Sale of your principal residence. We conform to the IRS rules and allow you to exclude, up to a certain amount, the gain you make on the sale of your home. You may take an exclusion if you owned and used the home for at least 2 out of 5 years. In addition, you may only have one home at a time.

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

Is money from sale of a house taxable income?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

What is the one time capital gains exemption?

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years. But it can, in effect, render the capital gains tax moot.

What should I do with large lump sum of money after sale of house?

Depending on your financial circumstances, it might make sense to pay down debt, invest for growth, or supplement your retirement. You might also consider purchasing products to protect yourself and your loved ones, including annuities, life insurance, or long-term care coverage.

Which real estate company has best training program?

Focusing on the agent's business has made us the real estate company with the best training. Keller Williams education is proven to give you the tools you need to be successful in any market.

Let's talk buying vs. renting a home for a minute.

— Thomas Frank (@TomFrankly) July 16, 2023

I see a lot of people fly into blind rage when @ramit suggests buying a home might not always be the best decision.

I even see personal finance creators getting mad about this.

For the record, I've purchased two homes. Sold…

Where is the best place to work as a new real estate agent?

Best Real Estate Companies to Work for in 2023

| Brokerage | Best For |

|---|---|

| Keller Williams | Building a team |

| RE/MAX | High-performing, established agents |

| Coldwell Banker | New agents |

| Compass | Agents in the luxury market |

Why did I leave exp Realty?

Some agents quickly move back to keller williams realty or their previous. Brokerage. Or find a new brokerage. Entirely. Most however stay and love the new way of working.

Is it OK to shop around for a realtor?

I always recommend two people I know and then tell my clients to find a 3rd and compare. Shop around a few reputable lenders (at local banks/credit union or savings and loans) and ask them about agents in the area that they'd recommend considering your financing situation.

How do you target a real estate seller?

Topics

- Game plan: Make prospecting part of your realtor routine.

- Tip 1: Network, network, network.

- Tip 2: Follow-up on every lead and be persistent.

- Tip 3.

- Tip 4: Find leads online in the right places.

- Tip 5: Get involved in content marketing.

- Tip 6: Become a data nerd for your area.

- Tip 7: Reach out to local employers.

What are the requirements for a Florida real estate license?

General Real Estate License Florida Requirements

- Be at least 18 years of age.

- High school diploma or equivalent.

- United States Social Security number.

- Complete 63 hours of approved pre-licensing instruction within the last two years.

- Pass the Florida sales associate exam.

- Pay the $89 fee and get fingerprinted.

What is the state exam for real estate in Virginia?

The Virginia Real Estate Exam consists of 120 questions. This includes 80 for the National section and 40 for the State section. You will have 150 minutes (2.5 hours) to complete the entire exam. The National section time is 105 minutes (1.75 hours), and the State section time is 90 minutes (.

What do you need to pass the California real estate exam?

Notification of Examination Results

To pass the examination, you must correctly answer at least: 70% of the questions (Salespersons), or. 75% of the questions (Brokers)

How hard is Florida real estate exam?

According to the Florida Real Estate Commission, the passing rate for the Florida real estate exam in 2020 was approximately 45%, which means that only about half of the test takers passed the exam on their first attempt. However, this passing rate varies depending on the specific exam and the time of the year.

How do I start a real estate business from scratch?

Here's what you'll need to do.

- Get a real estate license. Obtaining a real estate license is an important first step in your real estate career.

- Find a brokerage.

- Join the National Association of Realtors (NAR).

- Pay your dues.

- Find a mentor.

- Get crystal clear on who your ideal customer is.

- Build your personal brand.

What is the easiest way to start in real estate?

One of the fastest ways to get started in real estate is by wholesaling. This unique strategy involves securing a property under market value and assigning an end buyer to purchase the contract. Wholesalers never own the property and instead make money by adding a fee to the final contract.

What is a real estate offering?

A commercial real estate offering memorandum (OM), also known as an investment memorandum or a private placement memorandum (PPM), is a tool used to introduce prospective buyers or investors to the property and is vital in presenting your sale opportunity, credibility, and professionalism.

What to do before making an offer on a house?

10 things a first time home buyer should do before making an...

- Research the Area.

- Research the House.

- Do a Walkthrough.

- Check Utilities.

- Talk to the Neighbors.

- Get an Inspection.

- Give Yourself Options.

- Secure Financing.

How to start real estate with $1,000 dollars?

How to Invest $1,000 in Real Estate

- Fractional Ownership in Properties. Several platforms let you buy fractional shares of individual properties.

- Publicly-Traded REITs.

- Real Estate Crowdfunding: Private REITs.

