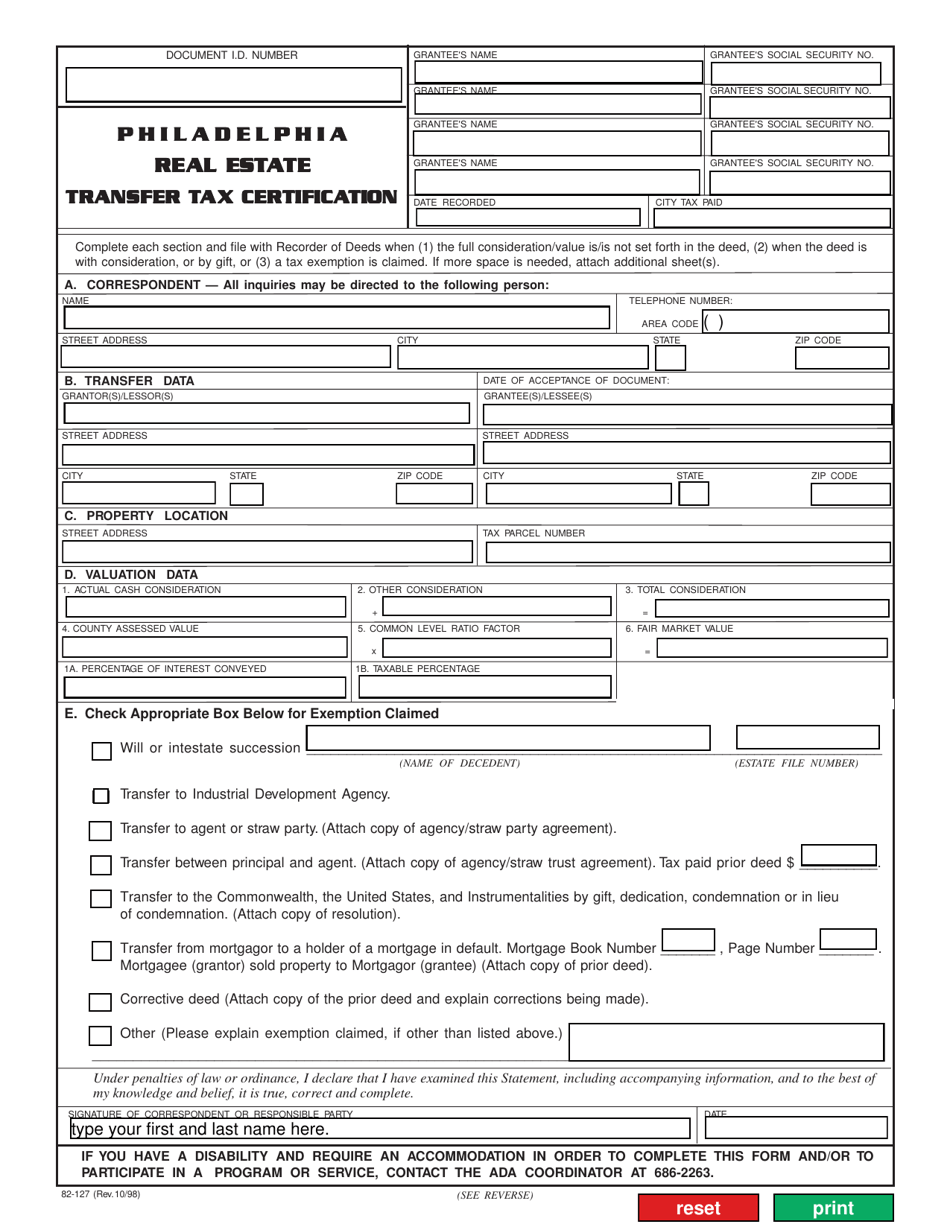

The 2% Transfer Tax is paid at the time of recording. State and local governments do not stipulate who pays the Transfer Tax. In most sale agreements, the seller and buyer divide the tax. However, the new owner is responsible if there is any question over the amount paid.

Who is exempt from PA realty transfer tax?

(6) Transfers between certain family members: (i) A transfer between any of the following: (A) Husband and wife. (B) A lineal ascendent-parent, grandparent, great grandparent and the like-and lineal descendent-child, grandchild, great grandchild and the like. (C) Children of the same parent-siblings.

How do I pay PA realty transfer tax?

- Online. Payments can be remitted online at myPATH.pa.gov via ACH withdrawal using your routing number and account number.

- By Phone.

- Mail.

Who is usually responsible for paying transfer taxes that are due in a real estate transaction?

As we said, the state and local transfer taxes are typically paid by the seller. However, either the buyer or the seller can pay the local taxes, so be sure to check with the particular municipality in which the property resides.

How much tax do you pay when selling a house in PA?

There are two capital gain tax rates to be aware of, Federal and State. The Federal rate is based on your tax bracket and depending on your income can be either 15% or 20%. Pennsylvania has an additional 3.07% (2022).

Does seller pay transfer tax in Pennsylvania?

The 2% Transfer Tax is paid at the time of recording. State and local governments do not stipulate who pays the Transfer Tax. In most sale agreements, the seller and buyer divide the tax. However, the new owner is responsible if there is any question over the amount paid.

At approximately 2:10 pm today at Clarksburg High School, a School Resource Officer arrested a Clarksburg HS male student for having a loaded, handgun on school property. The investigation is ongoing. We will release additional information as it is confirmed.

— Montgomery County Department of Police (@mcpnews) February 15, 2018

Is PA transfer tax paid by both parties?

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing. Both grantor and grantee are held jointly and severally liable for payment of the tax.

Frequently Asked Questions

What is sales tax on title transfer in PA?

6%

Pennsylvania sales tax is 6% of the purchase price or current market value of the vehicle (7% for Allegheny County and 8% for the City of Philadelphia). If you trade in a vehicle, only the difference between the value of the trade-in vehicle and the purchase price of the new vehicle is taxed.

Do you pay taxes when you sell a house in Pennsylvania?

FAQ

- How much are closing costs for buyer in PA?

The closing cost in Pennsylvania for buyers is approximately 2%–5% of the home's agreement value. While the sellers are expected to pay around 6–10% of the home's purchase price. For sellers, that includes the agency commission too.

- What taxes do you pay when you sell a house in PA?

There are two capital gain tax rates to be aware of, Federal and State. The Federal rate is based on your tax bracket and depending on your income can be either 15% or 20%. Pennsylvania has an additional 3.07% (2022).

Who pays real estate transfer tax in pennsylvania

| Who is responsible for transfer tax in PA? | The tax is usually split evenly between the buyer and the seller, but this is not a legal requirement. The City has the right to collect 100% of the tax from either party, so it's in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale. |

| How do I transfer a property title to a family member in PA? | Gift Deed for Real Estate Located in Pennsylvania. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. |

- What is the transfer tax in Reading PA for real estate?

Transfer tax must be calculated for all properties, except mobile homes. To calculate the transfer tax amount, take the amount of your bid and multiply it by 5% for properties located in the City of Reading or 2% for properties outside of the City of Reading.

- How do I avoid real estate transfer tax in PA?

Some real estate transfers are exempt from realty transfer tax, including certain transfers among family members, to governmental units, between religious organizations, to shareholders or partners and to or from nonprofit industrial development agencies.