To calculate the rent per month, multiply the rent per week by 52 and then divide by 12.

How much profit should you make on a rental?

The amount will depend on your specific situation, but a good rule of thumb is to aim for at least 10% profit after all expenses and taxes. While 10% is a good target, you may be able to make more depending on the property and the rental market.

What is the market rental rate?

Market Rental Rate is the rate (or rates) a willing tenant would pay and a willing landlord would accept for a comparable transaction (e.g., renewal, expansion, relocation, etc., as applicable, in comparable space and in a comparable building) as of the commencement date of the applicable term, neither being under any

How do you know if a rental property is worth it?

Find out an area's selling prices to get a sense of local market value. Research the average rent in the neighborhood and work from there to determine if buying a rental property is financially feasible. Compare all your costs to the rent you may charge to project your profit.

How much should rent be of monthly income?

30%

Use the 30% Rule

The 30% rule states that you should try to spend no more than 30% of your gross monthly income on rent. So if your salary is $5,000 per month, your target rent payment would be $1,500 or less.

How is the sale of an asset taxed?

Generally speaking, sales of assets such as equipment, buildings, vehicles and furniture will be taxed at ordinary income tax rates, while intangible assets such as goodwill or intellectual property will be taxed at capital gains rates.

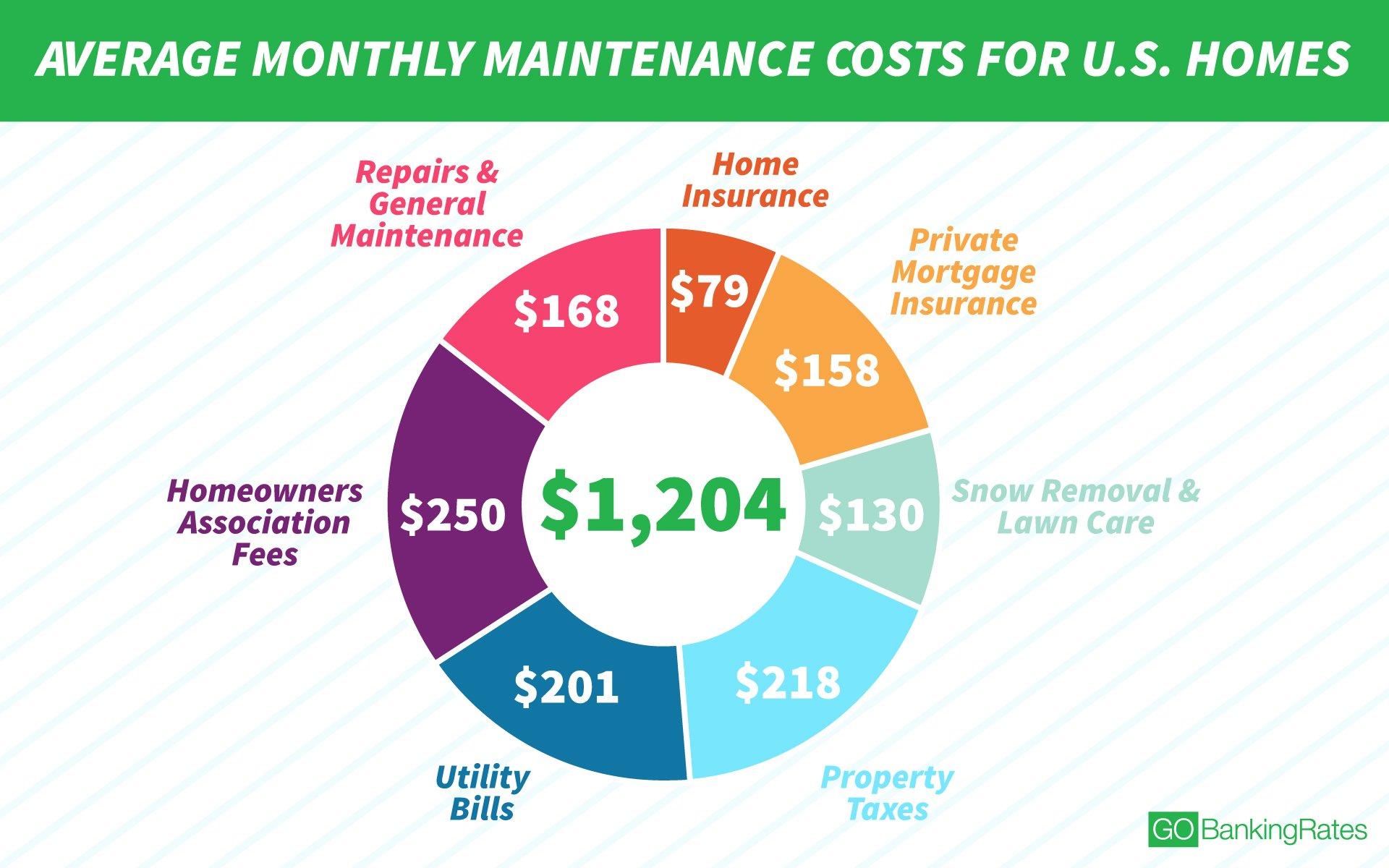

Many people don’t realize the hidden fees involved in buying a house

— Ramit Sethi (@ramit) June 8, 2023

I call these PHANTOM COSTS

They see this:

