Put simply: In real estate, the cost basis is the original value that a buyer pays for their property. This includes, but is not limited to, the price paid for the property, any closing costs paid by the buyer and the cost of improvements made (excluding tax credits associated with improvements).

How does the IRS know your cost basis?

How Does the IRS Verify Cost Basis in Real Estate? In real estate transactions, the IRS can verify the cost basis by looking at the closing statement of when the property was purchased, or any other legal documents associated with the property, such as tax statements.

What is the basis of property IRS?

The basis of property you buy is usually its cost. The cost is the amount you pay in cash, debt obligations, other property, or services. Your cost also includes amounts you pay for the following items. Sales tax.

How do you determine the cost basis of a house?

How Do I Calculate Cost Basis for Real Estate?

- Start with the original investment in the property.

- Add the cost of major improvements.

- Subtract the amount of allowable depreciation and casualty and theft losses.

What closing costs are not included in basis?

Only loan interest and real estate taxes are deductible closing costs for a rental property. Other settlement fees and closing costs for buying the property become additions to your basis in the property.

How to calculate closing costs?

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

#NewTaxRegime - Calculation of House Rent for Deductions

— K. RAJESH (@rajeshkmoorthy) July 13, 2023

How does the New Tax Regime figure out how much someone makes from their home?

If you want to switch to the new tax system and make money from real estate, there are some things you need to know before making the switch.… pic.twitter.com/1RIJ9EVmz3

What are the closing costs for a buyer in New York State?

How Much Are Closing Costs in New York? Closing costs in New York average $8,256 for a home loan of $352,314, or 2.34 percent of the home loan, according to a 2021 report by ClosingCorp, which researches residential real estate data.

What is the formula of closing?

Closing Stock Formula. The Closing Stock or the closing inventory Formula is Opening Stock + Purchases – Cost of Goods Sold. We need to add the cost of beginning inventory or the opening inventory to the cost of purchases during the period. This is the cost of goods which will be available for sale.

What is the professional name for a real estate agent?

A Realtor is a licensed real estate agent or broker (or other real estate professional) who is a member of the National Association of Realtors (NAR). Members must comply with NAR's strict Code of Ethics.

What do you put on a real estate business card?

4 Real Estate Business Card Requirements You Should Adhere To

- Include Your Licensed Name and License Number.

- Add an Updated Picture of Yourself.

- Incorporate your Logo and Any Associations You Belong To.

- Use a Clean, Simple Design.

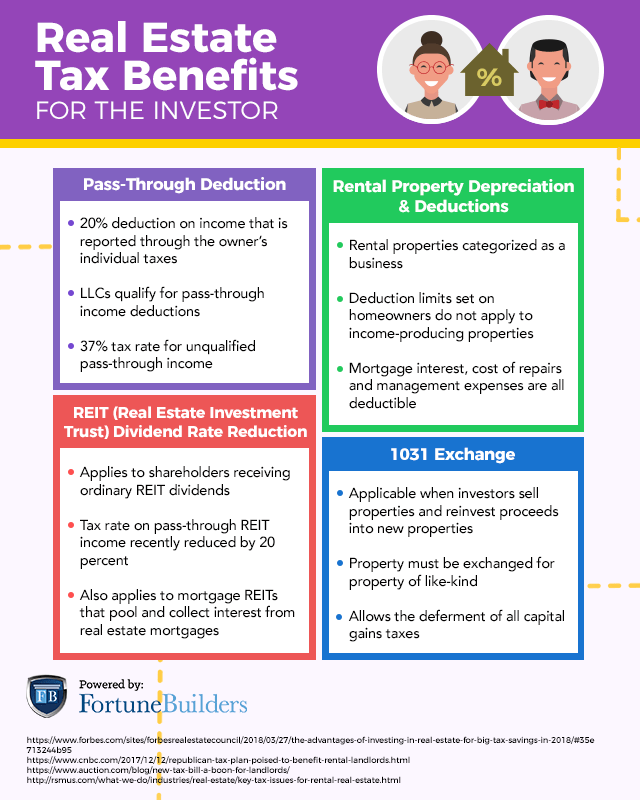

What is the best way to avoid capital gains tax on real estate?

