1) Fear of rejection.

This is often the first thing to come to mind when realtors are asked to share their biggest fear, especially for those agents who are new to the industry. It's a scary thing to put yourself out there—to go door-knocking or cold-calling.

How do you deal with difficult people in real estate?

5 Tips for Real Estate Agents to Handle Difficult Clients

- #1 Pre-Screen for Difficult Clients.

- #2 Listen Closely While They're Talking.

- #3 Educate Them Early.

- #4 Get Ready for Emotions.

- #5 Stay Calm and Decisive.

What is the biggest complaint about real estate agents?

As a real estate agent, maintaining the highest standards of professionalism, honesty, and trustworthiness is paramount. One of the most common complaints filed against real estate agents revolves around the concept of breach of duty.

What is the most common complaint about brokers from sellers?

Conflict of Interest

The Real Estate License Law prohibits brokers in a transaction from acting for more than one party without the knowledge of all parties for whom the broker acts. The most common complaints deal with dual agency, seller subagency, and special relationships between the parties.

What is the biggest lie in real estate?

The biggest lie in real estate is that when you buy a property you actually own it. That's right. Real estate ownership in the United States is a lie. It doesn't matter if you have a mortgage against the property or you own it free and clear.

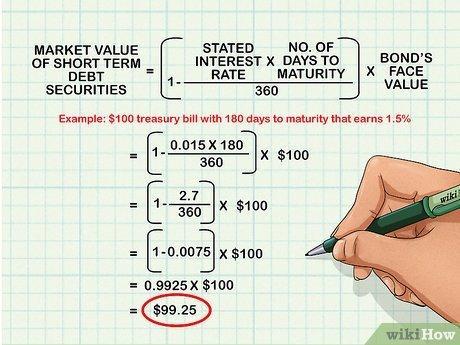

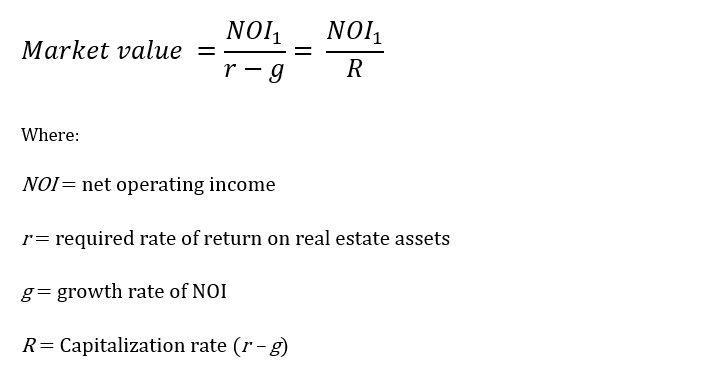

What is the formula for market value in real estate?

The GRM method determines the market value of a property by multiplying the gross rent multiplier (GRM) by the property's annual gross rental income. The formula to compute the GRM divides the sale price of a property by its annual gross rental income, which can be rearranged to isolate the price variable.

How do you calculate the price of a home?

— EstateMint (@estatemint) June 9, 2022

When seeking to buy a home, it's crucial to know the genuine market value of the property so you don't get taken advantage of by the seller, and the same is true when selling your home.

Read the blog to know morehttps://t.co/f3xMZc5Fus pic.twitter.com/nXPVltd7To

How do you determine fair market value of household items?

Fair market value is the amount that the item could be sold for now; what you originally paid for the clothing or household item is completely irrelevant. For example, if you paid $500 for a sofa that would only get you $50 at a yard sale, your deduction for charitable donation purposes is $50 (the sofa's current FMV).

What is the formula for market size value?

Formula for market size

Market volume x average value = market value.

How does the IRS know if I have rental income?

Ways the IRS can find out about rental income include routing tax audits, real estate paperwork and public records, and information from a whistleblower.

Do I have to report rental income from a family member IRS?

Thus, you would have to report all of the rent you receive in income, but none of your expenses for the home would be deductible.

What state has the most valuable real estate?

