How can I avoid capital gains taxes on real estate?

- Own and live in your house for at least two years before you sell.

- Sell before your profits exceed the allowable exclusion.

- Sell before you file for divorce: If you're planning to get divorced, you may want to sell your home first.

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.

What is a simple trick for avoiding capital gains tax on real estate investments?

One of the easiest ways to evade paying capital gains tax after selling your rental property is to invest in a retirement plan. You can invest in a 401(K) or an individual retirement account (IRA). Retirement plans enable you to buy and sell property within the retirement account without attracting capital gains tax.

Can I reinvest capital gains to avoid taxes?

To avoid paying capital gains taxes (and any depreciation recapture), you can reinvest in a "like-kind" asset with a sales price of at least $500,000. The IRS allows virtually any commercial real estate property to qualify as 'like-kind” as long as you hold it for investment purposes.

What is the best major for a real estate broker?

Popular majors for future real estate agents include marketing, finance, accounting, psychology, and business. Even though going to college isn't required, you may find it helpful to complete a degree or certificate program to gain knowledge that would help you succeed as a real estate agent.

7. Capital Gains

— Fiona Smith (@The_MMW) May 25, 2023

Invest in appreciating assets that will gain value over time.

Examples include:

- Fine art

- Real estate

- Classic cars

- Collectibles

Buy & hold for the long term to make money.

What is the job description of a broker?

A broker is a sales professional who executes sales transactions between two parties in exchange for a commission. Present in real estate, finance and other sectors, brokers facilitate the sale of financial products, property assets, intellectual property, material goods and more.

What degree do most brokers have?

What Types of Degrees Should I Earn to Become a Stock Broker? Ideally, a prospective stock broker will earn a bachelor's degree in business or a finance-related discipline such as accounting, economics, finance, business administration, marketing, management, or a similar degree.

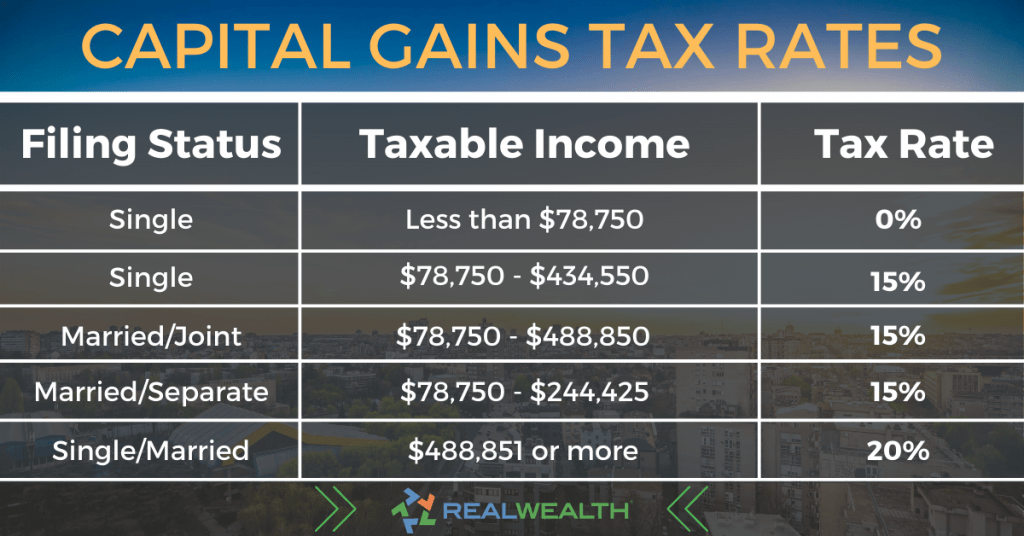

What is the threshold for capital gains on real estate?

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.

How much capital gains tax on $200,000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

What kind of credit do I need to buy an investment property?

Conventional loans

To qualify for a 15% down payment for a conventional loan on a one-unit investment property, you'll need at least a 700 credit score — in most cases. One exception is if your DTI ratio is 36% or lower; in that case, 680 is the minimum required credit score.

Can I buy an investment property with 650 credit score?

