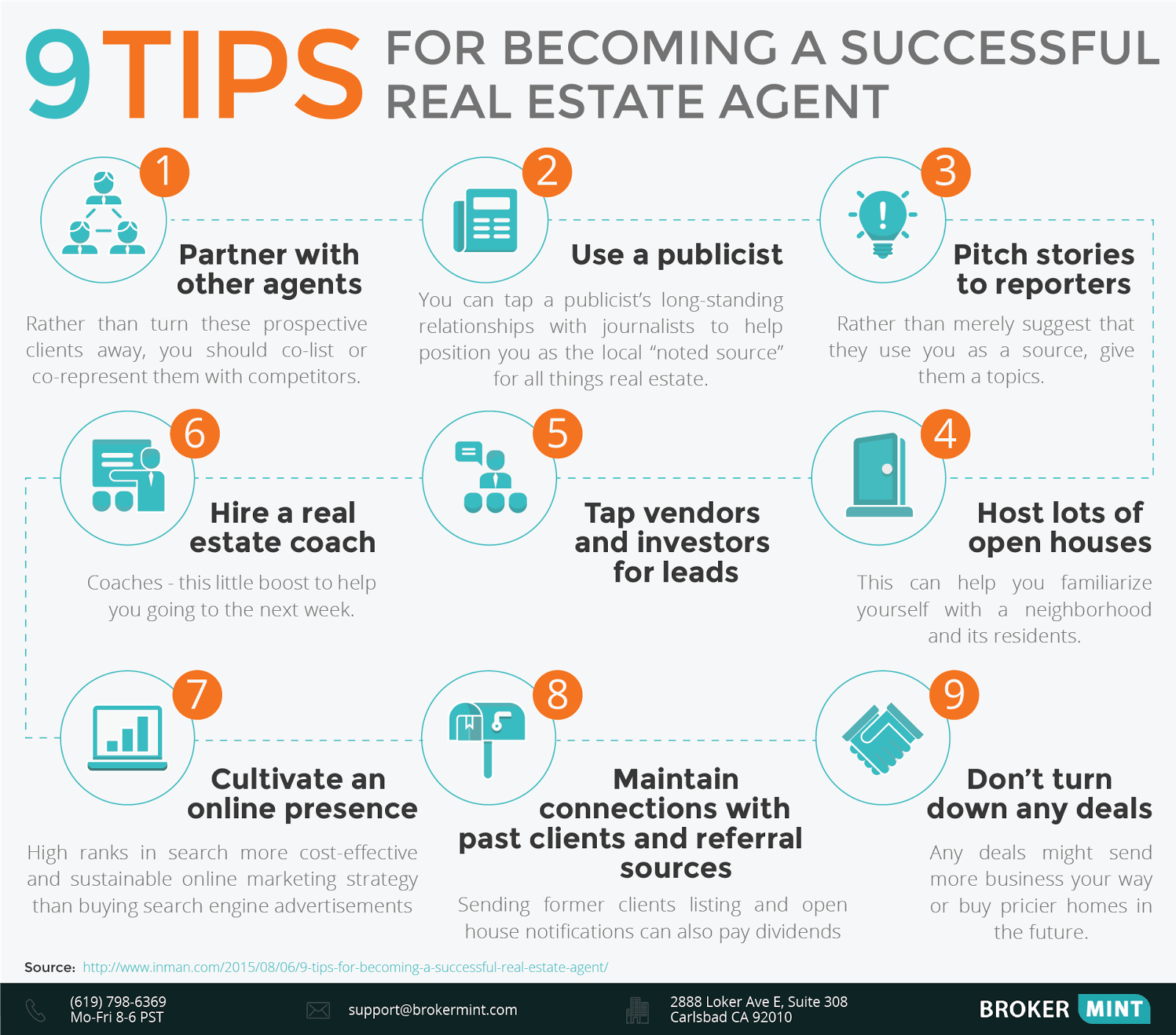

For greater success and effectiveness as a real estate agent, you can:

- Improve communication skills.

