Nov 5, 2019 — Have House Insurance ... Another crucial step to renting out your home without an agent is to protect your home with the correct insurance policy.

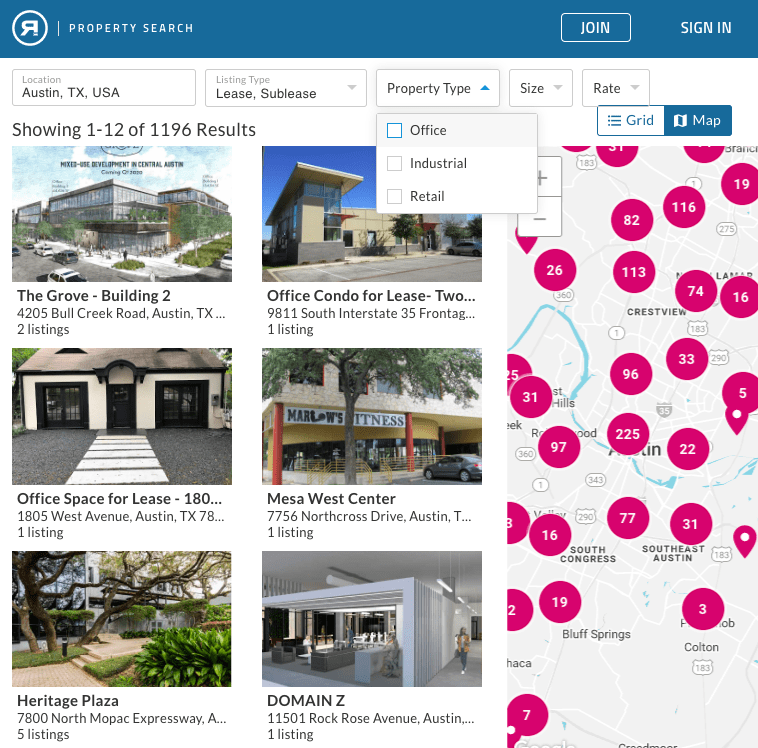

How do I access local MLS listings?

MLS access is generally restricted to licensed real estate agents, so if you want to view MLS listings, your best bet is to find a great local realtor. Your agent can set you up with MLS access through a private online portal, and they'll also set up instant MLS alerts when new homes go up for sale.

How to find a real estate agent in New York?

The New York NY real estate directory lets you view and compare real estate agents, read reviews, see an agent's current listings and past sales, and contact agents directly from their profile pages on Zillow.

How much does a real estate agent make in NYC?

The estimated total pay for a Real Estate Agent is $184,775 per year in the New York City, NY area, with an average salary of $121,305 per year. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users.

What does IDX stand for?

Internet Data Exchange

An Internet Data Exchange (IDX, also known as Information Data Exchange) refers to the agreement between listing (Selling) Agents or Brokers and Buyers' Agents to display Multiple Listing Service properties online, across multiple websites (via Real Estate Syndication where the listing Agent/Broker allows a listing to

Is the MLS the same as Zillow?

If you are able to view the MLS in your area online directly, you will only see properties that are currently active on the market. This makes the MLS more accurate than Zillow, which frequently keeps properties listed as available long after they have been taken off the market.

Realtor attacked yesterday when I shared how I'm generating leads for our new primary off-market.

— Joe Cassandra (@JoeCassandra) October 12, 2023

"Not using a realtor you're taking advantage of old people... selling on-market is the best thing for everyone."

Only people who've never bought off-market houses say dumb stuff…

What percent of people fail in real estate?

What's the Real Estate Exam Pass Rate in California? In the 2019/2020 fiscal year, there were 64,562 salesperson exams administered and 34,360 licenses issued. So, we can expect the pass rate of the real estate exam to be about 53.2%.

Why do people drop out of real estate?

Another major reason people quit real estate is because they expect big profits with very little knowledge. People that get involved in real estate, without any prior knowledge or experience tend to blame the field if they aren't immediately making money. The truth is real estate makes a lot of people a lot of money.

What job makes the most money in real estate?

The highest-paying real estate job is typically the role of a Real Estate Development Manager. Real Estate Development Managers are responsible for overseeing large-scale development projects, managing budgets, negotiating deals, and ensuring successful project completion.

How do I get my real estate license in Florida?

The Florida Real Estate Commission (FREC) requires completion of the following steps in order to receive a Real Estate Salesperson License in Florida.

- Complete 63 Hours of Approved Education.

- Pass the Course Final Exam.

- Submit Fingerprints.

- Complete the Licensing Application.

- Pass the Florida Real Estate Exam.

Can you make $1000000 a year in real estate?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

What is it called when you buy a house and then sell it?

Flipping is a real estate investment strategy where an investor purchases a property with the intention of selling it for a profit rather than using it. Investors who flip properties concentrate on the purchase and subsequent resale of one or a group of properties.

How does a concurrent closing work?

A concurrent closing means you sell one home and buy another quickly — sometimes even on the same day. Most people prefer a concurrent closing because they must sell their old house before closing on the new one. Often, people use proceeds from the sale of the old home for the downpayment on the new one.

Can you put your house up for sale and then change your mind?

Can you take your house off the market? You can take down the for-sale sign, terminate your listing agreement with your agent, and remove online evidence of your listing so long as you haven't already gone under contract with a buyer. It's your house — you can sell it. Or not sell it.

How long do you have to reinvest money from sale of primary residence?

