1031 Exchange

As long as the new property you buy is of equal or greater value than the one you sell, the program lets you swap them for tax purposes. That means you can defer paying the capital gains tax on the sale of the first property. You can use 1031 exchanges indefinitely.

How can I avoid paying taxes on the sale of my house?

Can Home Sales Be Tax Free?

- The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing).

- The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

Can you reinvest in real estate to avoid taxes?

Can You Avoid Capital Gains Tax by Reinvesting in Real Estate? You can't avoid capital taxes by reinvesting in real estate. You can, however, defer your capital gains taxes by investing in similar real estate property.

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

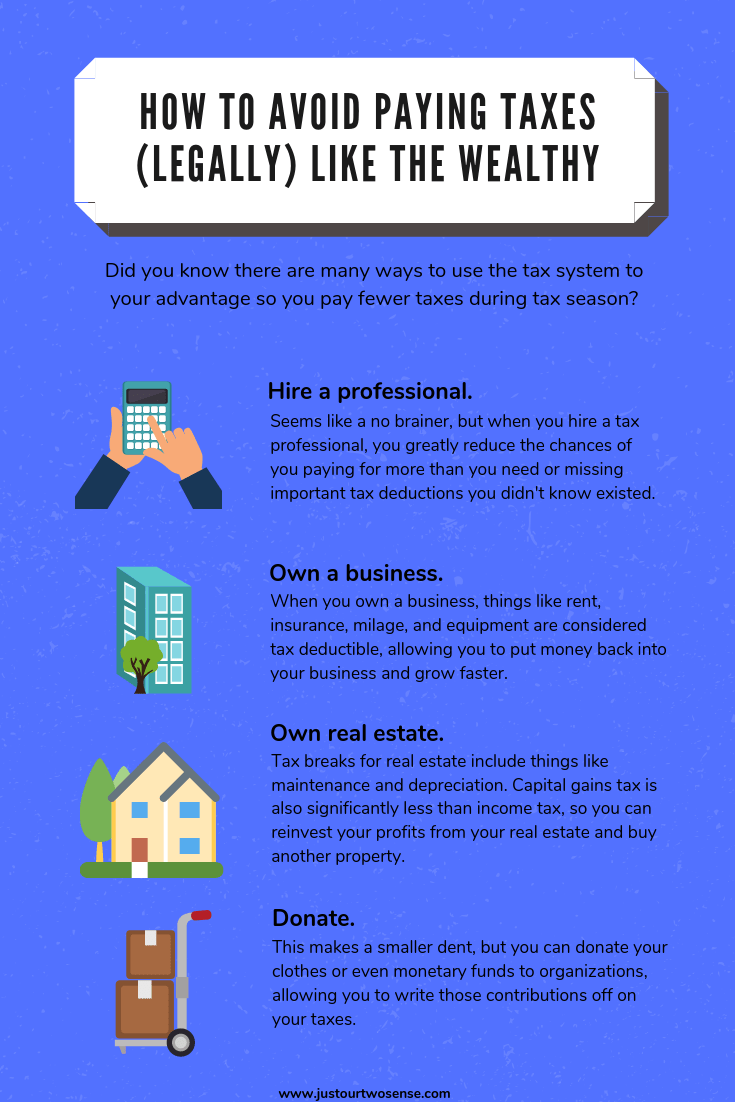

How do millionaires avoid estate taxes?

You can assign a portion of your wealth to charitable trusts of two types: lead trusts and remainder trusts. Your estate, such as investments, hard assets, and even cash, can be allocated to a trust in the form of charitable donations. Most billionaires and ultra-rich individuals use this strategy for tax planning.

How do you record the sale of a second home?

A second home, or a timeshare, used as a vacation home is a personal use capital asset. A gain on the sale is reportable income, but a loss is NOT deductible. If you receive Form 1099-S Proceeds from Real Estate Transactions for the sale of your vacation home, you need to report it in the TaxAct program on Form 1099-B.

Best way to avoid taxes is real estate. Honest truth.

— Joe Cassandra (@JoeCassandra) September 25, 2021

You could also buy a business and write off equipment as well as put money away in a SEP, etc.

Avoiding taxes = owning assets.

Is the sale of a second home considered income?

When you sell a vacation home, rental, fix-and-flip, or any second property that is not your primary residence, you will typically be responsible for paying capital gains taxes on any profits you make, at a rate of up to 20%, depending on your tax bracket. But you may be able to mitigate those taxes.

How is capital gains calculated on sale of second home?

Your gain is usually the difference between what you paid for your home and the sale amount. Use Selling Your Home (IRS Publication 523) to: Determine if you have a gain or loss on the sale of your home.

Is full service the same as NNN?

The full gross service lease differs from a triple net lease (NNN). In the NNN lease structure, the tenant covers all of the property's operating expenses. In contrast, in a full gross service lease the landlord shoulders all of these costs.