- Partner with other local agents.

- Find a publicist.

- Host open-house events.

- Pitch a realty story to a news outlet.

- Use email marketing.

- Keep in contact with past clients.

- Create social media profiles.

Is it hard to be successful in real estate?

Key Takeaways. Working as a real estate agent or broker can be fulfilling and financially rewarding, but it's not easy. A career in real estate requires drumming up business, promoting yourself, tracking leads, handling complex paperwork, providing customer service, and much, much more.

What makes people successful in real estate?

Paying close attention to the details is imperative for your real estate career. A complete real estate agent is attentive to the unique needs of their individual clients. If you are organized, follow up with leads, communicate well, and pay attention to the needs of your clients, you will close more deals.

How likely are you to be successful in real estate?

Being a successful real estate agent is easier said than done. After all, there's a reason 87% of real estate agents fail. However, knowing the mistakes these realtors make, such as failing to follow up with clients or not having adequate funding, can help you prepare and grow a successful real estate business.

Is 100k enough to start in real estate?

In affordable housing markets, $100k would be enough to cover a 20% down payment plus closing costs and holding costs until your new renter moves in. In a really affordable market, you might even have enough cash on hand to cover the necessary renovation costs as well.

How do I avoid paying taxes after selling my house?

If you owned and lived in the home for a total of two of the five years before the sale, then up to $250,000 of profit is tax-free (or up to $500,000 if you are married and file a joint return). If your profit exceeds the $250,000 or $500,000 limit, the excess is typically reported as a capital gain on Schedule D.

One of the most successful real estate investors I know has a strict rule:

— StripMallGuy (@realEstateTrent) June 16, 2023

The acquisitions team that found the deal also needs to implement the value-add strategy and see it through.

Put your money where your mouth is.

Such an important concept.

How do I reinvest capital gains to avoid taxes?

To avoid paying capital gains taxes (and any depreciation recapture), you can reinvest in a "like-kind" asset with a sales price of at least $500,000. The IRS allows virtually any commercial real estate property to qualify as 'like-kind” as long as you hold it for investment purposes.

How much capital gains tax on $200,000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

Can you start real estate investing with little money?

There are several ways to get started investing in real estate without having to be wealthy to begin with. This article has shown you how to invest in real estate with little money through renting out a room, crowdfunding, investing in REITs and buying a multi-unit primary residence.

How can I invest if I don’t have a lot of money?

Exchange-traded funds or index funds track the performance of a stock market or asset class. We explain more on ETFs here. ETFs tend to be much cheaper than actively managed funds (where a stock picker selects investments on your behalf). They are a simple and cost-effective way to build a portfolio with little money.

What is the average rate of return on real estate investments?

Average ROI in the U.S. Real Estate Market

Investment strategies affect the return on investment, and different types of properties attract investors employing different strategies. Residential properties generate an average annual return of 10.6%, while commercial properties average 9.5% and REITs 11.8%.

What is the 50% rule in real estate investing?

The 50% rule or 50 rule in real estate says that half of the gross income generated by a rental property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits.

How much will my house appreciate in 10 years?

In America, home appreciation rates range from 2-6% when looking at the real estate market over a period of 10 years or longer.

What is the 2% rule in real estate?

The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

How many times can you fail the real estate exam in New York?

Can I retake the New York real estate examination if I fail? For six months after initially failing the test, candidates can retake it as many times as possible until they pass.

How do I check the status of my real estate license in NY?

How to Check the Status of a New York Real Estate License Online

- Go to the State of New York's elicensing portal.

- Click option 1, 2 or 3 (you probably want option 3)

- Fill out the first and last name field (or license number field)

- Click the blue Search button.

How long does it take to get results from NYS real estate exam?

Within 5-7 days

How long does it take to get NYS real estate exam results? Your State Exam results will be ready within 5-7 days after taking the exam. In New York, exam results are reported as either passed or failed.

