Taxes are the property assessments collected by your local government. Homeowners insurance is required financial protection you must maintain in case your property is damaged by fire, wind, theft or other hazards. Mortgage insurance could be required if you need to make a smaller down payment.

What is the property tax rate in South Dakota?

South Dakota Property Taxes

Tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. Across the state, the average effective property tax rate is 1.08%.

What is the average property tax in Alabama?

Alabama has some of the lowest property taxes in the country. While property taxes in the state serve as an important source of revenue for local governments, public services and education, the average Alabama homeowner pays just $674 per year in property taxes. That's about a quarter of the national average of $2,795.

How much is property tax in Georgia?

Overview of Georgia Taxes

In general, property taxes in Georgia are relatively low. The median real estate tax payment in Georgia is $2,027 per year, about $800 less than the national average. The average effective property tax rate in Georgia is 0.81%.

How much should you spend on mortgage taxes insurance?

The 28% rule

The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g., principal, interest, taxes and insurance).

How hard is it to get a real estate license in Kansas?

The amount of time to get your Kansas real estate salesperson license varies due to the number of steps involved. Most complete the requirements within a few months. These include completing education, submitting an application for the license, passing the background check, and taking the licensing exam.

Do you want to become a licensed real estate agent? Now is the time to stop worrying and start working. Get started with your certification by taking our

— 360training (@360training) February 24, 2020

Real Estate Pre-License. ?https://t.co/Bik8vqUQEl

.

.#RealEstate #Agent #Realtor #Sale #ForSale #Home #PreLicense #Career pic.twitter.com/wfdNLscj0l

How much is a realtor license in Texas?

Between $1,000 and $1,500

The cost to get a real estate license in Texas is between $1,000 and $1,500 and takes 4-6 months on average. This means you can begin your new career and be just as, if not more, financially successful without debt and with many years to spare.

How long does it take to get a real estate license in KS?

Typically, it takes between three to six months to become a real estate agent in Kansas. You can take an accelerated pre-licensure course to help you pursue a license in three months. If you take a standard course, it may take up to six months to complete your pre-licensure course and examination.

Is real estate a profitable business?

In conclusion, there are several types of real estate that can be profitable for investors. The most profitable types of real estate include commercial properties, rental properties, vacation rental properties, development opportunities, and REITs.

Why do millionaires invest in real estate?

Federal tax benefits

Because of the many tax benefits, real estate investors often end up paying less taxes overall even as they are bringing in more income. This is why many millionaires invest in real estate. Not only does it make you money, but it allows you to keep a lot more of the money you make.

How do I prepare for a broker interview?

Showing up to the interview and with a warm, friendly personality will go further than you might think. You don't need the experience to become a real estate agent, so showing the brokerage that you're able to abide by the brokerage style, culture, and values will help you pass the interview.

How do I prepare for a new real estate agent interview?

- Know the Differences Between a Real Estate Agent & Salaried Worker.

- Make a Real Estate Business Plan.

- Create Your Real Estate Resume.

- Research the Real Estate Brokerage.

- Determine the Questions You Plan to Ask the Brokerage.

- Prepare for Potential Real Estate Interview Questions to Answer.

- Dress for Success.

What questions to ask the interviewer in a real estate interview?

Interview Questions

- I am interested in Real Estate Sales (or Property Management).

- Is the company independent, corporate owned or a franchise?

- What is your market share?

- How many offices do you have?

- How many total agents?

- What kind of management & systems support do you have?

How does interview broker work?

Benefits. Virtual Staff: Interview Broker provides applicants the ability to self-schedule their interviews, thereby relieving recruitment managers of the burden of direct email and telephone communications with innumerable applicants.

What can you write off when you sell land?

Selling land, what expenses be deducted to offset capital gains

- Real estate commissions.

- Transfer tax.

- Legal fees.

- Advertising fees.

- Home inspection reports.

- Title insurance.

- Geological surveys.

- Loan charges (points) or other fees paid on the buyer's behalf.

