How Many Realtors Are There in Each State?

- The states with the most Realtors are Florida (222.293), California (202,852), and Texas (152,222).

- Vermont is the state has the fewest (1,826).

- The Virgin Islands (389) has the fewest of the U.S. Territories.

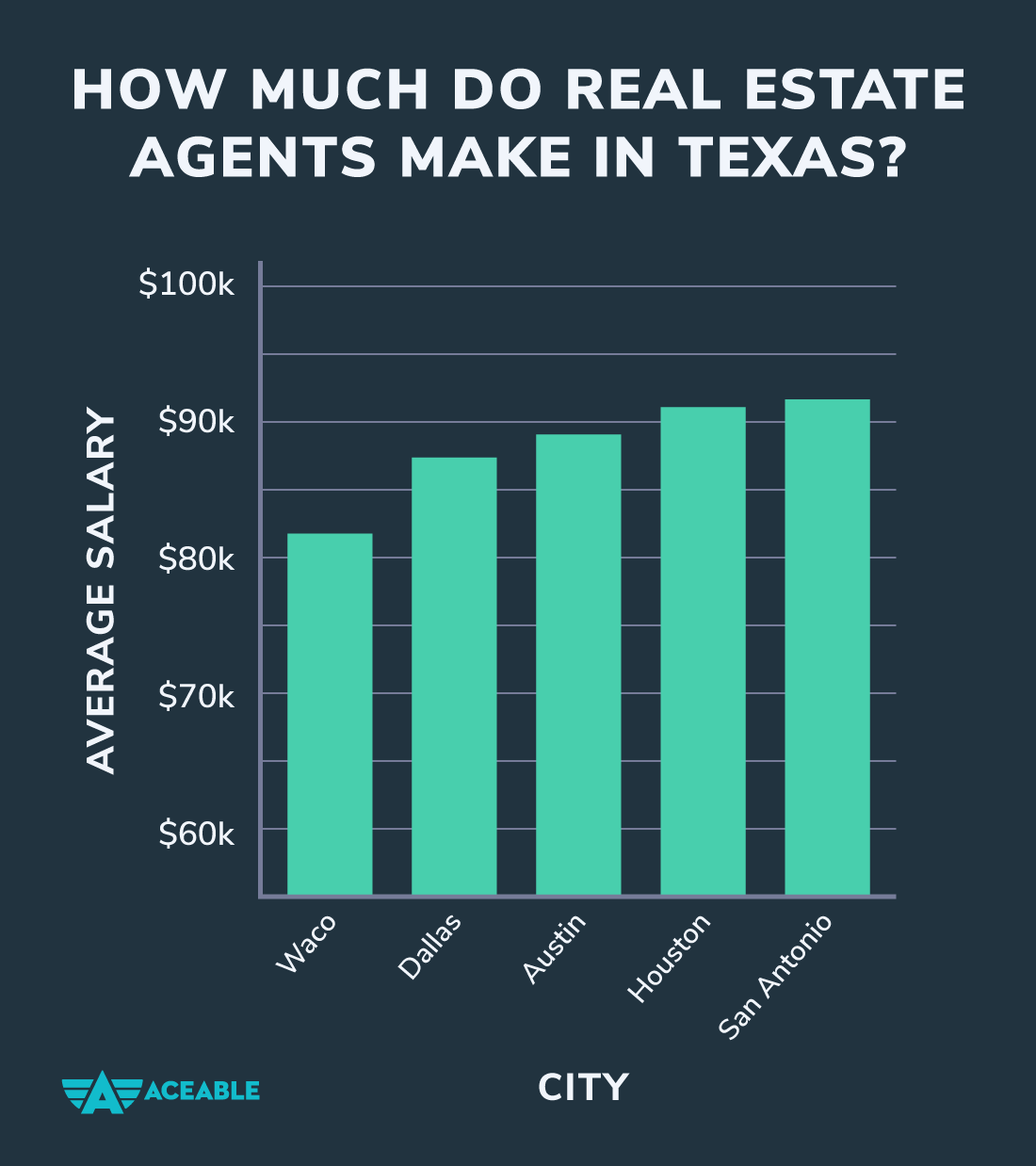

What’s the average salary of a Realtor in Texas?

What is the average salary for a real estate agent in Texas? The average salary for a real estate agent in Texas is $34,500 per year. Real estate agent salaries in Texas can vary between $17,000 to $118,500 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

Do realtors make a lot of money in Texas?

Real estate agents here make an average of $91,668 per year as of June 2022.

Is it worth becoming a Realtor in Texas?