- Real Estate Crowdfunding: Loans.

- Private Notes.

- Real Estate Wholesaling.

- Invest in Land.

- House Hack.

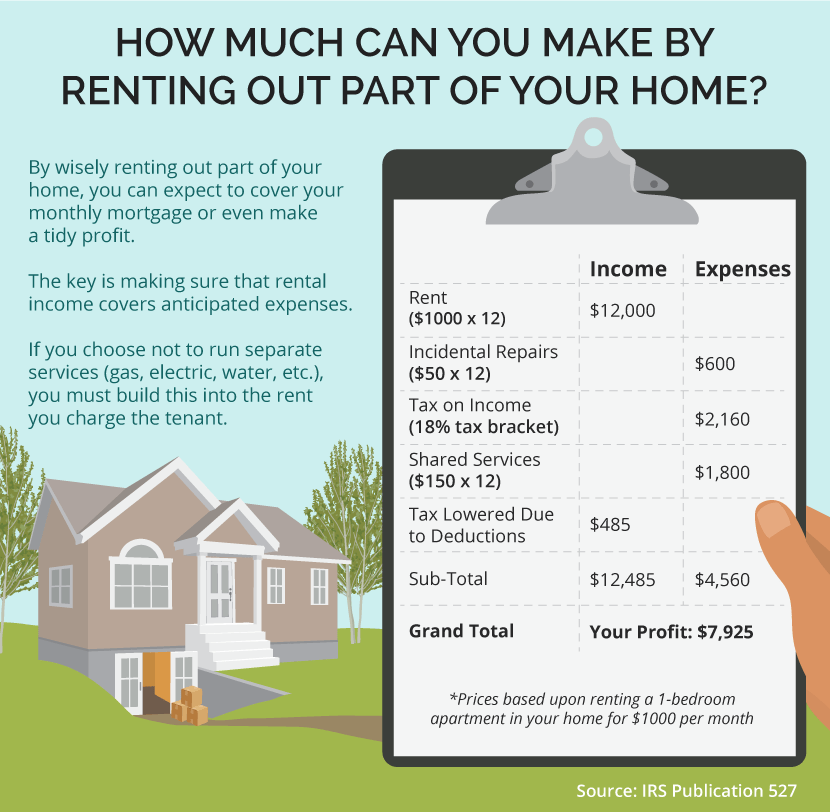

Is renting a room taxable income?

If you rent out a room in your home, the same tax rules apply to you as they do for landlords who rent out entire properties. All of the rent received is considered taxable income and must be reported to the IRS.

How does the IRS know if I have rental income?

Ways the IRS can find out about rental income include routing tax audits, real estate paperwork and public records, and information from a whistleblower.

What expenses can be deducted from rental income?

These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs. You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business.

Is renting a room passive income?

The IRS considers a rental activity to be passive if real estate is used by tenants and rental income (or expected rental income) is received mainly for the use of the property. In other words, owning a rental property and collecting rental income is considered passive and not active in most cases.

What happens if my expenses are more than my rental income?

If your rental expenses exceed rental income your loss may be limited. The amount of loss you can deduct may be limited by the passive activity loss rules and the at-risk rules. See Form 8582, Passive Activity Loss Limitations, and Form 6198, At-Risk Limitations, to determine if your loss is limited.

Who fills out the 593 form?

The seller/transferor must complete and sign this form and return it to your REEP or remitter by the close of the real estate transaction for it to be valid. The buyer/transferee is not required to sign Form 593 when no exemptions apply.

Where do I enter Form 593?

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return, Withholding (Form 592-B and/or 593). Attach one copy of Form(s) 593, to the lower front of your California tax return.

What is a 593 C?

• Seller is a tax-exempt entity. • Seller is an insurance company, individual retirement account, qualified pension plan, or charitable remainder trust. Sellers who meet one of the exemptions above must sign a written certification (FTB Form 593-C) under penalty of perjury to be exempt from withholding.

Where do I enter Form 593 in Turbotax?

Form 593 - For electronically filed returns, you must complete the 593 screens, located in the Payments folder within the CA input screens. This is a multi-unit screen and the total amount within the Amount withheld from this seller field must equal the amount reported on line 73 of Form 540, or line 83 of Form 540NR.

Should I claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

How do I choose a brokerage?

How to Choose the Right Brokerage Firm for You

- Decide what kind of account you want to open.

- Determine your investing priorities.

- Evaluate the broker tools and support you'll need.

- Compare costs and convenience.

- Explore trading platforms at different brokerage firms.

What are two questions you should ask before hiring a brokerage firm?

