Who's going to get the house? Well, it's kind of a trick question because it doesn't matter. It doesn't matter whose name is on the deed or whose name is on the mortgage.

What does it mean if your name is on the deed?

Having your name on a deed means that you have property title, which represents a set of rights you have as a homeowner.

What does it mean when someone puts you on the deed?

Your name on the deed means that you have title to the property, and as such, you have a “bundle of rights.” It is common for you to have the right of possession, which means you can possess the property, as well as the right of control, which means you can use the property; you also have the right to enjoy the

Can you find out who was the previous owner of the house?

Go online to your local registrar's website or visit the office in person to search for your property's deed. Once you have the previous owner's name, look up the deed for the property when he or she owned it. The deed will list the name of the person they purchased the home from.

What if my name is on the house but not the mortgage?

Yes, it is entirely possible for a person's name to be on the deed without being on the mortgage. For starters, a mortgage is only involved if the buyer of the home needed assistance financing their home purchase. There are certainly buyers out there who pay all cash for a home and don't need to take out a mortgage.

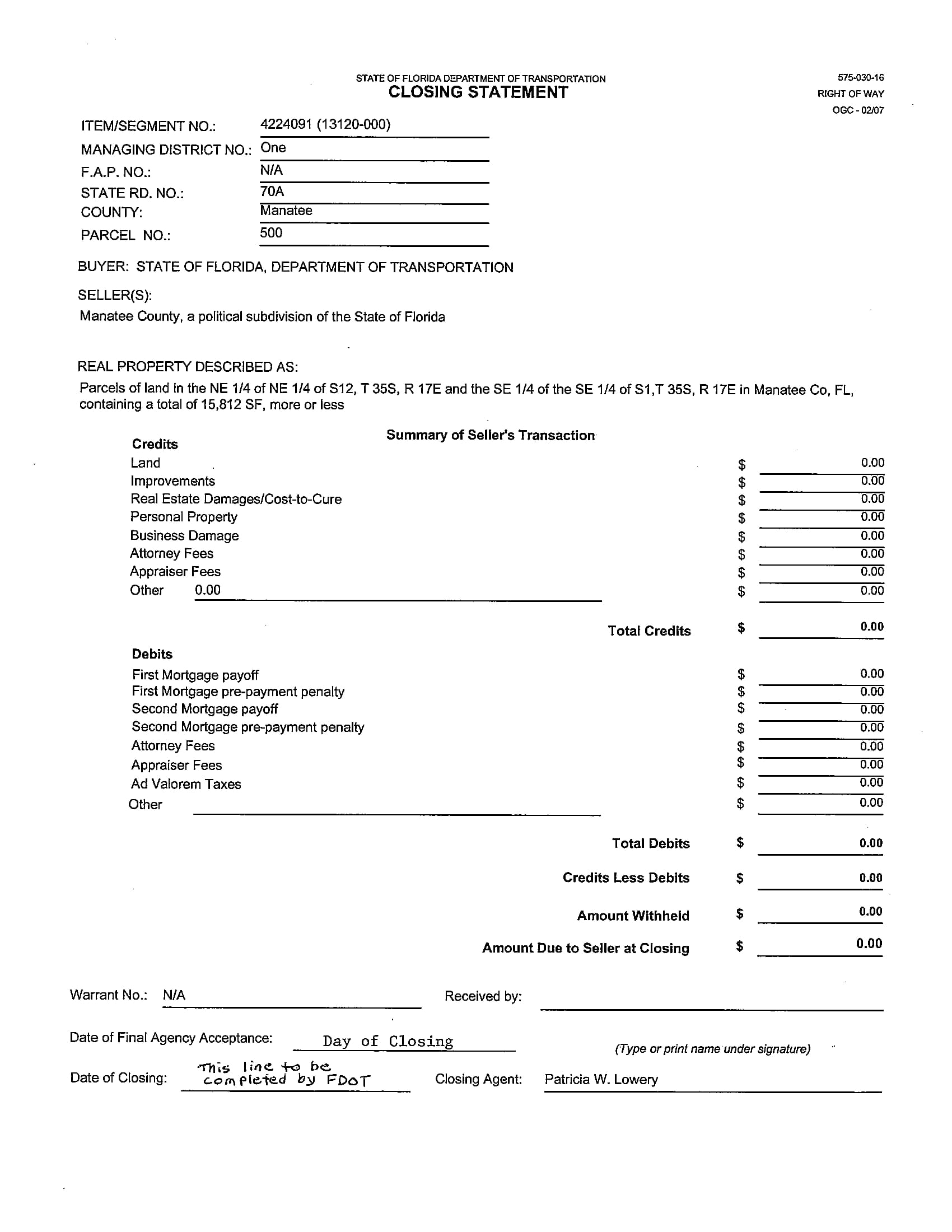

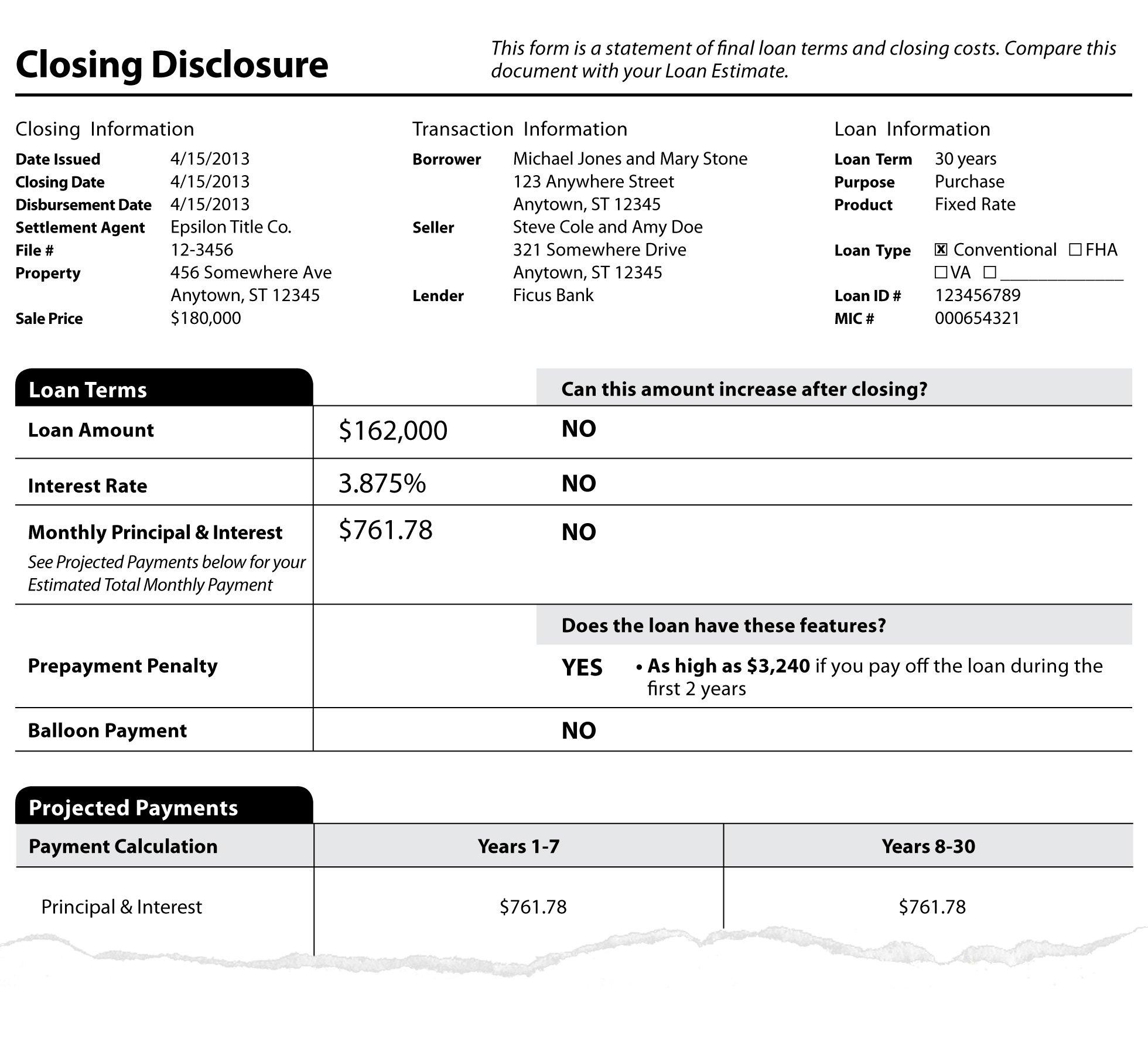

What is the closing statement used for most residential closings?

