How to avoid paying capital gains on real estate

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes. What is a simple trick for avoiding capital gains […]

Read MoreHow to report sale of main home

Reporting Home Sale Proceeds to the IRS You must report the sale of a home if you received a Form 1099-S reporting the proceeds from the sale or if there is a non-excludable gain.22 Form 1099-S is an IRS tax form reporting the sale or exchange of real estate. How do I avoid capital gains […]

Read MoreHow much is tax on real estate sale

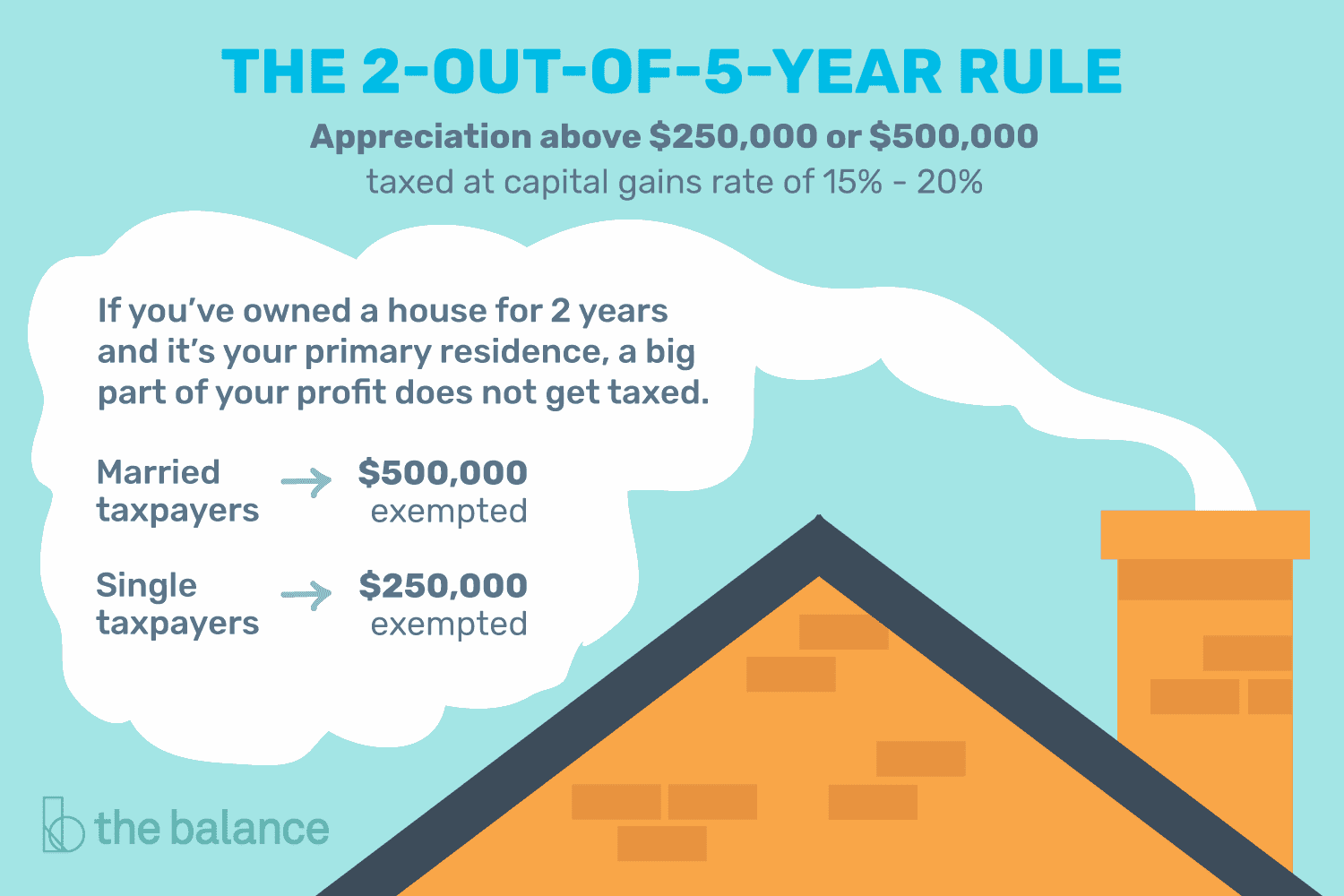

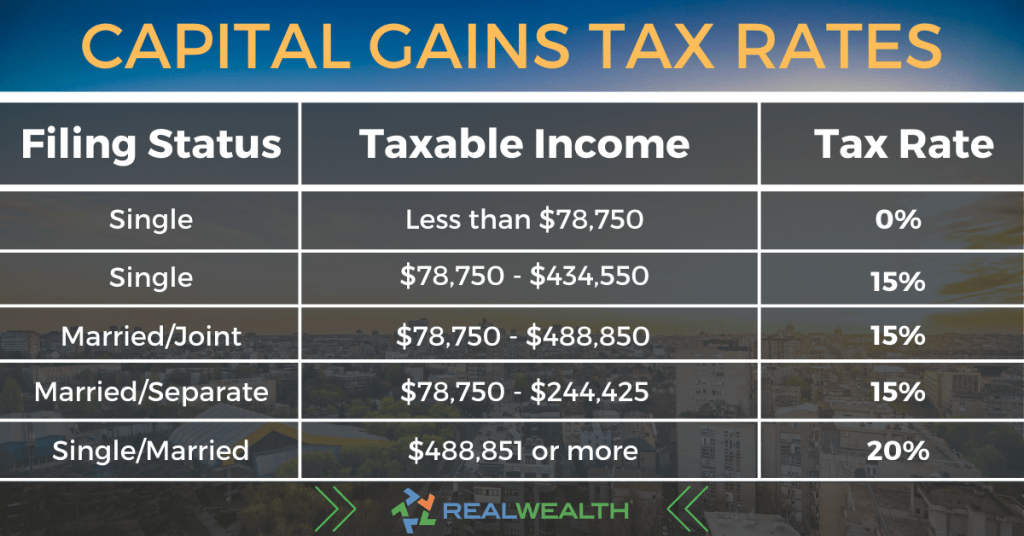

= $ Single Taxpayer Married Filing Jointly Capital Gain Tax Rate $0 – $44,625 $0 – $89,250 0% $44,626 – $200,000 $89,251 – $250,000 15% $200,001 – $492,300 $250,001 – $553,850 15% $492,301+ $553,851+ 20% Jan 11, 2023 What is the $250000 $500000 home sale exclusion? The seller must not have sold a home in […]

Read MoreWhen will real estate market crash

Housing economists point to five main reasons that the market will not crash anytime soon: low inventory, lack of new-construction housing, large amounts of new buyers, strict lending standards and fewer foreclosures. –Will housing prices drop in 2023? Probably not – or at least, not by much. Will the housing market crash in 2023 or […]

Read MoreHow many times can you use the home sale exclusion

