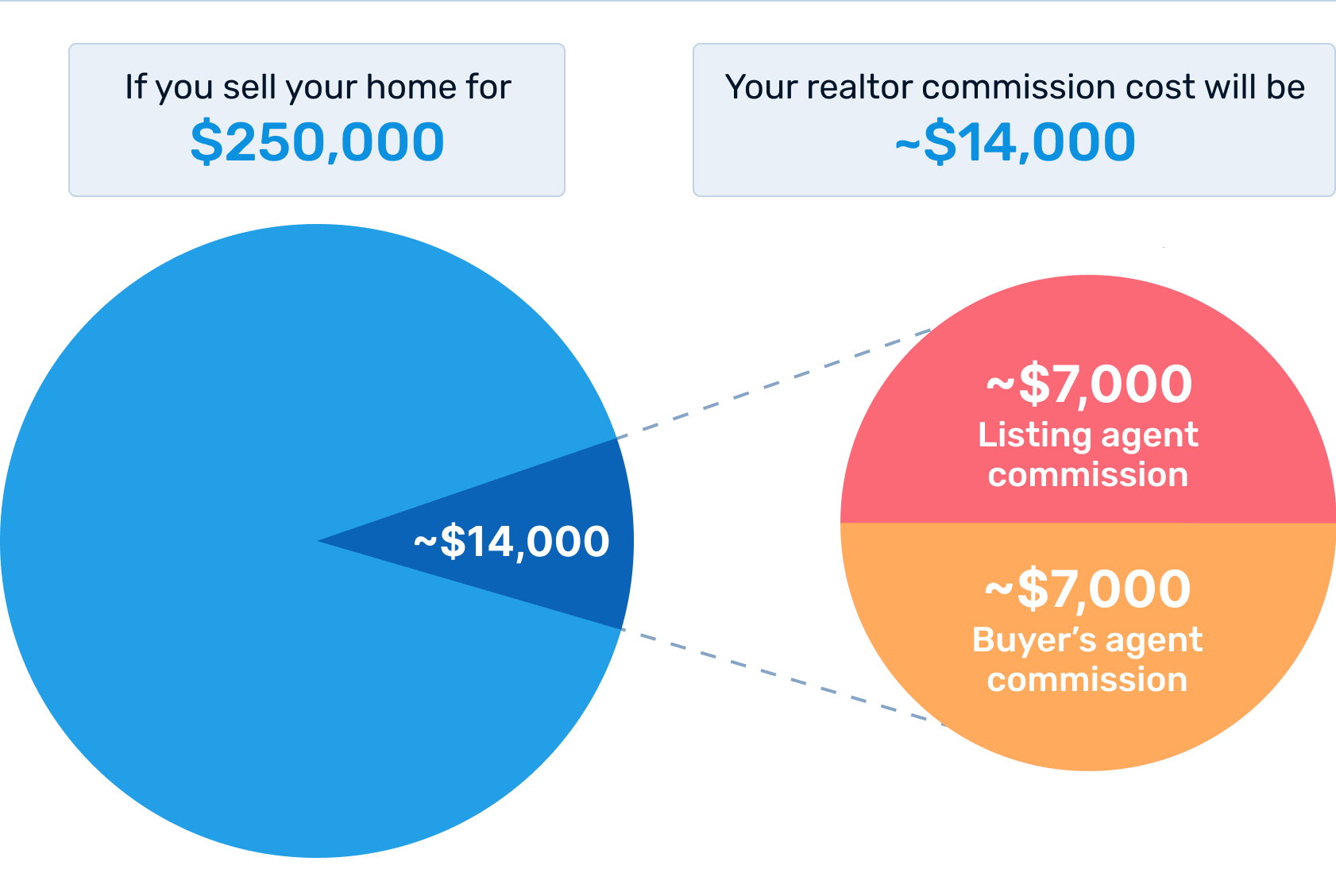

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

What percentage do most realtors charge in California?

The average California real estate agent commission rate is between 5-6%. However, commission on higher-priced home and property sales average 4-5% percent. The seller and agent usually negotiate the commission amount before entering into a listing contract.

What state has the highest real estate commission?

Missouri. The average real estate commission rate for agents in Missouri is 6.07%, and the state has the highest average realtor fees in the country.

