Testimonial 1:

Name: Sarah Thompson

Age: 33

City: Los Angeles

"I was in dire need of understanding the true implications of an intra-entity sale of land, and I stumbled upon this incredible website. The information provided was absolutely enlightening! The clarity with which the content was presented made it incredibly easy for me to grasp the concept. Not only did I find the answer to my query, but I also gained a deeper understanding of the topic. I couldn't be more grateful for this resource. It's like having a knowledgeable friend at your fingertips!"

Testimonial 2:

Name: John Anderson

Age: 41

City: New York City

"Wow, I have to say, I'm impressed! As someone who has always found the topic of intra-entity sales of land a bit perplexing, stumbling upon this website was a godsend. The content is presented in such a light and arbitrary manner that it almost feels like you're having a casual conversation with a friend, except this friend happens to be an expert in the field. The information provided was not only accurate but also easy to understand. Kudos to the team behind this amazing resource! You've truly made a complex subject accessible to all."

Testimonial 3:

Name:

When a 90 percent-owned subsidiary records a gain on the sale of land to an affiliate

Analyzing the Implications When a 90 Percent-Owned Subsidiary Records a Gain on the Sale of Land to an Affiliate in the US

Discover the intricacies and implications surrounding a 90 percent-owned subsidiary recording a gain on the sale of land to an affiliate in the US. This expert review provides a comprehensive analysis, shedding light on the financial and strategic aspects involved.

In the realm of business, subsidiaries often engage in various transactions with their affiliates. One such scenario occurs when a 90 percent-owned subsidiary records a gain on the sale of land to an affiliate in the US. This review aims to delve into the financial and strategic implications of this transaction, highlighting the importance of understanding the intricacies involved.

Understanding the Transaction:

When a subsidiary sells land to an affiliate, it typically involves a transfer of assets and funds within the same corporate group. In this case, the subsidiary, which is 90 percent-owned, records a gain on the sale of land to an affiliate based in the US. This transaction triggers several accounting and financial considerations that need to be addressed.

Accounting Treatment:

From an accounting perspective, the subsidiary must recognize the gain on the sale of land in its financial statements. The gain is calculated by subtracting the land

7 which of the following is true regarding an intra-entity sale of land?

Which of the following statements is true regarding an intra-entity transfer of land? A loss and a gain are deferred until the land is sold to an outside party.

When a 90 percent owned subsidiary records a gain on the sale of land

A 90% owned subsidiary sold merchandise at a profit to its parent ... percent of ownership between parent and subsidiary only when the selling affiliate is:

When an intra entity transfer of a depreciable asset took place?

An intra-entity transfer of a depreciable asset took place whereby the transfer price exceeded the book value of the asset.

What are sales from one subsidiary to another called?

Sales from one subsidiary to another are called. a. downstream sales.

What is the transfer of assets between inter companies?

Intercompany asset transfers: Intercompany transfer means the transfer of assets from the books of one company code to another company code. For the companies involved in the intercompany transfer, an intercompany transfer represents a retirement for the sender company and an acquisition for the receiver company.

Frequently Asked Questions

What is a purpose of the consolidation entry regarding the intercompany sale of land?

What is a purpose of the consolidations entry regarding the inter-company sales of land? To make consolidated net income the same as it would have been had the sale not occurred.

When should an intercompany gain or loss on a downstream sale of land be recognized?

The intercompany gain or loss on a downstream sale, which is the parent to the subsidiary, is recognized only when the latter sells it to the outside party because it is the actual realization of the gain or loss. During the intercompany sale transaction, unrealized gain or loss is the only one to be recorded.

What are the intercompany transaction rules?

Intercompany transaction rules are designed to prevent corporations from using "intercompany transactions" to create, accelerate, avoid, or defer consolidated taxable income or consolidated tax liability.

Where do intra-entity transfers of inventory appear?

Where do intra-entity transfers of inventory appear in a consolidated statement of cash flows? They do not appear in the consolidated statement of cash flows. Supplemental schedule of noncash investing and financing activities.

What are intra entity transfers between the component companies of a business?

Answer :- Intra entity transfers refer to an internal movement of inventory that creates no net change in the financial position of the business combination as a whole.

What are intra entity transactions?

2 The ASC's Master Glossary defines the term intra-entity as: “Within the reporting entity. This could be transactions or other activity between. subsidiaries of the reporting entity, or between subsidiaries and the parent of the reporting entity. Also called intercompany.”

FAQ

- Which of the following are examples of intercompany balances and transactions that must be eliminated in preparing consolidated financial statements?

6. In the preparation of consolidated statements, intercompany balances and transactions should be eliminated. This includes intercompany open account balances, security holdings, sales and purchases, interest, dividends, etc.

- How do you adjust intercompany transactions in consolidation?

During the consolidation process, these intercompany transactions are eliminated to prevent their inclusion in the consolidated financial statements. The elimination is necessary because these transactions do not represent economic activities with external parties but rather internal transfers within the group.

- What is intercompany sales of fixed assets?

Intercompany sales are transactions that occur between two or more entities of the same corporate group. This means that a parent company and its subsidiaries, or different subsidiaries owned by the same parent company, are involved in a business transaction with each other.

- What are intercompany transactions in consolidated financial statements?

