Form 1099-S

Use Form 1099-S to report the sale or exchange of real estate.

Who issues a 1099-s from sale of real estate?

Form 1099-S is used to report the sale or exchange of present or future interests in real estate. It is generally filed by the person responsible for closing the transaction, but depending on the circumstances it might also be filed by the mortgage lender or a broker for one side or other in the transaction.

Do you get a 1099-S at closing?

If you close a transaction with a title company or attorney (as most people do), they will collect the necessary information and file Form 1099-S for you.

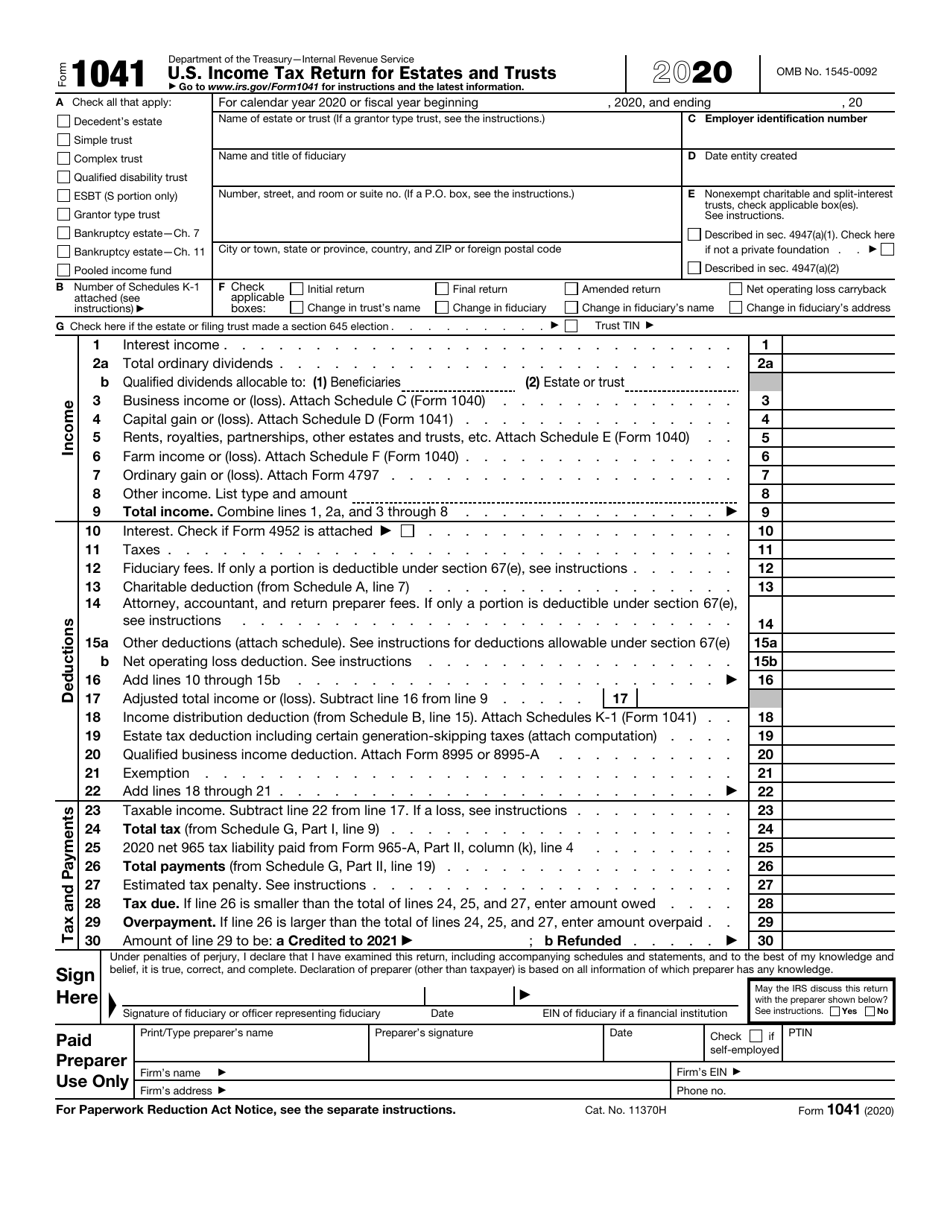

What is the IRS form for estate income tax?

Form 1041

Form 1041, U.S. Income Tax Return for Estates and TrustsPDF, is used by the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate to report: Income, deductions, gains, losses, etc.