What is commission in real estate in LA?

By Clever Real Estate Updated February 16, 2023. We polled local agents and found that the average real estate commission in Los Angeles is 5.50%, which is higher than the national average. More specifically, our survey revealed that commission rates in Los Angeles are typically in the range of 5.50% to 5.50%.

How much do top 1% realtors make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

How to make $100,000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

6) The data in this tweet thread came primarily from the NAR.

— Nick Gerli (@nickgerli1) May 19, 2023

They release their realtor member count every month. You can also see the breakdown by state.https://t.co/wyrkiKD0vD

How much does average realtor make in Ohio?

What is the average salary for a real estate agent in Ohio? The average salary for a real estate agent in Ohio is $32,000 per year. Real estate agent salaries in Ohio can vary between $17,000 to $90,500 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

How to make $1 million as a real estate agent?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

How does a mortgage pay the seller?

When the sale completes, the escrow agent makes payments to whoever is supposed to get the proceeds of the sale. This could be any holders of existing mortgages or liens on the property. The remainder typically goes to the seller in some convenient form such as an ACH transfer.

What should I do with large lump sum of money after sale of house?

Depending on your financial circumstances, it might make sense to pay down debt, invest for growth, or supplement your retirement. You might also consider purchasing products to protect yourself and your loved ones, including annuities, life insurance, or long-term care coverage.

How much do most realtors charge?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

Do buyers pay realtor fees in NJ?

Who pays realtor fees in New Jersey? In New Jersey, home sellers pay real estate commission fees out of the final sale proceeds for both agents involved in a deal. Offering to pay for the buyer's agent's commission is an incentive for agents to show your home to their clients.

How much is a real estate license in California?

How Much Does It Cost To Get A California Real Estate License?

| Course Tuition | $100 - $400+ |

| Background Check | $40 |

| Salesperson License Fee | $245 |

| Examination Fee | $60 |

| Total | $445 - $745 |

|---|

Is 6% normal for realtor?

Negotiate the commission rate.

Just because 5–6% is common, it doesn't mean that's what you have to accept. Ask your real estate agent if they're willing to take less.

What is the $250000 $500000 home sale exclusion?

The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9.

How do you calculate profit from a home sale?

You calculate your net proceeds by subtracting the costs of selling your home and your remaining mortgage balance from the sale price. For example, if your sale price is $1,000,000, your remaining mortgage balance is $350,000, and the total closing costs are $60,000, then your net proceeds would be $590,000.

How much equity should I have in my home before selling?

How much equity should you have before you sell your house? At the very least you want to have enough equity to pay off your current mortgage, plus enough left over to make a 20% down payment on your next home.

What happens to equity when you sell your house?

When the market value of your home is greater than the amount you owe on your mortgage and any other debts secured by the home, the difference is your home's equity. Selling a home in which you have equity allows you to pay off your mortgage and keep any remaining funds.

What is the capital gains tax on $200 000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

Are the sellers likely to pay closing costs?

Do Sellers Pay Closing Costs? Sellers pay fewer expenses, but they may actually pay more at closing. Typically, sellers pay real estate commissions to both the buyer's and the seller's agents. That generally amounts to average closing costs of 6% of total purchase price or 3% to each agent.

What are the fees that the buyer pays to close the deal called?

Closing costs include various fees due at the closing or settlement of a real estate transaction. Buyers are responsible for most of the costs, which include the origination and underwriting of a mortgage, taxes, insurance, and record filing.

Who generally prepares closing statements?

Closing statements are prepared by closing agents, who help facilitate the sale of a property to a buyer. Typically, closing agents are real estate attorneys, title companies or escrow officers.

What are the average closing costs in Ohio?

Closing costs in Ohio are, on average, $1,992 for a home loan of $145,637, according to a 2021 report by ClosingCorp, which researches residential real estate data.

What is the most seller can pay in closing costs?

Conventional Loans

- If your down payment is less than 10%, the seller can contribute up to 3%.

- If your down payment is 10 – 25%, the seller can contribute up to 6%.

- If your down payment is more than 25%, the seller can contribute up to 9%.

What are the chances of making it as a real estate agent?

