Income for real estate agents can vary greatly and is dependent on years of experience, hours worked, market conditions, specializations and more. A 2023 survey of nearly 11,000 licensed real estate professionals shows that their average gross income was $157,000.

How to make $100,000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

How much does a beginner real estate agent make in Texas?

Salaries by years of experience in Texas

| Years of experience | Per year |

|---|---|

| 1 to 2 years | $75,972 |

| 3 to 5 years | - |

| 6 to 9 years | - |

| More than 10 years | $99,681 |

Does real estate make millionaires?

Becoming a millionaire from real estate investing isn't as far-fetched as it may seem, but it's not an easy goal to reach. You shouldn't expect it to happen overnight, but it is achievable. If you have the right knowledge, develop a plan, and be persistent enough, you can become a millionaire real estate investor.

How much real estate to make $1 million a year?

Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

What expenses are paid by the seller?

Below is a list of common fees a seller will incur in the seller side of the real estate transaction:

- Realtor Commission Fees.

- Property Taxes.

- Home Owners Association (HOA) fee.

- Excise Tax.

- Attorney Fees.

- Mortgage Payoff.

- Due Diligence Fee.

- Seller Paid Closing Cost.

My real estate strategy:

— Nathan Barry (@nathanbarry) September 8, 2021

Buy 1 property per year.

Never sell.

Repeat for 30 years.

Sure, you can make money on a flip, but I much prefer building equity, appreciation, and cash flow by holding for the long term.

What is the seller fee?

Seller Fees means: (a) for a Service Contract, the fixed fee agreed between a Buyer and a Seller; and (b) any bonuses or other payments made by a Buyer to a Seller.

What is the largest closing expense for the buyer?

Origination fee (or service fee)

Most lenders charge an origination fee to cover service and administrative costs. This is typically the largest fee you pay to close your mortgage. Most borrowers pay 0.5% – 1.5% of the loan amount, though it can be higher or lower depending on your lender, according to Credible.

How much does it cost to become a real estate agent in PA?

1. How Much Does It Cost to Get Your Real Estate License in Pennsylvania?

| Average Course Tuition | $399-$649 |

|---|---|

| PA State Police Fingerprinting | $22 |

| Licensing Exam Fee | $49 |

| Application Fee | $97 |

| Total | $585-$835 |

How much is it to get your real estate license in Arizona?

The fee for an Arizona real estate salesperson license examination is $75, and the fee for a first-time license is an additional $60 (Original License Fee is $50; the Real Estate Recovery Fund Fee is $10). The Arizona real estate exam has two parts: general real estate knowledge and Arizona-specific knowledge.

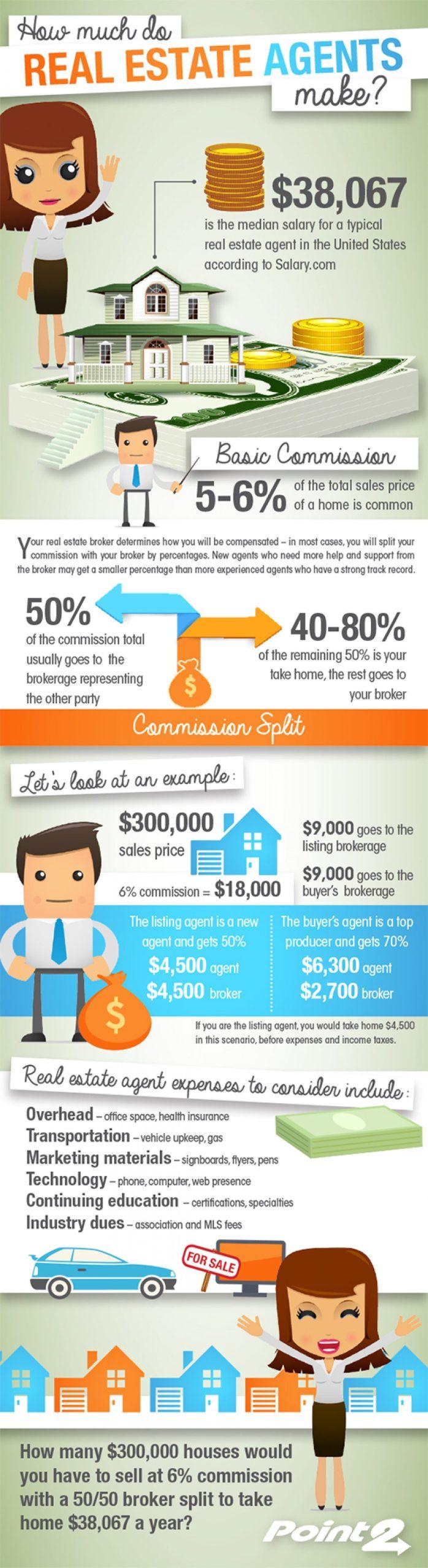

What percentage do most real estate brokers charge?

About 5 percent to 6 percent

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

How brokerage is calculated in real estate?

In India, real estate agents usually ask the seller and the buyer to pay 1-2% of the deal value as their commission, also known as the real estate brokerage fee. For instance, in case there is a property deal of Rs. 1,00,00,000, the broker would get Rs. 1,00,000 from the seller and Rs.

How do you calculate brokerage fees?

FAQ: What Are Brokerage Fees and How Do They Work?

- Key takeaways:

- Flat brokerage fee = number of trades x the agreed flat rate.

- Percentage brokerage fee = percentage fee x total value of all trades.

- Maintenance fee = 0.25% x total value of assets.

- Maintenance fee = 0.5% x total value of the assets.