Whether or not you can qualify for a mortgage on an investment property depends on your financial portfolio. You'll need a credit score of at least 640, though you probably want your score above 700 to qualify for a lower interest rate.

Can I buy a investment property with 700 credit score?

For a jumbo (non-conforming) loan on an investment property, you'll need a minimum credit score of at least 700, 12 months of cash reserves, and a minimum down payment of 20%. All conventional loans with Better Mortgage require borrowers to have a maximum debt-to-income ratio of 43%.

Is it harder to get a loan for an investment property?

Lenders don't want borrowers to default on investment property loans, which is why they can make it harder to qualify. If you're interested in getting a loan to buy an investment property, you have more than one option. Banks, credit unions and online lenders can offer investment property loans.

What state has the most valuable real estate?

1. Hawaii. Hawaii is known for its beautiful beaches, warm climate, and breathtaking scenery. However, it is also the most expensive state to buy a house, with a Zillow Home Value Index of $834,582.

What state has the hottest real estate market right now?

Best Real Estate Markets In The U.S.

- Austin, Texas (Metro Area) Median listing price: $620,000.

- Tampa, Florida. Median listing price: $388,800.

- Raleigh, North Carolina. Median listing price: $389,000.

- Nashville, Tennessee (Metro Area)

- Charlotte, North Carolina.

- San Antonio, Texas.

- Phoenix, Arizona.

- Jacksonville, Florida.

What is the hardest state to buy a house in?

Perhaps unsurprisingly, Hawaii tops the list of “the hardest state in which to buy a home”. It has been a tourist favorite since becoming the 50th U.S. state in 1959, with the yearly visitors outnumbering the residents in 2022.

Where is real estate growing the most?

U.S. metros with the biggest increases in home values in 2022

| Metro area | Growth | |

|---|---|---|

| 1. | FarmingtonNew Mexico | 20.3% |

| 2. | North Port-Sarasota-BradentonFlorida | 19.5% |

| 3. | Naples-Immokalee-Marco IslandFlorida | 17.2% |

| 4. | Greensboro-High PointNorth Carolina | 17% |

What is the best state to buy a house in?

10 best states for first-time homebuyers plus key factors

| Rank | State | 1-year home price change: 2021–2022 |

|---|---|---|

| 1 | Pennsylvania | 4.1% |

| 2 | North Carolina | 10.1% |

| 3 | Utah | 5.8% |

| 4 | Kentucky | 7.2% |

What is the capital gains tax on $60 000?

Capital gains tax rate – 2022 thresholds

| Rate | Single | Head of Household |

|---|---|---|

| 0% | Up to $41,675 | Up to $55,800 |

| 15% | $41,675 to $459,750 | $55,800 to $488,500 |

| 20% | Over $459,750 | Over $488,500 |

How do you calculate capital gains tax on the sale of a house?

Capital gains tax is the tax owed on the profit (aka, the capital gain) you make on an investment or asset when you sell it. It is calculated by subtracting the asset's original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price.

What is the capital gains on $100 000?

In this example, you see a capital gain of $100,000 on your home sale. If your income and asset class put you in the 20% capital gains tax bracket, you pay 20% of your profit. That's 20% of $100,000, or $20,000.

What is the capital gains tax on $200 000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

At what age do you not pay capital gains?

For individuals over 65, capital gains tax applies at 0% for long-term gains on assets held over a year and 15% for short-term gains under a year. Despite age, the IRS determines tax based on asset sale profits, with no special breaks for those 65 and older.

What are the rules for real estate withholding in California?

The standard withholding is 3.33% of the Sales Price. Sellers can pay more, but not less unless they take advantage of Part VI and request an Alternative Amount, like 12.3% on the gain amount for an individual or 8.84% or 13.8% for a corporation, depending on the type of corporation.

Under which circumstance may withholding be required?

California law requires withholding when a person (an individual, business entity, trust, or estate) sells California real property unless the seller qualifies for an exemption.

Who needs to file Form 593?

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

Who can be held liable for estimated taxes not withheld from the sale price of any property owned by a foreigner?

In most cases, the buyer (transferee) is the withholding agent. The transferee must find out if the transferor is a foreign person. If the transferor is a foreign person and the transferee fails to withhold, the transferee may be held liable for the tax.