Fortunately, the IRS gives homeowners and real estate investors ways to save big. You can avoid capital gains tax by buying another house and using the 121 home sale exclusion. In addition, the 1031 like-kind exchange allows investors to defer taxes.

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

What is the one time capital gains exemption?

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.

Which Realty company is the best to work for?

Best Real Estate Companies to Work for in 2023

| Brokerage | Best For |

|---|---|

| eXp Realty | Best overall, featuring an agent-forward virtual approach |

| Keller Williams | Building a team |

| RE/MAX | High-performing, established agents |

| Coldwell Banker | New agents |

Which real estate company pays the most commission?

eXp Realty

EXP Realty is the real estate company with the best commission split for its agents. Agents get an 80/20 commission split with an annual cap of $16,000, which means that after you hit that threshold, you earn 100% commission.

Where is the best place to work as a new real estate agent?

Keller Williams, Weichert, and Redfin all provide career support and training to new agents, as well as opportunities for growth. Deciding which real estate company is best for you depends on your experience level, needs, and career goals.

What is the best brokerage to work in Florida?

3 Best Real Estate Companies To Work For in Florida

Oct 7, 2023

| Real Estate Company | Commission Split | Profit Share |

|---|---|---|

| 1. eXp Realty | 80/20 | ❌ |

| 2. Keller Williams Realty | 64/36 | ✅ |

| 2. Compass | Based on agent discussion. | ❌ |

Why did I leave exp Realty?

Some agents quickly move back to keller williams realty or their previous. Brokerage. Or find a new brokerage. Entirely. Most however stay and love the new way of working.

What is the best strategy for selling a house?

10 tips to sell your home for more money

- Find a trusted real estate agent.

- Invest in value-adding improvements.

- Up your curb appeal.

- Get a pre-listing inspection.

- Highlight with pro photos.

- Stage your home.

- Set the right asking price.

- Remove personal items.

What to do first when selling your house?

The Home Selling Process in 10 Steps

- Determine how long it will take you to sell.

- Understand the costs of selling.

- Hire the right listing agent.

- Prepare your home for sale.

- Complete pre-listing marketing tasks.

- Fill out your selling disclosures.

- Show your home to prospective buyers.

- Review and accept an offer.

How to stage your home to sell for top dollar?

Below, we share simple tips that can help you prep your home for online listings and home showings!

- Clean & Declutter Your Home.

- Remove Personal Items.

- Furnish Empty Spaces.

- Let in Natural Light.

- Hire a Professional Photographer.

- Choose the Right Paint Color for Your Walls.

- Spruce Up Your Curb Appeal.

- Upgrade Carpets & Floors.

What makes a house harder to sell?

If your home has any mold, mildew, or musty odors, it could be making it harder to sell. These problems can be off-putting to potential buyers, and they can also be a sign of more serious issues, such as water damage.

What are the 3 most common methods of selling property?

Each method has its pros and cons, and which one you pick can significantly affect how well your house sells. The three most common ways to sell are auction, private treaty, and expression of interest (EOI).

What is the IRS deduction for real estate taxes?

You can deduct real estate taxes imposed on you. You must have paid them either at settlement or closing, or to a taxing authority (either directly or through an escrow account) during the year.

Are real estate taxes separate from standard deduction?

Remember, you can only claim your property tax deduction if you itemize your taxes. If you claim your standard deduction, you can't also write off property taxes.

How much is property tax on a $300000 house in California?

Let's talk in numbers: the average effective property tax rate in California is 0.77%. The national average sits at 1.08%. Of course, the average tax rate in California varies by county. If a property has an assessed home value of $300,000, the annual property tax for it would be $3,440 based on the national average.

Who claims property taxes when married filing separately?

Share: When claiming married filing separately, mortgage interest would be claimed by the person who made the payment. Therefore, if one of you paid alone from your own account, that person can claim all of the mortgage interest and property taxes.

What home purchase expenses are tax deductible?

You can deduct mortgage interest, property taxes and other expenses up to specific limits if you itemize deductions on your tax return. Barbara Marquand writes about mortgages, homebuying and homeownership. Previously, she wrote about insurance and investing at NerdWallet and covered personal finance for QuinStreet.