How many questions can you get wrong on NYS real estate exam?

The New York Real Estate Salesperson Examination consists of 75 total questions. To pass, you need to answer 70% of the questions correctly.

What is the hardest part of the real estate exam?

The area of the exam that is considered the most challenging varies from person to person, but many people find that the Practice of Real Estate and Disclosures section is the most difficult. This section takes up 25% of the exam and has between 37-38 questions to answer.

How do you politely ask for a house to rent?

The most polite way to ask for payment is to ask before anyone is late! When you send a reminder a few days before the rent is due, you can be very polite. Sending a reminder about an upcoming payment rather than a request for a late payment is always going to be a more welcome message.

How do you tell someone you want to rent their house?

Do:

- State who you are and why you need a rental.

- Mention where you found their ad and how you can afford the rental.

- Offer to provide references (work/volunteer/housing office)

What do you say when calling about renting a house?

Student: Hello (Name of landlord), my name is (Your name). I am calling because I saw a listing for your property at (Address of house/apartment) on (Where you found the listing). I am hoping to move in on (Date you want to move in) and am interested in more information about this property.

How do you convince someone to let you rent?

To show landlords that you care about the same things they care about, find ways to show them that you can truly afford the rent, that you can take care of their place and keep it in good shape, and that you aren't the kind of person to cause problems with other tenants or neighbours.

What do you say to convince a landlord to rent to you?

For example, you can offer to prepay rent, put down a larger security deposit, carry renters' insurance, have the rental professionally cleaned when you move out, or sign a long-term lease. If you have the financial means, you could even offer to pay a higher monthly rent.

How do I get a copy of my property tax bill in NY?

You can always download and print a copy of your Property Tax Bill on this web site. If you lost the original bill, and are making a payment, you can pay electronically or print out and send in the online copy with your tax payment. You do not need to request a duplicate bill.

How do I find my property tax bill online in Indiana?

indy.gov: Pay Your Property Taxes or View Current Tax Bill.

How do I find my personal property tax records in Missouri?

Personal property tax receipts are available online or in person at the Collector of Revenue's Office. An online tax receipt will be accepted at the Missouri Department of Revenue license offices when licensing your vehicle.

How do I find property records in New York?

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

How do I get a local property tax statement?

You can access the service through LPT online by following these steps:

- Enter your PPSN, property ID and property PIN, and click 'Login'

- On the home screen, click the 'View Payment History' button.

What do you do after you pass the NYS real estate exam?

After passing your State Exam and choosing a sponsoring broker, you can officially apply for your New York Real Estate Salesperson License and begin working in real estate! To apply for your license, you'll need to have a sponsoring broker and have their license number to input on your application.

How long is NYS real estate exam valid?

Two years

Exam results are reported as either passed or failed; you will not receive a numerical score. Passed exam results are only valid for a period of two years.

How long does it take to get your real estate license in NY?

5-6 months

Getting Your NY Real Estate License In A Classroom

Weekly classroom courses are designed for students to complete the course in 5-6 months. Complete the course during your daily class time – If you are completing the NY 77-hour pre-licensing course in a classroom setting, some course providers offer daily classes.

What to do after you pass the real estate exam Illinois?

Now that you have passed your Illinois broker real estate exam your next step should be to find a managing broker to work under. Once you have been hired by an Illinois license broker, you can submit your license application.

What is the pass rate for the NY real estate exam?

Exam results are reported as either passed or failed; you will not receive a numerical score. Passed exam results are only valid for a period of two years. Results will not be given over the phone, so please do not call Licensing Services for them. The passing rate for the New York Real Estate Salesperson Exam is 70%.

Who issues real estate license in FL?

The Florida Real Estate Commission (FREC) regulates education requirements for real estate agents in Florida. The Florida Department of Business and Professional Regulation (DBPR) oversees the FREC and takes care of the licensing and registration of real estate agents.

