Sell the Inherited Property Immediately

Capital gains taxes can take affect if retain the inherited property for even a short time before selling it. If you sell the inherited property immediately at its fair market value, you will not have to pay even short-term capital gains taxes on the sale.

How to avoid capital gains tax on real estate that is inherited?

How to Minimize Capital Gains Tax on Inherited Property

- Sell the inherited property quickly.

- Make the inherited property your primary residence.

- Rent the inherited property.

- Qualify for a partial exclusion.

- Disclaim the inherited property.

- Deduct Selling Expenses from Capital Gains.

What happens when you inherit a house from your parents?

If a house is willed to you alone or passed to your individual control through a trust, you have the absolute right to keep it as your own. You may live in it, sell it, or rent or lease it to others.

What is the inherited capital gains tax loophole?

When someone inherits investment assets, the IRS resets the asset's original cost basis to its value at the date of the inheritance. The heir then pays capital gains taxes on that basis. The result is a loophole in tax law that reduces or even eliminates capital gains tax on the sale of these inherited assets.

Which states have an inheritance tax?

States with inheritance taxes (Iowa, Kentucky, Nebraska, Maryland, New Jersey, and Pennsylvania) also use various exemptions and tax rates. For example, in New Jersey, surviving spouses, parents, children, and grandchildren are all exempt from the tax.

Do I need a license to rent my house in Oregon?

Renting residential property is business activity subject to the Business License Law (and Multnomah County Business Income Tax) and requires taxpayers to register for a Revenue Division tax account.

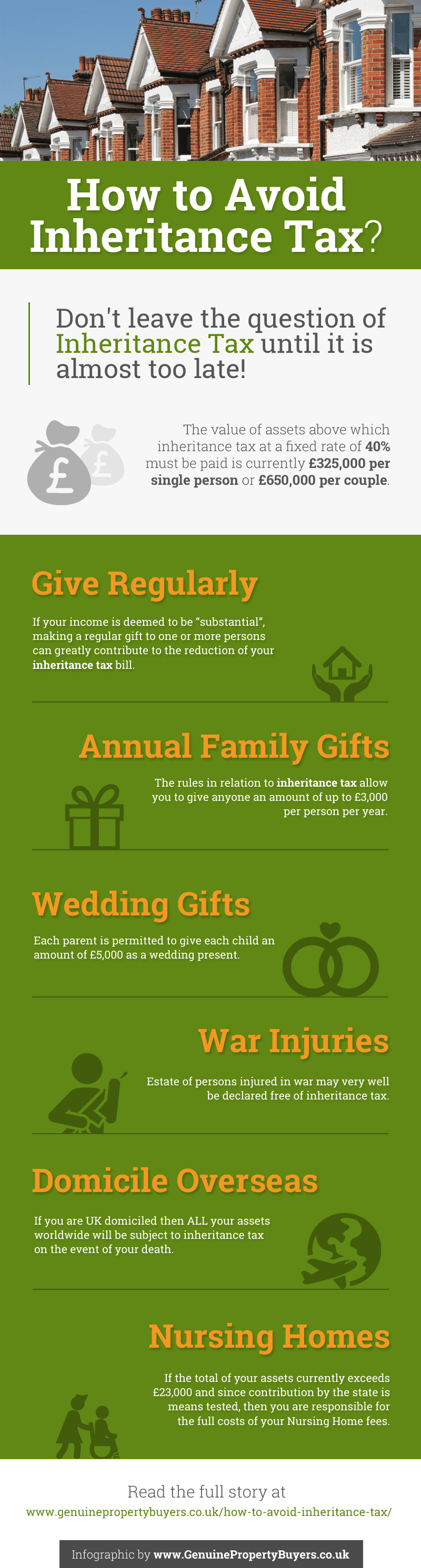

Tip 8 - Create a Will

— JS (Jackson Stephen LLP) (@jsllp) July 10, 2018

Most estates won’t exceed the inheritance tax threshold, however it’s possible your property value will push you over the threshold. Any value above the threshold is taxed at 40%, however by leaving everything to a spouse you can avoid this tax charge. pic.twitter.com/ENEGfClkxL

How long until property is considered abandoned in Oregon?

