Homeowners' Property Tax Credit

The State of Maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed percentage of the person's gross income. In other words, it sets a limit on the amount of property taxes.How do I pay my real estate taxes in Maryland?

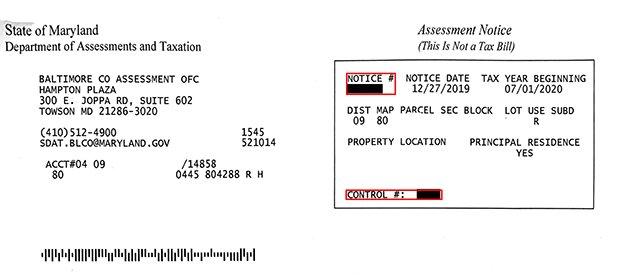

Most likely, payment of your real property tax is handled through your mortgage lender, but you can view local property tax rates on SDAT's Web site. You can also view Local Tax Billing & Collection Offices information. Get help if you need it! Contact SDAT or visit one of their local assessment offices.

How to file Maryland Annual Report and Personal Property tax Return?

- Determine your business's due date and filing fee.

- Submit your report online OR download a paper form.

- File your report and fee with the Maryland State Department of Assessments and Taxation.

Who is required to file a Maryland personal property tax return?

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.

Can you deduct local real estate taxes?

If you itemize your deductions, you can deduct the property taxes you pay on your main residence and any other real estate you own. The total amount of deductible state and local income taxes, including property taxes, is limited to $10,000 per year.

How often do you pay property tax in Baltimore County?

The first payment of the semiannual real property tax is due on July 1 of the tax year and may be paid without penalty or interest through September 30 of the tax year.

The check balanced: after 4 years, @WaysMeansCmte voted to disclose 6 years of @potus45’s tax returns https://t.co/njwZ57tqNC But the 117th Congress failed to mandate that every @POTUS must do so in the future. (President @JoeBiden & @VP @KamalaHarris both voluntarily disclosed.)

— Alex Howard (@digiphile) January 4, 2023

At what age do seniors stop paying property taxes in Maryland?

The Senior Tax Credit is available to homeowners at least 65 for whom the property is their principal residence (see the HOTC page for details); Interested homeowners must submit the Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation (SDAT).

Frequently Asked Questions

Are Maryland property taxes paid in advance or arrears?

In Maryland, the taxes give the state its dubious distinction. Maryland is one of only seven states that require homeowners to pay a year's worth of property taxes in advance upon closing a real estate deal. Most other states have a system whereby homeowners pay property taxes "in arrears" -- at the end of the year.

What is Baltimore County property tax?

Real Property—$1.10 per $100 of assessed value. Real Property Transfers—1.5 percent of purchase price (excluding the first $22,000 of residential transfers) and $2.50 per $500 of total value. Telephone and Wireless Service—Eight percent Telephone Line Revenue and Wireless Telephone line.

How do I find property records in Maryland?

How often are property taxes paid in Maryland?

Semi-annual

Effective July 1st, 2000, a semi-annual tax payment schedule became mandatory for all owner-occupied residential property owners in the State of Maryland. Taxpayers may opt to pay annually, but they must notify their lender prior to May 1st of their intention.

How much are my property taxes in MD?

Overview of Maryland Taxes

Maryland's average effective property tax rate of 0.99% is right at the national average, which is also 0.99%. However, because Maryland generally has high property values, Maryland homeowners pay more in annual property taxes than homeowners in most other states.

Does Maryland have property tax on houses?

State law provides that all real property is subject to the property tax. A property owner will receive a property tax bill each year.

FAQ

- Can I pay my Maryland property taxes online?

- You can pay your taxes online, by mail or in person. Search and pay for real or personal property tax information online. Note: You will need a parcel ID, account number or property address, which you will find on your tax bill.

- How do I pay my taxes owed to Maryland?