Can you deduct a mortgage from capital gains?

Mortgage interest deduction

No matter how long your house has been on the market, if you have a mortgage on the house you're selling — and it's your main house — there's a good chance you can deduct your mortgage interest from your income taxes.

Can I deduct mortgage interest on a piece of land?

Can I take the home mortgage interest deduction? No, you can't deduct interest on land that you keep and intend to build a home on. However, some interest may be deductible once construction begins.

Can closing costs be deducted from capital gains?

There is one tax benefit to these costs, though. You can add these closing fees to the cost basis of your home when you sell it. This lowers the amount of profit that you make. This can help reduce any capital gains tax you might have to pay on your home.

Does selling land count as revenue?

The gain on sale of land is usually reported as a separate item in the income statement under other income or gains. It's considered an unusual or infrequent item because selling land isn't part of the company's usual day-to-day business operations.

Can you write off a loss on a land sale?

When you sell an investment property at a loss, you'll need to report it on Schedule D of your Form 1040 to claim a deduction. Remember that deductions reduce your taxable income which could mean paying less in taxes or getting back a larger refund.

How do you claim capital loss on land?

Is the sale of vacant land for a loss considered a deduction or is the loss taken directly off my income? The loss is taken directly off your income; but not exactly. The loss is a capital loss reported on form 8949. It then carries to schedule D where it is used to reduce any capital gains that you have.

How much can you sell at a loss for a write off?

$3,000

Tax Loss Carryovers

If your net losses in your taxable investment accounts exceed your net gains for the year, you will have no reportable income from your security sales. You may then write off up to $3,000 worth of net losses against other forms of income such as wages or taxable dividends and interest for the year.

Why are capital losses limited to $3000?

The $3,000 loss limit is the amount that can go against ordinary income. Above $3,000 is where things can get a little complicated. The $3,000 loss limit rule can be found in IRC Section 1211(b). For investors who have more than $3,000 in capital losses, the remaining amount can't be used toward the current tax year.

How much is property tax on a $300000 house in California?

Let's talk in numbers: the average effective property tax rate in California is 0.77%. The national average sits at 1.08%. Of course, the average tax rate in California varies by county. If a property has an assessed home value of $300,000, the annual property tax for it would be $3,440 based on the national average.

How are taxes calculated?

How Income Taxes Are Calculated

- First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k).

- Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

Who pays taxes based on their property?

Property owners pay property tax calculated by the local government where the property is located. Property tax is based on the value of the property, which can be real estate or—in many jurisdictions—also tangible personal property. Improvements in water and sewer use the assessed taxes.

Are property taxes based on purchase price or assessed value in Florida?

The taxable value is the assessed value minus exemptions and is the value the tax collector uses to calculate the taxes due. The homestead exemption can result in exempting up to $50,000 of your home's assessed value from tax liability.

Is California property tax based on purchase price?

California property taxes are based on the purchase price of the property. So when you buy a home, the assessed value is equal to the purchase price. From there, the assessed value increases every year according to the rate of inflation, which is the change in the California Consumer Price Index.

What time of year is best to rent a property?

Summer

Summer Months Are Best for Rental Selection

The busiest rental and moving period tends to be between the months of May and September. 1 The reason for this is fairly straightforward: A number of life changes tend to occur in these months. Many high school graduates are leaving home for college or jobs.

How do you turn a house into a rental in Sims 4?

In the Lot Type dropdown menu, they should scroll down until they find Rental. Choosing this option will convert the lot into a rental property, denoted by a star icon over the building on the map.

What are three costs of renting?

What are three costs of renting? Utilities, monthly rent, and renter's insurance.

How to rent out a house in Florida?

How to Rent Your House in Florida

- Figure Out What Renters Want.

- Follow State and Local Laws and Restrictions.

- Make Sure You Have a Well-Drafted Lease.

- Get Your Property Rent Ready.

- Don't Forget that Renting Is a Business.

- Want to Rent Your House in Florida?

What are the worst months to rent?