Deferring Capital Gains Tax: Buying another home after selling an investment property within 180 days can defer capital gains taxes. Although reinvesting the proceeds from a sale still obligates the payment of capital gains, it can defer them.

Can you write off real estate investments on taxes?

Use Real Estate Tax Write-Offs

One of the biggest financial perks of this income stream is the real estate investment tax deductions you're able to take. You get to deduct expenses directly tied to the operation, management and maintenance of the property, such as: Property taxes. Property insurance.

Which things are tax deductible on real estate used for investing?

Legal compliance & taxes

Most real estate investors write off costs like mortgage interest, insurance, property taxes, and ordinary operating expenses, like maintenance and repairs — understandably, as these are widely known tax deductions.

What happens if my expenses are more than my rental income?

If your rental expenses exceed rental income your loss may be limited. The amount of loss you can deduct may be limited by the passive activity loss rules and the at-risk rules. See Form 8582, Passive Activity Loss Limitations, and Form 6198, At-Risk Limitations, to determine if your loss is limited.

Who qualifies for 20 pass through deduction?

20% Deduction for Taxable Income Below Annual Threshold

For 2023, the threshold is taxable income up to $364,200 if married filing jointly, or up to $182,100 if single. If your income is within this threshold, your pass-through deduction is equal to 20% of your qualified business income (QBI).

How much investment loss can you write off?

$3,000

If your net losses in your taxable investment accounts exceed your net gains for the year, you will have no reportable income from your security sales. You may then write off up to $3,000 worth of net losses against other forms of income such as wages or taxable dividends and interest for the year.

What is the oldest real estate brokerage in the United States?

Baird & Warner

The oldest real estate brokerage firm was established in 1855 in Chicago, Illinois, and was initially known as "L. D. Olmsted & Co." but is now known as "Baird & Warner".

What is discount in real estate?

The discount rate is a real estate metric that represents an investor's required rate of return on an investment. It is a key input in discounted cash flow analysis, which helps to determine a fair sales price for a property.

When did real estate first begin?

The real estate industry traces its roots back to the late 19th century. But it didn't begin to take shape as we know it until the early 1900s.

Were there real estate agents in the 1800s?

The profession of real estate broker began around 1900 in the United States. Since then, the profession of real estate brokers has flourished in the country. The initial home sale records began in the United States in 1890.

Who is the richest real estate broker in us?

Donald Bren

According to Forbes, Donald Bren's net worth as of August 2022 is $16.2 billion, making him the richest real estate mogul in the United States for 2022. He came in first place with a fortune of $16.2 billion. In just two years, his fortune grew by nearly two billion dollars.

How do you attract buyers and sellers in real estate?

Attract Traffic to Your Property—How To Make Buyers and Agents...

- Make Your Home Easy To Show.

- Offer a Competitive Buyer's Agent Commission.

- Increase Traffic Through Market Exposure.

- Host an Open House Extravaganza.

- Make a Limited-Time Offer.

- Drop Your Price as the Last Resort.

How do I attract buyers to my property?

8 Simple Ways to Attract Buyers to Your Home

- Picture Perfect. One of the first things that potential buyers will notice about your listing. is the photographs.

- Detailed Listing Information.

- Highlight the Features.

- Make Things Easy.

- Keep Your Listing Agent Away.

- Attractive Commissions.

How do I attract more buyers to my listing?

Focus on features that are relevant and important to them. Highlight the unique selling points of each property and showcase them in an attractive manner. Help buyers visualize themselves in the property by using professional-quality photos, virtual tours, and 360-degree videos.

How to get real estate clients without cold calling?

10 Ways to Get Listings Without Cold Calling

- Contact Your Sphere.

- Re-Engage & Follow Up with Past Clients.

- Attend Community Events.

- Build Your Social Media Following.

- Digital Prospecting with Facebook.

- Strengthen Lead Referrals through LinkedIn.

- Send Mailers.

- Go Door Knocking.

What brings buyers and sellers together?

The correct answer is (a) broker. During negotiations between sellers and buyers, a broker's function is to bring buyers and sellers together in a marketplace and ease each party's buying or selling process. The broker does not take the title of the products but assists the two parties to agree.

How are gross proceeds to a seller reported?

For real estate tax reporting, Form 1099-S is used to report gross proceeds on the sale or exchange of real estate property. This form is titled 'Proceeds From Real Estate Transactions. When selling a home, the seller receives gross proceeds.

What is the formula for gross proceeds?

To calculate gross proceeds with the gross proceeds formula, you simply subtract the cost of selling a product or service from the total price. For example, if your product sells for $40 but you paid $5 to ship it to the customer, then your gross proceeds for that transaction would be $35 ($40-$5).

How does IRS know you sold property?

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

Are gross proceeds the same as capital gains?

Depending on the asset sold, the costs may account for a small percentage of the gross proceeds or a substantial percentage of the gross proceeds. Capital gains taxes are paid on the net proceeds of a sale rather than the gross proceeds.

How do you calculate gross sale proceeds in real estate?

The amount includes the costs of production and other costs and expenses related to the transaction. For example, if a real estate agent sells a house for $100,000, that amount represents the gross proceeds. The amount includes the agent's fees or commission, as well as the closing costs.

Where do realtors get paid the most?

Real estate agents in high cost of living cities such as New York and San Francisco tend to be the highest earners.

What are the three types of brokers?

The three types of brokerage are online, discount, and full-service brokerages.