TILA disclosures is often provided as part of the loan contract, so the borrower may be given the entire contract for review when the TILA is requested. Borrowers should always receive and review the TILA disclosure page in detail before signing any loan contact that obligates repayment.

For which transaction must a lender follow the regulations of the Truth in Lending Act?

The regulations found in the TILA apply to most kinds of consumer credit, from mortgages to credit cards. Lenders are required to clearly disclose information and certain details about their financial products and services to consumers by law.

Does the Truth in Lending Act require lenders?

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.

What is the law that requires that a Lending institution disclose to the borrower in writing the actual rate of interest?

Created to protect people from predatory lending practices, Regulation Z, also known as the Truth in Lending Act, requires that lenders disclose borrowing costs, interest rates and fees upfront and in clear language so consumers can understand all the terms and make informed decisions.

What is the general requirements that apply to all Truth in Lending disclosures?

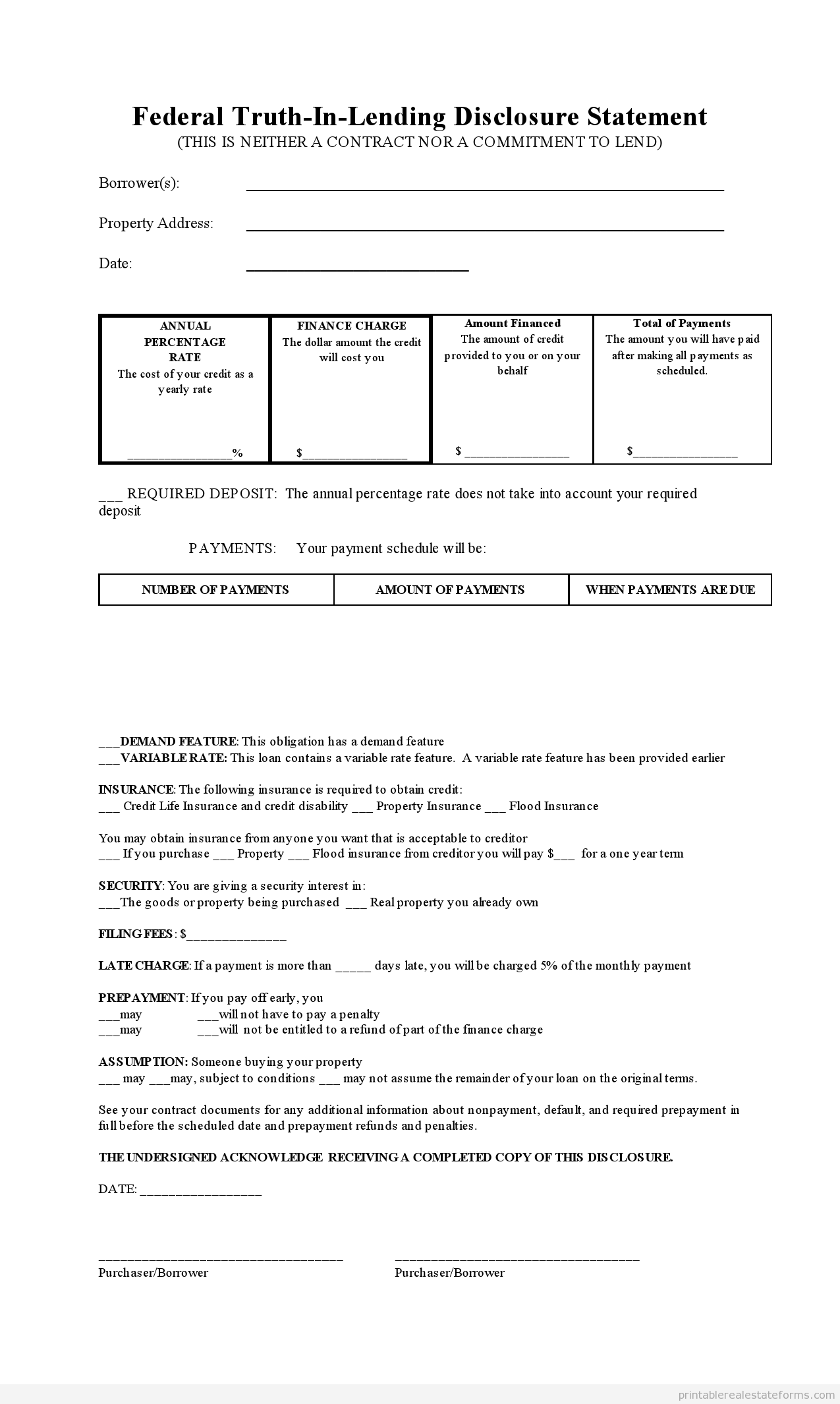

The disclosures must follow the required order and include the number of months and the total dollar amount to be paid at consummation for homeowner's insurance and mortgage insurance premiums, the prepaid interest to be paid at consummation, based on daily interest, number of days, interest rate and the total to be

What does the Truth in Lending Act apply to?