Once every two years You're only allowed to exclude gain on the sale of a home once every two years. This is true unless the reduced gain exclusion rules apply. You usually can't exclude the gain on the sale of a home if both of these apply: You sold another home at a gain within […]

Read MoreHow much do you pay on real estate income

= $ Single Taxpayer Married Filing Jointly Capital Gain Tax Rate $0 – $44,625 $0 – $89,250 0% $44,626 – $200,000 $89,251 – $250,000 15% $200,001 – $492,300 $250,001 – $553,850 15% $492,301+ $553,851+ 20% Jan 11, 2023 What percentage of rental income goes to expenses? The 50% Rule states that normal operating expenses – […]

Read MoreHow to avoid capital gains in real estate

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes. How long do I have to buy another property […]

Read MoreHow to start with real estate

One of the fastest ways to get started in real estate is by wholesaling. This unique strategy involves securing a property under market value and assigning an end buyer to purchase the contract. Wholesalers never own the property and instead make money by adding a fee to the final contract. How do beginners make money […]

Read MoreHow is apartment rent calculated

To calculate your monthly rent repayment, use this simple formula to convert weekly rent into the monthly rent payment. Step 1: Weekly Rent ÷ 7 = Daily Rent amount. Step 2: Daily Rent x 365 = Yearly Rent amount. Step 3: Yearly Rent ÷ 12 = Monthly rent amount. How much of your income should […]

