How Do I Calculate Cost Basis for Real Estate?

- Start with the original investment in the property.

- Add the cost of major improvements.

- Subtract the amount of allowable depreciation and casualty and theft losses.

What is an example of a cost basis in real estate?

Let's say that you purchase a property as a primary residence for a purchase price of $250,000. Over the years, you put in another $50,000 worth of home improvements, such as a new bathroom and kitchen. Those upgrades increased your adjusted basis to $300,000.

What is an example of a cost basis?

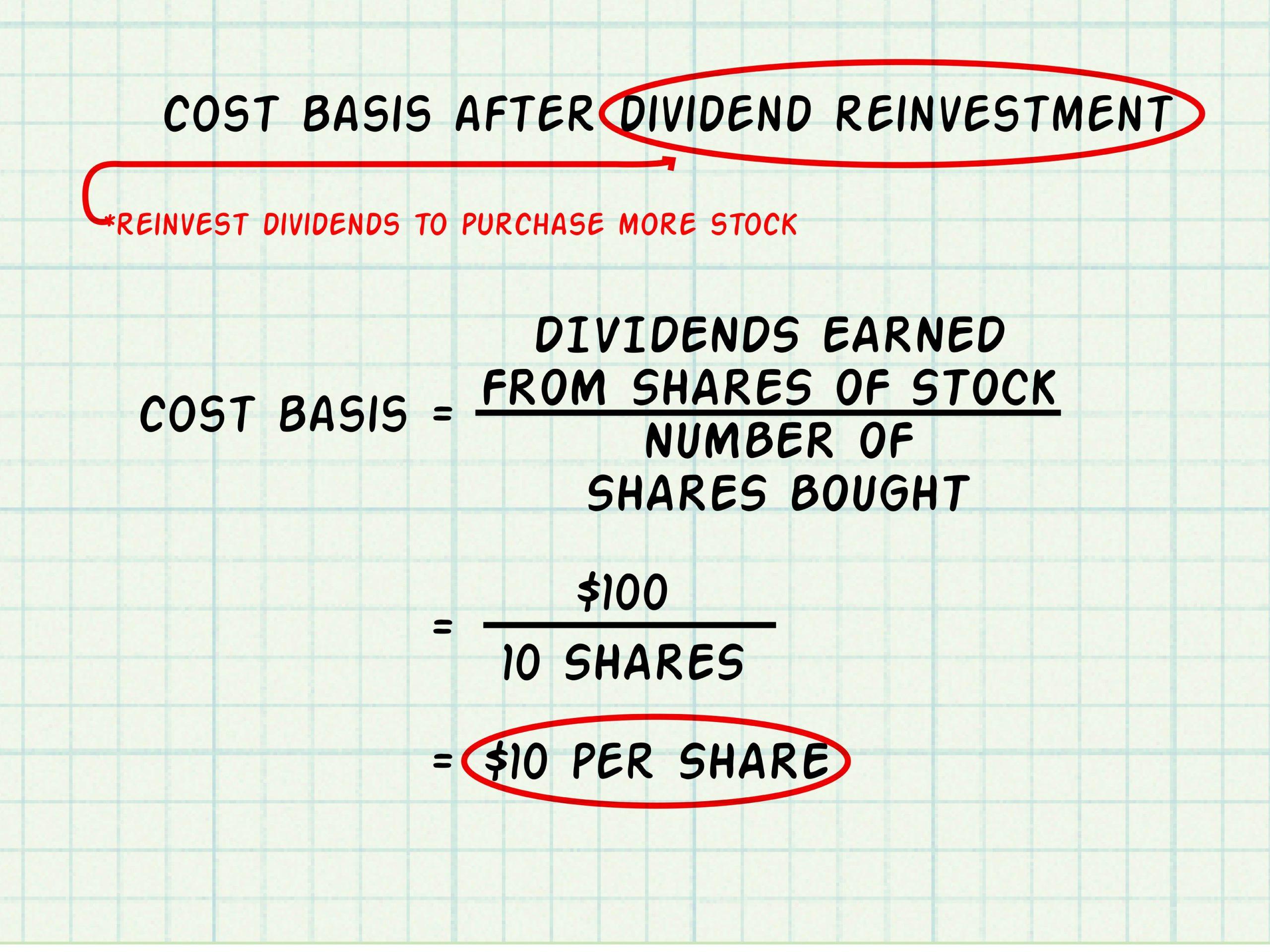

Typically, when you purchase shares of stock, the cost basis is simply the price you paid for each share. Say you purchased 10 shares of XYZ for $100 per share in a taxable brokerage account. The total cost would be $1,000, and your cost basis for each individual share would be $100.

What is cost basis in simple terms?

Simply put, cost basis is the amount you paid—including brokerage fees, loads, and any other trading cost—to purchase an investment. This often means the price at the time of original purchase, although in some cases you'll have an adjusted cost basis.

How does IRS verify cost basis?