What makes you exempt from California withholding?

In order to claim exemption from state income tax withholding, employees must submit a W-4 (PDF Format, 100KB)*. or DE-4 (PDF Format, 147KB)* certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Do sellers pay property taxes at closing Texas?

Prorated Bills for Sellers and Buyers

To put it in simple terms, the seller will be responsible for the property tax balance that accrued from the beginning of the tax year until the date of closing, and the buyer will be responsible for property taxes that are due for the period after the closing date.

How are property taxes handled at closing in Indiana?

Property taxes and HOA fees: These get charged right up until closing day. If you owe any outstanding property taxes and HOA fees at that date — for example, if they're due on the 1st of the month and you close on the 20th — you must pay those at the time of closing.

Are property taxes paid in advance or arrears in Georgia?

In Georgia, property taxes are paid in arrears. This means that bills are sent out between October and December (depending on the county), and the tax bill is assessed for the year just completed. For this reason, home sales will generally include a prorated property tax credited to the buyer.

Are Texas property taxes paid in advance or arrears?

Arrears

Property taxes in Texas are due annually, but paid in arrears. The Texas property tax year runs from January 1st through December 31st.

Who pays the property taxes when selling a house in Texas?

In Texas, the property taxes are due at the end of the year. The taxing authorities will only accept payment from one entity. Therefore, when you sell or buy a home, the property taxes will be prorated at closing so that each party pays their portion of the year's taxes.

How do you establish the basis of a property?

Cost Basis of a Property

You use the full purchase price as your starting point, regardless of how you pay for the property—with cash or a loan. If you buy property and take over an existing mortgage, you use the amount you pay for the property, plus the amount that still must be paid on the mortgage.

How does basis work in real estate?

Basis is generally the amount of your capital investment in property for tax purposes. Use your basis to figure depreciation, amortization, depletion, casualty losses, and any gain or loss on the sale, exchange, or other disposition of the property. In most situations, the basis of an asset is its cost to you.

How do you prove cost basis in a home sale?

To prove the amount of your basis, keep accurate records of your purchase price, closing costs, and other expenses that increase your basis. Save receipts and other records for improvements and additions you make to the home. When you eventually sell, your basis will establish the amount of your gain.

What costs can be added to the basis of a home?

The real estate basis of a property is the sales price plus certain expenses, like:

- Abstract of title fees.

- Charges for installing utility services.

- Legal fees, like: Title search. Preparation of the sales contract. Preparation of the deed.

- Recording fees.

- Surveys.

- Transfer taxes.

- Owner's title insurance.

- Closing costs.

How does IRS verify cost basis?

How Does the IRS Verify Cost Basis in Real Estate? In real estate transactions, the IRS can verify the cost basis by looking at the closing statement of when the property was purchased, or any other legal documents associated with the property, such as tax statements.

Can I Airbnb my house if I have a mortgage?

Listing a property on Airbnb that has a residential mortgage is possible. However, landlords must be aware of the terms and conditions of their residential mortgage agreement before embarking on the project. Most residential mortgage agreements won't specifically rule out the use of the property as an Airbnb.

Can I Airbnb my house?

So, as long as you have checked with your mortgage provider or landlord, letting out your property on Airbnb is possible. Providing you have a location people desire, pricing that draws attention, be fully safety compliant and have the correct insurance, there isn't much more you need to do.

When should you purchase a house that you plan to live in?

In general, it's best to buy when you have your eye on the horizon and you're thinking long-term. Experts largely agree that you shouldn't own unless you plan on staying in the home for at least five years. That's because, thanks to their high start-up costs, houses don't usually make great short-term investments.

What is the 90-day rule on Airbnb?

Airbnb doesn't allow properties to be rented out for more than 90 nights per year. If your limit for bookings is reached, Airbnb will automatically close your property until the end of the calendar year. In addition to 90 consecutive days, the 90-day limit also applies to 90 days spread throughout the year.

How do I get around 90-day rule on Airbnb?

If you have permission to host beyond the 90-day limit, you are able to request that Airbnb do not apply the 90-day rule to your property and they will remove the limit accordingly.