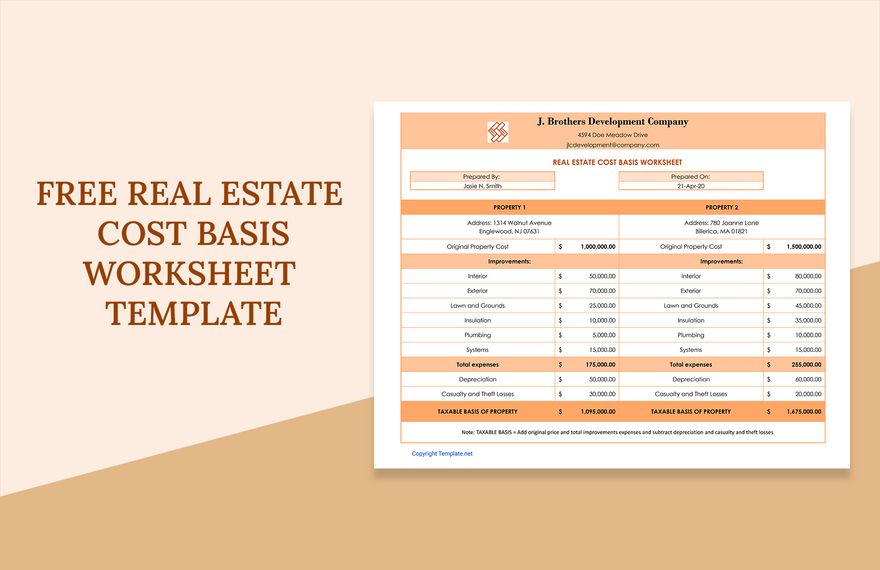

How Do I Calculate Cost Basis for Real Estate?

- Start with the original investment in the property.

- Add the cost of major improvements.

- Subtract the amount of allowable depreciation and casualty and theft losses.

What is an example of a cost basis in real estate?

Let's say that you purchase a property as a primary residence for a purchase price of $250,000. Over the years, you put in another $50,000 worth of home improvements, such as a new bathroom and kitchen. Those upgrades increased your adjusted basis to $300,000.

How do you establish the basis of a property?

Cost Basis of a Property

You use the full purchase price as your starting point, regardless of how you pay for the property—with cash or a loan. If you buy property and take over an existing mortgage, you use the amount you pay for the property, plus the amount that still must be paid on the mortgage.

How do you establish cost basis?

For stocks or bonds, the cost basis is generally the price you paid to purchase the securities, including purchases made by reinvestment of dividends or capital gains distributions, plus other costs such as the commission or other fees you may have paid to complete the transaction.

How does IRS verify cost basis?

How Does the IRS Verify Cost Basis in Real Estate? In real estate transactions, the IRS can verify the cost basis by looking at the closing statement of when the property was purchased, or any other legal documents associated with the property, such as tax statements.

How do I invest in a real estate fund?

Best ways to invest in real estate

- Buy REITs (real estate investment trusts) REITs allow you to invest in real estate without the physical real estate.

- Use an online real estate investing platform.

- Think about investing in rental properties.

- Consider flipping investment properties.

- Rent out a room.

Most great businesses end up as real estate businesses, and there's no mistaking why.

— Mitchell Baldridge (@baldridgecpa) August 27, 2023

If you start a great business that kicks off cash, and buy a bunch of real estate as a pro, you can end up with ALL CASH and NO TAX.

There are wealthy real estate folks in every town who pay… pic.twitter.com/4Y5MD8m2co

Is a real estate fund a good investment?

Investing in a real estate fund is a great way to generate passive income for those who are interested in owning real estate, but who do not want the responsibilities of direct ownership.

How to invest $100 000 dollars in real estate?

How to Invest $100k in Real Estate

- Residential Property for Long-Term Renters.

- Short-Term Rental Property.

- Flipping a House or Condo.

- Multi-Family Rentals.

- Commercial Property.

- Stocks in Real Estate Companies.

- REITs.

- Joint Ventures.

How to rent out a house in Florida?

How to Rent Your House in Florida

- Figure Out What Renters Want.

- Follow State and Local Laws and Restrictions.

- Make Sure You Have a Well-Drafted Lease.

- Get Your Property Rent Ready.

- Don't Forget that Renting Is a Business.

- Want to Rent Your House in Florida?

