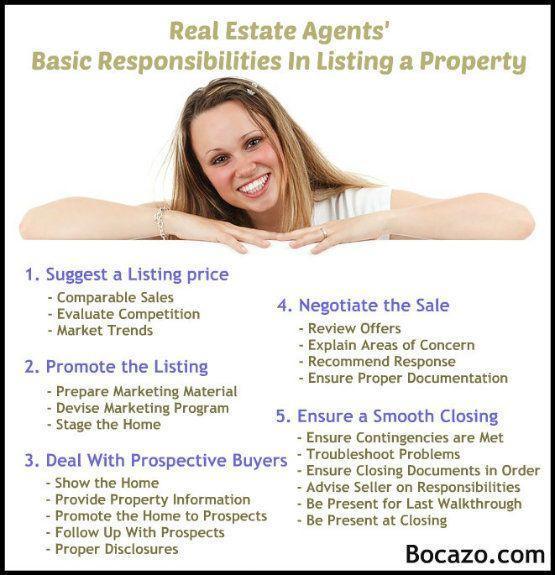

Real Estate Agent responsibilities include: · Providing guidance and assisting sellers and buyers in marketing and purchasing property for the right price under

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

How long do I have to buy another property to avoid capital gains?

Within 180 days

How Long Do I Have to Buy Another House to Avoid Capital Gains? You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.

What is the capital gains tax on $200 000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

Is there a one time forgiveness on capital gains tax?

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.

One reason I like investment sales brokerage as a path to doing your own deals:

— Moses Kagan (@moseskagan) October 13, 2023

The ~whole job is building relationships with rich people who invest in real estate.

What makes a good real estate deal?

If the listing price is lower than the fair market value of the property, it would probably be a good real estate investment deal. Consider doing a real estate appraisal to estimate the value of the rental property for sale. Location is one of the most important factors when it comes to investing in real estate.

How to do the 1 rule in real estate?

The 1% rule of real estate investing measures the price of the investment property against the gross income it will generate. For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price.

What are the rules for exclusion of gain on sale of home?

In order to qualify for the principal residency exclusion, an owner must pass both ownership and usage tests. The two-out-of-five-year rule states that an owner must have owned the property that is being sold for at least two years (24 months) in the five years prior to the sale.

How many times can you use the home sale exclusion?

You're only allowed to exclude gain on the sale of a home once every two years. This is true unless the reduced gain exclusion rules apply. You usually can't exclude the gain on the sale of a home if both of these apply: You sold another home at a gain within the past two years.

Which is a federal law that applies to real estate?

The Federal Fair Housing Act prohibits discrimination in real estate transactions on account of race, color, religion, sex,or national origin. See 42 U.S.C. §§ 3601-3631. Real estate brokers are specifically prohibited from discriminating by the act.

What is the law commonly referred to as real estate law?

California's Real Estate Law (also known as the license law) is contained in sections 10000 to 10580 of the Business and Professions Code. The purpose of the law is to regulate the real estate profession and protect the public from incompetent, unethical, or dishonest real estate agents.

Is real estate regulated in the US?

Real Estate and mortgages, are heavily regulated on the local, regional, and federal level. As such, materials from government agencies can enhance your research on these topics. This link provides assessor and property tax records resources by state. Each state has an office that handles property assessment.

What is the USA Patriot Act real estate?

The Patriot Act “blocks property and prohibits transactions with persons who commit, threaten to commit, or support terrorism.” OFAC regularly adds names of persons covered by the Patriot Act to their Specially Designated Nationals and Blocked Persons (SDN) list.

What is commission on a 500 000 house?

An individual real estate agent usually makes between 2–3% commission per home sale, which means you'll pay a combined total of 4–6% total commission on the sale of your home. That translates to $10,000–15,000 in real estate commission per agent on a $500,000 home sale.

What percentage do most realtors charge?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

How to make $1 million as a real estate agent?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

How to make over 6 figures as a real estate agent?

Outsource As Much As Possible

In order to make a six-figure income as a real estate agent, it is important to outsource as much work as possible. When you are able to focus on the tasks that generate income, you will be able to maximize your time, your profits and grow your business more efficiently.

What is the commission on a $40 million dollar home?

There was a recurring plot point on the first season of Selling Sunset, the Netflix show about the ambitious brokers at the Oppenheimer Group in Southern California: who could sell a coveted $40 million home, and with it, earn a hefty $1.2 million commission?

How does rentback com work?

Rentback is a sale-leaseback service that helps owners access the equity in their home while continuing to live in the residence as a renter. According to most sources, Rentback makes money primarily by connecting property investment companies with owners who want to access the equity in their home.

Is it better to sell a paid off house or use it as a rental?

