Working as a real estate agent or broker can be fulfilling and financially rewarding, but it's not easy. A career in real estate requires drumming up business, promoting yourself, tracking leads, handling complex paperwork, providing customer service, and much, much more.

What are the chances of making it as a real estate agent?

Being a successful real estate agent is easier said than done. After all, there's a reason 87% of real estate agents fail. However, knowing the mistakes these realtors make, such as failing to follow up with clients or not having adequate funding, can help you prepare and grow a successful real estate business.

How hard is it to become a real estate agent in Texas?

It may take up to six months to complete the required 180 hours of real estate education and become a licensed real estate agent in Texas. It might also take a few additional years if you decide to attend university and earn a degree in the field.

How long does it take to get a real estate license in CA?

3-6 months

TL;DR: Getting a real estate license in California typically takes 3-6 months. The process includes completing a pre-licensing course, passing the state exam, and completing background checks. The timeline may vary depending on individual circumstances.

Is real estate good for beginners?

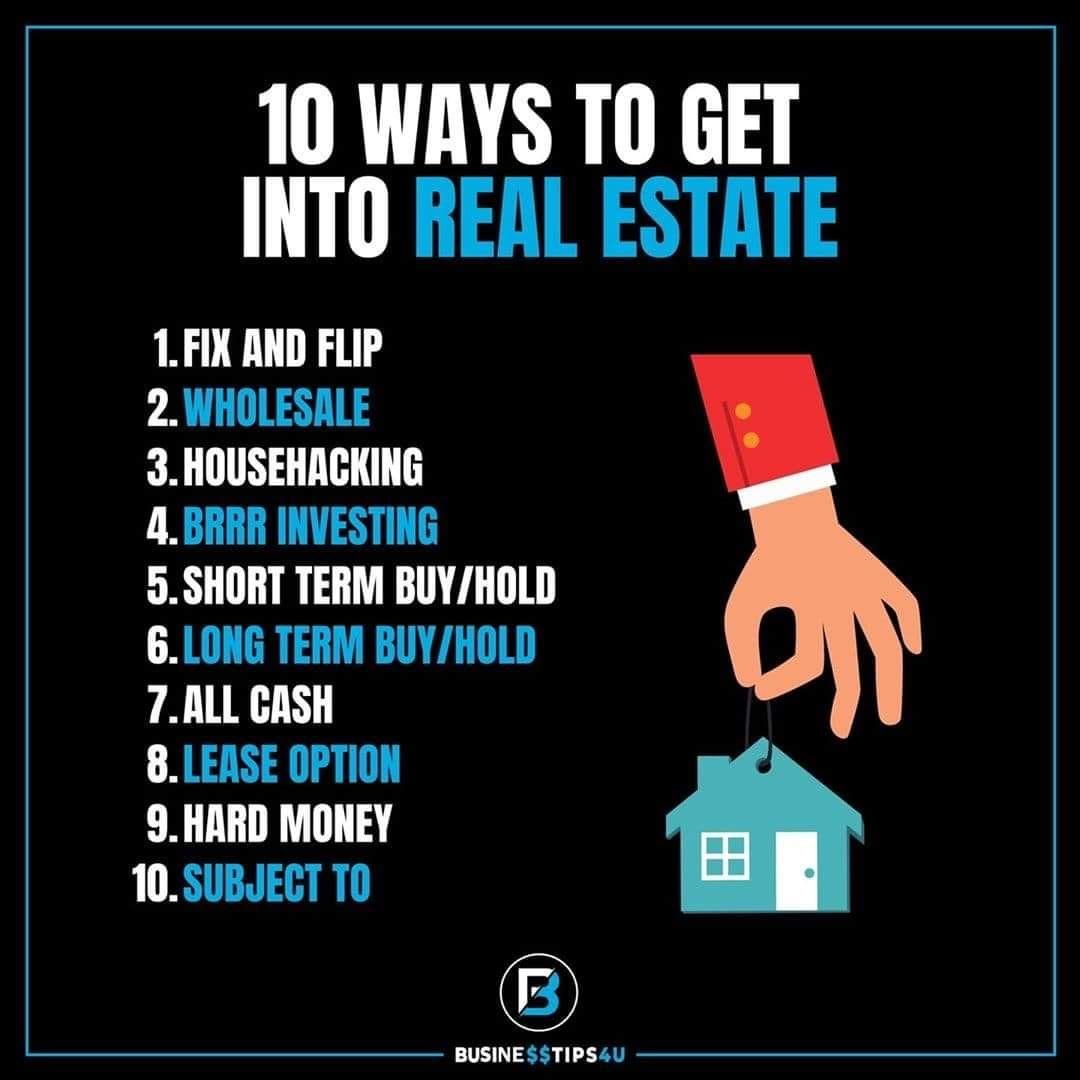

No matter what your starting point is, there is no reason real estate should be off-limits. Several investing strategies can serve as a gateway into a successful career in real estate. Take some time to learn about real estate investing for beginners and find the right strategy for you.

What is a home price estimate called?