Do I need a business license to rent my house in Florida?

As a real estate broker or agent. To be able to rent someone else's house but to rent your own. House. No you do not need to be licensed. This is why by the way that for sale by owner.

Does Article 1 require REALTORS to treat all parties?

Article 1 has 16 Standards of Practice covering a wide variety of behaviors, but focuses on protecting and promoting the interests of your client while treating all parties honestly. Key Standards of Practice: o SOP 1-6 & 1-7 – require agents to submit offers and counter offers objectively and quickly.

Who are obligated to abide by the Code of Ethics?

The NAR requires all its members to abide by the Code of Ethics. This includes real estate agents, brokers, appraisers, property managers, and other professionals who are members of the association.

Who primarily enforces the Code of Ethics in real estate?

Who enforces the code of ethics in real estate? Local Realtor associations enforce the NAR Code of Ethics. At the same time, NAR controls its code of ethics. Its articles offer standards for conduct with clients and customers, the public, and other Realtors.

What does Article 1 allow?

Article I of the Constitution enumerates the powers of Congress and the specific areas in which it may legislate. Congress is also empowered to enact laws deemed “necessary and proper” for the execution of the powers given to any part of the government under the Constitution.

How much does it cost to get a real estate license in Washington state?

Business license fees

| Service | Real estate firm fee |

|---|---|

| Service Get an original license | Real estate firm fee $304 |

| Service Renew a license | Real estate firm fee $304 |

| Service Renew a license late (with penalty) | Real estate firm fee $345 |

| Service Get a printed license by mail | Real estate firm fee $5 |

How much does it cost to get a real estate license in California?

How Much Does It Cost To Get A California Real Estate License?

| Course Tuition | $100 - $400+ |

| Background Check | $40 |

| Salesperson License Fee | $245 |

| Examination Fee | $60 |

| Total | $445 - $745 |

|---|

How long does it take to get a real estate license in CA?

3-6 months

TL;DR: Getting a real estate license in California typically takes 3-6 months. The process includes completing a pre-licensing course, passing the state exam, and completing background checks. The timeline may vary depending on individual circumstances.

How do I get my VA real estate license?

To earn your real estate license in Virginia, you must be at least 18 years of age, complete 60 hours of approved education, pass the Virginia real estate salesperson licensing exam, complete fingerprinting and a background check, and apply for a state license.

How much does the average realtor make in Washington?

As of Oct 9, 2023, the average annual pay for a Licensed Real Estate Agent in Washington is $95,308 a year. Just in case you need a simple salary calculator, that works out to be approximately $45.82 an hour. This is the equivalent of $1,832/week or $7,942/month.

What percentage do most brokers take from agents?

The brokers then split their commissions with their agents. A common commission split gives 60% to the agent and 40% to the broker, but the split could be 50/50, 60/40, 70/30, or whatever ratio is agreed by the agent and the broker.

What percentage do most real estate brokers charge?

About 5 percent to 6 percent

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

What percentage do most real estate agents get?

While realtor commission fees vary regionally, the average seller can expect to pay between 4.45% to 6.34% of the home's final sale price, according to our research. The U.S. average is currently 5.37%. The listing agent usually receives 2.72% of the proceeds.

What broker makes the most money?

High Paying Brokerage Professional Jobs

- Stock Broker. Salary range: $65,000-$225,000 per year.

- Commodity Broker. Salary range: $30,000-$105,000 per year.

- Broker. Salary range: $105,000-$105,000 per year.

- Associate Broker. Salary range: $48,000-$77,500 per year.

- Energy Broker.

- Broker Assistant.

- Brokerage Clerk.

Why a broker is better than an agent?

The main difference between an agent and broker is the number of responsibilities they're able to take on. A broker can do everything an agent can do, but they have the added responsibility of making sure all real estate transactions are lawful, all paperwork is accurately completed and all finances are accounted for.

What is the best way to advertise your property?

What are the Creative Ways to Market a House for Sale?

- List Your Home on FSBO Websites.

- List Your Home on the MLS.

- Buy a Yard Sign (For Sale By Owner Yard Signs)

- Utilize Power of Social Media.

- Try Craigslist.

- Hire a Professional Photographer.

- Create a Virtual Tour.

- Host a Unique Open House.

How do you sell private property?

How to sell a house by owner

- Determine the fair market value.