Ask These 20 Questions When Choosing a Real Estate Broker

- What are your commission splits? ( i.e. does the broker get 40% and you take 60% of the commission earned)

- Are there any franchise fees?

- Do you offer a commission cap?

- Are there any other brokerage-related fees?

- What other expenses might I be responsible for?

How do I choose a new brokerage agent?

As you look for a broker, consider these 15 items.

- Commission split. Too many new real estate agents think choosing a broker is primarily based on commission splits.

- Internet presence. This is very important these days.

- Fees.

- Brokerage size.

- Facilities.

- Location.

- Training.

- Mentor program.

How do you interview a real estate agent with a broker?

Agents should know what questions to ask a real estate broker when interviewing, like company structure, day-to-day operations, and the resources and tools provided. They also should review written company policies and gather information on compensation and commission splits.

What questions should I ask a broker?

Questions you may like to ask a mortgage broker include:

- Are they licensed?

- How many lenders do they deal with?

- What are their fees and commissions?

- What will the borrowing costs be?

- What type of interest rate is best for you?

- What is the comparison rate of the home loan?

- Is the loan the best one they can recommend?

Are property tax records public in Wisconsin?

Under Wisconsin law these records are public information. This site will be expanded as additional property tax processes are implemented into IPAS. The initial public access focus is the creation of a statewide database of Real Estate Transfer Returns (RETR).

How do I find my property tax bill online in Indiana?

indy.gov: Pay Your Property Taxes or View Current Tax Bill.

How do I find my personal property tax records in Missouri?

Personal property tax receipts are available online or in person at the Collector of Revenue's Office. An online tax receipt will be accepted at the Missouri Department of Revenue license offices when licensing your vehicle.

How do I get a copy of my property tax bill in NY?

You can always download and print a copy of your Property Tax Bill on this web site. If you lost the original bill, and are making a payment, you can pay electronically or print out and send in the online copy with your tax payment. You do not need to request a duplicate bill.

How do I get my Wisconsin property tax statement?

How do I request copies of tax records? Request copies online. If you are unable to use the online application, request copies by calling customer service at (608) 266-2772. You may also visit one of our offices to complete this request.

Can you withhold rent for repairs in Wisconsin?

Withholding Rent: If the landlord refuses to eliminate a condition hazardous to the health or safety of the tenant, the tenant may either move out or take a rent abatement to match the extent to which the tenant is deprived of full normal use of the unit. Tenants may not withhold rent in full (WI Stat. § 704.07(4)).

Can you withhold rent for repairs in Nebraska?

Withholding of Rent: A tenant is permitted to withhold rent for a landlord's failure to provide essential services, such as heat, water, etc. The tenant must give the landlord written notice of the actual violation. § 76-1427. Tenant Allowed to Repair and Deduct Rent: No.

Can you withhold rent for repairs in Oklahoma?

Can You Withhold Rent in Oklahoma? The only case in which a tenant may withhold rent in Oklahoma is under the repair and deduct statute. This takes effect if the landlord fails to make necessary repairs and then the tenant may pay for the repairs and deduct the cost from their next rent payment.

Can you withhold rent for repairs in Oregon?

➢ You can deduct up to $300 from the rent to pay for minor repairs, but first you must tell your landlord in writing. You CANNOT legally deduct for repairs without telling your landlord in writing first.

What are renters rights in Wisconsin?

The landlord may not confiscate your personal belongings, turn off your utilities, lock you out of your apartment, or use force to remove you. If the small claims court judge rules in the landlord's favor, the judge may issue a court order requiring you to leave the property.

Why do people choose to work in real estate?

From unlimited earning potential to the flexibility and freedom that the industry offers, to the ability to make a difference in the lives of others, the benefits of a career in real estate are seemingly endless.

What makes you passionate about real estate?

Are you passionate about homes, people, sales, building relationships, marketing, digital marketing, changing people's lives or even math, statistics, and the news? All of these make up a career in real estate.

What are 3 good things about real estate?

- You Could Earn Passive Income.

- You May Enjoy Tax Benefits.

- Your Property May Appreciate In Value.

- You Have The Potential To Build Capital.

- You Could Have More Protection From Inflation.

- You May Be Able To Finance Your Property.

- You May Be Able To Choose Your Level Of Involvement.

What are the 4 benefits of real estate?

Key Takeaways

- Real estate investors make money through rental income, appreciation, and profits generated by business activities that depend on the property.

- The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage.

What are the 4 P’s of real estate?

The 4 Ps of Real Estate Marketing

- Product. As a realtor, your product isn't just real estate — it's the unique characteristics of the real estate that will appeal to buyers.

- Promotion.

- Price.

- Place.