The second way a tenant's personal belongings are considered abandoned is when the tenant has been gone from the rental unit continuously for at least 7 days after a court has ordered an eviction of the tenant, even though the sheriff's department has not executed the court order or judgment.

Do you need a license to Airbnb in Oregon?

Salem, Oregon Airbnb laws require vacation rental operators to acquire a short-term rental license.

Which of the following business entities may register as a Florida real estate broker?

Business entities that may be registered as brokerage firms include sole proprietorships, general partnerships, limited partnerships, corporations, limited liability companies, and limited liability partnerships.

Do business brokers in Florida need a real estate license?

Yes, business brokers in Florida must be licensed. In Florida, state law defines “real estate” to include any business enterprises or business opportunities.

What is the shortest time you can rent an apartment?

You can find short-term apartment leases for three months, six months, nine months or even month-to-month. Monthly leases generally renew automatically each month as long as you and your landlord both agree.

What is defined as a short-term rental?

A short–term rental is typically defined as a rental of any residential home unit or accessory building for a short period of time. This generally includes stays of less than a month (30 days), but the maximum length can vary depending on the state and jurisdiction in which the rental is located.

What is the hardest month to rent an apartment?

The High-Demand Summer Months

Summer months (June-August) are often considered the worst months to rent an apartment, primarily due to the high demand, increased competition, and higher final rental prices.

What is the longest you can be late on rent?

However, even in states where landlords decide their grace period lengths, it's typically no more than a few days. The most common amount of time is three to five days before fees are incurred. Landlords are able to charge tenants late fees as soon as the grace period ends.

Does real estate prices go down in a recession?

Will house prices go down in a recession? While the cost of financing a home increases when interest rates are on the rise, home prices themselves may actually decline. “Usually, during a recession or periods of higher interest rates, demand slows and values of homes come down,” says Miller.

How much did house prices drop in the recession 2008?

For the whole year of 2008, NAR reported that the median existing-home price dropped by 9.5% to $197,100, compared to $217,900 in 2007. S&P/Case-Shiller Home Price Indices: Home prices fell by 18.2% in November 2008 compared to November 2007 in 20 major metropolitan areas.

Will home prices drop in 2023 recession?

Housing economists point to five main reasons that the market will not crash anytime soon: low inventory, lack of new-construction housing, large amounts of new buyers, strict lending standards and fewer foreclosures. —Will housing prices drop in 2023? Probably not — or at least, not by much.

Will 2023 or 2024 be a good time to buy a house?

Zillow has a similar forecast, as it expects home values to rise by 6.5% from July 2023 through July 2024, despite “despite persistent affordability challenges.” Likewise, Freddie Mac is forecasting prices rising by 0.8% between August 2023 and August 2024, followed by another 0.9% gain in the following 12 months.

Should I buy a house now or wait for recession?

However, the Forbes Advisor suggests that waiting for a recession to buy a house may not be the best idea. The article states that home prices generally fall during recessions, but they can rise or fall depending on various factors such as supply and demand dynamics, geography, and outlook for the labor market 2.

When you buy a house is everything in it yours?

What comes with the house. In most home purchasing contracts, it's clear that anything built-in or permanently affixed to the home comes with the house. This may seem like common sense, but you'd be surprised how many sellers assume they can take just anything with them.

Do I own 100% of my house?

To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity would be $17,500 or the amount of your down payment. For perspective, once you have paid off your mortgage you'll have 100% equity in the home.

What are the three most important words in real estate?

There is an old adage, that the three most important words in real estate are 'Location, Location, Location'.

Is it smart to invest all your money in real estate?

Putting all your money in one investment, whether stocks or real estate, can be too risky. But diversifying can reduce your risk of loss.

What happens if you buy a house and something is wrong?

Most states have laws that require sellers to advise buyers of certain defects in the property. If you find problems with your home after you move in, you may be within your rights to take legal action.

What does the IRS consider a real estate professional?

