When do i pay capital gains tax on real estate

Do I Have to Pay Capital Gains Taxes Immediately? In most cases, you must pay the capital gains tax after you sell an asset. What triggers capital gains tax on real estate? If you buy a home and a dramatic rise in value causes you to sell it a year later, you would be required […]

Read MoreHow much is real estate profit taxed

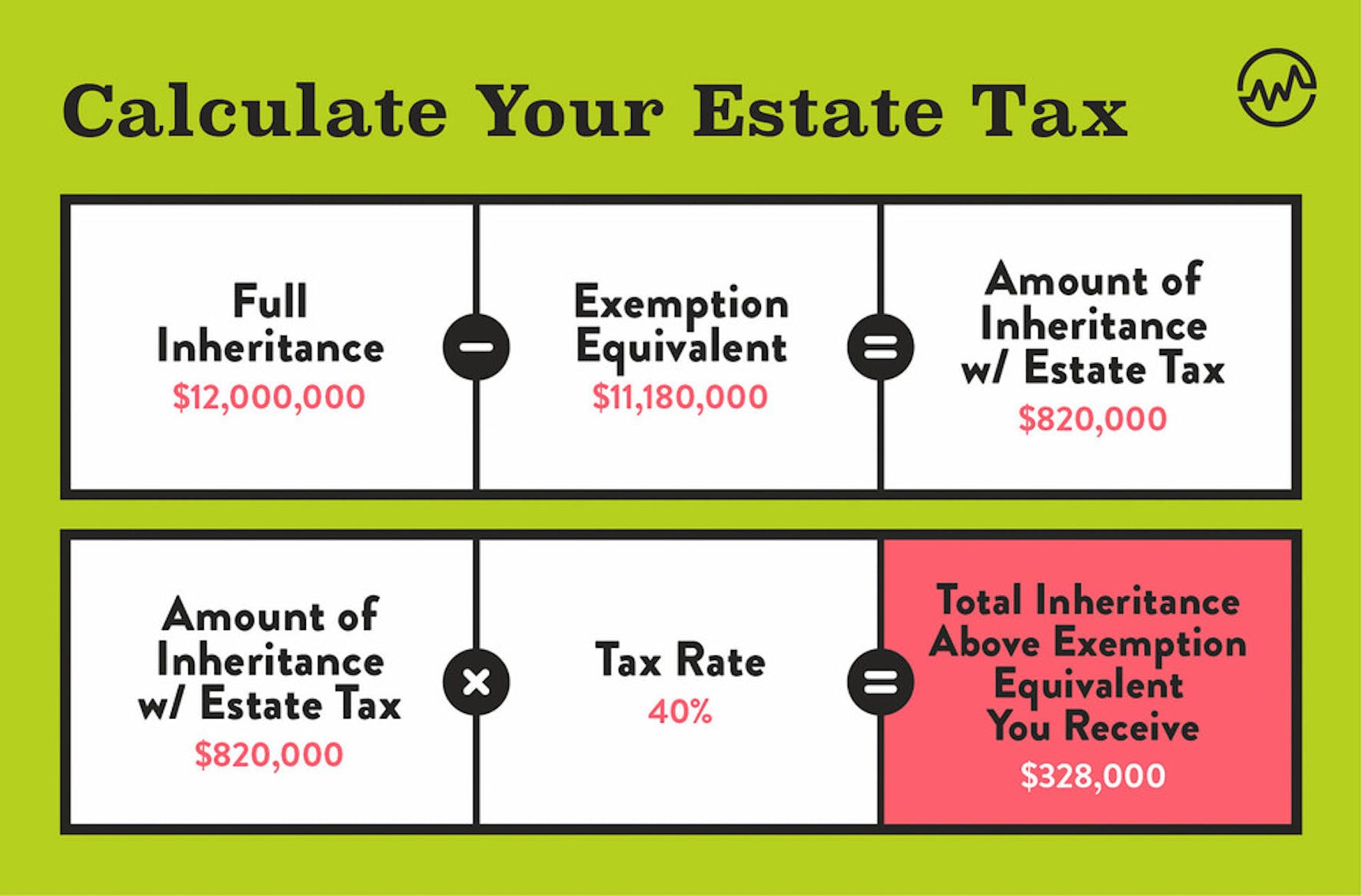

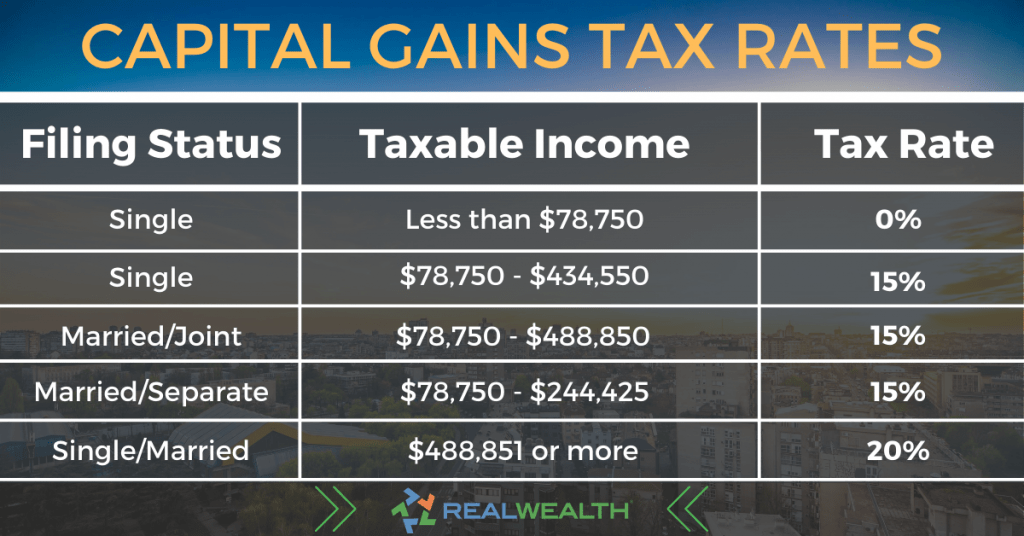

= $ Single Taxpayer Married Filing Jointly Capital Gain Tax Rate $0 – $44,625 $0 – $89,250 0% $44,626 – $200,000 $89,251 – $250,000 15% $200,001 – $492,300 $250,001 – $553,850 15% $492,301+ $553,851+ 20% Jan 11, 2023 What is the $250000 / $500,000 home sale exclusion? There is an exclusion on capital gains up […]

