Types of Selling Expenses That Can Be Deducted From Home Sale Profit

- Advertising.

- Appraisal fees.

- Attorney fees.

- Closing fees.

- Document preparation fees.

- Escrow fees.

- Mortgage satisfaction fees.

- Notary fees.

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.

What are exceptions to 2 year rule sale of primary residence?

Exceptions to the Two-in-Five-Year Rule

You were separated or divorced during the time you owned your home. Your spouse died during the time you owned your home. The sale of your home involved vacant land.

What is the IRS Publication 523 2017?

This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it.

What expenses can be offset against capital gains tax?

You can deduct the stamp duty costs and the solicotr fee. The mortgage fee is not in relation to the actual sale of the property and is therefore not allowable. You cannot deduct any outstanding mortgage either.

How does a beginner invest in real estate?

You can invest $10,000 dollars in real estate by flipping houses, becoming a landlord, crowdfunding sites, REITs, and more. Most real estate investing platforms require less than $10,000 to start investing in single-family rental properties, individual properties, and venture funds.

More on RE because this is important.

— Nick Huber (@sweatystartup) January 3, 2021

Early in your career you need to double and triple or create cash from nothing.

That’s hard AF to do in real estate.

It’s good at growing your wealth over a lot of TIME. Early on you don’t have time.

Do something else.

How to invest money to make money real estate?

How To Make Money In Real Estate: A Guide For Beginners

- Leverage Appreciating Value. Most real estate appreciates over time.

- Buy And Hold Real Estate For Rent.

- Flip A House.

- Purchase Turnkey Properties.

- Invest In Real Estate.

- Make The Most Of Inflation.

- Refinance Your Mortgage.

How to start real estate with $1,000 dollars?

How to Invest $1,000 in Real Estate

- Fractional Ownership in Properties. Several platforms let you buy fractional shares of individual properties.

- Publicly-Traded REITs.

- Real Estate Crowdfunding: Private REITs.

- Real Estate Crowdfunding: Loans.

- Private Notes.

- Real Estate Wholesaling.

- Invest in Land.

- House Hack.

What type of fund invests in real estate?

A real estate investment trust (REIT) is a corporation, trust, or association that invests directly in income-producing real estate and is traded like a stock. A real estate fund is a type of mutual fund that primarily focuses on investing in securities offered by public real estate companies.

How to afford to invest in real estate?

10 Best Ways to Invest in Real Estate With Little or No Money

- Purchase Money Mortgage/Seller Financing.

- Investing In Real Estate Through Lease Option.

- Hard Money Lenders.

- Microloans.

- Forming Partnerships to Invest in Real Estate With Little Money.

- Home Equity Loans.

- Trade Houses.

- Special US Govt.

Can you sell real estate in Arizona without a license?

It is ok, for someone to sell their own property, it is ok for a buyer to buy that property, that is perfectly legal. What is not legal is those who represent themselves as being able to sell Real Estate in Arizona without a Real Estate License or Brokers License.

Can you sell real estate in Texas without a license?

In Texas, if you are the property owner or a home builder, no you do not need a license to sell real estate you own. Yes a REALTOR can discount their fee, but we can only pay a referral fee to another licensed REALTOR. No, it's not legal if you collect a fee.

Who needs a Florida real estate license?

An active Florida real estate sales associate license is required when you represent a buyer or seller in a real estate transaction, including listing, selling, purchasing, leasing, lease options and renting, and earn a commission for services rendered.

How long does it take to get a real estate license Arizona?

How long does it take to get your real estate license in Arizona? On average, it takes between one (1) – three (3) months to become a real estate agent and get an Arizona real estate license.

How far behind on rent before eviction in Texas?

According to Texas law, rent on the rental unit becomes late if it isn't paid within 2 full days once it's due. When rent is late, you must give the tenant the 3-Day Notice to Quit to kick start the eviction process.

How many months behind on rent before eviction in Georgia?

You may begin eviction proceedings as soon as a tenant is late—Georgia law does not stipulate any grace period.

How soon does an eviction show up on your record?

Within 30 to 60 days

How Soon Does An Eviction Show Up? Evictions typically show up on records within 30 to 60 days; the exact amount of time it takes for these records to appear depends on the court system, the filing agencies, and what types of screening services are being used to check this data.

How long do you have to move out after eviction in PA?

10 days

Moving out

According to Pennsylvania law, once the Order of Possession is issued, law enforcement officials (only) have to serve it to the tenant within 48 hours from the time they receive it. Once the tenants receive the order, they have 10 days to move out before they are forcefully evicted from the property.

How long do I have to move after eviction in Texas?

The three-day eviction notice in Texas is a legal document that informs the tenant that they have three days to vacate the property or face legal action. In Texas, this notice can be given for various reasons, including non-payment of rent, violation of the lease agreement, or illegal activity on the property.

Are real estate transactions reported to IRS?

Reportable Real Estate

Generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future ownership interest in any of the following. 1. Improved or unimproved land, including air space. 2.

What is the timeline for 1031 exchange rules 2023?

TIMELINE REQUIREMENTS

Measured from when the relinquished property closes, the Exchangor has 45 days to nominate (identify) potential replacement properties and 180 days to acquire the replacement property. The exchange is completed in 180 days, not 45 days plus 180 days.

What is the 5 year rule for 1031 exchanges?

If a property has been acquired through a 1031 Exchange and is later converted into a primary residence, it is necessary to hold the property for no less than five years or the sale will be fully taxable.

What are the IRS rules for a 1031 exchange?

The main requirements for a 1031 exchange are: (1) must purchase another “like-kind” investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any “boot”); (4) must be the same title holder and taxpayer; (5) must identify new

How does the IRS know that you sold a house?

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

Who is the best person to talk about property investment?

This can save you lot of money as if it is done incorrectly there could other implications that you may have not thought of.

- MORTGAGE BROKER / FINANCIER.

- REAL ESTATE AGENT.

- PROPERTY MANAGER.

- FINANCIAL PLANNER.

- CONVEYANCER.

- LAWYER.

How do I get people to invest in my real estate?

1. Communicate Effectively

- Implementing well-designed email campaigns to educate your potential investors.

- Consistent posts on social media promoting your business.

- Regular insights on the changing market trends.

- Periodic financial reports of the ongoing deals.

- In-time information about the upcoming real estate deals.

What is the difference between a financial planner and advisor?

A financial advisor is a general term that can apply to anybody who helps you manage your money. This could include an employee of your financial institution, a stockbroker or an insurance agent. A financial planner is a type of advisor who helps you create a plan to reach your long-term financial goals.

How do you decide if a real estate investment is worth it?

Here, we go over eight critical metrics that every real estate investor should be able to use to evaluate a property.

- Your Mortgage Payment.

- Down Payment Requirements.

- Rental Income to Qualify.

- Price to Income Ratio.

- Price to Rent Ratio.

- Gross Rental Yield.

- Capitalization Rate.

- Cash Flow.

What is the 1 rule for investment property?

For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price. If you want to buy an investment property, the 1% rule can be a helpful tool for finding the right property to achieve your investment goals.

Can you get appraisal before offer?

“Appraisals aren't done at the beginning because the lender wants to assign the appraisal company that they work with,” says Julie Upton, a Realtor® in California's Marin County. “And they may not accept an appraisal that the seller did at the time of listing.”

What happens if appraisal is lower than offer?

If your appraised value is lower than the agreed upon sales price, you'll have to make up the difference in cash, or cancel the deal.

Do appraisals usually come in at asking price?

“You can't always avoid [a low appraisal],” says Megan Walters, a top-rated agent who sells homes more than 41% faster than the average agent in her Columbia, Missouri, market. Most appraisals come in at the right price. According to CoreLogic, in general, appraisals come in below contract only about 7-9% of the time.