What is the pass rate for the Wisconsin real estate exam?

If it is marked “Fail,” then you will see a breakdown of your score in the different areas of the exam. If you decide to retake the exam, use this as a guide for your studies. The passing rate for the Wisconsin Real Estate Salesperson Exam is 75%.

How long do most people study for real estate exam?

You should study for the real estate exam for at least several weeks before your test date. The whole point of taking your pre-licensing courses is to prepare you, first for the exam, and then for your work as an agent, so really, you should be thinking of your courses as exam prep time as well.

Is the NYS real estate exam easy?

The New York State Real Estate License Exam is not difficult, you just need to prepare for it. Making sure you understand the material and reviewing the course content are great first steps to take to increase your chances of passing.

Is the Illinois real estate exam hard?

Is the Illinois real estate exam hard? While the majority of students pass their real estate exam, a passing score isn't guaranteed. In Illinois, about 33% of students have to retake the test in order to pass. The best way to alleviate your nerves and pass the test is to work hard and prepare as much as possible.

Is the Wisconsin real estate test hard?

We know you have a busy life, and sometimes, it's not realistic to study for hours every day in the weeks leading up to your Wisconsin Real Estate licensing exam. That's okay, even just a few hours with our prep guide will mean you are able to pass your WI exam confidently – first try. Average pass rate is only 64%.

What do most real estate agents make their first year?

First Year Real Estate Agent Salary in California

| Annual Salary | Hourly Wage | |

|---|---|---|

| Top Earners | $129,667 | $62 |

| 75th Percentile | $103,700 | $50 |

| Average | $84,380 | $41 |

| 25th Percentile | $67,400 | $32 |

How do first year real estate agents succeed?

Follow all ten, and you'll do more than survive - you'll thrive in your first year!

- Get Your Mind Right.

- Choose Your Broker and Your Mentors Carefully.

- Create a First-Year Budget.

- Learn Everything You Can About Your Market.

- Find Your Niche.

- Set S.M.A.R.T.

- Create an Effective Routine.

- Prospect.

How do I get started in the real estate industry?

Though the specific requirements differ by state, here's a general rundown of how to become a real estate agent.

- Research Your State's Requirements.

- Take a Prelicensing Course.

- Take the Licensing Exam.

- Activate Your Real Estate Agent License.

- Consider Becoming a Realtor.

- Join a Real Estate Brokerage.

What is the best real estate company to work for?

Best Real Estate Companies to Work for in 2023

| Brokerage | Best For |

|---|---|

| eXp Realty | Best overall, featuring an agent-forward virtual approach |

| Keller Williams | Building a team |

| RE/MAX | High-performing, established agents |

| Coldwell Banker | New agents |

How to make $100,000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

How long does it take to move into a house?

Moving into a new home is hugely exciting - but we all know that it can be stressful and takes anywhere from 8 - 22 weeks, depending on a big list of variables! If you've got a solid timeline, understand each step, and know what to expect, you'll be in a great position to handle your house move calmly and capably.

When should you purchase a house that you plan to live in?

In general, it's best to buy when you have your eye on the horizon and you're thinking long-term. Experts largely agree that you shouldn't own unless you plan on staying in the home for at least five years. That's because, thanks to their high start-up costs, houses don't usually make great short-term investments.

Can I depreciate my primary residence if I rent it out?

Another benefit of converting a primary residence into a rental is the ability to depreciate the physical improvements, typically over a period of 27.5 years. As IRS Publication 946 explains, depreciation is an expense allowance for the wear and tear, deterioration, or obsolescence of the property.

How do I convert my primary residence to an investment property?

How to convert your primary residence to a rental property

- Check with your lender to see if you can use your mortgage for a rental property.

- Add landlord liability insurance.

- Apply for licenses and permits.

- Prep the property.

- Get property management software.

Why is it taking so long to move house?

The most straightforward (and yet frustrating) reason for the hold up is being part of a chain. The longer the chain is, the more complex everything becomes. In many cases, money has to transfer from the first sale to travel up the chain, so any delays at the start will continue down the line.