Downsides of a Real Estate LLC

- Triggers the Due on Sale Clause. If you already own some properties and want to transfer them into your LLC, you'll have to be careful.

- Doesn't Offer Complete Liability Protection.

- Increases Your Costs.

What is the best entity structure for real estate?

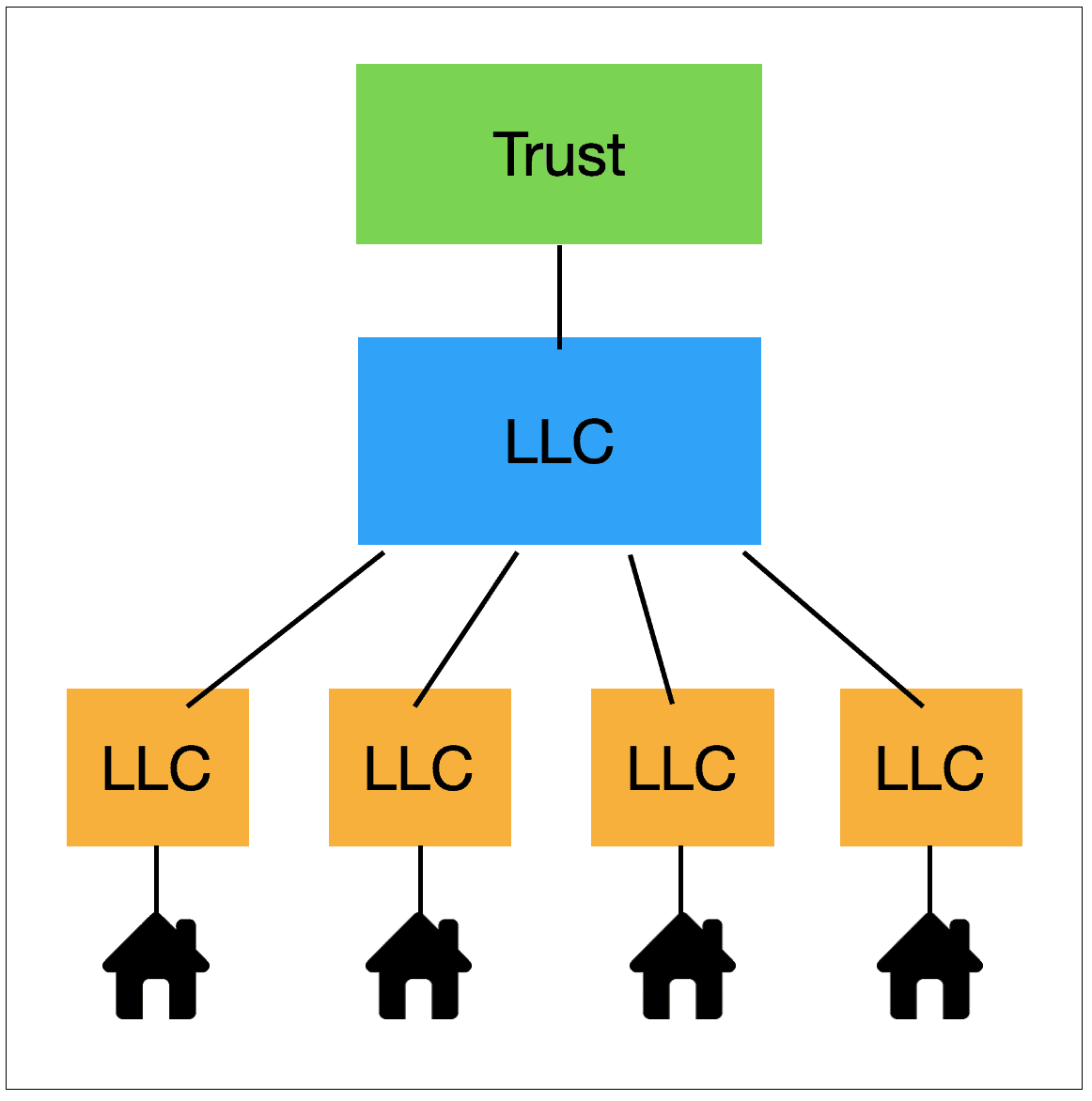

LLC. A limited liability company (LLC) is a common entity choice for real estate investors and offers many advantages. Choosing this structure for your real estate investment business allows you to limit your personal liability in the business to the money you contribute and the debts you co-sign for.

What business entity is best for holding real estate?

Real estate investment can be very lucrative, but it also can expose investors to risks that they didn't know enough about to anticipate. A good way to protect yourself is to form a real estate limited liability company (LLC).

How do you name multiple real estate LLCs?

When forming multiple LLCs, many investors and builders name each LLC after the address of the property it's created to protect (e.g., 123 Main Street, LLC; 456 State Street, LLC; you get the idea!)