Being a successful real estate agent is easier said than done. After all, there's a reason 87% of real estate agents fail. However, knowing the mistakes these realtors make, such as failing to follow up with clients or not having adequate funding, can help you prepare and grow a successful real estate business.

How much does a new realtor make in Texas?

Entry Level Real Estate Agent Salary in Texas

| Annual Salary | Hourly Wage | |

|---|---|---|

| Top Earners | $114,661 | $55 |

| 75th Percentile | $91,700 | $44 |

| Average | $83,550 | $40 |

| 25th Percentile | $59,600 | $29 |

What do most realtors make their first year?

While ZipRecruiter is seeing annual salaries as high as $144,000 and as low as $28,000, the majority of First Year Real Estate Agent salaries currently range between $65,000 (25th percentile) to $100,000 (75th percentile) with top earners (90th percentile) making $125,000 annually across the United States.

How do real estate agents get paid in SC?

How Are Real Estate Agents Paid in South Carolina? Typically, real estate agents don't get a standard salary or hourly rate. Instead, for each transaction they work they earn a commission. The commission is a percentage of the sale price of the home for which they either find a buyer or help sell.

How do realtors get paid in New York?

The Seller Usually Pays Realtor Fees In New York

In New York, like every other U.S. real estate market, the homeowner/seller pays the realtor fees out of the proceeds from the sale of the property. This means that they are paying for their agent as well as the agent of the Buyer.

What type of realtors make the most money?

The 6 Highest Paying Real Estate Careers with Good Salaries

- Home Inspector. If you already have a good main job and are looking for a part-time gig to maximize your income, you can work as a home inspector.

- Real Estate Lawyer.

- Real Estate Broker.

- Commercial Real Estate Agent.

- Property Manager.

- Corporate Real Estate Manager.

Where do realtors get paid the most?

Real estate agents in high cost of living cities such as New York and San Francisco tend to be the highest earners.

How do I find my property tax bill online in Indiana?

indy.gov: Pay Your Property Taxes or View Current Tax Bill.

How do I find my property tax records in Missouri?

Contact your County Assessor's Office. For contact information, see the Missouri State Tax Commission website.

How do I look up my property taxes in St Louis?

Real estate property tax amounts are posted at Real Estate Information. Search for the property and click on the address link to pull it up. If you want to view a specific tax year or print receipts for prior years, be sure to change the 'Available Tax Years' to the year you need before clicking on any links.

How do I pay my real estate tax in St Louis City?

Instructions

- In Person. In person payments are accepted in the form of credit or debit card, cash, check, money order or cashier's checks.

- By Mail. Mailed in payments are accepted in the form of check, money order, or cashier's check.

- By Phone. Payments can be made over the phone by calling (314) 408-6887.

- Online.

What age do you stop paying property taxes in Indiana?

Freezes the property tax liability on a homestead of an individual who is at least 65 years of age and has maintained a qualified interest in the homestead for at least 10 years.

Who sets the amount of a broker’s commission for a particular transaction?

Your Broker Makes Commission

The commission amount paid depends on the agreement made by both parties involved in the transaction. This includes: Buyer and seller in the case of a sale, or. Landlord and owner and tenant in the case of a lease.

Who directly pays the real estate salesperson his her commission?

Standard practice is that the seller pays the fee. However, the seller usually wraps the fee into the price of the home. So, the buyer ultimately ends up paying the fee, albeit indirectly. Let's say, for example, that a buyer and seller (each with a real estate agent) agree to a deal on a home for $200,000.

Who is the agents principal in a real estate sales transaction?

The principal is the individual who is selling the real estate property, while the agent is the licensed broker who has been contracted to represent the seller. In a complex market, it's a responsible choice for a seller to hire an agent to handle the intricate processes that come along with selling real estate.

Does the seller pay realtor fees in Florida?

Sellers Pay Real Estate Commission Fees

The Realtor commission fees are then split between the listing agent's brokerage and the buyer's agent's brokerage. The respective brokerages then give the agents their portion of the commission. Oftentimes, the realtor fees are split equally between the brokerage and the agent.

Do all brokers charge commission?

Some brokerages charge commissions on stock and ETF trades, but these costs are currently on the decline. To avoid them, look for: Brokers that offer commission-free trading, including Fidelity, TD Ameritrade, Charles Schwab, E-Trade, Interactive Brokers and Robinhood.