1. Hawaii. Hawaii is known for its beautiful beaches, warm climate, and breathtaking scenery. However, it is also the most expensive state to buy a house, with a Zillow Home Value Index of $834,582.

What state has the worst housing shortage?

California

The nation's shortfall reached 3.8 million homes in 2019, more than double 2012's tally of 1.7 million “missing” homes, according to a study by the non-profit group Up For Growth. With a shortage of 978,000 homes, California had the nation's biggest shortfall in 2019.

What is the hardest state to buy a house in?

Perhaps unsurprisingly, Hawaii tops the list of “the hardest state in which to buy a home”. It has been a tourist favorite since becoming the 50th U.S. state in 1959, with the yearly visitors outnumbering the residents in 2022.

What is the best state to buy a house in?

10 best states for first-time homebuyers plus key factors

| Rank | State | 1-year home price change: 2021–2022 |

|---|---|---|

| 1 | Pennsylvania | 4.1% |

| 2 | North Carolina | 10.1% |

| 3 | Utah | 5.8% |

| 4 | Kentucky | 7.2% |

How much is commercial real estate in the US?

The estimated total dollar value of commercial real estate was $20.7 trillion as of 2021:Q2. This research note summarizes a study by Nareit primarily using data from CoStar that estimates the total dollar value of commercial real estate was $20.7 trillion as of 2021:Q2.

What is the average profit on commercial real estate?

Commercial properties typically have an annual return off the purchase price between 6% and 12%, depending on the area, current economy, and external factors (such as a pandemic). That's a much higher range than ordinarily exists for single family home properties (1% to 4% at best). Professional relationships.

How do you calculate price per square foot for commercial?

It can be calculated by dividing the price of the building by the building's square feet. For example, if a 2500 square foot building is selling for $250,000, then the PPSF is $100. Price per square foot can vary depending on where you would like to purchase or lease commercial real estate.

How much is commercial real estate in San Francisco per square foot?

Average asking rents: $74.15/SF per year, full-service gross. Vacancy rate: 32.1% Absorption: -4,574,754 SF in 2022.

What is the most expensive commercial real estate in the US?

Research identifies most expensive U.S. commercial real estate...

- New York, N.Y., $48.27 per square foot (psf)

- Washington, D.C., $42.63 psf.

- San Mateo, Calif., $41.61 psf.

- Santa Monica, Calif., $36.67 psf.

- San Francisco, Calif., $34.86 psf.

- Boston, Mass., $31.15 psf.

- San Jose, Calif., $30.35 psf.

What percentage of people look online for a home?

While the expertise of REALTORS® remains vital to the home buying and selling process, the internet serves as a tool for all generations of home buyers; 97% of all homebuyers used the internet in their home search.

How important is a website for a realtor?

Having a real estate agent website is vital because it serves as the core of your online presence. An agent's website can be the center of marketing and have all other social pages and local directories link to the website. It's also a great place to add client testimonials and resources for buyers and sellers.

What is the most visited real estate site?

Most Visited Real Estate Websites

| Rank | Website | Rank Change |

|---|---|---|

| 1 | zillow.com | = |

| 2 | realtor.com | = |

| 3 | redfin.com | = |

| 4 | rightmove.co.uk | = |

Can you see how many people have viewed a listing on realtor com?

The listing traffic report shows the number of views that your property got in a period of time, daily/weekly/monthly or custom time in Zillow+Trulia/HAR and Realtor.com websites.

How long do most real estate agents last?

Most real estate agents fail in their first year, according to research. Three common mistakes that agents make is inadequate prospecting, failing to market properties in ways that lead to fast sales, and not following up with clients.

How late can you pay rent in Michigan?

Rent and Late fees

In Michigan, there are no statutes regarding late fee maximums, grace periods, nor notices involving rent increase. Rent is due as stated in the lease. Landlords are allowed to accept rent payments of any form.

How late can you pay rent in Florida?

It is not necessary that this notice be delivered by a Sheriff. Usually the landlord will post the notice on your door. If mailed, however, the landlord must add five (5) days for mailing. If you pay the full amount of rent due within the three day time period, your landlord cannot evict you for nonpayment of rent.