- List your property and find a buyer.

- Negotiate and secure an offer.

- Create a Real Estate Purchase Agreement and secure finances.

- Transfer the property title.

How do I write an ad to sell my house?

How to Write a Real Estate Listing Description that Sells

- Describe the property accurately.

- Choose adjectives wisely.

- Avoid red flag words.

- Include words that add value.

- Highlight unique features.

- Take notice of punctuation.

- Leave out super basic info.

- Use great photos.

How do I market my home for sale on social media?

Real Estate Social Media Marketing

- Promote the town, not just the house.

- Be yourself.

- Educate your buyers.

- Chat with your followers.

- Respond to comments, good and bad.

- Avoid simply shouting about your home listings.

- Don't forget video.

- Never assume you're only connecting with first-time buyers.

What is the best website to post a property?

Housing.com lets you post free property ad and is India's top property site and whether you are looking to sell property online or advertise property for rent, there is guaranteed visibility for your property at zero cost!

Can I work with 2 different brokers at the same time?

Q. As a broker-associate, can I work for multiple real estate brokers? A. Yes, a broker-associate can work in the capacity of a salesperson for another broker or brokers while also working as an independent broker as long as this activity is permitted under the affiliation agreement signed by the applicable parties.

Is it unethical to work with multiple real estate agents?

Ethical concerns

Buyer's agents only receive their commission when they close on a deal. Working with multiple agents means that whichever one doesn't close on a house with you misses out on their compensation. “Simply put, you're asking one of the agents to work for free, and that is wrong,” says Capozzolo.

Can a real estate broker work for two firms in Florida?

In Florida, a real estate broker who wishes to work for more than one entity can apply for multiple licenses. Multiple licenses give the broker the ability to hold the title of broker at numerous real estate agencies at the same time. The broker can also remain a sole proprietor of his agency.

Can a NC broker work for two firms?

What does a full broker need in order to affiliate with multiple firms (dually affiliate)? Permission of the BICs at both firms. (Provisional brokers can only be dually affiliated with BICs of two different firms if both BICs are located at the same physical location and acting as co-listing or co-selling agents.)

Can you work for more than one broker dealer?

Individuals may be registered with more than one firm if the firms are affiliated with one another.

Can you side hustle as a real estate agent?

Not only can you choose among dozens of career paths in the real estate industry, but when you work in real estate sales, you get to decide how much you'll work and when. You can get started in real estate part-time as a side hustle or you can launch a new full-time career.

What job makes the most money in real estate?

The highest-paying real estate job is typically the role of a Real Estate Development Manager. Real Estate Development Managers are responsible for overseeing large-scale development projects, managing budgets, negotiating deals, and ensuring successful project completion.

What degree is best for real estate?

Popular majors for future real estate agents include marketing, finance, accounting, psychology, and business. Even though going to college isn't required, you may find it helpful to complete a degree or certificate program to gain knowledge that would help you succeed as a real estate agent.

How do you stand out as a real estate agent?

8 Ways Realtors Can Stand Out From Their Competitors

- Enhance The Client Experience.

- Be Professional When Approaching Prospects.

- Find Your Speciality & Excel At It.

- Build A Formidable Online Presence.

- Get On Google My Business.

- Invest In Branding.

- Build Your Network And Connections.

- Sponsor Local Events.

How to make $1 million as a real estate agent?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

What should I do with large lump sum of money after sale of house?

Depending on your financial circumstances, it might make sense to pay down debt, invest for growth, or supplement your retirement. You might also consider purchasing products to protect yourself and your loved ones, including annuities, life insurance, or long-term care coverage.

How long do you have to reinvest money from the sale of your home?

Within 180 days

If the home is a rental or investment property, use a 1031 exchange to roll the proceeds from the sale of that property into a like investment within 180 days.13.

Is profit from selling a house considered capital gains?

If you owned and lived in the home for a total of two of the five years before the sale, then up to $250,000 of profit is tax-free (or up to $500,000 if you are married and file a joint return). If your profit exceeds the $250,000 or $500,000 limit, the excess is typically reported as a capital gain on Schedule D.

Do you have to report sale of home on tax return?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

How do I avoid capital gains tax on my house?

If you have owned and occupied your property for at least 2 of the last 5 years, you can avoid paying capital gains taxes on the first $250,000 for single-filers and $500,000 for married people filing jointly.