Taxes are mailed in January to be paid in February and again in June to be paid in July of each year.

What day are property taxes due in LA County?

The first installment of your tax bill is due on November 1 and becomes delinquent by the close of business on December 10. The second installment of your tax bill is due on February 1 and becomes delinquent by the close of business on April 10.

How often do you pay property tax on a house in Ohio?

Real estate property taxes are actually billed and assessed one year in arrears. Ohio real estate taxes may be paid in two, semi annual installments. Because of the payment in arrears phenomenon, the taxpayer is, in effect, paying taxes based on a non-current valuation of their property.

Where do I pay my Lorain County property taxes?

Are Ohio property taxes paid in advance or arrears?

Arrears

In Ohio, taxes for the previous year are collected during the current year. This is known as arrears.

When should I receive my property tax bill in Ohio?

Failure to receive a tax bill does not excuse or delay the payment nor does it excuse any penalty or interest. Taxes are mailed in January to be paid in February and again in June to be paid in July of each year.

What is the property tax in Lorain County Ohio?

| Montgomery County Property Tax | ||

|---|---|---|

| Municipality | Median Home Value | Taxes as % of Home Value |

| Moraine | $73,295 | 2.00% |

| Jefferson Twp. | $68,430 | 2.00% |

| Vandalia | $113,165 | 1.97% |

Frequently Asked Questions

Are property taxes paid in advance in Ohio?

How do I pay my property taxes in Ohio?

Whether you file your returns electronically or by paper, you can pay by electronic check or credit/debit card via ODT's OH|TAX eServices (registration is required) or Guest Payment Service (no registration is required).

Where do I pay my Will County real estate taxes?

- Local Banks. You can pay your property taxes at more than 100 branch locations.

- By Phone. You can pay by phone by calling 815-723-4741.

- At Our Office. While there is a short wait time, we can professionally process payments in our office.

- At Our Drop Box.

FAQ

- How long do you have to pay property taxes in Ohio?

According to statute, at least one half of a real property tax bill is due by Dec. 31, with the balance due by June 20. In practice, these deadlines are often extended in the ways described below.

- Can I pay my Lorain County real estate taxes online?

- We accept online Income tax payments only. (We do not accept Utility payments/ County property tax payments.) Your balance due will not be available until your return has been processed. Please make sure you have your File Number when accessing the online payments.

When are real estate taxes due in lorain county oho

| How do I find out how much my property taxes are in Ohio? | You pay real estate taxes on the assessed value (35% of the property's appraised value) of your property. The assessed value of the property multiplied by the effective tax rate of voted levies equals the amount owed. |

