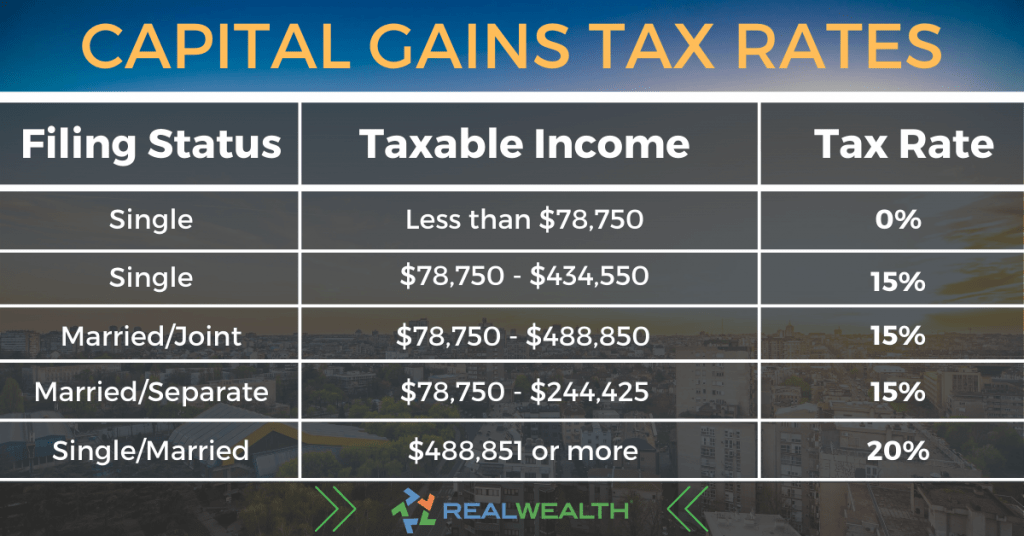

That's where your tax accountant can help you understand your actual bottom line. There are two capital gain tax rates to be aware of, Federal and State. The Federal rate is based on your tax bracket and depending on your income can be either 15% or 20%. Pennsylvania has an additional 3.07% (2022).

How is capital gains calculated on sale of real estate?

Do you pay capital gains tax on the sale of a house in PA?

How much capital gains tax on $200,000?

= $

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

How do I avoid capital gains tax when selling my house?

How do I avoid capital gains tax on real estate in PA?

You can sell your primary residence exempt of capital gains taxes on the first $250,000 if you are single and $500,000 if married. This exemption is only allowable once every two years. You can add your cost basis and costs of any improvements you made to the home to the $250,000 if single or $500,000 if married.”

In every property investment there is something called return on Capital and Return of capital. Where the earlier addresses secured inflows in rents based on investment & the other taking care of the actual Capital recouping. Investors go to market assuming capital was borrowed.

— SEGA L'éveilleur® (@segalink) April 25, 2020

What is the $250000 / $500,000 home sale exclusion?

Frequently Asked Questions

Is sale of second home taxable in PA?

Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax (PA PIT) law.

How to avoid paying capital gains on sale of a vacation home?

- You owned the home and used it as your main home during at least two of the five years leading up to the date of the sale.

- You did not acquire the home through a like-kind exchange (also known as a 1031 exchange) during the past five years.

Is the sale of a second home considered income?

When you sell a vacation home, rental, fix-and-flip, or any second property that is not your primary residence, you will typically be responsible for paying capital gains taxes on any profits you make, at a rate of up to 20%, depending on your tax bracket. But you may be able to mitigate those taxes.

How do I avoid capital gains tax on the sale of my home?

How do I avoid the capital gains tax on real estate? If you have owned and occupied your property for at least 2 of the last 5 years, you can avoid paying capital gains taxes on the first $250,000 for single-filers and $500,000 for married people filing jointly.

Do you have to report sale of home on tax return?

Reporting the Sale

Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale.

Is the sale of a house considered taxable income?

