Americans' Perceptions of Best Long-Term Investment

Real estate is number one, at 34%. With U.S. stock indices failing to gain ground over the past year, fewer Americans now (18%) than in 2022 (24%) see stocks or mutual funds as the best investment.

What percent of the population invests in real estate?

In 2022, the No. 1 action Americans took to build wealth, stated by 27% of respondents, was investing in the stock market. Just 12% invested in real estate.

Why 90% of millionaires invest in real estate?

Federal tax benefits

Because of the many tax benefits, real estate investors often end up paying less taxes overall even as they are bringing in more income. This is why many millionaires invest in real estate. Not only does it make you money, but it allows you to keep a lot more of the money you make.

What percentage of real estate investors succeed?

Upwards of 87% according to some estimates. But it's not just real estate wholesalers and flippers. It's been published that 96% of businesses go out of business within the first 10 years, and over half fold up their tent by the end of the first year.

Does 90% of wealth come from real estate?

“90% of all millionaires become so through owning real estate.” This famous quote from Andrew Carnegie, one of the wealthiest entrepreneurs of all time, is just as relevant today as it was more than a century ago. Some of the most successful entrepreneurs in the world have built their wealth through real estate.

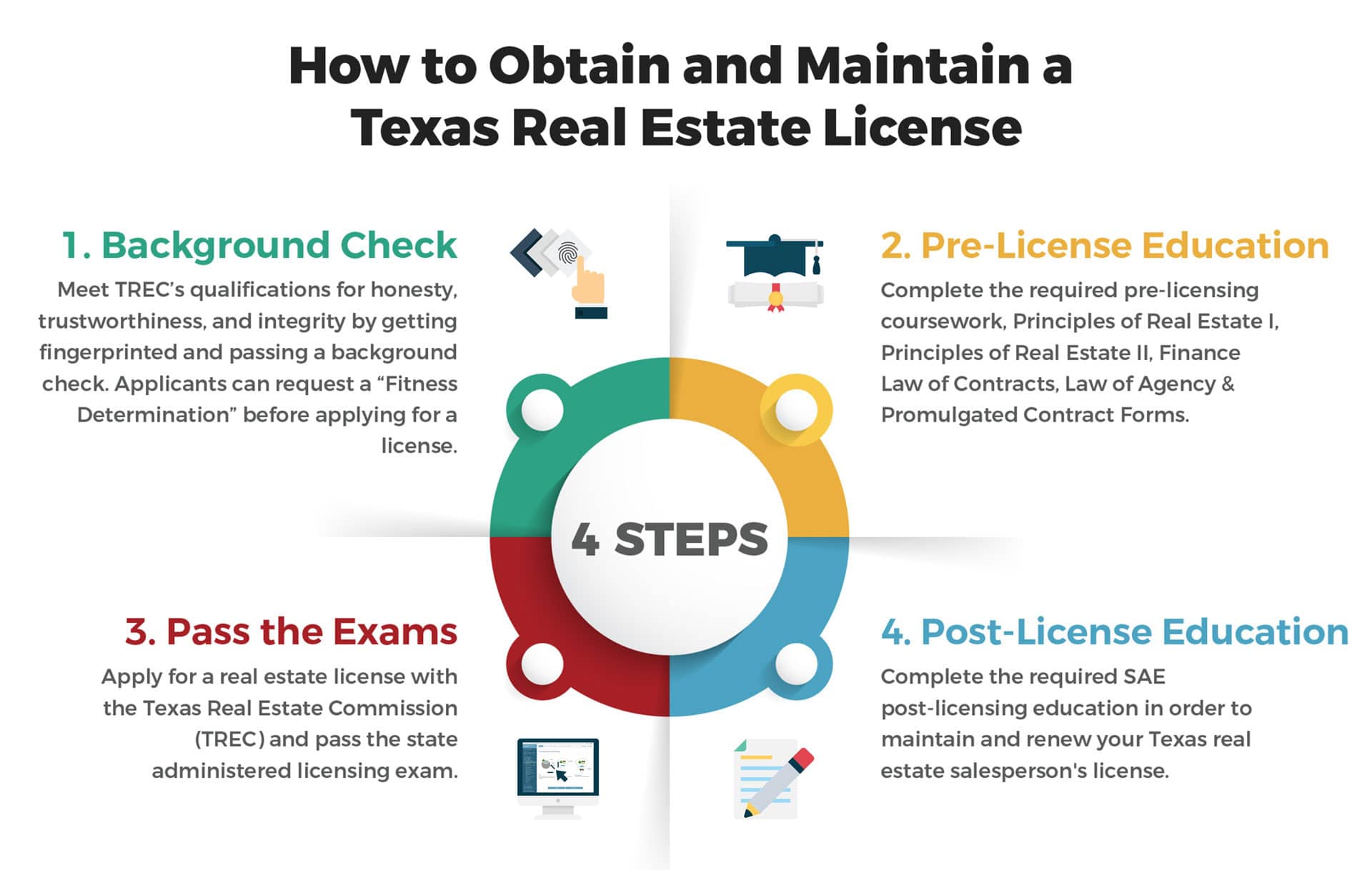

How much does it cost to get a real estate license in PA?