What happens if appraisal is higher than offer?

What happens if the appraisal comes in above the purchase price of the home? You're in a good situation if this happens. It simply means that you've agreed to pay the seller less than the home's market value. Your mortgage amount does not change because the selling price will not increase to meet the appraisal value.

Is the appraisal before or after the offer?

The appraisal usually happens after an offer has been made and the home has been inspected. As the buyer, you'll pay for the appraisal and most likely have to arrange for it to be done as well.

Do you always have to put 20% down on a second home?

How much do I need for a down payment on a second home? The down payment for a first home can be as low as 0% and as high as 20% for a conventional loan. But the required down payment for a second home is around 10%, and sometimes more than 20%.

What percentage should you put down on a new house?

20%

If you're wondering what percentage you should put down on a house, 20% down is the rule of thumb, but there is no one-size-fits-all figure. For example, some loan programs require a down payment as little as 3% or 5%, and some don't require a down payment at all.

How much money should I have left over after buying a house?

After buying a home, the amount you have left will vary depending on your financial situation. However, it's a good idea to have at least 3 to 6 months of living expenses in reserve. That way, in case of an emergency, you can stay afloat financially.

How do I sell my house and buy another one at the same time?

Bridge loan: A bridge loan is a temporary financial arrangement that lets you buy a new home without selling your old one. It's important to know these loans use your current home as collateral, and they are only meant to last a short amount of time (six months to one year).

How to not pay 20% down for second home?

Methods of financing a second home with no down payment

- Government-backed loans.

- Assumable mortgages.

- Reverse mortgages.

- Buying from a family member who gifts you equity.

- Leasing with an option to buy.

- Tapping into home equity or retirement savings.

What is the cons to renting a house?

Cons of Renting:

- Your landlord can increase the rent at any time.

- You cannot build equity if you're renting a property.

- There are no tax benefits to renting a property.

- You cannot make any changes to your house or your apartment without your landlord's approval.

- Many houses available for rent have a “No Pets” policy.

Which is better renting or owning?

Renting offers flexibility, predictable monthly expenses, and someone to handle repairs. Homeownership brings intangible benefits, such as a sense of stability and pride of ownership, along with the tangible ones of tax deductions and equity.

What is the biggest monthly expense as a tenant?

Landlords usually consider little more than your monthly income and employment longevity. Renters' most significant expenses are rent, insurance, and utilities. Homeowners have housing expenses that are much higher and include items that should be considered.

What are 3 advantages of renting?

Benefits of renting often include:

- Rent payments tend to be lower than a comparable house payment.

- Utility costs may be included in rental fee, creating additional savings.

- Relocation is easier.

- Maintenance and repairs are not your responsibility.

- Credit requirements are less strict.

What are the pros and cons of renting a home?

What Are the Advantages of Renting?

- #1 Less Responsibility.

- #2 Lower Monthly Payments.

- #3 No Closing Costs or Down Payments.

- #4 Greater Flexibility and Freedom (from HOAs)

- #1 What You See is What You Get.

- #2 Renting (Likely) Won't Help Your Credit.

- #3 You Could End Up Paying More.

- #4 Rent Is Effectively Money Lost.