What is the capital gains tax on selling a house in PA?

Instead, it taxes all capital gains as ordinary income, using the same rates and brackets as the regular state income tax. Pennsylvania is one of the states with a flat income tax rate, so no matter the amount of taxable ordinary income, the state tax rate will always be 3.07%.

FAQ

- How is capital gains calculated on sale of home?

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

- Is PA exempt from capital gains tax?

You can sell your primary residence exempt of capital gains taxes on the first $250,000 if you are single and $500,000 if married. This exemption is only allowable once every two years.

- How do you calculate capital gains on a second home?

Capital gain calculation in four steps

Determine your realized amount. This is the sale price minus any commissions or fees paid. Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.- How to avoid capital gains tax when selling a second house?

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

- Is selling a second home considered capital gains?

You cannot depreciate a vacation home, which is considered personal property, but because it's a second property, when you sell, it is fully taxable at the capital gains rate as an investment.

- How is capital gains calculated on the sale of a house?

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

- How much gain on sale of home is not taxable?

Capital gains taxes can apply to the profit made from the sale of homes and residential real estate. The Section 121 exclusion, however, allows many homeowners to exclude up to $500,000 of the gain from their taxable income. Homeowners must meet certain ownership and home use criteria to qualify for the exemption.

How to figure capital gains pa real estate

| When you sell your house does the profit count as income? | It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000. |

| Do I have to pay capital gains tax immediately? | Do I Have to Pay Capital Gains Taxes Immediately? In most cases, you must pay the capital gains tax after you sell an asset. |

| Do I have to pay taxes on gains from selling my house in NJ? | You will report any income earned on the sale of property as a capital gain. When filing your New Jersey Tax Return, a capital gain is calculated the same way as for federal purposes. Any amount that is taxable for federal purposes is taxable for New Jersey purposes. |

| What is capital gains tax on real estate in Pennsylvania? | Instead, it taxes all capital gains as ordinary income, using the same rates and brackets as the regular state income tax. Pennsylvania is one of the states with a flat income tax rate, so no matter the amount of taxable ordinary income, the state tax rate will always be 3.07%. |

| What is NJ capital gains tax on home sale? | New Jersey exit tax particulars The New Jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: whichever is higher. |

| Do you pay taxes when you sell a house in Pennsylvania? | Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax (PA PIT) law. |

| What real estate taxes do you pay in PA? | PA's average effective property tax rate can range from . 87% to 2.45%, with a 1.36% average rate. Anyone who owns property in the commonwealth is required to pay property taxes, which are used to fund public services, such as schools, roads, bridges, parks, police, etc. |

- Who pays real estate transfer tax in PA?

The tax is usually split evenly between the buyer and the seller, but this is not a legal requirement. The City has the right to collect 100% of the tax from either party, so it's in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale.

- Do I have to pay PA state taxes on the sale of my home?

Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax (PA PIT) law.

- Who pays transfer tax on home sale in PA?

The tax is usually split evenly between the buyer and the seller, but this is not a legal requirement. The City has the right to collect 100% of the tax from either party, so it's in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale.

- Is there a capital gains tax on land in PA?

Instead, it taxes all capital gains as ordinary income, using the same rates and brackets as the regular state income tax. Pennsylvania is one of the states with a flat income tax rate, so no matter the amount of taxable ordinary income, the state tax rate will always be 3.07%.

- How do you calculate gain on sale of land?

Upon the sale of a piece of real estate (for example, your single-family home residence) profit or loss is calculated by taking the property's sales price and subtracting it from your cost basis on the date of sale.

- What is the capital gains tax on $200 000?

= $

Jan 11, 2023Single Taxpayer Married Filing Jointly Capital Gain Tax Rate $0 – $44,625 $0 – $89,250 0% $44,626 – $200,000 $89,251 – $250,000 15% $200,001 – $492,300 $250,001 – $553,850 15% $492,301+ $553,851+ 20%

- How do you calculate taxable gains on sale of property?

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains.