Why Do Real Estate Investors Like Texas? Texas is an attractive market for foreign real estate investors due to its diverse economy and low taxes. The state boasts a large population and a rapidly growing job market, making it a prime choice for real estate investment opportunities with cash flow from rental income.

Do you need a license to invest in real estate in Texas?

It is not necessary to have RE license to invest in real estate,but there may be benefits in each scenario. Weigh the costs vs the benefits. For buy and hold, you can work with a real estate agent and the seller typically pays the 6% realtor commission fees (3% for seller's agent, 3% for buyer's agent).

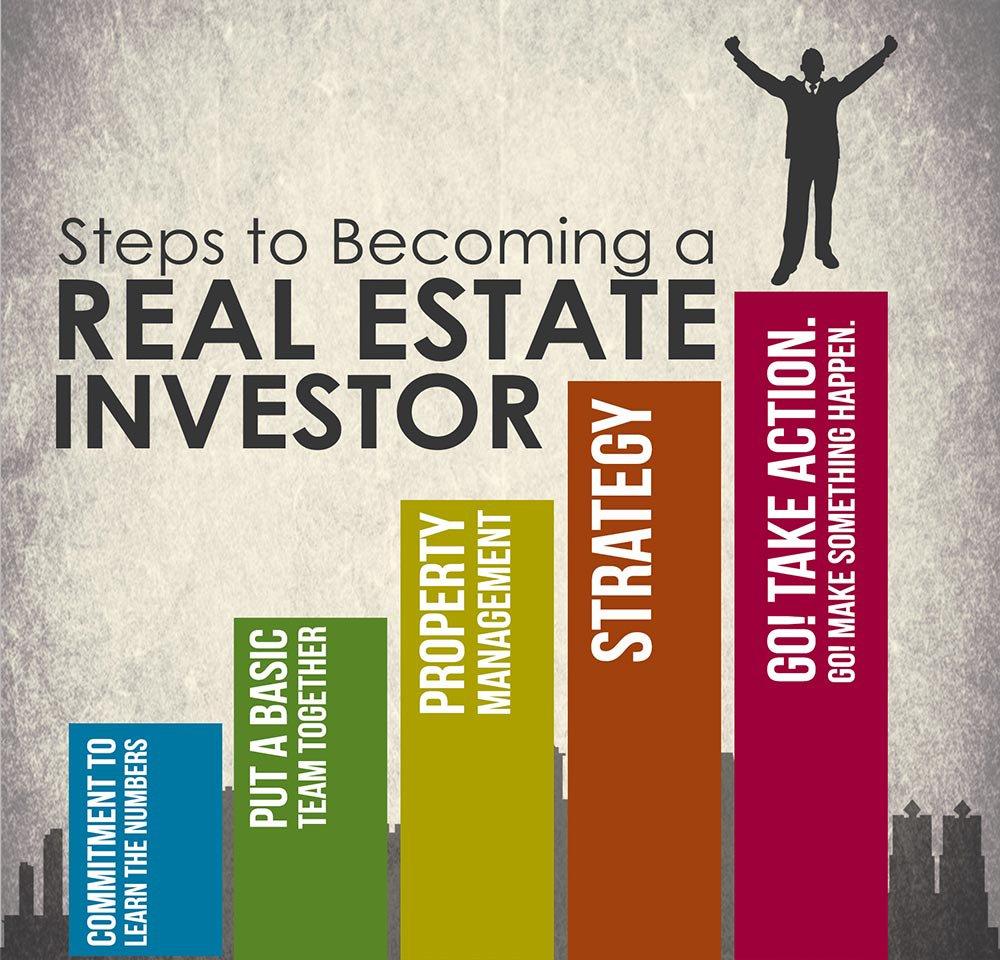

How do I become a small real estate investor?

10 Best Ways to Invest in Real Estate With Little or No Money

- Purchase Money Mortgage/Seller Financing.

- Investing In Real Estate Through Lease Option.

- Hard Money Lenders.

- Microloans.

- Forming Partnerships to Invest in Real Estate With Little Money.

- Home Equity Loans.

- Trade Houses.

- Special US Govt.

Can I buy house in Texas for investment?

The Lone Star State is an excellent place for buying an investment property. With no state income tax and major cities such as Dallas, Houston, and San Antonio, real estate investors and homebuyers are in for treat when buying a home in Texas.

How much does a real estate investor make in Texas?

The average real estate investor salary in Texas is $93,500 per year or $44.95 per hour. Entry level positions start at $46,500 per year while most experienced workers make up to $125,000 per year.

What are tenants rights in New York?

In New York City, tenants have many rights relating to the safety and quality of their housing. Tenants should expect to live in safe, well-maintained buildings that are free from vermin, leaks, and hazardous conditions. Laws protect tenants from harassment and discrimination.

PowerPoint is banned if I become President

— Texas Real Estate Investor (@realest49919420) October 18, 2022

What rights do landlords have in NYS?