The provisions of the act apply to most types of consumer credit, including closed-end credit, such as car loans and home mortgages, and open-end credit, such as a credit card or home equity line of credit.

Does the Truth in Lending Act apply to personal loans?

Frequently Asked Questions

What does the Truth in Lending Act not apply to?

THE TILA DOES NOT COVER: Ì Student loans Ì Loans over $25,000 made for purposes other than housing Ì Business loans (The TILA only protects consumer loans and credit.) Purchasing a home, vehicle or other assets with credit and loans can greatly impact your financial security.

Who holds lenders accountable?

How do lenders frequently violate the Truth in Lending Act?

Some examples of violations are the improper disclosure of the amount financed, finance charge, payment schedule, total of payments, annual percentage rate, and security interest disclosures.

What does the Truth and Lending Act apply to?

The regulations found in the TILA apply to most kinds of consumer credit, from mortgages to credit cards. Lenders are required to clearly disclose information and certain details about their financial products and services to consumers by law.

What violates the Truth in Lending Act?

Some examples of violations are the improper disclosure of the amount financed, finance charge, payment schedule, total of payments, annual percentage rate, and security interest disclosures. Under TILA, a creditor can be strictly liable for any violations, meaning that the creditor's intent is not relevant.

FAQ

- What is the difference between truth in lending and respa?

Two different federal statutes were relied upon: The Truth in Lending Act (TILA) which required the Truth in Lending disclosure, and the Real Estate Settlement Procedures Act of 1974 (RESPA) which required the HUD-1 settlement statement.

- Who enforces Truth in Lending Act?

- The Federal Trade Commission is authorized to enforce Regulation Z and TILA. Federal law also gives the Office of the Comptroller of the Currency the authority to order lenders to adjust and edit the accounts of consumers whose finance charges or annual percentage rate (APR) was inaccurately disclosed.

- What is a truth in lending statement real estate?

The Truth in Lending Act, or TILA, also known as regulation Z, requires lenders to disclose information about all charges and fees associated with a loan. This 1968 federal law was created to promote honesty and clarity by requiring lenders to disclose terms and costs of consumer credit.

- What is an example of the Truth in Lending Act?

Examples of the TILA's Provisions

For example, when would-be borrowers request an application for an adjustable-rate mortgage (ARM), they must be provided with information on how their loan payments could rise in the future under different interest-rate scenarios.

- What are the 6 things in the Truth in Lending Act?

Lenders have to provide borrowers a Truth in Lending disclosure statement. It has handy information like the loan amount, the annual percentage rate (APR), finance charges, late fees, prepayment penalties, payment schedule and the total amount you'll pay.

When is lender legally obligated to provide truth in lending statement real estate

| Which of the following loans would be subject to the Truth in Lending Act? | The provisions of the act apply to most types of consumer credit, including closed-end credit, such as car loans and home mortgages, and open-end credit, such as a credit card or home equity line of credit. |

| What type of property is exempt from the federal Truth in Lending Act? | TILA requirements do not apply to the following types of loans or credit: Credit extended primarily for business, agricultural or commercial purposes. Credit extended to an entity (not a person, with an exception for certain trusts for tax or estate planning), including government agencies or instrumentalities. |

| What transactions are not covered by Reg Z? | Coverage Considerations under Regulation Z Regulation Z does not apply, except for the rules of issuance of and unauthorized use liability for credit cards. (Exempt credit includes loans with a business or agricultural purpose, and certain student loans. |

| Which of the following loans is exempt from the Truth in Lending Act on the basis of the type of loan itself? | Business loans and agricultural loans are exempt from the Truth in Lending Act. RESPA applies to first-lien residential mortgages for one-family to four-family homes, cooperatives, and condominiums. |

| What would the Truth in Lending Act not apply to a loan for? | THE TILA DOES NOT COVER: Ì Student loans Ì Loans over $25,000 made for purposes other than housing Ì Business loans (The TILA only protects consumer loans and credit.) Purchasing a home, vehicle or other assets with credit and loans can greatly impact your financial security. |

- What loans are covered by the Truth in Lending Act?

What loans does the Truth In Lending Act apply to? TILA's provisions cover open and closed-end credit. Open-end credit includes home equity lines of credit (HELOCs), credit cards, reverse mortgages and bank-issued cards. Closed-end credit includes home equity loans, mortgage loans and car loans.

- Would Regulation Z of the Truth in Lending Law apply to real estate loans for all?

Regulation Z protects consumers from misleading practices by the credit industry and provides them with reliable information about the costs of credit. It applies to home mortgages, home equity lines of credit, reverse mortgages, credit cards, installment loans, and certain kinds of student loans.

- Who enforces the Truth in Lending Act?

- The Federal Trade Commission is authorized to enforce Regulation Z and TILA. Federal law also gives the Office of the Comptroller of the Currency the authority to order lenders to adjust and edit the accounts of consumers whose finance charges or annual percentage rate (APR) was inaccurately disclosed.

- Who enforces TILA and Regulation Z?

Regulation Z (TILA)

The FTC enforces TILA and its implementing Regulation Z with regard to most non- bank entities.