Worst for Availability: October to April

Because most people move during the summer months and sign year-long leases, many apartments are full during the off-season months between October to April.

How do you tell a broker you chose someone else?

Do for your agent what you expect in return, and be direct and kind. Ask them if there's a good time for you both to talk, so they can be mentally prepared for the rejection. During your scheduled call, tell your real estate agent you've chosen to work with someone else and thank them for their time.

Does it matter who your broker is?

Your choice of broker should reflect your investment style—whether you lean toward active trading or a more passive, buy-and-hold approach. Always make sure your broker is fully licensed by state regulatory authorities and FINRA and registered (individually or via their firm) with the SEC.

What not to tell a broker?

Contents

- You Won't Settle for a Lower Price.

- Only Bring Me Serious Offers.

- Don't Show My Home Unless I'm Available.

- You Have All the Time in the World to Sell.

- You are Selling the Home Because of a Divorce.

- You Have to Sell Because of Financial Problems.

- You Are Moving Because of a Serious Illness.

What not to tell a real estate agent?

Here are the 7 most important things to not tell your realtor when selling.

- What you think your home is worth.

- Your need to sell quickly.

- Plans for upgrades before selling.

- Non-mandatory legal information about your property.

- You're okay with an inflated history of dual agency.

- Your lowest acceptable selling price.

What happens when you switch brokers?

If you have a brokerage account, this isn't too difficult. You simply sell all of your securities and then move the cash to the new brokerage. You may not even need help, since you can withdraw the cash. Then you can invest the money how you choose at your new broker.

How much should loan origination fees be?

0.5% to 1%

An origination fee is typically 0.5% to 1% of the loan amount and is charged by a lender as compensation for processing a loan application. Origination fees are sometimes negotiable, but reducing them or avoiding them usually means paying a higher interest rate over the life of the loan.

What percentage are loan fees?

Between 0.5% and 1%

How Much Are Loan Origination Fees? Typically, a loan origination fee is charged as a percentage of the loan amount. Furthermore, lender origination fees are usually anywhere between 0.5% and 1% of the loan amount plus any mortgage points associated with your interest rate.

What fees may a lender charge for making a loan?

Loan application fees are just one type of fee lenders can charge on a loan. Other fees may include an origination fee and monthly service fees. 1 In general, fees help a lender cover costs associated with underwriting and processing a loan.

What is the average loan arrangement fee?

Lender arrangement fees range from 0–3 % of the loan amount depending on the perceived lending risk associated with the property transaction. Some lenders may charge a non-refundable commitment fee which is part of the overall arrangement fee, payable upon acceptance of the formal mortgage offer.

Is 2.5% origination fee high?

Mortgage origination fees are generally 0.5% to 1% of the value of the loan. For instance, a $400,000 home loan could have a fee ranging from $2,000 to $4,000 fees. But mortgage origination fees are just one part of the overall closing costs, which can range from 3% to 6% of your loan amount.