Likewise, landlords may have the right to deduct damages from the security deposit, enter the rental property in emergency situations, and more. Some cities, such as New York City, have their own specific laws and regulations, so it's important that landlords check their local regulations.

What are the apartment occupancy laws in New York State?

The roommate law has several restrictions. New York law does not permit the number of occupants to exceed the number of tenants, and each person residing in the apartment must have a livable area of at least 80 square feet. The square footage count does not include bathrooms, closets or hallways.

How many houses do most realtors sell a year?

So How Many Houses Does a Realtor Really Sell Each Year? Only a small number of realtors sell more than a hundred homes a year, and the majority sell anywhere between 2-10 homes a year. Further, first-year or those just starting as realtors usually sell the least number of homes.

How many clients do realtors have at a time?

A: Realtors typically represent any number of clients simultaneously. Each client's needs can vary, so rather than focusing on an arbitrary number of clients, the issue is rather how to effectively manage multiple clients.

Can you claim house expenses on your taxes?

To deduct expenses of owning a home, you must file Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Income Tax Return for Seniors, and itemize your deductions on Schedule A (Form 1040). If you itemize, you can't take the standard deduction.

What can a homeowner write off on taxes?

8 Tax Breaks For Homeowners

- Mortgage Interest. If you have a mortgage on your home, you can take advantage of the mortgage interest deduction.

- Home Equity Loan Interest.

- Discount Points.

- Property Taxes.

- Necessary Home Improvements.

- Home Office Expenses.

- Mortgage Insurance.

- Capital Gains.

What happens if my expenses are more than my rental income?

If your rental expenses exceed rental income your loss may be limited. The amount of loss you can deduct may be limited by the passive activity loss rules and the at-risk rules. See Form 8582, Passive Activity Loss Limitations, and Form 6198, At-Risk Limitations, to determine if your loss is limited.

What deductions can I claim without receipts?

10 Deductions You Can Claim Without Receipts

- Home Office Expenses. This is usually the most common expense deducted without receipts.

- Cell Phone Expenses.

- Vehicle Expenses.

- Travel or Business Trips.

- Self-Employment Taxes.

- Self-Employment Retirement Plan Contributions.

- Self-Employed Health Insurance Premiums.

- Educator expenses.

What are the cons of being a realtor?

Having long hours can be a negative to being a real estate agent for several reasons. First, it can lead to burnout. Second, it can make it difficult to maintain a work/life balance. Third, it can cause you to miss important events in your personal life.

What is the life of a real estate agent?

A typical day might involve spending time at the office, meeting with clients, staging and showing homes, and scheduling appraisals and inspections. Other tasks include generating leads, researching, marketing, and accompanying clients to property closings.

Why do you need a real estate license in America?

A real estate license allows realtors to legally sell, broker, or rent real estate to prospective tenants and buyers on behalf of a real estate brokerage. A real estate license is required to do this work, and the requirements to obtain one vary from state to state.

Why do you want to be a real estate agent essay?

I want to become a real estate agent because I have a passion for helping people and pointing them in the right direction. I want to help them with everything from inspections, property analysis, repairs, moving, cleaning, packing, everything involved in a sales transaction, I want to help people with it.

What are 3 advantages of being a real estate agent?

So, here's a list of the pros of becoming a real estate agent.

- #1. Income Potential.

- #2. Flexible Schedule.

- #3. You are a Business Owner.

- #4. It's a People Business.

- #5. You Help People Achieve Their Dreams.

- #1. Success Requires Patience.

- #2. You Experience Rejection.

- #3. This Job is Competitive.

Are property taxes paid in advance or arrears in Michigan?

You are paying ahead when you pay the treasurer on July 1st until the end of June next year.  So remember you are paying your taxes ahead. The time it runs from.  Many people believe that Michigan property taxes run for six months.

Are property taxes paid in advance or arrears in Georgia?

In Georgia, property taxes are paid in arrears. This means that bills are sent out between October and December (depending on the county), and the tax bill is assessed for the year just completed. For this reason, home sales will generally include a prorated property tax credited to the buyer.

Are taxes collected from owned property or real estate?

Real estate taxes are the same as real property taxes. They are levied on most properties in America and paid to state and local governments. The funds generated from real estate taxes (or real property taxes) are typically used to help pay for local and state services.

How are property taxes paid at closing in Florida?

Real property taxes are paid in arrears (meaning at the end of the year) in Florida and are not assessed until November of the year for which they are due. Therefore, when a closing takes place between January and the first week in November, the amount of the current years property taxes are unknown.

Are property taxes prorated at closing in Michigan?

A tax proration is a matter of negotiation between buyer and seller and there is not a uniform tax proration in the State of Michigan. In many counties, including Jackson, the local Board of Realtors will have a method of tax proration printed in the purchase agreement.

How much is a real estate license in NY?

How Much Does It Cost to Get a Real Estate License in New York? Becoming a real estate professional in New York isn't prohibitively expensive. When all is said and done, an aspiring agent will spend around $500 to $1,000 to get their license, while a broker can expect to pay around $950 to $1,450.