The answer is Closing Disclosure. The closing statement used for most residential closings is the Closing Disclosure prepared by the CFPB. credit to the seller. debit to the buyer.

President @realDonaldTrump is laying out a vision to bring thousands more factories and millions more jobs back to American soil! ?? pic.twitter.com/3dUxpl1xjV

— The White House 45 Archived (@WhiteHouse45) August 6, 2020

What is a closing statement in real estate?

The closing statement, also called a closing disclosure or settlement statement, is essentially a comprehensive list of every expense that either the buyer and seller must pay to complete the purchase of a home (or whatever the property is).

Frequently Asked Questions

What is the most important element of a closing statement?

Reinforce the main points of your case and remind the jury that they should reach a verdict in your client's favor. Show the jury that you respect their time and efforts by ending with a short and simple “Thank you.”

What is the difference between closing disclosure and final closing disclosure?

The initial closing disclosure is not perfect; however, it's mandatory that it be acknowledged via e-signatures. The Final CD is what will be signed at closing and outlines the exact fees of the loan. The Final Closing Disclosure is typically prepared a day or two before closing by the title company.

Is the closing disclosure the last step?

Unlike the loan estimate received at the beginning of the loan process, the closing disclosure is a final accounting of the dollars and cents for you to review before you sign your final mortgage paperwork at your closing.

What is the period of time between the signing of a residential sales contract and closing called?

Share. Save. Buying a home can be a long and somewhat complicated process. The period between when the purchase contract is signed and closing is often called the "escrow period".

What is the contract signed between the buyer and the seller?

When the buyer and seller have signed and delivered a purchase agreement the closing must occur?

The answer is on or before the date in the purchase agreement. The closing must occur by the date stipulated in the purchase agreement.

What is the day of signing a contract?

If a contract begins on the date all parties sign it, that is a conditional effective date. The execution date is the day both parties have signed the contract. It's when both parties agree to the contract's terms and conditions. However, this isn't necessarily the same day the contract comes into effect.

What is examination title?

A title examination is a process by which the property is deemed suitable for sale. A thorough review of the chain of title will identify issues or ensure the seller has a marketable title to sell.

What is a title exam important primarily to determine that?

examination is the examination of the documents found during the title search that affect the title to the property. This is when verification of the legal owner is made and the debts owed against the property are determined.

Which of the following are common problems in title examinations?

- Errors in public records. To err is human, but when it affects your homeownership rights, those mistakes can be devastating.

- Unknown liens.

- Illegal deeds.

- Missing heirs.

- Forgeries.

- Undiscovered encumbrances.

- Unknown easements.

- Boundary/survey disputes.

What is a final title opinion?

A title opinion is the written opinion of an attorney, based on the attorney's title search into a property, describing the current ownership rights in the property, as well as the actions that must be taken to make the stated ownership rights marketable.

FAQ

- What does it mean when a paper asks for your title?

- They are asking for the name by which your job is formally known. Whatever your official job description says.

- What are the 4 steps in the closing process in order?

- The 4 Steps in the Closing Process

- Close revenue accounts to income summary (income summary is a temporary account)

- Close expense accounts to income summary.

- Close income summary to retained earnings.

- Close dividends (or withdrawals) to retained earnings.

- What's the title insurance representative's responsibility at a closing?

The title insurance representative is responsible for the title search and for providing the buyer with proof of title. Most title representatives will also help prepare the parties, but that responsibility rests with the agents representing them.

- Who delivers the evidence of a clear title at closing?

- The closing agent, usually a title company representative, presents all documents to the parties, obtains signatures, and delivers evidence that the title is ensured. Contracts signed include the sales agreement, mortgage loan commitment, and title insurance contract.

- Whose role is it to pay for and receive clear title to a property at closing quizlet?

- Buyer - Pays for the property and receives clear title. Seller - Conveys the property and receives payment.

- What is closing stages?

Description. The purpose of the closing phase in the project management lifecycle is to confirm completion of project deliverables to the satisfaction of the project sponsor, and to communicate final project disposition and status to all participants and stakeholders.

- Who prepares the settlement statement?

Who prepares the settlement statement? Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

- What is the closing agent's role in preparing the closing disclosure?

The closing agent receives closing instructions or a closing disclosure from the lender. The agent prepares a final closing statement that includes a list of fees, charges, and pro-rations associated with closing, along with bottom line amounts due from the buyer and seller at closing.