Read MoreHow to calculate real estate capital gains tax

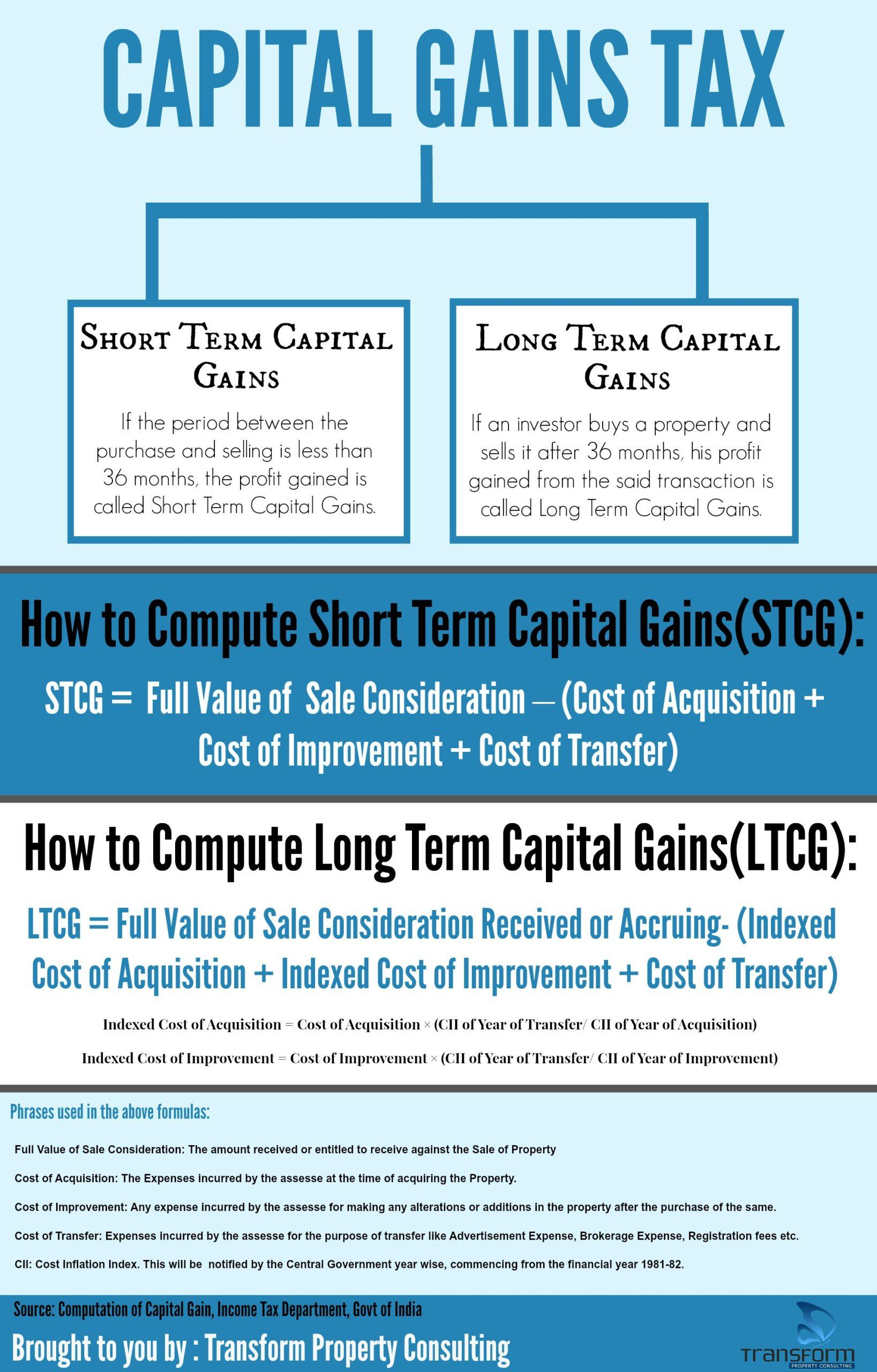

Capital gains tax is the tax owed on the profit (aka, the capital gain) you make on an investment or asset when you sell it. It is calculated by subtracting the asset's original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price. What is the capital gains tax […]

Read More