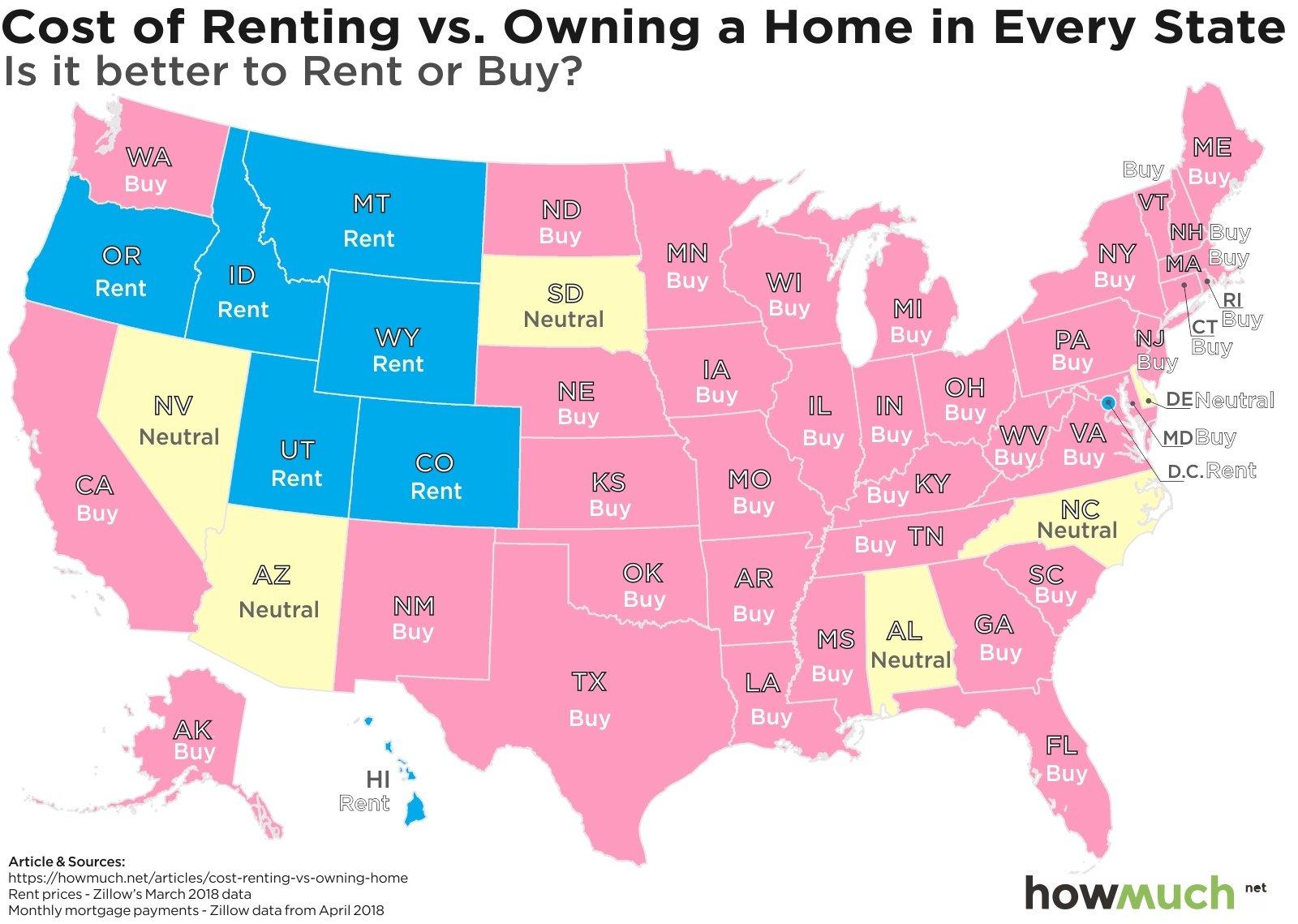

Read MoreWhat are the requirements to rent a house

620 Prove your financially stable. You should aim for a minimum credit score of at least 620 before you apply for a rental home. If you don't meet the credit criteria, a high income and proof of finances can show the landlord you're stable and can afford the rent. What do you need to rent […]

Read MoreHow to avoid capital gains on real estate sales

Fortunately, the IRS gives homeowners and real estate investors ways to save big. You can avoid capital gains tax by buying another house and using the 121 home sale exclusion. In addition, the 1031 like-kind exchange allows investors to defer taxes. How long do I have to buy another property to avoid capital gains? Within […]

Read MoreHow much is house rent in us per month

The average rent for an apartment in the U.S. is $1,702. The cost of rent varies depending on several factors, including location, size, and quality. What is the average rent for a house in the US? Overall, the average rent price in the U.S. is $1,249. Nineteen of 44 reportable states—or 43% —came in above […]