The process many realtors use to estimate a home's value is called a Comparative Market Analysis (CMA).

Starting a real estate private equity firm is hard.

— Sean Sweeney (@seandsweeney) September 9, 2023

Very hard.

Scaling it? Even harder.

Most people that successfully grow a company have a mentor.

Or multiple.

And a peer group experiencing the same challenges.

These are key.

But finding these people is hard.

Nearly…

What is the expense sheet for selling a house?

The seller's net sheet is calculated by taking the home sale price or an offer and then subtracting any encumbrances on the property (outstanding mortgage being the most common), closing costs and miscellaneous fees.

What is estimate also called?

Preliminary estimates are also called rough or approximate estimates, according to Civil Engineering Daily. This is because they are not final—they give a ballpark idea of how much a project will cost. A preliminary estimate is made at the very beginning of a project when there's limited information available.

Is it hard starting in real estate?

Key Takeaways. Working as a real estate agent or broker can be fulfilling and financially rewarding, but it's not easy. A career in real estate requires drumming up business, promoting yourself, tracking leads, handling complex paperwork, providing customer service, and much, much more.

What do you need to become a real estate agent in North Carolina?

Requirements to Qualify to Become a North Carolina Real Estate Broker

- Be at least 18 years old.

- Be a US citizen, a non-citizen national, or a qualified alien under federal law.

- Complete a state-approved 75-hour broker prelicensing course.

- Pass the North Carolina State Licensing Examination with a score of at least 75%.

What is the best month to list rental property?

The best time to list a home for rent to a long-term tenant is during the peak summer rental season, when there is more demand. College towns typically have a peak rental season from May to August, while vacation rentals can have a peak season that varies depending on the location.

Is it better to sell a paid off house or use it as a rental?

Selling your home might be the better option if you need the money to pay for your next home, have no interest in being a landlord or stand to make a large profit. Renting it out might be a better choice if your move is temporary, you want the rental income or you expect home values to go up in your area.

Is it better to keep property or sell it?

If you are planning to put your home on the market because you're moving for a period of five years or more, then selling could make more sense than renting out your home. You can use the profit from the sale to purchase a new home, which helps to offset financial losses and build equity over time.

What month is rent cheapest?

The cheapest months to rent are between December and March, or early winter to early spring. Compared to peak months, rental prices during this period tend to be 3.4% lower, with dollar savings coming in at $38 to $139 less for one bedroom apartments and $47 to $176 less for two bedroom apartments.

Is 2 years too soon to sell a house?

Selling before the two-year mark can be costly. “Staying long enough to hit 24 months can save you a significant amount of money on taxes,” says Jeremy Babener, a tax attorney and founder of Structured Consulting in Portland, Oregon. It's all about capital gains taxes.

What is the 2 out of 5 year rule?

When selling a primary residence property, capital gains from the sale can be deducted from the seller's owed taxes if the seller has lived in the property themselves for at least 2 of the previous 5 years leading up to the sale. That is the 2-out-of-5-years rule, in short.

How long do you need to live in a house to avoid capital gains?

Two years

The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify. The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

How much equity should I have in my home before selling?

How much equity should you have before you sell your house? At the very least you want to have enough equity to pay off your current mortgage, plus enough left over to make a 20% down payment on your next home.

How can I avoid capital gains tax before 2 years?

Capital gains taxes will be paid at the standard rate if you sell before the two-year mark because you won't receive any exemption. To avoid the taxes on a sale of a home, you must use the property as your primary residence for a minimum of two years. Doing so will ensure you avoid any capital gains penalties.

What are the rights of a tenant during the sale of a house in Massachusetts?

The mere sale of property, on its own, will not require any existing tenants to vacate the property. All landlords need to exercise extreme care with Massachusetts' security deposit law. This law regulates the acceptance, holding, and return of a security deposit, and comes with severe penalties if violated.

What is the 2% rule in real estate?

The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

How much profit should you make on a rental property?

The amount will depend on your specific situation, but a good rule of thumb is to aim for at least 10% profit after all expenses and taxes. While 10% is a good target, you may be able to make more depending on the property and the rental market.

What happens if my landlord sells the house I m renting in Massachusetts?

In general, a lease agreement is binding until the end of the lease term, even if the property is sold during that time.

How do investors make money in real estate?

There are four main money making strategies for real estate investors: buy a property and wait for it to appreciate in value; rent out a property to tenants or businesses to generate cash flow; invest in residential properties; invest in real estate projects or find other work in the industry.

How do I become a small real estate investor?

10 Best Ways to Invest in Real Estate With Little or No Money

- Purchase Money Mortgage/Seller Financing.

- Investing In Real Estate Through Lease Option.

- Hard Money Lenders.

- Microloans.

- Forming Partnerships to Invest in Real Estate With Little Money.

- Home Equity Loans.

- Trade Houses.

- Special US Govt.

What do investors do in real estate?

Real estate investing involves the purchase, management and sale or rental of real estate for profit. Someone who actively or passively invests in real estate is called a real estate entrepreneur or a real estate investor. Some investors actively develop, improve or renovate properties to make more money from them.

