Real Estate Agent Salary in California. $67,400 is the 25th percentile. Salaries below this are outliers. $103,700 is the 75th percentile.

What is the highest paid real estate agent?

The highest-paid real-estate agent is a luxury broker.

Luxury brokers earn an average salary of $142,000 per year with commissions reaching up to $10M annually. As a luxury broker, you would specialize in multimillion-dollar deals and work closely with developers, architects, and designers.

Do real estate agents make a lot of money in California?

That said, we conducted a survey in 2020 finding the average first-year real estate agent in California earns approximately $41,000, and that number rises to over $104,000 between years four and ten of their career.

Where are the highest paid realtors?

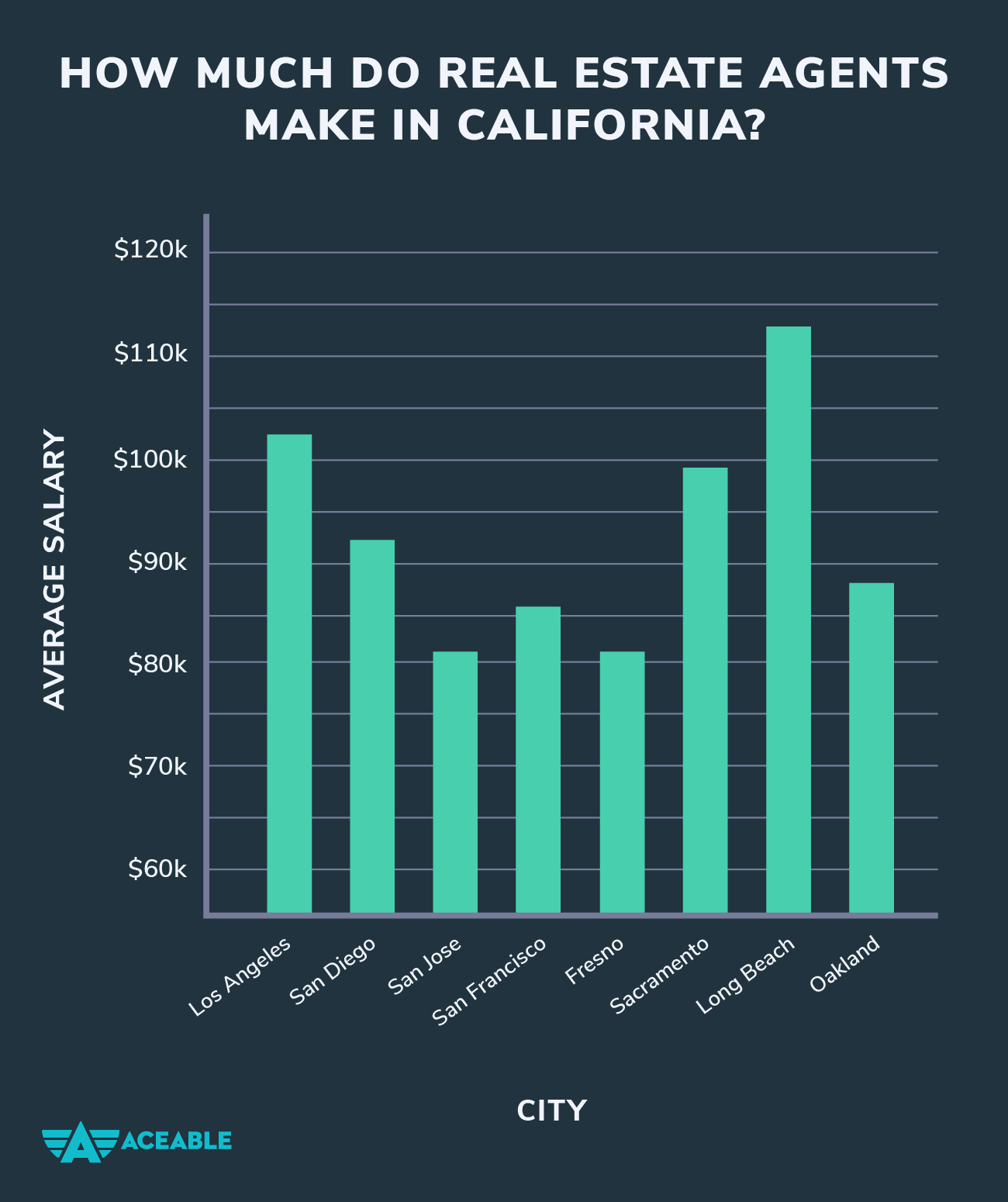

Real estate agents in high cost of living cities such as New York and San Francisco tend to be the highest earners.

How to make $100,000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

What is the federal tax rate on sale of land?

Capital gains tax basics

Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a 3.8% investment tax for people with higher incomes.

We’re proud to announce that State Representative Jim Bosman is all in for @ewarren!

