Negotiate the commission rate.

Just because 5–6% is common, it doesn't mean that's what you have to accept. Ask your real estate agent if they're willing to take less.

What percentage do most realtors take?

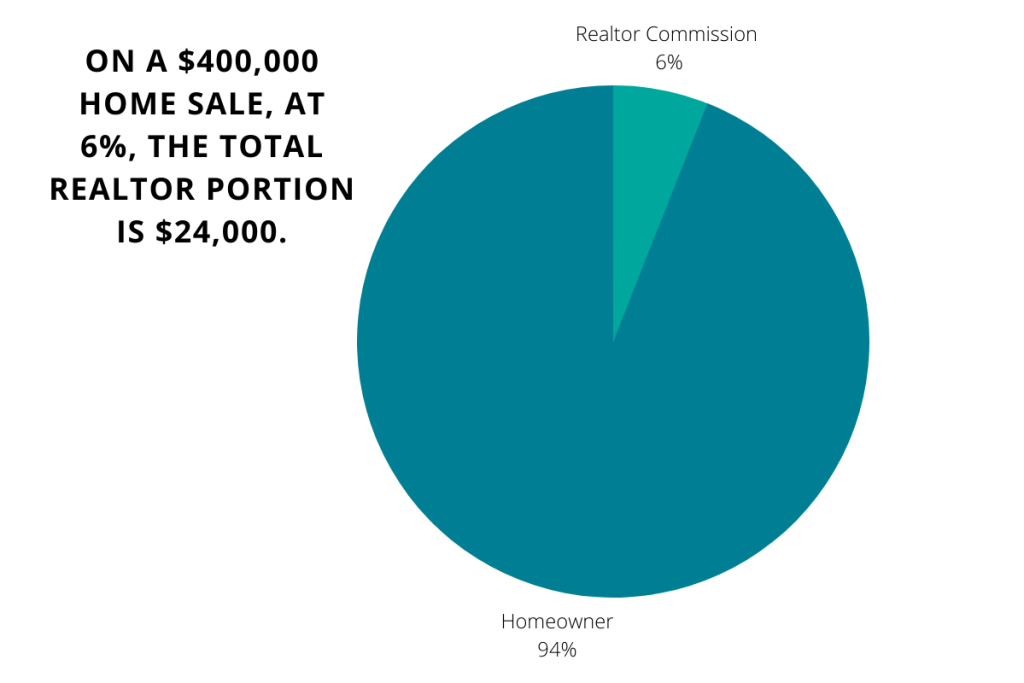

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

How much do most realtors make on a sale?

Around 5-6%

How much do Realtors and real estate agents make? Real estate agents make a commission on each home they successfully sell. That commission is generally around 5-6% of the sales price.

Do buyers pay realtor fees in NY?

The Seller Usually Pays Realtor Fees In New York

In New York, like every other U.S. real estate market, the homeowner/seller pays the realtor fees out of the proceeds from the sale of the property. This means that they are paying for their agent as well as the agent of the Buyer.

What is commission on a 500 000 house?

An individual real estate agent usually makes between 2–3% commission per home sale, which means you'll pay a combined total of 4–6% total commission on the sale of your home. That translates to $10,000–15,000 in real estate commission per agent on a $500,000 home sale.

What percentage do most realtors charge?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

This is a tactic by desperate realtors. They suggest listing at a high price that excites you so you sign the listing agreement and work with them. When the house doesn’t sell, they suggest a reduction in price in order for the sale to happen and they get paid their commission.

— The Pursuit of Enough (@PursuitOfEnough) October 4, 2023

Which real estate company pays the most commission?

eXp Realty

EXP Realty is the real estate company with the best commission split for its agents. Agents get an 80/20 commission split with an annual cap of $16,000, which means that after you hit that threshold, you earn 100% commission.

Do buyers pay realtor fees in PA?

Once the sale is final, both realtors will split a commission fee which is calculated by the purchase price of the home. This fee is paid by the seller, but it is calculated into the overall cost of the home. So, once you make the transaction on the home or property sale, you've done your part in “paying” the agents.