What is the difference between a broker and an agent?

Differences between agents and brokers

Because brokers represent their clients, they have a duty to provide impartial advice and act in the buyers' best interest. Agents, on the other hand, are motivated to sell the products that the insurers they represent offer.

Do buyers pay realtor fees in NY?

The Seller Usually Pays Realtor Fees In New York

In New York, like every other U.S. real estate market, the homeowner/seller pays the realtor fees out of the proceeds from the sale of the property. This means that they are paying for their agent as well as the agent of the Buyer.

Do buyers pay realtor fees in PA?

Once the sale is final, both realtors will split a commission fee which is calculated by the purchase price of the home. This fee is paid by the seller, but it is calculated into the overall cost of the home. So, once you make the transaction on the home or property sale, you've done your part in “paying” the agents.

Do buyers pay realtor fees in Massachusetts?

In effect, property owners pay all Realtor fees when selling. That total compensation or real estate commission rate is then split between the listing agent and the agent or broker that brings the buyer to the transaction (sometimes referred to as the cooperating broker).

Do buyers pay realtor fees in Michigan?

Who pays realtor fees in Michigan? In Michigan, home sellers pay real estate commission fees out of the final sale proceeds for both agents involved in a deal. Offering to pay for the buyer's agent's commission is an incentive for agents to show your home to their clients.

Do sellers pay closing costs in NY?

While you and the buyer can be liable to pay the closing costs, it is almost always the buyer who pays it. In New York, closing costs for sellers range from 8% to 10%, although this is if you have paid the 6% agent commission. Your closing costs are also typically higher than that of buyers.

How is the broker’s commission usually paid out?

The commission is split between the seller's agent and buyer's agent right down the middle. Usually, the commission is paid directly to the brokerage, who distributes it to the agent.

At what point is commission traditionally considered earned?

At what point is commission traditionally considered earned? When a ready, willing, and able buyer is found. This is meant to mean when the buyer has agreed to all sellers terms or the seller has agreed to the buyers counter offer.

What does commission pay mean in real estate?

A real estate commission is a percentage of a property's purchase price that is paid to the real estate agents and brokers that facilitated the purchase and sale of a property. Real estate agents typically make their money through their commission and do not make a commission (or get paid) unless the house sells.

What is commission called in real estate?

The realtor's commission is a fee paid to a realtor for the services provided to home buyers and sellers. It is typically paid to the real estate brokerage firm that the realtor works for and then split with the realtor on a pre-determined basis.

Who pays a broker’s commission?

Most mortgage brokers are small businesses or contractors so they only earn an income from the commission they receive from the lender. These commissions are calculated based on a few factors such as the loan amount, the Loan to Value Ratio (LVR), and the quality of the overall loans they write.

What happens if seller doesn’t pay commission?

If the seller of a home refuses to pay the real estate broker their earned commission, the real estate broker can take the seller to court and sue them for what they are owed.

Which clause allows a broker to sue for a commission?

Safety protection clause

A safety protection clause entitles a real estate broker to a commission if a sale occurs after the listing agreement expires. This protects the broker from collusion between sellers and buyers to save the seller the cost of real estate commission.

What type of clause allows a broker to collect a commission for some period of time after the listing expires?

Safety protection clause

– A safety clause, also known as a safety protection clause or extender clause, is a provision in a listing agreement that allows the listing broker to still receive their commission fees if the property sells to a buyer they procured within a specified period after the listing expires.

What to do if someone doesn’t pay you for a commission?

According to California law, an earned commission is a form of wage. Therefore, your boss cannot refuse to pay you the commission you earned under the terms of your commission agreement. And if they do, you can seek trusted legal advice and bring your claim to the Labor Commissioner if necessary.

What percentage do most realtors charge?

Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for.

What do the top 1% of realtors make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

How much do most realtors make on a sale?

Around 5-6%

How much do Realtors and real estate agents make? Real estate agents make a commission on each home they successfully sell. That commission is generally around 5-6% of the sales price.

How much does average realtor make in Ohio?

What is the average salary for a real estate agent in Ohio? The average salary for a real estate agent in Ohio is $32,000 per year. Real estate agent salaries in Ohio can vary between $17,000 to $90,500 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

Is 6% normal for realtor?

Negotiate the commission rate.

Just because 5–6% is common, it doesn't mean that's what you have to accept. Ask your real estate agent if they're willing to take less.

What percent commission do most real estate agents make?

The average agent commission rate nationwide is 5.8% of the home sale price, according to HomeLight's real estate transaction data of thousands of home sales each year.

What are the odds of making it as a realtor?

Being a successful real estate agent is easier said than done. After all, there's a reason 87% of real estate agents fail. However, knowing the mistakes these realtors make, such as failing to follow up with clients or not having adequate funding, can help you prepare and grow a successful real estate business.

What is the most common commission split in real estate?

50/50

Typical commission splits include 50/50, where the broker and real estate agent receive equal sums of money from a commission split, but they can also use the 60/40 or 70/30 split options. In these situations, the real estate agents get a larger sum of the money than the brokers.

What percentage do most realtors charge in California?

The average California real estate agent commission rate is between 5-6%. However, commission on higher-priced home and property sales average 4-5% percent. The seller and agent usually negotiate the commission amount before entering into a listing contract.

Do buyers pay realtor fees in NJ?

Who pays realtor fees in New Jersey? In New Jersey, home sellers pay real estate commission fees out of the final sale proceeds for both agents involved in a deal. Offering to pay for the buyer's agent's commission is an incentive for agents to show your home to their clients.