Is it a good idea to invest in real estate?

Real estate investments can serve as a hedge against inflation. Real estate ownership is generally considered a hedge against inflation, as home values and rents typically increase with inflation. There can be tax advantages to property ownership.

How much do most real estate investors make?

Real Estate Investor Salary in California

| Annual Salary | Weekly Pay | |

|---|---|---|

| Top Earners | $414,935 | $7,979 |

| 75th Percentile | $123,400 | $2,373 |

| Average | $130,647 | $2,512 |

| 25th Percentile | $39,900 | $767 |

What is the IRS 1040 deduction for real estate taxes?

The total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or sales taxes) is limited to $10,000; or $5,000 if married filing separately.

When would IRS Form 1099s be used in real estate?

If real estate is sold or exchanged and other assets are sold or exchanged in the same transaction, report the total gross proceeds from the entire transaction on Form 1099-S. You must request the transferor's TIN no later than the time of closing. The TIN request need not be made in a separate mailing.

What 1099 is used for real estate?

Form 1099-S

Use Form 1099-S to report the sale or exchange of real estate.

What is IRS Form 6198 used for?

Use Form 6198 to figure: The profit (loss) from an at-risk activity for the current year. The amount at risk for the current year. The deductible loss for the current year.

Can property taxes be deducted in IRS?

State and local real property taxes are generally deductible. Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare.

How do I prepare my home for long term rental?

Make sure it is clean and freshly painted, and replace anything that looks severely dated. Understand Fair Housing laws before you list the property, and run a credit check on prospective renters. Consider hiring a property management company to serve as the landlord for you.

Will the bank find out if I rent my house?

Renting out your home and failing to notify your mortgage provider about it could prove to be a very expensive mistake. If your lender catches you doing this when the terms and conditions of your mortgage specifically forbid it, they could potentially call in the entire amount of the loan.

Can I Airbnb my house?

So, as long as you have checked with your mortgage provider or landlord, letting out your property on Airbnb is possible. Providing you have a location people desire, pricing that draws attention, be fully safety compliant and have the correct insurance, there isn't much more you need to do.

Can I depreciate my primary residence if I rent it out?

Another benefit of converting a primary residence into a rental is the ability to depreciate the physical improvements, typically over a period of 27.5 years. As IRS Publication 946 explains, depreciation is an expense allowance for the wear and tear, deterioration, or obsolescence of the property.

What are three costs of renting?

What are three costs of renting? Utilities, monthly rent, and renter's insurance.

What makes a real estate agent stand out?

Here are some practical tips that you can work with to achieve this goal:

- Find Your Niche.

- Create an Influential Online Presence.

- Be Realistic with Your Clients.

- Identify Your Uniqueness.

- Advertise and Promote Yourself with Creativity.

- Become a Community Leader.

- Final Thoughts Standing Out as a Real Estate Agent.

What are the three most important things in real estate as an agent?

I believe the three most important things when it comes to real estate are "location, timing, and circumstances," and here's why.

What personality types are real estate agents?

Personality Traits of the Average Real Estate Agent

- Risk-tolerant. Willing or open to taking risks.

- Trusting. Belief in a person's honesty or sincerity; not suspicious.

- Optimistic. Hopeful and confident about the future.

- Deliberate. Fully considered; not impulsive.

- Matter-of-fact. Unemotional and practical.

- Autonomous.

- Supporting.

How can I look good as a real estate agent?

Maintain a Professional Appearance

A real estate agent is a professional career, and your attire should reflect this level of accomplishment and expertise. Traditional options include dress pants or slacks, blazers, cardigans, and blouses or shirts. Unless you work in a farm community, reserve jeans for free time.

Can a shy person be a real estate agent?

While extroverts get all the credit for closing sales, introverts have their own skillset--one that is surprisingly perfect for real estate.

What are the three most important things in real estate?

To achieve those goals, the three most important words in real estate are not Location, Location, Location, but Price, Condition, Availability. Let's look at the first word – Price.

What are the 5 golden rules of real estate?

Summary. If you follow these 5 Golden Rules for Property investing i.e. Buy from motivated sellers; Buy in an area of strong rental demand; Buy for positive cash-flow; Buy for the long-term; Always have a cash buffer. You will minimise the risk of property investing and maximise your returns.

What are the 4 P’s of real estate?

The 4 Ps of Real Estate Marketing

- Product. As a realtor, your product isn't just real estate — it's the unique characteristics of the real estate that will appeal to buyers.

- Promotion.

- Price.

- Place.

What is Rule 70 in real estate?

Put simply, the 70 percent rule states that you shouldn't buy a distressed property for more than 70 percent of the home's after-repair value (ARV) — in other words, how much the house will likely sell for once fixed — minus the cost of repairs.

What are the 4 R’s of real estate?

The BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method is a real estate investment approach that involves flipping a distressed property, renting it out and then getting a cash-out refinance on it to fund further rental property investments.