Who pays closing costs in NY?

While you and the buyer can be liable to pay the closing costs, it is almost always the buyer who pays it. In New York, closing costs for sellers range from 8% to 10%, although this is if you have paid the 6% agent commission. Your closing costs are also typically higher than that of buyers.

Who pays closing costs Illinois?

The buyer

In Illinois, the buyer usually pays the closing costs, which are around 3-4% of the home's price. The buyer pays for things like title insurance, fees to get the mortgage, and taxes.

Who generally prepares closing statements?

Closing statements are prepared by closing agents, who help facilitate the sale of a property to a buyer. Typically, closing agents are real estate attorneys, title companies or escrow officers.

Do realtors make good money in Texas?

As of Oct 9, 2023, the average annual pay for an Entry Level Real Estate Agent in Texas is $83,550 a year. Just in case you need a simple salary calculator, that works out to be approximately $40.17 an hour. This is the equivalent of $1,606/week or $6,962/month.

What is the highest salary for real estate?

Here are the top five highest-paying states for real estate agents:

- New York: $102,200.

- Massachusetts: $94,100.

- Colorado: $81,210.

- Connecticut: $78,540.

- California: $76,750.

How much do realtors make in Georgia?

The average salary for a realtor in Georgia is $40,500 per year. Realtor salaries in Georgia can vary between $16,500 to $126,500 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

How to make $1 million as a real estate agent?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

Are real estate companies profitable?

In conclusion, there are several types of real estate that can be profitable for investors. The most profitable types of real estate include commercial properties, rental properties, vacation rental properties, development opportunities, and REITs.

Who is the highest paid real estate owner?

At the top, Orange County, California-based Donald Bren remains the wealthiest real estate billionaire in the country with an estimated $16.2 billion net worth, nearly $1 billion higher than last year.

What states do realtors make the most money 2023?

According to Glassdoor's data, the top five highest-paying states for real estate brokers are Montana, Missouri, Massachusetts, California, and South Carolina.

How much does a real estate broker make in Florida?

The estimated total pay for a Real Estate Broker is $174,763 per year in the Florida area, with an average salary of $105,782 per year. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users.

Can a real estate be a millionaire?

About 90% of the world's millionaires over the last 2 centuries have come from real estate. So that's a resounding yes! For many investors, real estate offers a great opportunity to build wealth and create a large profit on each deal.

How does a brokerage firm make money?

Generally, brokerages make fees for every transaction. The online broker who offers free stock trades receives fees for other services, plus fees from the exchanges.

Are brokerage firms profitable?

Well-operated traditional brokerages, offering more traditional administration and management services, achieve profit margins of from 6 to 10 percent.

How do brokerage firms make money with zero commission?

Let's take a look at a few of the key revenue streams.

- Interest.

- Premium Services.

- Payment for Order Flow.

- How do Zero Commission Stock Brokers Make Money?

- Execution Quality.

- Tools and Resources.

- Customer Service.

- Amateur Traders/Investors May Overtrade.

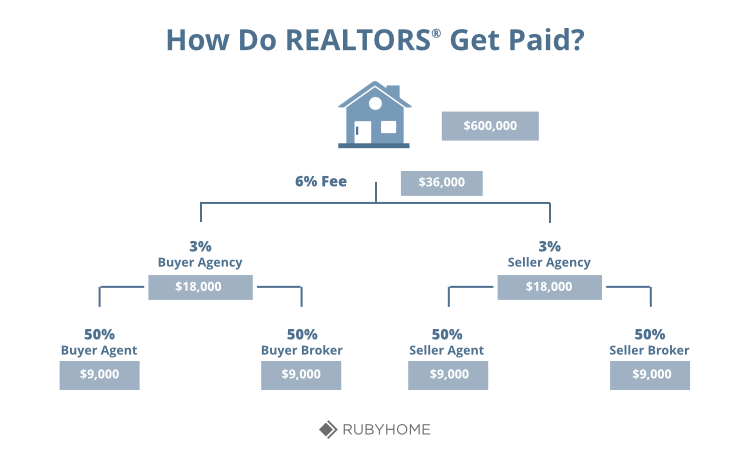

What percentage do most brokers take from agents?