What is meant by a full service lease?

A full service lease is a lease in which a tenant pays only a base rate, and the landlord is responsible for paying all other expenses. Full service leases often contain an expense stop, a point above which a tenant becomes responsible for contributing to the operating expenses of the property.

What is the easiest way to start in real estate?

One of the fastest ways to get started in real estate is by wholesaling. This unique strategy involves securing a property under market value and assigning an end buyer to purchase the contract. Wholesalers never own the property and instead make money by adding a fee to the final contract.

Is it hard starting out in real estate?

A real estate education will be challenging, especially if you don't have prior experience. The courses you take in a California real estate school are college-level, so there is a degree of difficulty, particularly for some students. Because everyone is different, everyone will have different experiences.

What do you need to become a real estate agent in North Carolina?

Requirements to Qualify to Become a North Carolina Real Estate Broker

- Be at least 18 years old.

- Be a US citizen, a non-citizen national, or a qualified alien under federal law.

- Complete a state-approved 75-hour broker prelicensing course.

- Pass the North Carolina State Licensing Examination with a score of at least 75%.

How to start real estate with $1,000 dollars?

How to Invest $1,000 in Real Estate

- Fractional Ownership in Properties. Several platforms let you buy fractional shares of individual properties.

- Publicly-Traded REITs.

- Real Estate Crowdfunding: Private REITs.

- Real Estate Crowdfunding: Loans.

- Private Notes.

- Real Estate Wholesaling.

- Invest in Land.

- House Hack.

Where are the best places to work in real estate?

35 Best Workplaces in Real Estate

- Transwestern.

- Zillow Group.

- Venterra Realty.

- BH Management Services.

- Hilltop Residential.

- Sequoia Equities.

- Revantage.

- Fort Capital.

What industries use brokers?

11 Examples of Brokering Services

- Stocks.

- Credit.

- Real Estate.

- Business.

- Forex (foreign exchange)

- Insurance.

- Prime.

- Futures.

Where do most people find their real estate agent?

Where To Find a Real Estate Agent

- Your personal network. About 40% of home sellers find their agent this way, according to the NAR.

- Research. Review each agent's online presence, including social media platforms and consumer ratings.

- Official referral sources.

- Contact a referral agent.

Where do real estate brokers make the most money?

Real estate agents in high cost of living cities such as New York and San Francisco tend to be the highest earners.

What is the highest-paying real estate job?

The highest-paying real estate job is typically the role of a Real Estate Development Manager. Real Estate Development Managers are responsible for overseeing large-scale development projects, managing budgets, negotiating deals, and ensuring successful project completion.

Can you start real estate investing with little money?

There are several ways to get started investing in real estate without having to be wealthy to begin with. This article has shown you how to invest in real estate with little money through renting out a room, crowdfunding, investing in REITs and buying a multi-unit primary residence.

How to do the 1 rule in real estate?

The 1% rule of real estate investing measures the price of the investment property against the gross income it will generate. For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price.

Is $40 K enough to invest in real estate?

Real Estate

While $40,000 can start you toward significant earnings, it likely won't be enough to purchase property outright. However, there are still several ways you can use it to start investing in real estate. For some, $40,000 can be a sizable portion of your down payment.

Who pays settlement fee in Florida?

Buyers

The costs can include fees for the title search, appraisal, and other services. They may also include charges for loan origination, document preparation, and insurance. In Florida, buyers are typically responsible for paying the closing costs. However, in some cases, the seller may agree to pay a portion of the costs.

Are the sellers likely to pay closing costs?

Do Sellers Pay Closing Costs? Sellers pay fewer expenses, but they may actually pay more at closing. Typically, sellers pay real estate commissions to both the buyer's and the seller's agents. That generally amounts to average closing costs of 6% of total purchase price or 3% to each agent.

What is the recording charge the buyer usually pays for in a real estate settlement?

Recording fees: These fees may be paid by you or by the seller, depending upon your agreement of sale with the seller. The buyer usually pays the fees for legally recording the new deed and mortgage.

What is the settlement of a real estate transaction?

The settlement is the final stage in the home transaction. This is when the ownership of the property will be transferred from the seller to the buyer.

Does the seller pay realtor fees in Florida?

Sellers Pay Real Estate Commission Fees

The Realtor commission fees are then split between the listing agent's brokerage and the buyer's agent's brokerage. The respective brokerages then give the agents their portion of the commission. Oftentimes, the realtor fees are split equally between the brokerage and the agent.

What are steps in rent?

They might include:

- Logical or rationalizing techniques.

- Guided imagery and visualization.

- Reframing, or looking at events in a different way.

- Humor and irony.

- Exposure to a feared situation.

- Disputing irrational thoughts.

What do I need to know before renting my first house?

Here are 14 points to keep in mind when considering renting a house or property.