You can pay your Maryland taxes with a personal check, money order or credit card. You may also choose to pay by direct debit when you file electronically. If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card.

- Can you pay property taxes with a credit card in Maryland?

Methods of Payment

Online payments can be made in the form of electronic check, credit card or debit card (MasterCard, Discover, American Express and Visa).- How are property taxes handled at closing in Maryland?

Property Tax – Maryland closing property tax is due within 60 days of purchase by the loan services, paid at closing. Recording Fees – This is an amount charged by the local recording office for the recording of public land records.

- How do I get a copy of my Baltimore City property tax bill?

Tax information, including open balances and the address where the City mails an owner's bill, is available online at BaltimoreCity.gov, by calling 410-396-3987, or by visiting Counter 2 in the Wolman Municipal Building, 200 Holliday St., and any weekday between 8:30 a.m. to 4:30 p.m. The City also accepts advance

- How do I get a statement of local property taxes?

Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. If you do not receive the original bill by November 1, contact the County Tax Collector or Assessor for a duplicate bill.

How to report md real estate taxes

| What is the new Maryland tax break for seniors? | Starting in tax year 2022, residents who are at least 65 on the last day of the tax year may be eligible for a nonrefundable tax credit of up to $1,000. This was a piece of legislation that AARP Maryland sponsored and helped pass in the 2022 legislative session. |

| How do I get a SDAT in Maryland? | You must register with the Department of Assessments & Taxation in order to receive an SDAT number. If you are a Sole Proprietor (work for yourself, pay no wages to staff, and are solely liable for any damages), you can register, and get a FEIN, without cost. |

| Can I pay my MD state taxes online? | Online Bill Pay is an easy, convenient and secure way to pay your Maryland tax liabilities online for free. |

| How are property taxes billed in Maryland? | Property tax rates are expressed as a dollar amount per $100 of assessment. For example, for a property with a fair market value of $100,000, the property taxes would be calculated by dividing the assessment by 100 and multiplying the product by the property tax rate. |

| How long do you have to pay property taxes in Maryland? | Annual tax bills are due September 30th. First semi-annual installments are due September 30th. Supplemental and revised tax bills are due 30 days from the time of issue. Pursuant to Maryland Law, tax payments must be made on or before the due date to avoid interest and penalty charges. |

| Who has the highest property tax in Maryland? | Baltimore's property tax rate for the 2022-2023 fiscal year is 2.248% or $2.248 per $100 of assessed property—the highest in Maryland. |

- How much are Baltimore City property taxes?

$2.248 per $100

Baltimore City

The average effective property tax rate here is 0.988%, higher than any of Maryland's counties. However, homeowners who do not receive any tax credits may pay even higher rates than that. In 2022 and 2023, the total listed tax rate in Baltimore is $2.248 per $100 of assessed value.

- How do I pay my Baltimore City property taxes?

Baltimore City now offers customers the ability to pay online via credit card or a personal/business checking account. Online payments are available 24 hours a day, 7 days a week. Avoid the lines and pay online!

- How do I find out who owns a property in Baltimore City?

For all recent city land-related matters, contact the Land Records Division of the Circuit Court of Baltimore City at (410) 333-3760. Land records are a part of the Maryland State Archives holdings.

- How do I calculate property tax in Maryland?

Property tax rates are expressed as a dollar amount per $100 of assessment. For example, for a property with a fair market value of $100,000, the property taxes would be calculated by dividing the assessment by 100 and multiplying the product by the property tax rate.

- What happens if you don't pay your property taxes in Maryland?

When you don't pay your property taxes, the past-due amount becomes a lien on your home. This type of lien almost always has priority over other liens, including mortgages. (See "What Happens to My Mortgage in a Tax Sale" below.)

- What county in Maryland has the highest property tax?

The typical homeowner in Howard County pays $6,373 annually in property taxes, which is the most expensive amount in the state. Unsurprisingly, tax rates in Howard County also rank as some of the highest in the state, with an average effective rate of 1.37%.