative marks still may end up on your credit report if you default on the seller-financed mortgage. If you fall behind on payments, the seller-lender may pursue a court judgment against you or may turn over your account to a debt collector.

How long does it take for funds to be released after closing?

A wire transfer can take between 24 to 48 hours to process but is usually available in your account within one business day. Meanwhile, a paper check could be available right at the time of closing but will need to be deposited and cleared, and a bank can often hold that deposit for up to seven days.

Do home improvements count against capital gains?

While capital improvement projects generally don't qualify for tax deductions, they might have other tax implications. That's because you can usually add capital improvement expenses to the home's cost basis—which might reduce your capital gains taxes when you sell the house.

What home improvements are against capital gains?

When a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis. Capital improvements can reduce this tax by increasing the cost basis for a home. The original cost basis is the purchase price of the home, including closing and other costs.

What is considered improvements for capital gains tax?

A capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. The IRS grants special tax treatment to qualified capital improvements, distinguishing them from ordinary repairs.

Do I need receipts for home improvements for capital gains?

According to the IRS, capital improvements aren't taxed directly but can affect the taxes you pay when you sell the property. This is why homeowners need to document improvements made during a renovation or remodel and to keep the receipts as proof.

What are examples of improvements that increase basis?

The cost of improvements, or money spent during the time you own a property to improve or add to its value, is added to basis. Some things that can increase basis include the cost of improvements anticipated to last for longer than a year (such as a new roof or HVAC system), impact fees and zoning costs.

How do you calculate basis on a house sale?

To calculate your adjusted basis:

- Begin by noting the cost of the original investment that you made in your property.

- Next, add in the cost of major improvements (for example, additions or upgrades).

- Then, subtract any amounts allowed via depreciation or casualty and theft losses.

How does the IRS know your cost basis?

How Does the IRS Verify Cost Basis in Real Estate? In real estate transactions, the IRS can verify the cost basis by looking at the closing statement of when the property was purchased, or any other legal documents associated with the property, such as tax statements.

What is the basis of property IRS?

The basis of property you buy is usually its cost. The cost is the amount you pay in cash, debt obligations, other property, or services. Your cost also includes amounts you pay for the following items. Sales tax.

What are exceptions to 2 year rule sale of primary residence?

Exceptions to the Two-in-Five-Year Rule

You were separated or divorced during the time you owned your home. Your spouse died during the time you owned your home. The sale of your home involved vacant land.

How do I calculate my basis?

At a very basic level, basis is the cost of your business. The calculation of basis consists of your financial contributions into the company plus ordinary income and losses minus distributions (like dividends and other payouts).

What do you need to become a real estate agent in North Carolina?

Requirements to Qualify to Become a North Carolina Real Estate Broker

- Be at least 18 years old.

- Be a US citizen, a non-citizen national, or a qualified alien under federal law.

- Complete a state-approved 75-hour broker prelicensing course.

- Pass the North Carolina State Licensing Examination with a score of at least 75%.

What are the three most important things in real estate?

To achieve those goals, the three most important words in real estate are not Location, Location, Location, but Price, Condition, Availability. Let's look at the first word – Price.

How hard is the NC real estate exam?

The passing rate for the North Carolina Real Estate Provisional Broker Exam is 71%. This test is purposefully difficult, but not impossible. Be sure to pay attention during your pre-license course and take studying seriously. If you put the proper effort forth, we know that you can pass on your first attempt!

How long is realtor school in NC?

75-hour

Taking the Required North Carolina Real Estate Course

The North Carolina Real Estate Commission (NCREC) has established an education requirement that must be met prior to receiving a real estate license. There is a 75-hour pre-licensing course that every prospective real estate agent must pass.

What’s the best way to learn about real estate?

Universities and real estate trade groups (the National Apartment Association, the Institute of Real Estate Management and the Building Owners and Managers Association, for example) are some of the best resources for grasping the fundamentals in this field.

Do renters pay property tax in Texas?

For instance, all households pay property taxes. Homeowners pay their property taxes directly, while renters pay property taxes indirectly. Landlords initially pay the taxes on the property, and then pass the cost of the taxes on to their tenants through higher rents.

Do renters pay property tax in CT?

If the property is tenancy in common property, each tenant in common is liable for the property taxes but only to the extent of that person's interest in the property.

Do you pay taxes on rent in Arizona?

Residential rental properties are also subject to tax, known as transaction privilege tax (TPT), and imposed when engaged in business under the residential rental classification by the Model City Tax Code. Some cities, not all, opt to tax residential rental income.

How does the IRS know if I have rental income?

Ways the IRS can find out about rental income include routing tax audits, real estate paperwork and public records, and information from a whistleblower.

Who has to pay property tax in Texas?

The property owner, whether residential or business, is responsible for paying taxes and has a reasonable expectation that the taxing process will be fairly administered. The property owner is also referred to as the taxpayer.