- 2-bedroom house for $1600 rent

- 2-bedroom house for $1600 mortgage

And think: “Same price? I should build equity!”

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

Does the sale of an asset count as income?

The sale of capital assets results in capital gain or loss. The sale of real property or depreciable property used in the business and held longer than 1 year results in gain or loss from a section 1231 transaction. The sale of inventory results in ordinary income or loss.

Will real estate agents be around in 10 years?

Real estate agents are highly unlikely to go the way of the Caspian tiger or Guam flying fox anytime soon. Still, it seems likely that the demand for real estate agents will decline over the next decade. In fact, the writing is already on the wall.

How hard is it to become a real estate agent in Georgia?

Class Requirements:

-Complete 75-hour Pre License course. *Failure to meet this grade will require you to retake the course. Luckily, the Georgia Academy of Real Estate has a passing rate of 97% for our traditional class setting and a 95% passing percentage in our online course.

How to make money investing in residential real estate?

How To Make Money In Real Estate: A Guide For Beginners

- Leverage Appreciating Value. Most real estate appreciates over time.

- Buy And Hold Real Estate For Rent.

- Flip A House.

- Purchase Turnkey Properties.

- Invest In Real Estate.

- Make The Most Of Inflation.

- Refinance Your Mortgage.

What is the 5 rule in real estate investing?

The 5 rule in real estate investing suggests that the purchase price of a property should not exceed 5 times its potential annual rental income.

How do real estate investors make money?

There are four main money making strategies for real estate investors: buy a property and wait for it to appreciate in value; rent out a property to tenants or businesses to generate cash flow; invest in residential properties; invest in real estate projects or find other work in the industry.

What type of real estate makes the most money?

Commercial properties are considered one of the best types of real estate investments because of their potential for higher cash flow. If you decide to invest in a commercial property, you could enjoy these attractive benefits: Higher-income potential. Longer leases.

How do you calculate partial exclusion of gain on sale of a house?

The amount of the partial exclusion is equal to the available exclusion amount (a maximum of $250,000 or $300,000, depending on your filing status) multiplied by the percentage of time for which you qualified.

What are unforeseen circumstances capital gains tax?

Unforeseen circumstances are defined by Treas. Reg. § 1.121-3(e)(1) as events the taxpayer could not reasonably have anticipated before purchasing and occupying the residence. Specific-event safe harbors are provided in Treas.

What is the unforeseen circumstances rule?

They broadly define unforeseen circumstances as those events “that the taxpayer could not reasonably have anticipated before purchasing and occupying the residence.” Treas. Reg.

What are the two rules of the exclusion on capital gains for homeowners?

The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify. The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

How much is a partial capital gains exclusion?

If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it. The exclusion is increased to $500,000 for a married couple filing jointly.

What is included in basis from settlement statement?

Your basis includes the settlement fees and closing costs for buying property. You can't include in your basis the fees and costs for getting a loan on property.

Who claims property taxes when married filing separately?

Share: When claiming married filing separately, mortgage interest would be claimed by the person who made the payment. Therefore, if one of you paid alone from your own account, that person can claim all of the mortgage interest and property taxes.

What is tax deductible from my settlement statement?

Typically, the only closing costs that are tax deductible are payments toward mortgage interest, buying points or property taxes.

What items are tax deductible on a seller’s settlement statement?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

How do you read a settlement statement for tax purposes?

This first page also includes your principal. And interest payment for your loan. Including any escrows. So you'll see principal and interest underneath it'll say estimated escrows.

Can I rent out my NYC apartment?

Short-term rental refers to renting out a home or apartment for any period shorter than 30 days. You cannot rent out an entire apartment or home to visitors for less than 30 days, even if you own or live in the building. This applies to all permanent residential buildings.

How do I become a landlord in NY?

How to be a Landlord in New York

- Preparing your New York rental property.

- Research the New York Landlord-Tenant laws.

- Market your rental property.

- Find the perfect tenant.

- Landlord Check-Ins & Maintenance.

- Bonus: Learn About Taxes on Rental Income in New York.

What are the rights of renters in upstate NY?