Do I pay taxes to the IRS when I sell my house?

If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. Your gain is usually the difference between what you paid for your home and the sale amount. Use Selling Your Home (IRS Publication 523) to: Determine if you have a gain or loss on the sale of your home.

Which illegal act may lead to a real estate salesperson losing his her license?

Mishandling or Stealing Client Money. Mishandling a client's money is one of those scenarios that is typically more related to negligence than anything nefarious — unless, of course, you actually steal a client's money.

As per my Tax Advocate, Income Tax Notice may come on these 5 Cash Transactions.

— R.K. (@ipo_mantra) March 15, 2023

Check Details :

1. Bank Fixed Deposit:

Cash deposit in bank FD should not exceed Rs 10 lakh. The Central Board of Direct Taxes (CBDT) has announced that banks will have to disclose whether…

What is an example of exception where the real estate law does not require licensing?

If an investor is buying and selling their own properties, they don't need a real estate license. Anyone can buy and sell their own property without representation, and without a license.

Which would be considered the unauthorized practice of law by a real estate agent?

The unauthorized practice of law is performing legal services, creating legal documents, or offering legal advice as a person who is unlicensed, disbarred, or with no bar admission authorizing an individual to be able to do so. A real estate agent, for example, is not allowed to offer legal opinions to clients.

Is 1200 rent too much?

How Much Should You Spend on Rent? Try the 30 Percent Rule. Financial experts generally recommend spending around 30% of your gross income on rent. So if you earn $48,000 a year – $4,000 a month before taxes – you should spend around $1,200 a month on rent.

Do you have to make 40 times the rent in NYC?

The concept of affordable rent is subjective. Some landlords, particularly those in New York City, require that prospective tenants have an annual gross income of at least 40 times the rent. While this requirement can be helpful, it shouldn't be the only way to determine apartment affordability.

How do you accumulate wealth through real estate?

7 Ways to Build Wealth Through Real Estate Investing

- Invest in a Private Equity Fund.

- Invest eligible capital gains in a Qualified Opportunity zone.

- Invest in a REIT.

- Complete a 1031 exchange.

- Invest in a syndicate.

- Participate in a “mini-IPO”

- Invest in a private debt fund.

What type of real estate makes the most money?

Commercial properties are considered one of the best types of real estate investments because of their potential for higher cash flow. If you decide to invest in a commercial property, you could enjoy these attractive benefits: Higher-income potential. Longer leases.

How to use real estate to become a millionaire?

8 Tips On How To Become A Real Estate Mogul or Millionaire

- Have a Good Business Plan.

- Find Sustainable Real Estate Markets.

- Narrow Down Your Scope.

- Build Your Real Estate Team.

- Acquire Your First Investment Real Estate.

- Step Back and Evaluate Your Investments.

- Step Back and Wait.

Why real estate creates 90% of millionaires?

Real estate investment is not a get-rich-quick scheme. Instead, it's a long-term strategy that can steadily build wealth over time. As you continue to own and manage properties, their value appreciates, and your equity grows. Diversifying your investment portfolio is a crucial wealth-building strategy.

What is the largest expense in most real estate firms?

Vehicle expenses

Transportation. Most REALTORS® say that their largest category of business expenses is vehicle expenses, according to the NAR report.

What percentage do most brokers take from agents?

The brokers then split their commissions with their agents. A common commission split gives 60% to the agent and 40% to the broker, but the split could be 50/50, 60/40, 70/30, or whatever ratio is agreed by the agent and the broker.

How much should a real estate agent spend on marketing?

The amount of money you should spend on marketing as a real estate agent is entirely dependent on your income and available resources. Most agents recommend allocating 10% of your commission money to marketing.

Where do real estate brokers make the most money?

Real estate agents in high cost of living cities such as New York and San Francisco tend to be the highest earners.

Who gets paid the most in real estate business?

A career as a real estate broker is one of the highest paying and lucrative professions in the real estate industry. On average, experienced brokers take home a six-figure pay. You can only achieve this number once you get a significant amount of good reputation.

What do you pay after mortgage is paid off?

You'll Need to Update Your Insurance and Taxes

In addition to covering the installment on your home loan, your monthly mortgage payments likely collected funds used to pay for homeowners insurance coverage and your annual property taxes.

Does homeowners insurance go down when mortgage is paid off?

Unfortunately, paying off your mortgage doesn't reduce homeowners insurance premiums. You will no longer be required to carry home insurance as it isn't legally mandated, but your home will still require the same level of coverage to protect you from financial losses.