How Does the IRS Verify Cost Basis in Real Estate? In real estate transactions, the IRS can verify the cost basis by looking at the closing statement of when the property was purchased, or any other legal documents associated with the property, such as tax statements.

What happens if I dont pay my broker?

If the investor is unable to bring their investment up to the minimum requirements, the broker has the right to sell off their positions to recoup what it's owed. The broker may also charge commissions, fees, and interest to the account holder.

How To Calculate New Basis In A 1031 Exchange

— Daniel Goodwin (@Provident1031) July 30, 2022

Table of Contents:

How To Calculate New Basis in 1031 Exchange

What Is A Cost Basis in Real Estate?

1031 Exchange Basis Calculations

and much more!https://t.co/Yoxnu5TjJb#1031Exchange #DSTs #DST #DanielGoodwin #Provident1031 pic.twitter.com/SgrdAfeghs

Can a seller refuse to pay buyers agent in Texas?

The simple answer is yes — you're not legally obligated to offer buyer's agent commission. But you'll have to decide this up front and advertise it in your listing accordingly.

Can you sue a broker for losing money?

Can You Sue Your Broker? Yes, you can sue your broker if you have had losses in your financial account. There are two primary ways of suing your broker: filing a suit or filing an arbitration. Keep in mind that you cannot simply sue your broker and be successful in doing so if you have suffered financial losses.

What IRS forms do I need when I sell my house?

File the following forms with your return:

- Federal Capital Gains and Losses, Schedule D (IRS Form 1040 or 1040-SR)

- California Capital Gain or Loss (Schedule D 540) (If there are differences between federal and state taxable amounts)

Who issues a 1099-s from sale of real estate?

Form 1099-S is used to report the sale or exchange of present or future interests in real estate. It is generally filed by the person responsible for closing the transaction, but depending on the circumstances it might also be filed by the mortgage lender or a broker for one side or other in the transaction.

Where do I report sale of land on 4797?

The disposition of each type of property is reported separately in the appropriate part of Form 4797 Sales of Business Property (for example, for property held more than one year, report the sale of a building in Part III and land in Part I).

Is sale of land an income?

If you own land for more than one year before selling it, this would be considered a long-term capital gain or loss. If you own land for a year or less, it's considered a short-term capital gain or loss. The taxes you pay will depend on this net gain or loss.

Should I file form 8949 or Schedule D?

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

Does sale of land go on 4797 or Schedule D?

What Is the Difference Between Schedule D and Form 4797? Schedule D is used to report gains from personal investments, while Form 4797 is used to report gains from real estate dealings—those that are done primarily in relation to business rather than personal transactions.

How do I get more sales in real estate?

Unique Real Estate Marketing Ideas

- Create a website.

- Build a blog.

- Develop email marketing campaigns.

- Employ virtual staging.

- Try experiential marketing.

- Partner with local businesses.

- Run paid Instagram promotion.

- Use drone photography.

How can I grow faster in real estate?

How to Grow Your Real Estate Business

- Leverage your sphere of influence.

- Start networking.

- Learn how to use sites such as Zillow to your advantage.

- Check the cost for Google Ads in your area.

- Run Facebook ads.

- Optimize your website for organic search.

- Start blogging.

How do I get more buyers and sellers in real estate?

Here are 11 ways to get clients in real estate:

- Buy Real Estate Leads.

- Engage With Your Community.

- Ask Existing Clients for Referrals.

- Create a Website.

- Post On Social Media.

- Specialize In a Niche.

- Try Cold Calling.

- Host Open Houses.

Where do realtors get most of their leads?

20 Places to Find Real Estate Leads for New Agents

- Reach Out to Friends and Family.

- Attend Chamber of Commerce Events.

- Get Active on Social Media.

- Research Instagram Hashtags.

- Reach Out to FSBO's.

- Reach Out to FRBO's.

- Give a Free Seminar.

- Host an Open House.

How many houses do most realtors sell a year?

So How Many Houses Does a Realtor Really Sell Each Year? Only a small number of realtors sell more than a hundred homes a year, and the majority sell anywhere between 2-10 homes a year. Further, first-year or those just starting as realtors usually sell the least number of homes.

How do you determine the selling price of a house?

One of the most accurate ways to figure out the value of your home is by getting a home appraisal by a professional. Lenders will rely on a third-party home appraiser before approving a mortgage, but it's not a requirement for homeowners. However, using an appraiser is a good idea if you're preparing to sell your home.

What describes a seller’s asking price for a property?

The asking price – also referred to as a listing price or list price – is the amount of money a seller would like to receive for their home. The seller and their real estate agent come up with the asking price as a starting point for potential buyers.

Who or what actually determines the selling price for real estate?

Unfortunately, there is no easy or universal way to determine market value for real estate. However, nearly every market valuation comes down to two factors: real estate appraisals and recent comparable sales.

What are the three pricing strategies for real estate?

If you're looking to price your real estate competitively and profitably, there are three broad strategies you can follow: aspirational pricing, market value pricing, and below-market pricing.