What are 5 disadvantages of LLC?

- Limited liability has limits. Your LLC structure may not be protecting your assets, according to a judge's ruling.

- Self-employment tax.

- Consequences of member turnover.

- Personal liability protection.

- Corporate taxes are usually bypassed.

- Difficult to transfer ownership.

- Self-Employment Taxes.

- Confusion About Roles.

What percentage do most property managers take?

Property management companies typically charge a monthly fee of 8%–12% of the monthly rent. If the rent on your rental property is $1,200 per month, the property management fee will likely range from $96–$144.

Second, this structure provides you flexibility.

— Michael Girdley (@girdley) August 24, 2021

Say some idiot comes along and wants to buy your real estate for a crazy price and lease it back to you at a 2 CAP.

If your property was in the OpCo, it'd be a mess.

This allows you to do that without disturbing your OpCo,

Can a landlord ask for 6 months rent in advance in California?

If, however, the term of the lease is six months or longer, the landlord is not prohibited from collecting an advance payment of not less than 6 months rents.

What state do property managers make the most money?

Highest-Paid Property Managers By State

| Rank | State | 90th Percentile |

|---|---|---|

| 1 | New Jersey | $99,000 |

| 2 | New York | $98,000 |

| 3 | Connecticut | $98,000 |

| 4 | Idaho | $84,000 |

What happens if you live with someone and they pass away?

Owning your home with someone else — like a spouse or partner — is known as “joint ownership.” In this case, the other person automatically becomes the property's sole owner when you pass away. This only applies if you're both listed on the deed, meaning that you each legally own the house.

How long does the executor have to pay the beneficiaries?

As a rule, gifts of a set amount of money in a will should be paid out within a year of death. If the executor isn't able to pay the legacy within that time, the beneficiaries will be entitled to claim interest.

Is it hard starting out in real estate?

A real estate education will be challenging, especially if you don't have prior experience. The courses you take in a California real estate school are college-level, so there is a degree of difficulty, particularly for some students. Because everyone is different, everyone will have different experiences.

Do you have to be good looking to sell real estate?

If you enlist the help of a more-attractive listing agent, you have a better chance of selling your home at your desired price, but your house will have to sit on the market for a longer period of time. Additionally, Salter's study concluded that more-attractive agents take fewer listings and make fewer sales.

Is it hard to buy and sell a house at the same time?

Selling your house and buying another home at the same time is the ultimate feat in multitasking, and it comes with a tricky timing challenge. If you have a mortgage on your current home and you buy a house before selling, you could get stuck with loan payments and the cost of upkeep on both properties.

What do most realtors make their first year?

While ZipRecruiter is seeing annual salaries as high as $144,000 and as low as $28,000, the majority of First Year Real Estate Agent salaries currently range between $65,000 (25th percentile) to $100,000 (75th percentile) with top earners (90th percentile) making $125,000 annually across the United States.

What happens after a buyer makes an offer?

The timeline between making an offer and closing on a home is typically about 45 days. The seller accepts your offer and takes the house off the market when you make an earnest money deposit. You'll schedule an inspection while the lender takes care of the appraisal and title search.

What’s the correct way to make an offer?

- Make sure your financing and cash are all set.

- Set an offer price.

- Decide how much earnest money to offer.

- Choose the contingencies to include.

- Write a purchase offer.

- Walk away, negotiate or move toward closing.

How do you write an offer to buy real estate?

- Address the seller and introduce yourself. If you know the seller's name, use that, but you likely won't know the name of the owner of the home.

- Detail what makes the home stand out to you.

- Find something in common.

- Present your offer.

- Note any contingencies you have.

- Close with a friendly thank you.

What do you say when sending an offer to a listing agent?

Let the agent know when to expect your offer – and meet or beat that deadline. And – tell the agent a bit about your clients – how much they love the home, how they have been looking in the neighborhood for some time, or how important it is to them to send their kids to that school.

Can a seller cancel after accepting an offer?

Can a seller pull out after accepting an offer? If there is an available contingency in the contract, the buyer can't secure funding, or there is fraud on the part of the buyer, the seller may usually cancel the contract. You may also cancel the sale during the attorney review period.

How likely is it to fall out of escrow?

Based on my 26 years of selling real estate in Los Angeles, my opinion is that when a house goes under contract and opens up the escrow, there's about a 30 percent chance that it falls out. Why? Well, there are three contingencies, which are hurdles to the sale.

Why do people fall out of escrow?

If a buyer's mortgage application is ultimately declined by the lender and they do not qualify for financing, a home that has gone “pending” can easily fall out of escrow. This can be because of a job status change, accruing additional debt, and more.

At what point do most house sales fall through?

But when is a house sale most likely to fall through? It can happen early on due to mortgage issues, In the middle after the survey, Or at the last minute due to gazumping or a sudden change of heart.