The benefits of becoming a Realtor generally outweigh the minor cons. For most Texas agents, getting a Realtor license is well worth the time and expense. If you plan a little time to complete the application and build the dues into your budget, you'll be able to enjoy the perks of your Realtor license.

Where is the hottest real estate in the US?

Top 10 home buying zip codes

| Rank | Zip Code | City (Metro Area) |

|---|---|---|

| 1 | 43230 | Gahanna, OH (Columbus, OH) |

| 2 | 06489 | Southington, CT (Hartford, CT) |

| 3 | 07450 | Ridgewood, NJ (New York, NY) |

| 4 | 01810 | Andover, MA (Boston, MA) |

How are funds disbursed at closing?

The most common ways are by cashier's check or wire transfer. You can take payment by check in person at the closing or have it mailed to you or your REALTOR®.

With over 122,000 Real Estate Agents in Texas, Thank You for your trust and continued support! Taking care of you is my passion. It feels incredible to help so many Houstonians make their home dreams come to reality ✨?✨ pic.twitter.com/owX8ZBD3e1

— Deshia Joelle (@Realtor_Deshia) December 27, 2021

When you sell a house does the bank give you all the money?

When you close on the sale, you'll use the proceeds to pay off your mortgage lender and any outstanding fees or closing costs. A representative of the lender will be at the closing to collect the money due to them. Whatever is left over after that is your profit — that's the money you get to keep, aka the net proceeds.

How long does it take for funds to be released after closing?

A wire transfer can take between 24 to 48 hours to process but is usually available in your account within one business day. Meanwhile, a paper check could be available right at the time of closing but will need to be deposited and cleared, and a bank can often hold that deposit for up to seven days.

How long does money stay in escrow after closing?

30-60 days

The escrow process typically takes 30-60 days to complete. The timeline can vary depending on the agreement of the buyer and seller, who the escrow provider is, and more. Ideally, however, the escrow process should not take more than 30 days.

What is the hardest section of the real estate exam?

The area of the exam that is considered the most challenging varies from person to person, but many people find that the Practice of Real Estate and Disclosures section is the most difficult. This section takes up 25% of the exam and has between 37-38 questions to answer.

What are the three areas of focus with real estate?

The main segments of the real estate sector are residential real estate, commercial real estate, and industrial real estate.

What is the hardest license to get?

Based on failures by well prepared persons, I believe the Bar Exam (becoming a lawyer) is the hardest professional license to get. I passed both halves of the PE (EIT and PE) on first shot, which is unusual -- tough, but… My ex passed the Realtor's License -- required study, but not all that rough.

When you sell a house do you get all the money at once?

The full amount of the home's final price doesn't go right into your pocket. In fact, all in all, you might only realize only 60 to 70 percent of the home's value in net proceeds. Let's look at where the money goes, and how much you get to keep when you sell a home.

How is the money split when a house is sold?

How to Split Proceeds from the Sale of a House. The proceeds are divided according to each owner's percentage of ownership in the property, unless there is an agreement in place that specifies a different distribution. This split remains based on the percentage of ownership each person has in the property.

How do I file income taxes for an estate?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

Do I have to report the sale of my primary residence to the IRS?

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

How do I report rental income to the IRS?

If you rent real estate such as buildings, rooms or apartments, you normally report your rental income and expenses on Form 1040 or 1040-SR, Schedule E, Part I. List your total income, expenses, and depreciation for each rental property on the appropriate line of Schedule E. See the Instructions for Form 4562 to figure ...

Do I have to file an estate tax return federal?

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

How many clients do realtors have at once?

A: Realtors typically represent any number of clients simultaneously. Each client's needs can vary, so rather than focusing on an arbitrary number of clients, the issue is rather how to effectively manage multiple clients.

How many houses do most realtors sell?

According to NAR, the average Realtor completes a median of 12 residential transactions annually. However, it's important to keep in mind that this doesn't necessarily indicate how many houses the average Realtor sells. A completed transaction can mean the agent assisted on either the buyer's or seller's side.

How many houses do you need to sell to make $100 000?

How many houses does an agent have to sell to make $100,000 a year? If you are selling $100,000 houses and paying 40 percent of your commission to your broker you would have to sell over 50 houses a year to gross $100,000 a year. That is a lot of houses to sell, especially for a new agent.

How to make $100 000 your first year in real estate?

To make $100,000 a year real estate agents will need to focus on constant lead generation to maintain and grow their database. Taking action on priority tasks, not getting distracted by shiny objects. And be extremely consistent even when busy or when things don't feel like they're working.

How many houses do most realtors sell a year?

So How Many Houses Does a Realtor Really Sell Each Year? Only a small number of realtors sell more than a hundred homes a year, and the majority sell anywhere between 2-10 homes a year. Further, first-year or those just starting as realtors usually sell the least number of homes.