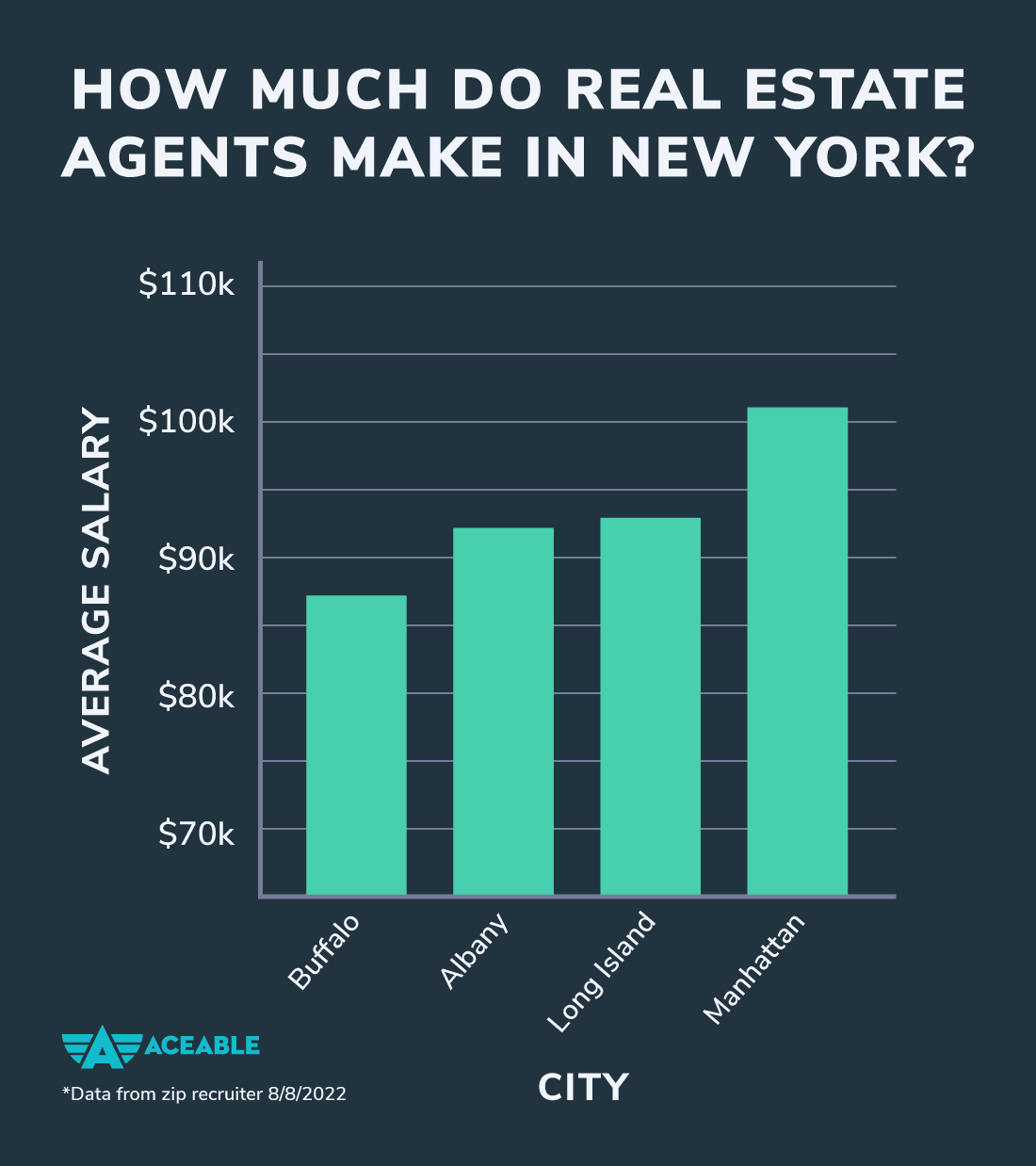

What do the top 1% of realtors make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

How to make $100,000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

What is the average salary for a realtor in Illinois?

What is the average salary for a real estate agent in Illinois? The average salary for a real estate agent in Illinois is $43,000 per year. Real estate agent salaries in Illinois can vary between $16,500 to $172,500 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

How much do most realtors make on a sale?

Around 5-6%

How much do Realtors and real estate agents make? Real estate agents make a commission on each home they successfully sell. That commission is generally around 5-6% of the sales price.

Can you be a millionaire as a realtor?

About 90% of the world's millionaires over the last 2 centuries have come from real estate. So that's a resounding yes! For many investors, real estate offers a great opportunity to build wealth and create a large profit on each deal.