A taxpayer qualifies as a real estate professional for any year the taxpayer meets both of the following requirements: (1) more than half of the personal services performed in all trades or businesses during the tax year were performed in real property trades or businesses in which the taxpayer materially participated;

Can realtors deduct meals with clients?

You can deduct as a business expense the cost for meals with abona fide business purpose. This means whenever you have coffee, lunch, etc with clients, prospects, referral sources, and business colleagues.

Can I write off my commission split?

You can deduct the split you pay to your Broker only if the 1099-MISC you receive at the end of the year includes the full amount of the commission (yours plus the Broker's). This would be highly unusual. In most cases, the 1099-MISC will reflect only the commission that you actually received.

Can realtors write off closing gifts?

Client Gifts

You can deduct up to $25 of the cost of business gifts that you give to each person throughout the year. If you and a spouse give gifts to the same person, you can only deduct the cost of one gift. Incidental costs (packaging, shipping, wrapping, etc.)

Are real estate sales reported to IRS?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

Which of the following rentals is considered to be used primarily as a rental?

A) A property rented for 15 days or more and used for personal use for no more than 14 days is categorized as primarily rental.

Which of the following expense items are deductible as rental expense for a rental property?

The nine most common rental property tax deductions are:

- Mortgage Interest.

- Property Taxes.

- Insurance Premiums.

- Real Estate Depreciation.

- Maintenance and Repairs.

- Utilities.

- Legal and Professional Fees.

- Travel and Transportation Expenses.

What does rental income include quizlet?

Rental income includes advance rent, expenses paid by tenant, property or services in lieu of rent and non-refundable security deposits. Deposits earmarked for return to tenant upon lease termination (a refundable security deposit) are not included in rental income.

Is 1 percent of the principal amount of the loan that is deductible when paid to the lender in exchange for a reduced?

Discount points are a one-time fee, paid up front either when a mortgage is first arranged or during a refinance. Each discount point generally costs 1% of the total loan and lowers the loan's interest rate by one-eighth to one-quarter of a percent.

What is the basis of a rental property?

The original cost basis of a rental property is the purchase price plus certain closing costs that must be capitalized instead of expensed.

How do you split the house among heirs?

Selling the Home: The easiest solution when inheriting a house with siblings is generally to sell the house and divide the proceeds from the sale among the siblings according to the percentage shares each sibling had been designated by the will or trust.

How long does it take to release money from the estate?

Unfortunately, every estate is different, and that means timelines can vary. A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Does the sale of inherited property count as income?

Any gains when you sell inherited investments or property are generally taxable, but you can usually also claim losses on these sales.

Which is the correct order of payment from an estate?

Every state sets the priority according to which claims must be paid. The estate's beneficiaries only get paid once all the creditor claims have been satisfied. Usually, estate administration fees, funeral expenses, support payments, and taxes have priority over other claims.

What happens when 3 siblings inherit a house?

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others' shares, or whether ownership will continue to be shared.

What people should know about real estate?

The Most Important Factors for Real Estate Investing

- Property Location.

- Valuation of the Property.

- Investment Purpose and Investment Horizon.

- Expected Cash Flows and Profit Opportunities.

- Be Careful with Leverage.

- New Construction vs. Existing Property.

- Indirect Investments in Real Estate.

- Your Credit Score.

What gets people interested in real estate?

Passion and Interest in Real Estate

One of the main reasons people love real estate is because they are passionate about houses, interior design, and basically anything else that you could watch on HGTV.

What’s the first thing you need to know about real estate?

Study Local Pricing. The first things to study are the current price trends in the area. For example, a potential investor should look to see if the price of homes is accelerating faster in one area than in others. Next, check to see if the average home price is more than in other neighboring towns.

What do people want most in a real estate agent?

The number one quality consumers seek in an agent is trust. Buyers and sellers want full disclosure at all times about every document. They want to be given the heads up about important changes to housing regulations and mortgage rules.

What are three important things about real estate?

To achieve those goals, the three most important words in real estate are not Location, Location, Location, but Price, Condition, Availability. Let's look at the first word – Price.