Sample Pennsylvania Real Estate License Costs

Sep 26, 2023

| Prelicensing classes (75 hours) | $419-$685 (through The CE Shop) |

|---|---|

| Exam registration | $49 |

| Background check | $22 |

| License application | $97 |

| Total Costs: | $636-$902 |

Scope Realty will pay for your real estate license! All you have to do is register for an in person interview to get started with us.

— Scope Realty NYC (@scoperealtynyc) July 10, 2018

We offer free continuing education and buyer leads.

Visit https://t.co/K0dh6NWejy#RealEstateCareers #RealEstateNYC #ScopeRealty pic.twitter.com/TinJL1UHx3

How long does it take to get your real estate license in PA?

The amount of time to get your Pennsylvania real estate salesperson license varies due to the number of steps involved. Most complete the requirements within four months. These include completing education, submitting an application for the license, passing the background check, and taking the licensing exam.

Is the PA real estate exam hard?

Is the Pennsylvania real estate exam hard? A passing score is never guaranteed, and very few students report the exam experience as “easy.” However, with the right amount of hard work and preparation, you can alleviate your nerves and dramatically up your chances of success.

How likely are you to be successful in real estate?

Being a successful real estate agent is easier said than done. After all, there's a reason 87% of real estate agents fail. However, knowing the mistakes these realtors make, such as failing to follow up with clients or not having adequate funding, can help you prepare and grow a successful real estate business.

What is the key to being a successful real estate agent?

Assertive Attitude. An agent who is able to articulate facts assertively yet politely will earn the respect (and business!) of their clients, colleagues, and customers! This is not always easy, but it is always right, as evidenced by repeated studies showing this key trait among top producing agents!

How do I file a federal estate tax return?

For calendar year estates and trusts, file Form 1041 and Schedule(s) K-1 on or before April 15 of the following year. For fiscal year estates and trusts, file Form 1041 by the 15th day of the 4th month following the close of the tax year.

Who must file estate tax return 706?

Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $12.06 million for decedents who died in 2022 ($12.92 million in 2023), or34.

Do I need an estate tax closing letter?

The Treasury Department and IRS understand that executors, local probate courts, state tax departments, and others have come to rely on estate tax closing letters for confirmation that the IRS examination of the estate tax return has been completed and the IRS file has been closed.

Do I have to file an estate tax return federal?

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

What are net proceeds on the sale of a home?

The money a home seller keeps after all fees, commissions, closing costs and other expenses have been paid is referred to as net proceeds. The exact amount of net proceeds a seller might earn is hard to calculate until an offer has been accepted on the home.

Do my proceeds from a home sale go to my bank account?

When your buyer is approved for a loan, their bank sends money to your closing agent, who holds it in escrow until the sale is complete. Then, your closing agent uses the proceeds from the sale to pay everyone, including you. Though some sellers prefer a paper check, a wire transfer is usually the faster, safer option.

What is the difference between net proceeds and gains?

If the investor sells the stock to another investor for $6,000 and pays $60 in broker commissions, then the net proceeds of the transaction are $5,940 ($6,000 – 60). To get the capital gains, subtract the basis from the net proceeds. It brings the capital gains to $890 ($5,940 – $5,050).

What is the difference between net proceeds and home equity?

Net proceeds refers to the amount of money a seller takes away from selling a home. This is different from the homeowner's equity in the home because it takes into account agent commissions and closing costs, which are paid by the seller and subtracted from the sale price.

Are proceeds from home sale taxed as income?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

How do you pivot out of real estate?

Follow these steps to make a career change from real estate:

- Determine why you want to change. Everyone has unique reasons for wanting to change careers.

- Consider what to do next.

- Evaluate the timing.

- Consider your interests.

- Think about your skills.

- Complete training courses.

- Look for opportunities.

- Update your resume.

Where do real estate brokers make the most money?

Real estate agents in high cost of living cities such as New York and San Francisco tend to be the highest earners.

What real estate position makes the most?

The highest-paying real estate job is typically the role of a Real Estate Development Manager. Real Estate Development Managers are responsible for overseeing large-scale development projects, managing budgets, negotiating deals, and ensuring successful project completion.

What is the job outlook for real estate brokers and agents in other words are job opportunities growing or shrinking and at what rate ?)?

Job Outlook

Overall employment of real estate brokers and sales agents is projected to grow 3 percent from 2022 to 2032, about as fast as the average for all occupations. About 51,600 openings for real estate brokers and sales agents are projected each year, on average, over the decade.

What is the 70 rule in real estate flipping?

Put simply, the 70 percent rule states that you shouldn't buy a distressed property for more than 70 percent of the home's after-repair value (ARV) — in other words, how much the house will likely sell for once fixed — minus the cost of repairs.

What items are tax-deductible when selling a house?