Who issues licensees to sell real estate in Pennsylvania?

The Real Estate Commission

The Real Estate Commission grants and renews licenses to persons who bear a good reputation for honesty, trustworthiness, integrity and competence to transact the business of broker, salesperson, cemetery broker, cemetery salesperson, campground membership salesperson, time-share salesperson, builder-owner salesperson

Who regulates real estate agents in Indiana?

Formed by the Indiana Legislature, the Indiana Real Estate Commission (IREC) has the legal authority to license and regulate real estate licensees. The rules and regulations created by IREC carry the force of law.

How do I get my VA real estate license?

To earn your real estate license in Virginia, you must be at least 18 years of age, complete 60 hours of approved education, pass the Virginia real estate salesperson licensing exam, complete fingerprinting and a background check, and apply for a state license.

What does DBPR do in Florida?

The Department of Business and Professional Regulation (DBPR) is the agency charged with licensing and regulating more than 1.6 million businesses and professionals in the State of Florida, such as alcohol, beverage & tobacco, barbers/cosmetologists, condominiums, spas, hotels and restaurants, real estate agents and

What realtor has lowest fees?

At a Glance: Where to Find the Best Low Commission Realtors in 2023

| Company | Listing Fee | Customer Satisfaction* |

|---|---|---|

| 1. Clever Real Estate | 1.5% (min. $3,000) | ✅ |

| 2. Redfin | 1.5% (min. varies) | ❌ |

| 3. Ideal Agent | 2% (min. $3,000) | ✅ |

| 4. Prevu | 1.5% (min. varies) | ✅ |

Which real estate brokerage has the lowest monthly fees?

Rankings: 10 Best Low Commission Real Estate Agents & Companies

| Low Commission Realtor / Company | Fee | 5-star Reviews* |

|---|---|---|

| 1. Houzeo | $329 Flat Fee | ✅ |

| 2. Redfin | 1.5% Commission | ❌ |

| 3. Ideal Agent | 2% Commission | ✅ |

| 4. HomeLight | 2.5% Commission | ✅ |

What percentage do most real estate brokers charge?

About 5 percent to 6 percent

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

Who is the best 1 percent real estate agent?

The 4 Best 1 Percent Commission Realtors

| Company | Listing Fee | Availability |

|---|---|---|

| 1. Clever Real Estate | 1.5% or $3,000 | Nationwide |

| 2. Redfin | 1–1.5%* | 135 U.S. cities |

| 3. SimpleShowing | 1% | FL, GA, and TX |

| 4. Redefy | 1% or $3,500 | CO, FL, GA, IL, NC, SC, TN, TX, and VA |

Why not to choose Redfin?

Since Redfin often has several different people working on listings, you don't always have one point person to deal with. This can make the process much murkier than it needs to be. You can avoid this potential pitfall by picking an agent with a reputation for being available and engaged.

What is the home sale exclusion for 2023?

Capital gains taxes can apply to the profit made from the sale of homes and residential real estate. The Section 121 exclusion, however, allows many homeowners to exclude up to $500,000 of the gain from their taxable income. Homeowners must meet certain ownership and home use criteria to qualify for the exemption.

What are the two rules of the exclusion on capital gains for homeowners?

The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify. The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

What is the 2 out of 5 years rule?

When selling a primary residence property, capital gains from the sale can be deducted from the seller's owed taxes if the seller has lived in the property themselves for at least 2 of the previous 5 years leading up to the sale. That is the 2-out-of-5-years rule, in short.

What are exceptions to 2 year rule sale of primary residence?

Exceptions to the Two-in-Five-Year Rule

You were separated or divorced during the time you owned your home. Your spouse died during the time you owned your home. The sale of your home involved vacant land.

How to avoid capital gains tax 2023?

For 2023, you may qualify for the 0% long-term capital gains rate with taxable income of $44,625 or less for single filers and $89,250 or less for married couples filing jointly.