— New Hampshire for Warren (@NHforWarren) January 26, 2020

Thanks for being in this fight with us, Jim. We’re thrilled to have you on the team!#FITN #NHPolitics pic.twitter.com/DrpwJW0pbU

What is the capital gains tax on $200 000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

Are land sales reported to IRS?

Any time you sell or exchange capital assets, such as stocks, land, and artwork, you must report the transaction on your federal income tax return.

What is the largest privately owned real estate company?

Pittsburgh, PA (April 4, 2022) – The Hanna Family of Companies has once again been named the #1 privately held real estate brokerage firm in the United States, accordingly to the recently released 2022 RealTrends 500 report and the RISMedia Power Broker Report.

What is the largest commercial real estate company in the world?

CBRE Group, Inc.

The abbreviation CBRE stands for Coldwell Banker Richard Ellis. It is the world's largest commercial real estate services and investment firm (based on 2021 revenue). CBRE Group, Inc.

What are the biggest closing costs usually paid by buyers?

Origination fee (or service fee)

Most lenders charge an origination fee to cover service and administrative costs. This is typically the largest fee you pay to close your mortgage.

What closing costs are negotiable?

There are a number of closing costs you may be able to negotiate down with your lender, including application fees, fees associated with rate locks or the purchase of points, and the real estate commissions paid to your agent and the seller's agent.

Which of the following closing cost fees is commonly charged on a loan?

Common closing fees or charges may include: Appraisal fees. Tax service provider fees. Title insurance.

What is the most expensive part of closing costs?

Buyers pay a long list of closing fees, all of which are itemized on the standard Loan Estimate you'll get from any lender. But the main (most expensive) fees to be aware of are: Loan origination fee or broker fee (0-1% of loan amount): A fee the lender or broker charges for its services.

What is the largest closing expense for the buyer?

Origination fee (or service fee)

Most lenders charge an origination fee to cover service and administrative costs. This is typically the largest fee you pay to close your mortgage. Most borrowers pay 0.5% – 1.5% of the loan amount, though it can be higher or lower depending on your lender, according to Credible.

How to calculate closing costs?

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

What does the seller pay at closing in Texas?

What are typical closing costs for a seller in Texas? Sellers are responsible for real estate agent commissions, some title fees and any outstanding HOA fees or property taxes. Agent commissions will make up the bulk of these costs, typically 5 to 6 percent of the home's sale price.

What is the most seller can pay in closing costs?

For a conventional loan, sellers can pay your closing costs up to 3% of the property's purchase price if your down payment is less than 10%. If your down payment is 10% or more, the seller credit increases to 6% of the purchase price.

What is the easiest way to start in real estate?

One of the fastest ways to get started in real estate is by wholesaling. This unique strategy involves securing a property under market value and assigning an end buyer to purchase the contract. Wholesalers never own the property and instead make money by adding a fee to the final contract.

How do I get started in the real estate industry?

Though the specific requirements differ by state, here's a general rundown of how to become a real estate agent.

- Research Your State's Requirements.

- Take a Prelicensing Course.

- Take the Licensing Exam.

- Activate Your Real Estate Agent License.

- Consider Becoming a Realtor.

- Join a Real Estate Brokerage.

Is it hard starting in real estate?

Key Takeaways. Working as a real estate agent or broker can be fulfilling and financially rewarding, but it's not easy. A career in real estate requires drumming up business, promoting yourself, tracking leads, handling complex paperwork, providing customer service, and much, much more.

How do you make money off real estate?

There are four main money making strategies for real estate investors: buy a property and wait for it to appreciate in value; rent out a property to tenants or businesses to generate cash flow; invest in residential properties; invest in real estate projects or find other work in the industry.

How to start real estate with $1,000 dollars?

How to Invest $1,000 in Real Estate

- Fractional Ownership in Properties. Several platforms let you buy fractional shares of individual properties.

- Publicly-Traded REITs.

- Real Estate Crowdfunding: Private REITs.

- Real Estate Crowdfunding: Loans.

- Private Notes.

- Real Estate Wholesaling.

- Invest in Land.

- House Hack.

Who is responsible for paying the loan origination fee in a financed real estate transaction?

The Bottom Line

Buyers are responsible for most of the costs, which include the origination and underwriting of a mortgage, taxes, insurance, and record filing. Closing costs must be disclosed by law to buyers and sellers and agreed upon before a real estate contract is completed.

Which of the following fees must be paid by real estate seller?

Sellers often pay real estate agent commissions, title transfer fees, transfer taxes and property taxes.

Are the sellers likely to pay closing costs?

Do Sellers Pay Closing Costs? Sellers pay fewer expenses, but they may actually pay more at closing. Typically, sellers pay real estate commissions to both the buyer's and the seller's agents. That generally amounts to average closing costs of 6% of total purchase price or 3% to each agent.

Who pays most of the closing costs?

Buyer

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

Who gets the origination fee?