#1: Renters have the right to safe, livable, and sanitary homes. #2: Renters have the right to make a housing complaint - without experiencing retaliation. #3: Renters have the right to live free from discrimination in their housing. #4: Renters cannot be required to give up their rights when they sign a lease.

Do I have to give my landlord a key to my apartment New York?

While tenants in New York City are generally not legally required to give their landlord a key to their apartment, it is important to understand any provisions related to this in your lease agreement. Consider your personal circumstances and relationship with your landlord before deciding whether to give them a key.

Can I rent out my apartment on Airbnb NYC?

The Short-Term Rental Registration Law requires short-term rental hosts to register with the Mayor's Office of Special Enforcement (OSE). Booking platforms (such as Airbnb, VRBO, Booking.com, and many others) are prohibited from allowing transactions for unregistered short-term rentals.

Why is the buyer responsible for FIRPTA withholding?

FIRPTA is essentially a mechanism to capture capital gains from foreign investors when they sell property. Because there is generally not an enforcement mechanism available to the IRS in the event such taxes are not paid, FIRPTA shifts that obligation to the buyer.

Who is liable for the withholding?

An employer required to deduct and withhold federal income tax from an employee's wages is liable for paying tax, whether or not it is collected from the employee by the employer.

What happens if a buyer fails to withhold the Firpta tax?

Although the tax charged comes from the sales price, the responsibility to withhold is on the buyer. If the buyer fails to comply with the FIRPTA withholding requirements, then they may be held liable for the tax owed—in addition to penalties and interest.

Under which circumstance may withholding be required of the buyer real estate?

Withholding is required when the combined sales price of all parcels exceeds $100,000, even though the sales price of each separate parcel in the same escrow transaction is under $100,000. Example: Three properties (parcels) are sold within the same escrow agreement.

Who is responsible to ensure that the FIRPTA tax is paid?

In most cases, the buyer (transferee) is the withholding agent. The transferee must find out if the transferor is a foreign person. If the transferor is a foreign person and the transferee fails to withhold, the transferee may be held liable for the tax.

Can you reinvest real estate capital gains to avoid taxes?

Although reinvesting the proceeds from a sale still obligates the payment of capital gains, it can defer them. Taxes cannot be completely avoided by reinvesting in real estate, but they can be deferred by investing in similar real estate property1.

Do I have to pay capital gains tax if I reinvest?

With some investments, you can reinvest proceeds to avoid capital gains, but for stock owned in regular taxable accounts, no such provision applies, and you'll pay capital gains taxes according to how long you held your investment.

What are the benefits of a 1031 exchange?

1. Tax Benefits. The main benefit of carrying out a 1031 exchange rather than simply selling one property and buying another is the tax deferral. A 1031 exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property.

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.

What is the one time capital gains exemption?

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.

How do I record a sale of primary residence?

Per IRS Instructions for Schedule D, if you sold or exchanged your main home, do not report it on your tax return unless your gain exceeds your exclusion amount. Any gain not excluded is taxable and reported on Form 8949 Sales and Other Dispositions of Capital Assets and Schedule D (Form 1040) Capital Gains and Losses.

Does selling your primary residence count as income?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

Is the sale of a house reported on Schedule D?

Sale of Your Home

You may not need to report the sale or exchange of your main home. If you must report it, complete Form 8949 be- fore Schedule D. the sale or exchange. Any gain you can't exclude is taxable.

What is Form 4797 and 8949?

Should You Use Form 8949 or Form 4797? When reporting gains from the sale of real estate, Form 4797 will suffice in most scenarios. Form 8949 will need to be used when deferring capital gains through investments in a qualified fund.

What is Form 8949 for sale of primary residence?

Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.

Does escrow go on tax return?

Escrow accounts.

Many monthly house payments include an amount placed in escrow (put in the care of a third party) for real estate taxes. You may not be able to deduct the total you pay into the escrow account. You can deduct only the real estate taxes that the lender actually paid from escrow to the taxing authority.

Where do I enter 1099-S on my tax return?

If Form 1099-S was for the sale of business or rental property, then it's reportable on Form 4797 Sales of Business Property and Schedule D.

Do I have to report a 1099-S on my tax return?

Yes. Form 1099 is used to report non-employment income to the IRS. There are up to 20 different types of 1099 forms. 1099-S is one of those types, and it's used for reporting capital gains on real estate transactions.

How do taxes get paid from escrow?

Your lender holds the tax payment in a restricted or escrow account until the tax payment is due. At that time the lender or a service company sends your town your tax payment.

What should I do with my escrow refund check?

What Can You Do With an Escrow Refund Check?

- Bolster your household emergency fund.

- Pay down your credit cards.

- Make an extra payment on your car loan or mortgage.