Can I use Section 121 exclusion on a rental property?

Homeowners can move out of their primary residence and convert it to any other non-qualified use such as rental, investment, vacation, or business use property and still qualify for the tax free exclusion under Section 121.

How many times can you use the home sale exclusion?

You're only allowed to exclude gain on the sale of a home once every two years. This is true unless the reduced gain exclusion rules apply. You usually can't exclude the gain on the sale of a home if both of these apply: You sold another home at a gain within the past two years.

What are the two rules of the exclusion on capital gains for homeowners?

The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify. The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

What is the basis when converting home to rental?

The property's "regular basis" on the conversion date. This generally equals the original cost of both the land and the building plus the cost of any improvements (not counting normal repairs and maintenance) minus any depreciation deductions you might have claimed before the property was converted into a rental.

What are the limitations of Section 121 exclusion?

The Section 121 Exclusion is an IRS rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000.

How much does it cost to get your real estate license in Kentucky?

Here are the costs associated with obtaining your Kentucky real estate salesperson license. State Exam Fee: $100. License Application Fee: $130. Total Cost: $664.25.

How much is PA real estate license?

Sample Pennsylvania Real Estate License Costs

Sep 26, 2023

| Prelicensing classes (75 hours) | $419-$685 (through The CE Shop) |

|---|---|

| Exam registration | $49 |

| Background check | $22 |

| License application | $97 |

| Total Costs: | $636-$902 |

How much does it cost to get your real estate license in NC?

Sample North Carolina Real Estate License Costs

Apr 28, 2023

| 75-hour Prelicensing Course | $715 (through The CE Shop) |

|---|---|

| Exam Registration | $56 |

| Background Check | $15 |

| License Application | $100 |

| Total Costs: | $886 |

Is the Mississippi real estate exam hard?

The passing rate for the Mississippi Real Estate Salesperson Exam is 75%. This test is purposefully difficult, but not impossible. Be sure to pay attention during your pre-license course and take studying seriously. If you put the proper effort forth, we know that you can pass on your first attempt!

How hard is the real estate exam in KY?

The passing rate for the Kentucky Real Estate Salesperson Exam is 75%. This test is purposefully difficult, but not impossible.

What does minimum market value mean?

Minimum Market Price The Minimum Market Price (MMP) is the minimum price allowed in the STTM for any type of bid, offer, or market price.

How do you determine the market value of a property?

How Can I Determine The Value Of My Home?

- Use Online Home Valuation Tools. One of the easiest ways to estimate the value of your home is by using an online home valuation tool.

- Hire A Professional Appraiser.

- Consult A REALTOR®

- Pull 'Comps' On Similar Properties.

How do you determine fair market value for tax purposes?

According to the IRS, it's the price that property would sell for on the open market. This is the price that would be agreed upon between a willing buyer and a willing seller. Neither would be required to act, and both would have reasonable knowledge of the relevant facts.

What is considered market value in real estate?

Market value is how much a home would sell for under normal conditions. This excludes sales where the buyer or seller is under pressure to act, perhaps due to career relocation, death of a family member, or divorce.

What is the difference between market price and market value?

If you want to be a successful real estate investor, you need to understand the difference between market price and market value. Essentially, market price is what someone is willing to pay for a property. Market value, on the other hand, indicates what a property is actually worth.

Is $1,500 rent too much?

Take rent for example. The traditional advice is simple: Spend no more than 30% of your before-tax income on housing costs. That means if you bring in $5,000 per month before taxes, your rent shouldn't exceed $1,500.

How much of your take home should go to rent?

Try the 30% rule. One popular rule of thumb is the 30% rule, which says to spend around 30% of your gross income on rent. So if you earn $3,200 per month before taxes, you should spend about $960 per month on rent. This is a solid guideline, but it's not one-size-fits-all advice.

Is 1200 rent too much?

How Much Should You Spend on Rent? Try the 30 Percent Rule. Financial experts generally recommend spending around 30% of your gross income on rent. So if you earn $48,000 a year – $4,000 a month before taxes – you should spend around $1,200 a month on rent.

How much of your net income should you spend on housing?

35% / 45% rule

Essentially, this housing payment rule says your housing payment shouldn't be more than 35% of your gross income or more than 45% of your net income after you pay taxes.

Is 30% rent unrealistic?

The 30% Rule ignores your full financial picture

Say you're making $30,000 per year and have no household debt. According to the 30% Rule, you would be able to spend $750 per month on rent, which would leave roughly $1,300 a month for savings and expenses (or $325 per week, or $46 per day) after taxes.