- Who should review the settlement statement before closing?

Most buyers and sellers review the settlement statement or the closing disclosure form with a real estate agent, attorney, or settlement agent because it is important that the terms and costs are correct including spelling of the parties' names, loan types, amounts to close the transaction, the loan term and amount,

- Is a settlement statement the same as a closing statement?

- The closing statement, also called a closing disclosure or settlement statement, is essentially a comprehensive list of every expense that either the buyer and seller must pay to complete the purchase of a home (or whatever the property is).

Which statement is true of real estate closings in most states?

| Who is primarily responsible for the seller's statement of settlement? | (d) If closing documents and statements are prepared by, and the closing is conducted by, an employing broker's company such broker is primarily responsible for the accuracy and completeness of the settlement statements and documents. |

| Who generally prepares closing statements? | In real estate transactions, a real estate closing agent prepares the closing statement and this is required for the transaction to be complete. All the details involved in the sale and purchase of a real estate property are outlined in the closing statement. |

| What is closing date on closing disclosure? | The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan. This three-day window allows you time to compare your final terms and costs to those estimated in the. |

| Is closing statement same as closing disclosure? | A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller. |

| Whose closing statement goes first? | Usually, the prosecution first makes a closing argument, then the defense attorney. The prosecutor, who has the burden of proof, frequently gets the chance to respond to the defense's final argument. Defend your rights. We've helped 95 clients find attorneys today. |

| What is a timeline in real estate? | Timelines – The entire process of a real estate transaction hinges on certain timelines and contingency dates. For instance when an offer is Accepted the timelines of that transaction start on the definition of the “Acceptance” date. |

| What is the timeline after accepting an offer? | Your closing is typically 30-45 days after the offer has been accepted. |

| Why does it take 45 days to close on a house? | Once the seller accepts your offer, there are a few things that can delay the home closing. One of the most common issues is the home appraisal — specifically, whether the home appraises for the full purchase price (or more). Lenders want to make sure the home is worth enough to secure the mortgage. |

| How long before closing date is scheduled? | Provide at least 30 days from the time of the offer until the closing date. In general, most people set a closing date 30 to 45 days after the offer has been accepted. There are a few steps that need to occur between a final offer and the closing date. You must allow ample time for these steps. |

| What are the 4 stages of the real estate cycle? | The real estate cycle is a four-stage cycle that represents changes within the housing market. The four stages include recovery, expansion, hyper-supply, and recession. Understanding each phase and how it affects the housing market is crucial for investors looking to buy real estate. |

- Which statement is true of real estate closings in most states

- Which statement is TRUE of real estate closings in most states? A.) Closings are generally conducted by real estate professionals.

- What is the difference between Alta and settlement statement?

ALTA Settlement Statement Cash – This is the version used for cash transactions for property purchases. Settlement Statement – This is the version used specifically for the buyers in the real estate purchase and contains only information pertinent to the buyer's side of the transaction.

- What is an alta settlement statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes, and other pertinent information is contained in this document.

- What does a settlement statement provide in a real estate transaction?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

- What document lists the actual settlement costs paid at closing?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

- What is the 3 day rule for the Alta statement?

The three-day period is measured by days, not hours. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Note: If a federal holiday falls in the three-day period, add a day for disclosure delivery.

- Does seller pay title fees in Florida?

In Florida, the seller customarily pays for title insurance in many counties, including Palm Beach, Hillsborough County, Osceola County, and Orange County. However, in some counties, including Collier County, Sarasota County, Broward County, and Miami-Dade County, the buyer typically pays.

- What is the meaning of title services?

Services means title services necessary or incident to the purchase and sale of property including but not limited to: (a) ordering and issuing preliminary title searches; (b) researching, negotiating and clearing any defective title issues; and (c) ordering and issuing title insurance policies.

- Who picks the title company in Arizona?

The buyer

The accepted practice in real estate industry is for the buyer to submit an offer to purchase a property either alone or through an agent. The buyer will then select a title company.

- Who is responsible for completing the closing disclosure?

Lender: Must a settlement agent provide a copy of the seller's Closing Disclosure to the lender? The settlement agent is responsible for creating and delivering a Closing Disclosure to the seller and the Rule mandates that a copy of the seller's Closing Disclosure be given to the creditor.