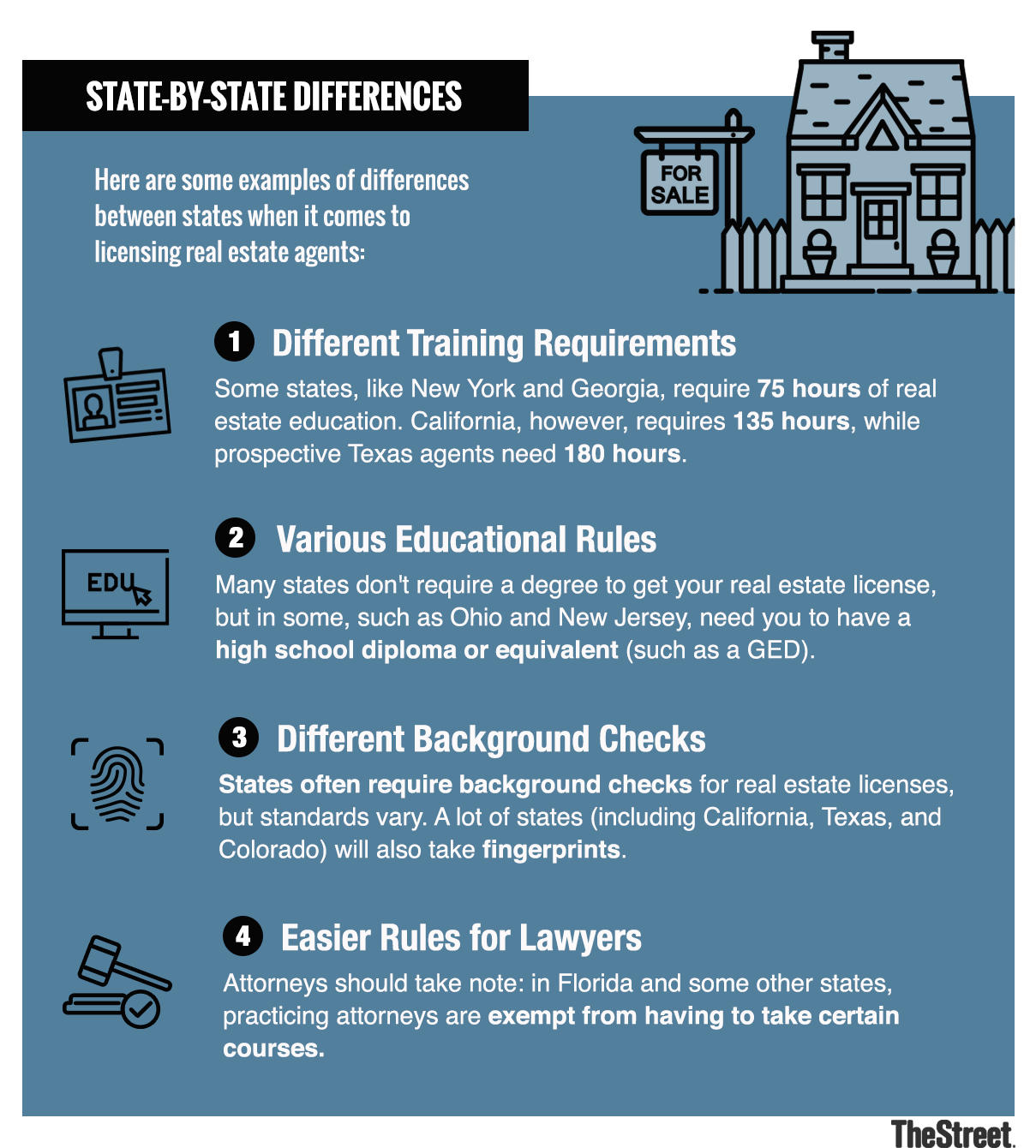

Who must be licensed to practice real estate in Florida?

The general requirements for obtaining a Florida real estate license include: Be at least 18 years of age. High school diploma or equivalent. United States Social Security number.

Can a felon be a realtor in Texas?

All applicants are evaluated on a case-by-case basis and offenses don't automatically disqualify you. TREC Rules 545.1(b) and 545.1(c) also considers factors like… So yes, you might be able to get a real estate license even if you have a criminal record.

What type of real estate license holder must be sponsored by another type of license holder in Texas?

Texas real estate brokers do not have to be sponsored to practice their profession; if they have a broker's license, they can hang a shingle and provide brokerage services all by themselves, without supervision by another license holder. On the other hand, sales agents cannot provide brokerage services on their own.

How does a person get to serve on the Oklahoma real estate Commission?

OREC is the sole governing body of all things real estate in Oklahoma. Seven members make up the body and each has been appointed by the governor of the state to serve for four years.

Who is exempt from real estate licensure in Florida?

Exemptions from education requirements:

Lawyers: Any active member in good standing with the Florida Bar, who is otherwise qualified under the real estate license law, is exempt from the Florida Real Estate Commission 's prescribed prerequisite educational course for licensure as a real estate sales associate.