Selling your home might be the better option if you need the money to pay for your next home, have no interest in being a landlord or stand to make a large profit. Renting it out might be a better choice if your move is temporary, you want the rental income or you expect home values to go up in your area.

What are 3 advantages of rent to own?

The Pros Of Rent-To-Own Homes

- It allows you to save money for a down payment. It's a great way to pay toward a down payment and test-drive a home to make sure you like it.

- You can save on repair costs.

- It offers you the option to buy or move.

What is the main reason to avoid renting to own?

You will pay much more than the cost of the item in a short period of time. Renting to own typically involves paying more for the item over time compared to buying it outright. The extra cost comes in the form of fees and interest that are added to the base price of the item.

What is the disadvantage of rent back?

Cons Of A House Rent-Back

The rent may be more expensive for the seller than their mortgage payment. If there's damage to the house, sellers may lose their security deposit. The buyer can't take possession of the house upon closing. The buyer ends up taking on landlord responsibilities.

What is the income threshold for 0% capital gains tax?

Here's your capital gains tax bracket

For 2023, you may qualify for the 0% long-term capital gains rate with taxable income of $44,625 or less for single filers and $89,250 or less for married couples filing jointly.

What is the capital gains tax rate for 2018?

Capital gains rates for individual increase to 15% for those individuals with income of $38,600 and more (($77,200 for married filing joint, $38,600 for married filing separate, and $51,700 for head of household) and increase even further to 20% for those individuals with income over $425,800 ($479,000 for married

What is the threshold for capital gains on real estate?

Key Takeaways. You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly.

How much is capital gains tax with no other income?

The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% or 37%. Capital gains taxes apply to the sale of capital assets for profit.

How do I calculate my capital gains tax?

How to Calculate Long-Term Capital Gains Tax

- Determine your basis. The basis is generally the purchase price plus any commissions or fees you paid.

- Determine your realized amount.

- Subtract the basis (what you paid) from the realized amount (what you sold it for) to determine the difference.

- Determine your tax.

What does it mean when a tax bill is paid in arrears?

Arrears is a financial and legal term that refers to the status of payments in relation to their due dates. The word is most commonly used to describe an obligation or liability that has not received payment by its due date. Therefore, the term arrears applies to an overdue payment.

How are property taxes paid in Ohio in arrears?

Real estate property taxes are actually billed and assessed one year in arrears. Ohio real estate taxes may be paid in two, semi annual installments. Because of the payment in arrears phenomenon, the taxpayer is, in effect, paying taxes based on a non-current valuation of their property.

Are Maryland property taxes paid in advance or arrears?

In Maryland, the taxes give the state its dubious distinction. Maryland is one of only seven states that require homeowners to pay a year's worth of property taxes in advance upon closing a real estate deal. Most other states have a system whereby homeowners pay property taxes "in arrears" -- at the end of the year.

How are property taxes paid in Wisconsin?

The bills must be mailed in early December. The initial property tax payment is normally paid to the municipal clerk or treasurer. Generally, a real estate property tax bill is due for payment no later than the following January 31. However, a real property owner may opt to pay his or her bill in installments.

What is an example of paid in arrears?

Paid in arrears meaning in payroll

For example, imagine that you pay employees on the fifth of March for work that was completed during the full month of February. Because the employees receive their paychecks after the work has already been completed, it's paid monthly in arrears.

How do I find out if someone has a real estate license in NY?

Public License Searches in New York

This function is available to everyone who goes to the Division of Licensing Services website. You don't need to have a real estate salesperson or broker account to make a search. You can search using their name, their license number, or the company they represent.

What appears on a Florida real estate license?

The real estate license indicates the name of the licensee, the type of license, the licensee's address, effective date, expiration date, Seal of the State of Florida, the name of the Governor and the name of the secretary of the DBPR.

What do I need to know for Michigan real estate exam?

Exam Topics

- Contracts - 17% of the Questions.

- General Principles of Agency - 13% of the Questions.

- Practice of Real Estate - 13% of the Questions.

- Financing - 10% of the Questions.

- Real Estate Calculations - 10% of the Questions.

- Property Ownership - 8% of the Questions.

- Transfer of Title - 8% of the Questions.

Can you get a real estate license with a misdemeanor in NY?

Misdemeanors vs.

Being found guilty of any type of sex offense (many of which are felonies) is also an immediate disqualifier. Misdemeanors, however, shouldn't prevent you from getting a real estate license in New York.

What happens if a person without a real estate license is acting as a finder and performs duties beyond just introducing the buyer and seller such as negotiation or advising?

What happens if a person without a real estate license is acting as a finder and performs duties beyond just introducing the buyer and seller, such as negotiation or advising? The individual could face penalties for acting as a real estate licensee without having a real estate license.