How much does it cost to get your real estate license in NC?

Sample North Carolina Real Estate License Costs

Apr 28, 2023

| 75-hour Prelicensing Course | $715 (through The CE Shop) |

|---|---|

| Exam Registration | $56 |

| Background Check | $15 |

| License Application | $100 |

| Total Costs: | $886 |

How long does it take to get a real estate license in CA?

3-6 months

TL;DR: Getting a real estate license in California typically takes 3-6 months. The process includes completing a pre-licensing course, passing the state exam, and completing background checks. The timeline may vary depending on individual circumstances.

How long is real estate school in Illinois?

75-hour

Candidates need to complete a 75-hour training course before they can qualify to take the state licensing exam. This training course introduces students to key subjects in federal and state property laws, real estate appraisals, practices and principles of real estate sales and financing.

How hard is NY real estate exam?

The passing rate for the New York Real Estate Salesperson Exam is 70%. This test is purposefully difficult, but not impossible. Be sure to pay attention during your pre-license course and take studying seriously. If you put the proper effort forth, we know that you can pass on your first attempt!

What is Chapter 1101 of the Texas Occupations Code?

OCCUPATIONS CODE CHAPTER 1101. REAL ESTATE BROKERS AND SALES AGENTS.

Is the legislation that governs the licensing of Texas real estate license holders?

Our license holders are governed by the Texas Real Estate License Act, the Inspector Act, and the Timeshare Act. These Acts establish the makeup of the Commission and its advisory committees and outline procedures by which a person can become real estate license holders in Texas.

Who governs real estate licenses in Florida?

The Florida Real Estate Commission

The Florida Real Estate Commission (FREC) regulates education requirements for real estate agents in Florida. The Florida Department of Business and Professional Regulation (DBPR) oversees the FREC and takes care of the licensing and registration of real estate agents.

What is Section 14 of the Texas real estate licensing Act?

Section 14(a) of the Act provides that it is unlawful for a broker to compensate a person for performing an act as a real estate broker if the person is not a licensed broker or licensed salesman in this state.

What is Texas Occupations Code 304.0015 Article III?

(n) Pursuant to the Nurse Licensure Compact, Texas Occupations Code §304.0015, Article III, (c)(7), an individual will not be eligible to hold a multistate licensure privilege if the individual has been convicted or found guilty, or has entered into an agreed disposition, of a felony offense under applicable state or

What state has the highest real estate commission?

Missouri. The average real estate commission rate for agents in Missouri is 6.07%, and the state has the highest average realtor fees in the country.

What percentage do most realtors charge?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

What is the most common commission split in real estate?

50/50

Typical commission splits include 50/50, where the broker and real estate agent receive equal sums of money from a commission split, but they can also use the 60/40 or 70/30 split options. In these situations, the real estate agents get a larger sum of the money than the brokers.

What is real estate commission in USA?

Real estate commissions are always negotiable—otherwise, agents would be in violation of state and federal antitrust laws—so they vary. Though 6% has traditionally been regarded as the standard fee, commissions typically fall between 4% and 5% nowadays.

What state pays real estate agents the least?

10 States Where Real Estate Agents Earn The Least Money

| Rank | State | 2017 Mean Annual Wage |

|---|---|---|

| 1 | Ohio | $41,650 |

| 2 | Arkansas | $41,660 |

| 3 | Montana | $42,010 |

| 4 | Indiana | $43,230 |

How do you calculate capital gains tax on the sale of a house?

Capital gains tax is the tax owed on the profit (aka, the capital gain) you make on an investment or asset when you sell it. It is calculated by subtracting the asset's original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price.

How much capital gains tax on $90,000?

A capital gains tax example

Your taxable income is $90,000 in the same year you sell your home, so your tax rate is 15%. You'll pay an estimated $7,500 in capital gains tax.

What is the capital gain 15% bracket?

Long-term capital gains tax rates for the 2022 tax year

| FILING STATUS | 0% RATE | 15% RATE |

|---|---|---|

| Source: Internal Revenue Service | ||

| Single | Up to $41,675 | $41,676 – $459,750 |

| Married filing jointly | Up to $83,350 | $83,351 – $517,200 |

| Married filing separately | Up to $41,675 | $41,676 – $258,600 |

What is the capital gains on $100 000?

In this example, you see a capital gain of $100,000 on your home sale. If your income and asset class put you in the 20% capital gains tax bracket, you pay 20% of your profit. That's 20% of $100,000, or $20,000.

What is the capital gains tax on $200 000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

Do you owe federal taxes when you sell a house?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

How long do I have to buy another property to avoid capital gains?

Within 180 days

How Long Do I Have to Buy Another House to Avoid Capital Gains? You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

What is the $250000 $500000 home sale exclusion?

The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9.

How do you calculate capital gains tax on the sale of a home?

Capital gain calculation in four steps

- Determine your basis.

- Determine your realized amount.

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference.

- Review the descriptions in the section below to know which tax rate may apply to your capital gains.