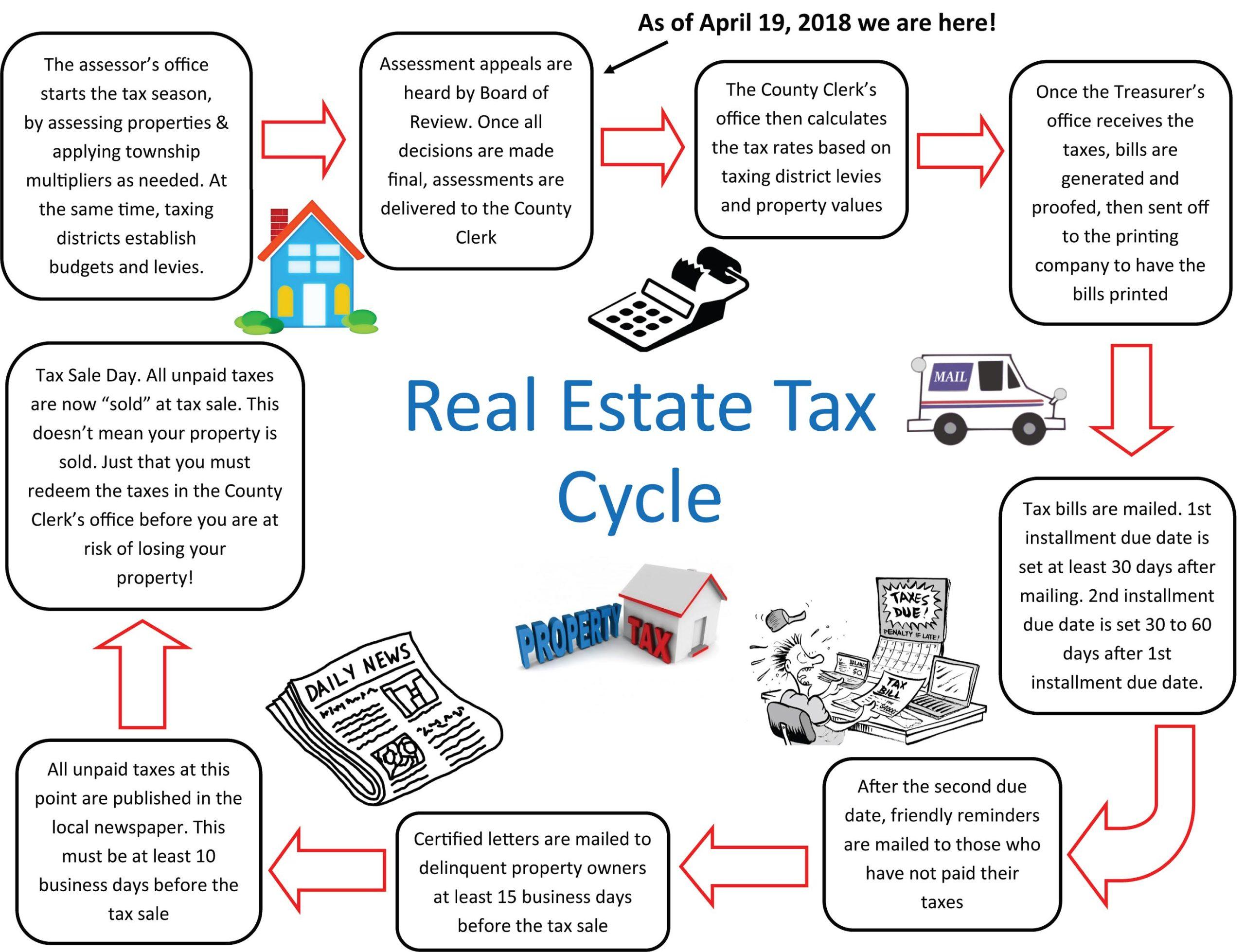

Read MoreHow is real estate taxed

The tax is nearly always computed as the fair market value of the property, multiplied by an assessment ratio, multiplied by a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. How are real estate investment gains taxed? […]

Read MoreHow to rent a house as a landlord

One popular rule of thumb is the 30% rule, which says to spend around 30% of your gross income on rent. So if you earn $3,200 per month before taxes, you should spend about $960 per month on rent. This is a solid guideline, but it's not one-size-fits-all advice. How do I calculate 2.5 times […]

Read MoreHow to avoid short term capital gains on real estate

Can Home Sales Be Tax Free? The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. What […]

Read MoreHow is a real estate sale taxed

The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9. How can […]