Is the sale price of a house is always equal to its value?

While cost and price can affect value, they do not determine value. The sales price of a house might be $150,000, but the value could be significantly higher or lower.

How do I rent out privately?

When renting out your house, if you don't use a letting agent, it's crucial to find reliable tenants who will take care of your property and pay rent on time. To do this, you'll need to screen potential tenants carefully. This includes checking their credit score, rental history, and employment status.

What is a broker in rent?

Sometimes referred to as apartment brokers or rental agents, they help connect the dots between people who are looking to rent apartments and people who are looking to fill them—and all at usually no cost to the renter. Important to note is that rental brokers aren't real estate agents.

How do you list properties?

How to Write a Real Estate Listing Description that Sells

- Describe the property accurately.

- Choose adjectives wisely.

- Avoid red flag words.

- Include words that add value.

- Highlight unique features.

- Take notice of punctuation.

- Leave out super basic info.

- Use great photos.

Can I rent my own property to my business Australia?

In essence, it' is possible to rent out your own property to you business if two things are in place: The property is held in a trust structure where you are the beneficiary. The business in question is registered as a company.

Can I Airbnb my house?

So, as long as you have checked with your mortgage provider or landlord, letting out your property on Airbnb is possible. Providing you have a location people desire, pricing that draws attention, be fully safety compliant and have the correct insurance, there isn't much more you need to do.

What are the exceptions to the primary residence exclusion?

Exceptions include experiencing a death in the family, losing a job and receiving unemployment, no longer being able to make payments on the house due to a divorce, death, or change in job, having become physically or mentally disabled, or being on official extended duty in the Foreign Service, intelligence community,

What are the two rules of the exclusion on capital gains for homeowners?

The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify. The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

How many times can you use the home sale exclusion?

You're only allowed to exclude gain on the sale of a home once every two years. This is true unless the reduced gain exclusion rules apply. You usually can't exclude the gain on the sale of a home if both of these apply: You sold another home at a gain within the past two years.

What are the unforeseen circumstances with capital gains tax?

§ 1.121-3(e)(2): involuntary conversion of the residence; disasters or acts of war or terrorism damaging the residence; or a qualified individual's death, unemployment (if eligible for unemployment compensation), change in employment status that results in an inability to pay housing costs and basic living expenses, ...

What are unforeseen circumstances for 1031 exchange?

Unforeseen circumstances are when the taxpayer fails to meet the original intent by reason of a change in the location of employment, health, or, to the extent provided in the Regulations.

What percentage do most realtors take?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

Who pays the transaction fee?

A credit card transaction fee is charged to the merchant or vendor, not the cardholder. Businesses pay the card transaction fees to the credit card issuer or payment processor company.

How do you handle a real estate transaction?

The 10 Steps of a Real Estate Transaction or Closing

- Step One: Find a Trusted Real Estate Agent and Lender (Buyer)

- Step Two: Find or List Your Home (Buyer/Seller)

- Step Three: Sign the Contract and Open Escrow (Buyer)

- Step Four: Complete Inspections (Buyer) & Repairs (Seller)

Do buyers pay realtor fees in NY?

The Seller Usually Pays Realtor Fees In New York

In New York, like every other U.S. real estate market, the homeowner/seller pays the realtor fees out of the proceeds from the sale of the property. This means that they are paying for their agent as well as the agent of the Buyer.

What is the 80 20 rule for realtors?

The rule, applicable in many financial, commercial, and social contexts, states that 80% of consequences come from 20% of causes. For example, many researchers have found that: 80% of real estate deals are closed by 20% of the real estate teams. 80% of the world's wealth was controlled by 20% of the population.

What is the best time to call real estate leads?

For example, findings from one recent study suggested that “decision makers are more likely to engage in the late afternoon,” with engagement rates peaking “during the 4-5 p.m. hour.” And data from another study showed that “the best time to cold call a prospect is between 9 a.m. and 4 p.m., with 10 a.m. (15.53%) and 2

What percentage of leads turn into sales real estate?

Between 0.4% and 1.2%

Some will even tell you to shoot for an average of 5% just to stay afloat. But the truth of the matter is far more layered. The actual national average real estate conversion rate falls somewhere between 0.4% and 1.2%.

How do real estate leads work?

Real estate leads are people who are looking at property and might be interested in hearing a pitch from you. You might call a lead a “future client.” If everything goes well, then you'll likely close the deal. In between getting a lead and closing a deal, you need to nurture the lead.

How often do you contact real estate leads?

The deal may have closed, but it is important to make sure your client keeps you top of mind when they think of real estate. Twice a year: Check in with a quick call, text or email just to see how they're doing. Or, check in on their important days (birthdays, home anniversaries, etc).

How late is too late to call leads?

How early is too early, and how late is too late to call your prospects and internet leads? Even though Federal Law allows calling between 8 AM and 9 PM, some states place additional restrictions on telemarketing calling hours.