Intercompany transactions are financial transactions between related companies, for example between a group and a subsidiary or between two subsidiaries of a group. Intercompany transactions are recorded separately to distinguish them from external transactions and to avoid them being recorded twice.

- Why is it important to adjust intercompany balances for consolidation of financial statements?

Essentially, intercompany elimination ensures that there are only third party transactions represented in consolidated financial statements. This way, no payments, receivables, profits or losses are recognised in the consolidated financial statements until they are realized through a transaction with a third party.

- What are elimination entries for consolidation?

Final Elimination Entry at Corporate Level

At different levels of the consolidation, certain intercompany payables and receivables balances must be eliminated. Eliminations are only required in the context of a consolidation where the trading parties are both included in a given consolidation.

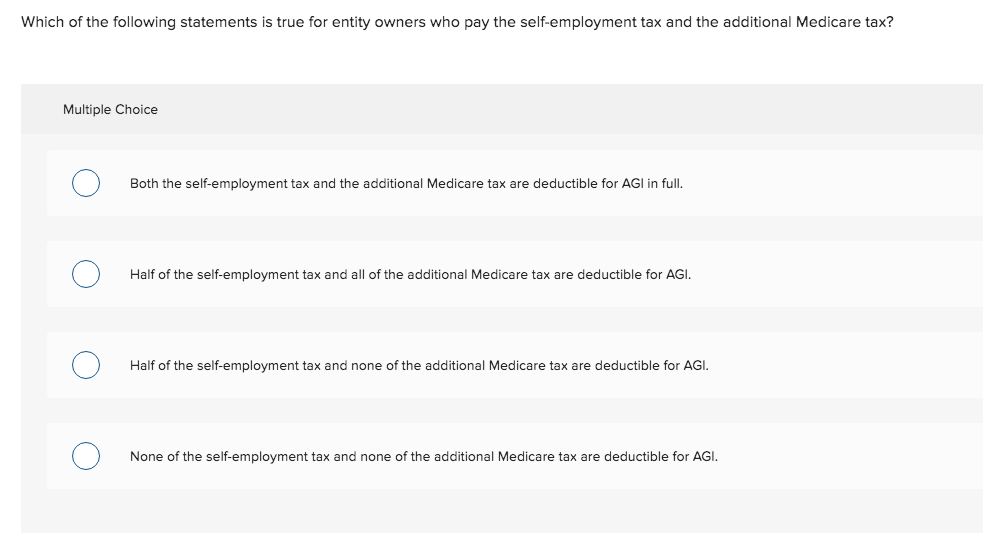

Which of the following statements is true regarding an intra-entity sale of land?

| What is the purpose of intercompany transactions? | Why are intercompany transactions important for business today? An intercompany transactions list enables your company to: Track, record and reconcile the transactions between your company and group entities. Understand and assess the types of transactions within your group company and parties involved. |

| What is the objective of eliminating the effects of intercompany sales of plant assets in preparing consolidated financial statements? | INTERCOMPANY PROFIT TRANSACTIONS — PLANT ASSETS. Answers to Questions 1 The objective of eliminating the effects of intercompany sales of plant assets is to reflect plant assets and related depreciation amounts in the consolidated financial statements at cost or book value to the consolidated entity. |

| Which intercompany transactions are eliminated in consolidation? | In the preparation of consolidated financial statements, intra-entity balances and transactions shall be eliminated. This includes intra-entity open account balances, security holdings, sales and purchases, interest, dividends, and so forth. |

| What is a purpose of the consolidation entry regarding the inter-company sale of land? | Question: What is a purpose of the consolidation entry regarding the inter-company sale of land? Select one: A. To make consolidated net income the same as |

| How do you eliminate intercompany profit in consolidation? | To eliminate and consolidate intercompany profits, these preconditions must be met:

|

| Which of the following statements is true regarding an intercompany sale of land? | Which of the following statements is true regarding an intra-entity sale of land? A. A loss is always recognized but a gain is eliminated in a consolidated |

- Should consolidated net income for a parent and its 80 percent owned subsidiary be computed by eliminating?

Consolidated net income for a parent and its 8o percent owned subsidiary should be computed by eliminating: all unrealized profit in downstream intercompany inventory sales and made during unrealized profit in upstream intercompany inventory sales made during the current year.

- When a parent owns less than 100% of a subsidiary?

- A non-controlling interest (NCI) typically occurs when a company owns more than 50% of another company, but less than 100%. Since the first company (parent company) effectively controls the second company (subsidiary company), the parent will fully consolidate the subsidiary's financials with its own.

- Can a parent company own less than 50% of a subsidiary?

- A holding or parent company may own a smaller stake, including less than 50%, as long as it gives the subsidiary's managers day-to-day control. But to be a holding or parent company it must have overall control of the subsidiary, being able to hire and fire executives and set strategy.

- What happens when a parent loses control over a subsidiary?

If a parent loses control of a subsidiary, the parent [IFRS 10:25]: derecognises the assets and liabilities of the former subsidiary from the consolidated statement of financial position.

- Can a subsidiary be less than 50%?

- A subsidiary is a company whose parent company is a majority shareholder that owns more than 50% of all the subsidiary company's shares. An affiliate is used to describe a company with a parent company that possesses 20 to 50% ownership of the affiliate.