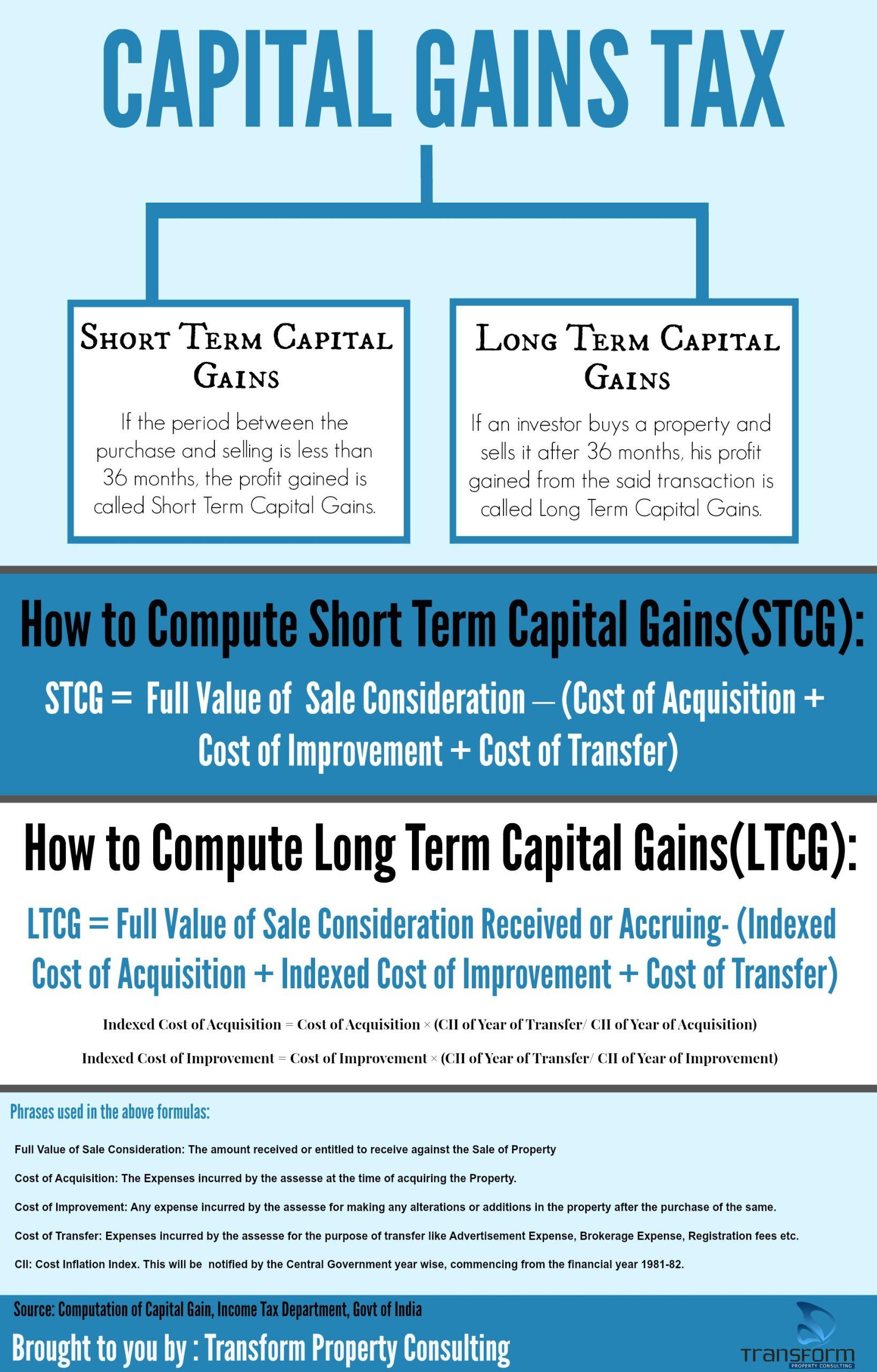

Read MoreHow is capital gains tax on real estate calculated

5 days ago Basically, if you sell a property within 36 months of buying it, you might have to pay CGT. The main goal of this rule is to stop people from avoiding taxes by quickly buying and selling properties. However, there are some special cases where this rule doesn't apply. Do I have to […]

Read More