Closing costs that can be deducted when you sell your home

- Owner's title insurance. An owner's title insurance policy protects you against prior ownership claims on the property.

- Property taxes.

- Title fees or abstract fees.

- Legal and recording fees.

- Survey fees.

- Utility installation charges.

- Transfer or stamp taxes.

What items can be home improvements to not be considered capital gains?

A capital improvement is a permanent structural alteration or repair to a property that improves it substantially, thereby increasing its overall value. That may come with updating the property to suit new needs or extending its life. However, basic maintenance and repair are not considered capital improvements.

Can you write off home renovations on taxes?

In general, home improvements are not tax deductible. But there are a few exceptions. Learn about certain tax breaks you could be eligible for. Many home improvement projects don't qualify for tax deductions.

What does the IRS consider capital improvements?

A capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. The IRS grants special tax treatment to qualified capital improvements, distinguishing them from ordinary repairs.

Is the seller credit at closing tax deductible?

Seller Deductions

But the IRS views such a seller payment as a reduction in the net gain of the home. The lower the net gain, the lower the gain taxes the seller has to pay. So while closing cost credits are not individually deductible, any money the seller pays to closing costs will have a tax benefit in the end.

How much is property tax on a $300000 house in California?

Let's talk in numbers: the average effective property tax rate in California is 0.77%. The national average sits at 1.08%. Of course, the average tax rate in California varies by county. If a property has an assessed home value of $300,000, the annual property tax for it would be $3,440 based on the national average.

How taxes are calculated?

How Income Taxes Are Calculated. First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

How are Texas property taxes calculated?

Texas levies property taxes as a percentage of each home's appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.

Are property taxes based on purchase price or assessed value in Florida?

The taxable value is the assessed value minus exemptions and is the value the tax collector uses to calculate the taxes due. The homestead exemption can result in exempting up to $50,000 of your home's assessed value from tax liability.

What is the property tax on a 10 million dollar house in California?

Properties sold above $5 million but below $10 million are subject to a 4% sales or transfer tax, while properties that sold for more than $10 million will face a 5.5% tax, according to the city clerk's voter information pamphlet.

Do you pay capital gains if you lose money on a house?

Losses from the sale of personal–use property, such as your home or car, are not deductible. It is not eligible for the capital gains loss of up to $3,000 annually. For more information, see About Publication 523, Selling Your Home.

Do you count the sale of a house as income?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

Can you deduct a loss from the sale of your main home?

You can't claim a loss on the sale of your main home unless you used it for business. You should only report the sale if you: Rented the home at some time in the past. Took a deduction for a business use of the home.

Can you subtract closing costs from capital gains?

There is one tax benefit to these costs, though. You can add these closing fees to the cost basis of your home when you sell it. This lowers the amount of profit that you make. This can help reduce any capital gains tax you might have to pay on your home.

What happens if you lose money when selling your house?

If you end up selling for less than your cost, you incur a loss. In most cases, capital losses can be used to offset capital gains, and unused losses can be carried into future years to offset capital gains. However, losses on personal-use assets are generally not deductible.

How much house can I buy with $50,000 down payment?

Most home loans require a down payment of at least 3%. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability. For a $250,000 home, a down payment of 3% is $7,500 and a down payment of 20% is $50,000.

Is 50k down on a house good?

A $50,000 down payment is a good down payment for a $350,000 house. It represents a 14.28% down payment, which is considered to be a good amount by most lenders. A larger down payment will lower your monthly mortgage payments and your overall interest costs.

How much house can I get for $2000 a month?

Between $250,000 to $300,000

With $2,000 per month to spend on your mortgage payment, you are likely to qualify for a home with a purchase price between $250,000 to $300,000, said Matt Ward, a real estate agent in Nashville. Ward also points out that other financial factors will impact your home purchase budget.

How much is a downpayment on a 500 00 house?

Payments on $500K house

Realtor states that most loan programs that will provide you with a mortgage to purchase your home choose the down payment price of 3 to 3.5% of the total price of the home. For a house that costs around $500K, this means you must have between $15,000 and $17,500 for the down payment alone.

What credit score do you need to buy a 50000 house?

Conventional Loans Minimum Credit Score: 620

Conventional loans typically require a minimum credit score of 620, though some may require a score of 660 or higher. These loans aren't insured by a government agency and conform to certain standards set by the government-sponsored entities Fannie Mae and Freddie Mac.

What is commission on a 500 000 house?

An individual real estate agent usually makes between 2–3% commission per home sale, which means you'll pay a combined total of 4–6% total commission on the sale of your home. That translates to $10,000–15,000 in real estate commission per agent on a $500,000 home sale.

How much do top 1% realtors make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

What percentage do most realtors take?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

How to make $1 million as a real estate agent?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

What is the commission on a $40 million dollar home?

There was a recurring plot point on the first season of Selling Sunset, the Netflix show about the ambitious brokers at the Oppenheimer Group in Southern California: who could sell a coveted $40 million home, and with it, earn a hefty $1.2 million commission?