What percentage of house purchases fall through?

According to Trulia, over 96% of real estate contracts successfully close. In other words, less than 4% of contracts fall through for any reason.

What can stop escrow from closing?

Escrow procedures and rules vary by state, but some problems may prevent buyers from closing the deal during this period. Pest damage, low appraisals, claims to title, and defects found during the home inspection may slow down closing.

How much does property value increase each year in California?

The average rate of appreciation in California came in at 6.77% annually over the 39 year time frame.

How much has the housing market increased in California?

California market trends and stats

According to data from the California Association of Realtors (CAR), existing single family homes sold for a median of $859,800 in August 2023, compared to $834,740 in August 2022. That's a 3 percent increase, and it's more than double the national median of $407,100.

How much does real estate appreciate per year in California?

Between 2017 and 2021, California homeowners enjoyed an average 5.6% real gain a year — 8.3% annual appreciation minus 2.7% inflation rates.

How real are California home price gains?

The price gains are most felt in Greater Los Angeles, where home prices increased 23.8% over the 12 months ending in September 2023, according to Realtor.com data released Thursday.

How much did property tax go up in California?

Levies Total $79.9 Billion for Fiscal Year 2020-21

This is an additional $4.5 billion, or a 6% increase, in property tax levies from FY 2019-20 of $75.4 billion. “The increase in property tax levies to almost $80 billion is a clear reflection of California's vibrant real estate market,” said Chair Malia M.

What is considered a liability in real estate?

A liability is defined as anything — typically money — a person or company owes. In commercial real estate investing, a liability is generally called “commercial real estate debt.” Other examples of liabilities include loans, mortgages, deferred revenues and accrued expenses.

What are the three types of liability real estate?

How is Vicarious Liability Assigned?

- Single Agency; as a buyer's agent or a seller's agent.

- Dual Agency; as an agent for both the buyer and the seller.

- Subagency; where a seller may authorize their real estate broker to use agents from other firms to find the buyer a property.

Which type of deed creates the least liability?

Quitclaim deed

The deed that creates the least liability for the grantor is the: Quitclaim deed. To remove a cloud from the title of your property, you would most likely obtain a: Quitclaim deed.

Why is a house a liability and not an asset?

Some say that since homes regularly require spending money to maintain them, this makes them a liability at all times — even if the house is owned outright. On the other hand, unlike a rental property, the value of your home can actually increase over time as the market grows.

What are liabilities in house examples?

For most households, liabilities will include taxes due, bills that must be paid, rent or mortgage payments, loan interest and principal due, and so on. If you are pre-paid for performing work or a service, the work owed may also be construed as a liability.

Is capital gains based on closing date?

Capital Gains Tax Rate

For tax purposes, these dates are calculated from the day after the original purchase to the date of sale of the property.

Do I have to pay capital gains tax immediately?

Do I Have to Pay Capital Gains Taxes Immediately? In most cases, you must pay the capital gains tax after you sell an asset.

Is there a way to avoid capital gains tax on the selling of a house?

The good news is that many people avoid paying capital gains tax on the sale of their primary home because of an IRS rule that lets you exclude a certain amount of the gain from your taxable income. Generally, people who qualify for the home sale capital gain exclusion can exclude: $250,000 of capital gains if single.

Do closing costs reduce capital gains?

There is one tax benefit to these costs, though. You can add these closing fees to the cost basis of your home when you sell it. This lowers the amount of profit that you make. This can help reduce any capital gains tax you might have to pay on your home.

At what point does capital gains tax kick in?

A tax on capital gains only happens when an asset is sold or "realized." Investors can also have unrealized and realized losses. An unrealized loss is a decrease in the value of an asset or investment you own but haven't yet sold—a potential loss that exists on paper.

How much money do you need for a 4 bedroom house?

Average cost of building a 4 bedroom house

The typical size of a four-bedroom house can range from around 140 square metres to 200 square metres, meaning the cost of building a four-bedroom house can range from around £196,000 to £500,000, with an average cost of around £348,000.

What house can I afford with $50000?

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That's because your annual salary isn't the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Is $50,000 enough to buy a house?

What you can afford: With a $50k annual salary, you're earning $4,167 per month before tax. So, according to the 28/36 rule, you should spend no more than $1,167 on your mortgage payment per month, which is 28% of your monthly pre-tax income.

Can I afford a 300K house on a $70 K salary?

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford?” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*. That's a monthly house payment between $2,000 and $2,500 a month, depending on your personal finances.

How to afford a 300K house?

How much do I need to make to buy a $300K house? You'll likely need to make about $75,000 a year to buy a $300K house. This is an estimate, but, as a rule of thumb, with a 3 percent down payment on a conventional 30-year mortgage at 5 percent, your monthly mortgage payment will be around $1,900.