The brokers then split their commissions with their agents. A common commission split gives 60% to the agent and 40% to the broker, but the split could be 50/50, 60/40, 70/30, or whatever ratio is agreed by the agent and the broker.

How is the broker’s commission usually paid out?

The commission is split between the seller's agent and buyer's agent right down the middle. Usually, the commission is paid directly to the brokerage, who distributes it to the agent.

How do you calculate net proceeds from a home sale?

How to calculate net proceeds. The simplest way to calculate net proceeds is to deduct all of the seller's closing costs, expenses and the mortgage balance from the final sale price of the home. Generally, you can expect to pay between 7 percent and 10 percent of your home's value in fees.

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

How do you calculate seller’s net sheet?

The seller's net sheet is calculated by taking the home sale price or an offer and then subtracting any encumbrances on the property (outstanding mortgage being the most common), closing costs and miscellaneous fees.

What are gross proceeds when selling a house?

The proceeds received before any deductions are made are known as gross proceeds, and they comprise all the expenses incurred in the transaction such as legal fees, shipping costs, and broker commissions.

Are proceeds from home sale taxed as income?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

What do most realtors make their first year?

While ZipRecruiter is seeing annual salaries as high as $144,000 and as low as $28,000, the majority of First Year Real Estate Agent salaries currently range between $65,000 (25th percentile) to $100,000 (75th percentile) with top earners (90th percentile) making $125,000 annually across the United States.

How much do top 1% realtors make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

What realtors make the most money?

The 6 Highest Paying Real Estate Careers with Good Salaries

- Home Inspector. If you already have a good main job and are looking for a part-time gig to maximize your income, you can work as a home inspector.

- Real Estate Lawyer.

- Real Estate Broker.

- Commercial Real Estate Agent.

- Property Manager.

- Corporate Real Estate Manager.

What is the #1 best paying job?

Get Matched!

- Anesthesiologist. #1 in Best Paying Jobs.

- Oral and Maxillofacial Surgeon. #2 in Best Paying Jobs.

- Obstetrician and Gynecologist. #3 in Best Paying Jobs.

- Surgeon. #4 in Best Paying Jobs.

- Orthodontist. #5 in Best Paying Jobs.

- Physician. #6 in Best Paying Jobs.

- Psychiatrist. #7 in Best Paying Jobs.

- Nurse Anesthetist.

How much profit to expect from home sale?

After selling your home, you must pay any outstanding mortgage, agent commissions, and closing fees. You keep the remaining money after settling these costs. After all the deductions, you have 60 to 85 percent of the house's total sale.

How do I calculate my profit from selling my house?

You calculate your net proceeds by subtracting the costs of selling your home and your remaining mortgage balance from the sale price. For example, if your sale price is $1,000,000, your remaining mortgage balance is $350,000, and the total closing costs are $60,000, then your net proceeds would be $590,000.

What do I need to know before selling my house?

Close: Make sure you have all your documentation ready.

- Set a timeline for selling your home.

- Hire an agent who knows the market.

- Determine what to upgrade — and what not to.

- Set a realistic price.

- List your house with professional photos.

- Review and negotiate offers.

- Weigh closing costs and tax implications.

What is the best month to sell a house 2023?

Spring (March-May)

The spring months are often considered the best month to sell a house. In fact, across the country, the first two weeks of May are often the busiest and most lucrative time for sellers.

Is profit from a home sale considered income?

You are required to include any gains that result from the sale of your home in your taxable income. But if the gain is from your primary home, you may exclude up to $250,000 from your income if you're a single filer or up to $500,000 if you're a married filing jointly provided you meet certain requirements.