What does rent due mean?

Doing something like rent is due means doing it very passionately, because you need money for the rent - https://www.urbandictionary.com/define.php?

Is rent due on the 1st or 31st Ontario?

Rent is due on the actual day listed in the lease — e.g. September 1st. Payment received even a day later, is considered late — e.g. September 2nd.

What is the longest you can be late on rent?

However, even in states where landlords decide their grace period lengths, it's typically no more than a few days. The most common amount of time is three to five days before fees are incurred. Landlords are able to charge tenants late fees as soon as the grace period ends.

Is it a good idea to invest in real estate?

Real estate investments can serve as a hedge against inflation. Real estate ownership is generally considered a hedge against inflation, as home values and rents typically increase with inflation. There can be tax advantages to property ownership.

What is the 5 rule in real estate investing?

The 5 rule in real estate investing suggests that the purchase price of a property should not exceed 5 times its potential annual rental income.

Is real estate a better investment than stocks?

The truth is that both tactics have their merits and drawbacks. Stocks, for example, offer greater liquidity and higher profit margins over a shorter time horizon. Purchasing real estate may be more suitable if you want consistent returns and tax advantages.

What is the 1 rule in real estate investing?

For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price. If you want to buy an investment property, the 1% rule can be a helpful tool for finding the right property to achieve your investment goals.

Who should not invest in real estate?

Read on to learn more about who should not invest in real estate.

- People who are low on capital. It is one of the most capital-intensive investments out there.

- People who seek high returns on low expenses.

- People who are not ready for hard work.

- People who don't like to play the long game.

- People who want excitement.

How do you sell a house and buy another at the same time?

Bridge loan: A bridge loan is a temporary financial arrangement that lets you buy a new home without selling your old one. It's important to know these loans use your current home as collateral, and they are only meant to last a short amount of time (six months to one year).

What happens to your mortgage when you sell your house and don t buy another?

The biggest point to remember when considering what happens to your mortgage when you sell your house is that the debt doesn't disappear when you sell the home. You'll still owe the money, even if you're planning on using the proceeds from the sale of your home to pay off the mortgage.

How does selling a house you have a mortgage on work?

What happens to equity when you sell your house? When you sell your home, the buyer's funds pay your mortgage lender and cover transaction costs. The remaining amount becomes your profit. That money can be used for anything, but many buyers use it as a down payment for their new home.

How to buy second house without selling first?

You can buy another house while still owning one by coming up with cash for a down payment on a new home and taking out a second mortgage to finance it. If you don't have cash on hand for a down payment, you might be able to cash-out refinance, take out a loan or work with a buy-before-you-sell company.

What is a home bridge loan?

A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one. Sometimes you want to buy before you sell, meaning you don't have the profit from the sale to apply to your new home's down payment.

What is the step up basis for foreign property?

Step-up Basis at Expatriation for Foreign Assets

Since he received it when she passed, the value is a stepped-up basis. For example, if David's sweet grandma purchased the property for $100,000, and now it is worth $800,000, when David receives the property through inheritance, his basis will be $800,000.

How do I report a sale of property in a foreign country?

When you sell a property overseas, you're responsible for capital gains taxes — or taxes you owe when you sell a property for more than you paid for it. You must report any capital gains on Form 1040, Schedule D in USD.

Do I have to pay tax on property sold overseas?

You have to report the sale of foreign property to the Internal Revenue Service (IRS) when you sell it, just as you would any other sale of property in the U.S.

Does foreign real estate need to be reported to IRS?

Yes, you must report foreign properties on your U.S. tax return just like you would report any owned U.S. property. To do that, you first need to know what type of ownership you have because it affects what tax forms you must file.

Does step-up in basis apply to all assets?

The step-up in basis provision applies to financial assets like stocks, bonds, and mutual funds as well as real estate and other tangible property. Of course, if the price of an asset has declined from that paid by the owner's date of death, the asset's cost basis would step down instead of stepping up for heirs.