An origination fee is what the lender charges the borrower for making the mortgage loan. The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination fees generally can only increase under certain circumstances.

What is the best day to host a broker open house?

Most of the top realtors agree that weekends, especially the first Sunday after your home is listed, is the best day for home sellers to hold an open house. This is because most of the potential home buyers are off from work on weekends, thus making Saturday and Sunday the best days for holding an open house.

What is the best day and time for a broker open?

Weekday afternoons are usually a good bet for a brokers open. Some tips when planning when to hold the broker's open: Usually a 1-2 hour window between 1-6pm will work fine. You don't need to have as long a window for the brokers open as the public Open House.

What is a brokers event?

And how should you go about trying to find the right people. Simple at the brokerage event in Europe most brokerage. Events are organized by the enterprise Europe Network.

What is clear cooperation rule in real estate?

The Clear Cooperation Policy is a NAR-mandated policy that governs the public marketing of listings and their entry into the multiple listing service. Within one (1) business day of marketing a property to the public, the listing broker must submit the listing to the MLS for cooperation with other MLS participants.

What are the busiest days for real estate agents?

Thursday is the most popular day for agents to debut new listings, and homes listed on that day apparently sell fastest, according to Redfin, a real estate brokerage. Redfin analysts based their findings on a sample of 100,000 homes that sold in 2017.

Why do you want to pursue a career in real estate?

If you like change, new trends, and adapting to different markets, real estate will offer the versatility in a work environment that you crave. You also get to deal with many different personality types. For some people, this can be an incredibly exciting part of the job.

What makes you passionate about real estate?

Are you passionate about homes, people, sales, building relationships, marketing, digital marketing, changing people's lives or even math, statistics, and the news? All of these make up a career in real estate.

Why do you want to be a real estate agent essay?

I want to become a real estate agent because I have a passion for helping people and pointing them in the right direction. I want to help them with everything from inspections, property analysis, repairs, moving, cleaning, packing, everything involved in a sales transaction, I want to help people with it.

Why do I love being a real estate agent?

I have the opportunity to work with a lot of different people with different backgrounds, different interests, different income levels, and different needs. I love getting to know each individual; I love building rapport with each individual; I love earning the trust of each individual.

Why do I love being a realtor?

I have the opportunity to work with a lot of different people with different backgrounds, different interests, different income levels, and different needs. I love getting to know each individual; I love building rapport with each individual; I love earning the trust of each individual.

How do I determine the value of an investment property?

Also known as GRM, the gross rent multiplier approach is one of the simplest ways to determine the fair market value of a property. To calculate GRM, simply divide the current property market value or purchase price by the gross annual rental income: Gross Rent Multiplier = Property Price or Value / Gross Rental Income.

What is the 2% rule in real estate investing?

The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

What is the 5% rule in real estate investing?

Applying the 5% rule would look like this: Multiply the value of the property you own/like to obtain by 5%. Divide by 12 (to get a monthly amount). If the resulting amount is costlier than you would pay to rent an equivalent property, renting your home and investing your money in rental properties may work better.

What is the 10% rule in real estate investing?

Say, for example, that you purchased a property for $150,000. Following the rule, you put $15,000 (10 percent) forward as a down payment. Think of that 10 percent as all the skin you have in the game. The bank took care of the rest, and you'll cover that debt when you sell the home.

What are the 4 ways to value a property?

Top 4 Methods of Real Estate Appraisal

- Sales Comparison Approach. The sales comparison approach assumes that prior sales of similar properties provide the best indication of a property's value.

- Cost Approach Appraisal.

- Income Approach Appraisal.

- Price Per Square Foot.

How to invest in real estate with low or no money down?

How To Invest In Real Estate With No Money: 11 Ways

- Hard Money Lenders.

- Private Money Lenders.

- Wholesaling.

- Equity Partnerships.

- Home Equity.

- Option To Buy.

- Seller Financing.

- House Hacking.

How do I avoid 20% down payment on investment property?

Yes, it is possible to purchase an investment property without paying a 20% down payment. By exploring alternative financing options such as seller financing or utilizing lines of credit or home equity through cash-out refinancing or HELOCs, you can reduce or eliminate the need for a large upfront payment.

How to raise capital to buy real estate with none of your money?

Purchasing real estate with no money down

- Borrow the money.

- Assume the existing mortgage.

- Lease with option to buy.

- Seller financing.

- Negotiate the down payment.

- Swap personal property.

- Exchange your skills.

- Take on a partner.

Can you use equity in one house to buy another?

Key Takeaways. If you have enough equity in your home, you can use the money from a home equity loan to buy another house. Like regular mortgages, home equity loans are secured by your home, so you will be putting it at risk if you're unable to repay the loan.

What is the Brrrr method?

The BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method is a real estate investment approach that involves flipping a distressed property, renting it out and then getting a cash-out refinance on it to fund further rental property investments.