What happens at the end of the mortgage term?

When your mortgage term ends, you must pay off the whole balance outstanding on your account and any associated loans (if the associated loans have also came to an end). This requirement is part of the terms and conditions of your mortgage.

Is it good to have a paid off house?

Key Takeaways

Paying off your mortgage early could free up your cash for travel, retirement, or other long-term plans. Being mortgage-free may insulate you from losing your home if you run into financial difficulties.

What is a good age to have your house paid off?

Sure, there's something to be said for being completely debt-free by age 45, but do remember that mortgage debt is considered a healthy type to have. And many homeowners continue to make mortgage payments well into their 50s and 60s. Some people even have a mortgage during retirement.

Do you get a tax break when you pay off your mortgage?

The interest paid on a mortgage is tax-deductible. When you pay off your mortgage, you will no longer be paying interest and will lose this tax deduction. This will make your taxes go up as a result of eliminating this mortgage interest deduction.

What happens to my taxes when I pay off my mortgage?

Once you pay off your house, your property taxes aren't included in your mortgage anymore, because you don't have one. Now it's on you to pay property taxes directly to your local government. How often you pay property taxes depends on where you live.

Can you write off paying off a loan?

Though personal loans are not tax-deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted on your annual taxes, effectively reducing your taxable income for the year. You shouldn't need a tax break to afford a personal loan.

Can I deduct mortgage interest paid at closing?

Typically, the only closing costs that are tax deductible are payments toward mortgage interest, buying points or property taxes. Other closing costs are not.

Is there a downside to paying off mortgage early?

Disadvantages of Paying Off Mortgage Early

If you have credit card or student loan debt, funneling your extra cash toward paying off your mortgage early can actually cost you in the long run. This is because these other types of debt likely have higher interest rates. Less money for savings.

How do you calculate appraised value of a house?

Appraisers estimate a home's value in three main ways:

- Comparing it with other properties (market data analysis)

- Calculating how much it would cost to rebuild the property from scratch (cost to reproduce)

- Calculating how much income it produces (income capitalization)

What not to say to an appraiser?

In his post, he lists 10 things as a Realtor (or even homeowner), you should avoid saying to the appraiser:

- I'll be happy as long as it appraises for at least the sales price.

- Do your best to get the value as high as possible.

- The market has been “on fire”.

- Is it going to come in at “value”?

Do houses usually appraise above selling price?

“You can't always avoid [a low appraisal],” says Megan Walters, a top-rated agent who sells homes more than 41% faster than the average agent in her Columbia, Missouri, market. Most appraisals come in at the right price. According to CoreLogic, in general, appraisals come in below contract only about 7-9% of the time.

What can negatively affect a home appraisal?

The appraisal process depends upon the good upkeep of the home and general maintenance of residential appliances. Outdated appliances, peeling paint, and poor overall condition will reduce a home's value.

How accurate is Zillow Zestimate?

The nationwide median error rate for the Zestimate for on-market homes is 2.4%, while the Zestimate for off-market homes has a median error rate of 7.49%.

How do you report the sale of a house on your tax return?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

What IRS forms do I need when I sell my house?

File the following forms with your return:

- Federal Capital Gains and Losses, Schedule D (IRS Form 1040 or 1040-SR)

- California Capital Gain or Loss (Schedule D 540) (If there are differences between federal and state taxable amounts)

Who sends a 1099 when you sell a house?

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return.

How does IRS know you sold property?

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

Are you required to report sale of home on tax return?

You are required to include any gains that result from the sale of your home in your taxable income. But if the gain is from your primary home, you may exclude up to $250,000 from your income if you're a single filer or up to $500,000 if you're a married filing jointly provided you meet certain requirements.

How to calculate closing costs?

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Which of the following closing cost fees is commonly charged on a loan?

These costs are generally 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes and more.

Do sellers pay closing costs in NY?

While you and the buyer can be liable to pay the closing costs, it is almost always the buyer who pays it. In New York, closing costs for sellers range from 8% to 10%, although this is if you have paid the 6% agent commission. Your closing costs are also typically higher than that of buyers.

Do sellers pay closing costs in Ohio?

In Ohio, as in most states, closing costs can include fees related to the mortgage loan, title search, appraisal and any applicable taxes. Although the buyer pays most of these costs, as the one taking out the loan, the seller is not off the hook.

Which of the following is an example of a closing cost?

Examples of closing costs include fees related to the origination and underwriting of a mortgage, real estate commissions, taxes, insurance, and record filing.