- Research the Neighborhood.

- Find Out the Fair Market Rent.

- Consider Your Budget.

- Know What is Included in the Rent.

- Discuss Paying Money in Advance.

- Obtain Renters Insurance.

- Ask About Pets.

- Inspect the Place Thoroughly.

How to rent my house in Florida?

How to Rent Your House in Florida

- Figure Out What Renters Want.

- Follow State and Local Laws and Restrictions.

- Make Sure You Have a Well-Drafted Lease.

- Get Your Property Rent Ready.

- Don't Forget that Renting Is a Business.

- Want to Rent Your House in Florida?

How much should you have before renting?

Based on the above categories, you should save an amount equal to at least 3-4 months' rent. That will cover paying rent for the first month, security deposits and last month's rent.

What do you say when renting a house?

What to Include in a Rental Cover Letter

- Summarize Your Employment History. A landlord is far more likely to rent to someone with steady employment – they need the tenant to be able to pay rent every month.

- Share Your Hobbies.

- Discuss Your Thoughts on What Makes a Good Neighbor.

- Explain Why You Want To Live in This House.

How do you choose a market to invest in real estate?

Eight Factors to Consider When Selecting the Right Real Estate Investment Market

- Job centers/economic diversity.

- Pricing and leverage.

- Vibrant culture/community.

- Median age of the population.

- Transportation.

- Path of development.

- Asset class: single-family vs. multifamily.

- Local zoning laws.

What makes a good market for real estate investment?

The adage "location, location, location" is still king and continues to be the most important factor for profitability in real estate investing. Proximity to amenities, green space, scenic views, and the neighborhood's status factor prominently into residential property valuations.

Which real estate is best to invest in?

One reason commercial properties are considered one of the best types of real estate investments is the potential for higher cash flow. Investors who opt for commercial properties may find they represent higher income potential, longer leases, and lower vacancy rates than other forms of real estate.

What is the best way to invest $200000 in real estate?

Purchasing real estate can be an excellent choice for those interested in investing significant capital. The best way to invest $200,000 is through a multifamily real estate syndication, thanks to the fact that it provides passive cash flow, upfront tax advantages, and appreciation over time.

How do I choose the right market?

How to Choose the Right Target Market for your Business

- Determine Who Needs Your Products And Services.

- Survey Your Current Customer Base.

- Look At Your Competition's Target Market.

- Analyze Your Industry's Target Markets.

- Consider Niche Target Markets.

- Continue to Evaluate Your Target Market.

- The Benefit of A Target Market.

Are real estate taxes itemized deductions?

If you itemize your deductions, you can deduct the property taxes you pay on your main residence and any other real estate you own. The total amount of deductible state and local income taxes, including property taxes, is limited to $10,000 per year.

What can you deduct on taxes if you don’t itemize?

Tax Breaks You Can Claim Without Itemizing

- Educator Expenses.

- Student Loan Interest.

- HSA Contributions.

- IRA Contributions.

- Self-Employed Retirement Contributions.

- Early Withdrawal Penalties.

- Alimony Payments.

- Certain Business Expenses.

Can you deduct state and local taxes if you don’t itemize?

You can deduct property taxes AND state and local income taxes OR you can deduct property taxes AND sales taxes if you itemize your taxes. You cannot deduct state and local income taxes AND sales taxes.

Are real estate taxes separate from standard deduction?

Remember, you can only claim your property tax deduction if you itemize your taxes. If you claim your standard deduction, you can't also write off property taxes.

What is the IRS deduction for real estate taxes?

You can deduct real estate taxes imposed on you. You must have paid them either at settlement or closing, or to a taxing authority (either directly or through an escrow account) during the year.

Why is real estate so popular?

Residential real estate provides housing for families. It is the greatest source of wealth and savings for many Americans. Commercial real estate, which includes income producing properties such as apartment buildings, retail shopping centers, office buildings, and manufacturing also creates many jobs.

What are the 3 most important factors in real estate?

The three most important factors when buying a home are location, location, and location. Too often I hear people talking about making decisions based on the home itself, instead of the location, and that is a mistake.

Why does everyone want to be in real estate?

You have a high earning potential

Real estate agents often have the potential to earn an unlimited salary. This means that your income may have no corporate or legal limitations. You might also be able to determine your own income, depending on how well you're able to help people sell and buy homes.

What is interesting about the real estate industry?

The Commercial Real Estate Finance industry provides $3.5 trillion in financing for office buildings, apartment properties, shopping malls, industrial properties and other income-producing real estate throughout the United States. Commercial real estate is financed with more than $3 trillion in mortgage debt.

Why is real estate interesting?

A passion for real estate

A top reason people explore real estate is that they are fascinated by it. They get a thrill from touring properties and imagining how to transform spaces and build lives within them. They can readily imagine how to increase property values through a few well-chosen upgrades.