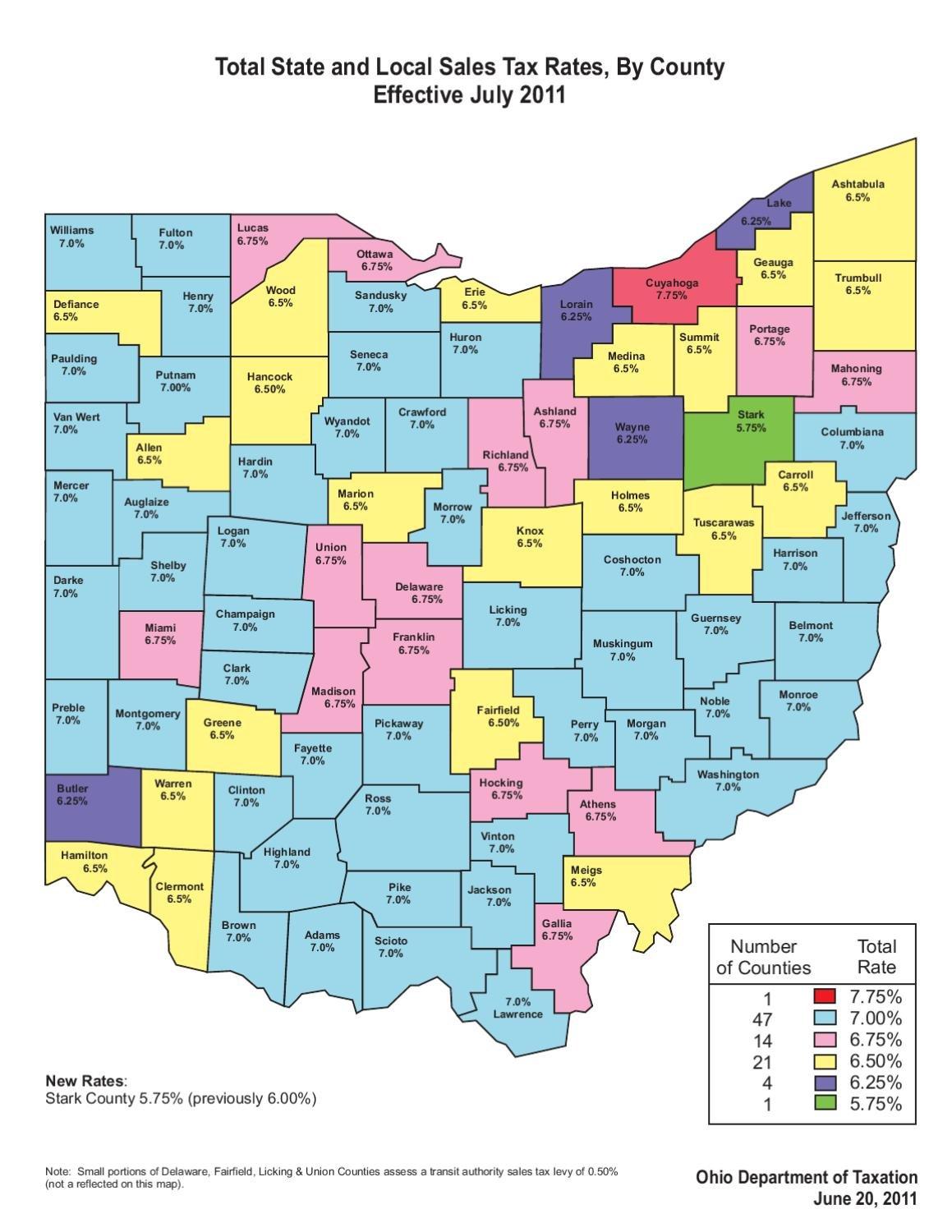

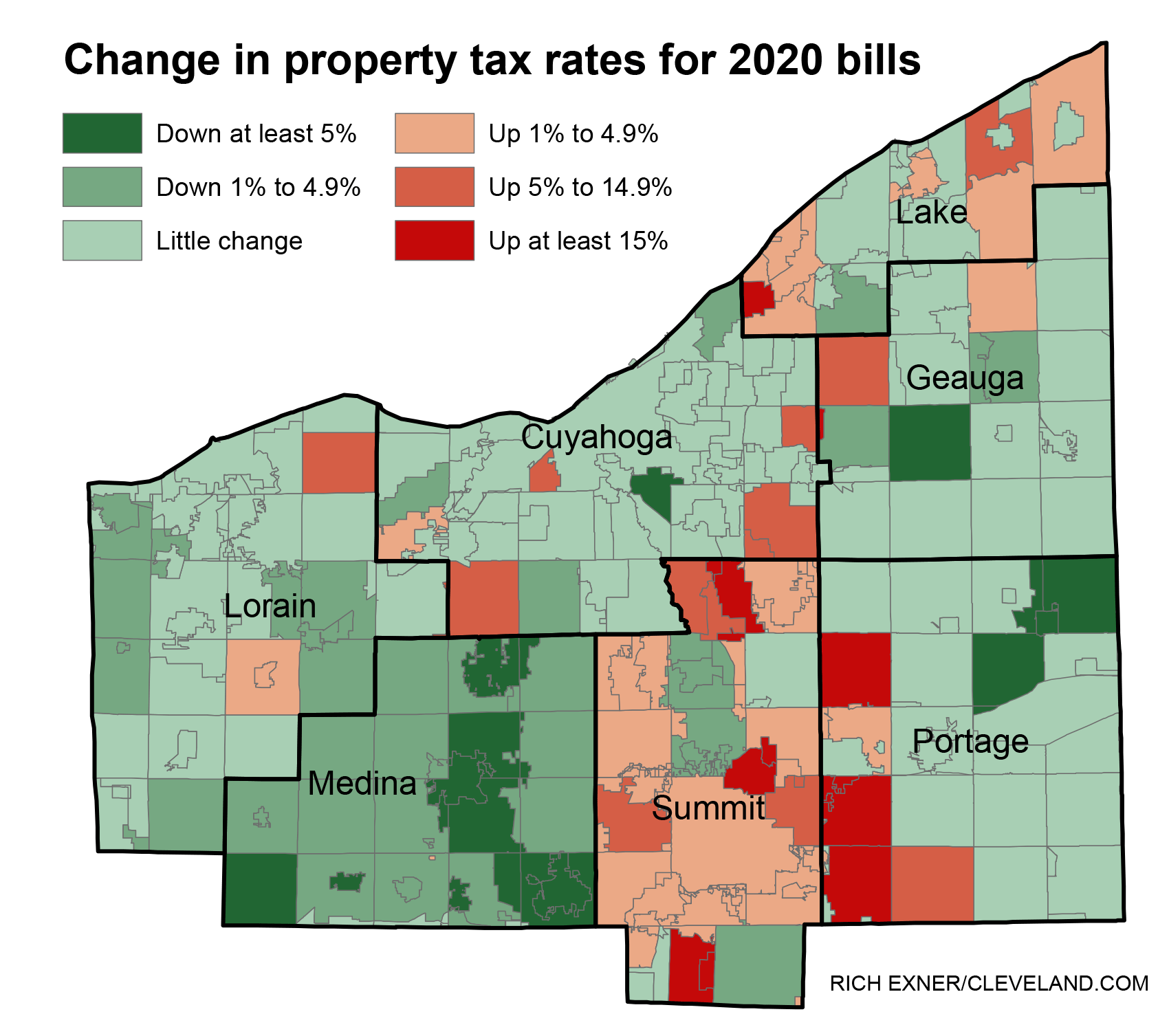

| What county in Ohio has the lowest property taxes? | Lawrence County The average effective property tax rate in Ohio is 1.41%. However, tax rates vary significantly between Ohio counties and cities. The highest rates are in Cuyahoga County, where the average effective rate is 2.51%. The county with the lowest rate is Lawrence County, which has an average effective rate of 0.86%. |

- How do I pay my local property taxes online?

To make your payment in full, or set up a phased payment arrangement, please log into the LPT Portal. You can also pay in full, or on a phased basis, through an approved payment service provider (PSP). The approved PSPs are An Post, Omnivend and Payzone.

- When are real estate taxes due for lorain county ohio

Jul 4, 2023 — Property tax bills are due Friday, July 7, according to the Lorain County Treasurer's Office. Treasurer Dan Talarek announced that 132,792