If the closing date is missed, then at a minimum, the contract is in jeopardy; the worst-case scenario is the contract has expired. The typical action is to extend the closing date, but the sellers might not agree.

What happens if the buyer didn’t show up at closing?

In most cases, assuming that the earnest money deposit is large enough, forfeiture should be your remedy. Even if you have to file suit to get this deposit released by the escrow agent, it should not impact on your ability to find another buyer. You may also want to consider going to binding arbitration.

How do you avoid a delayed closing?

To avoid a delayed closing, you can ask the seller to complete the repairs before purchasing the home (if they can be done quickly) or request some form of seller concession to offset the cost of repairs. The goal is to remain as open as possible when negotiating to prevent the deal from falling through.

What happens if mortgage commitment is late?

If the commitment expires before you can close, you may need to resubmit documents and go through another credit approval to get a new mortgage commitment. This could result in a delay in the process and may change your loan terms, like how much you pay each month or how much you qualify for.

Why is closing date important?

Your closing date is the day your transaction officially closes and is recorded with the county. All funds are transferred to the appropriate parties and the deal is done. By this point all of your closing costs and down payment have already been put in escrow.

Is the contract automatically terminated if the closing date has passed?

How long can you push out closing?

If you have a good reason for missing the closing date, the courts will usually decide in your favor and grant a reasonable postponement, giving the buyer an extra 30 days to complete the transaction.

Frequently Asked Questions

Can you be denied on closing day?

Can a mortgage be denied after the closing disclosure is issued? Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

Why is clear to close taking so long?

Typically, a longer closing process indicates that some complexities have arisen in your financial situation or in the appraisal/inspection of the property itself. These aren't necessarily dealbreakers, though they will likely require additional information before you can be clear to close on your house.

Can a buyer cancel a sale after closing?

According to Tomazic, it's too late to cancel the contract once all contingencies are resolved. If you do cancel your contract, the seller can either release you from the sale contract or sue you for specific performance. And once you've closed on the property, you're the new owner.

Do you have to close by closing date?

In most circumstances, the seller can cancel the deal if the buyer is not ready to close by that date. Some contract cancellation possibilities can benefit both the buyer and the seller. The seller may provide the buyer with an extension of time.

Do you have to close by the date on the contract?

If you do not adhere to the agreed closing date, as the seller you could be held in breach of contract by the buyer. It is also prudent to note that if the buyer is working with a lender, their mortgage rate can changes if closing doesn't go as scheduled.

Can you change the closing date on a contract?

Closing dates are outlined in the purchase contract. Most closing dates are open to negotiation, but some are set in stone, so check your contract to see if you can even make a change. “A typical purchase contract says 'Closing on or before X date unless a change is mutually agreed upon by both parties,'” says Hardy.

FAQ

- What is a closing and why is its date important in a real estate contract?

Your closing date is the final step in your home purchase, but it is set at the start of your real estate transaction. Setting the right date for your closing can make everything easier when it comes time to get ready to move into your new home.

- Can you back out of a loan before closing?

- You can back out of a mortgage before closing

There are legitimate reasons why you may need to put the brakes on a mortgage before you get to closing. For example, the home inspection may have revealed serious issues that the seller refuses to address.

- What happens if escrow doesn't close on time in California?

Escrow not closing on time can cause various issues for the buyer. A major problem with purchase contracts is that they include acceptance and closing dates. The contract may have expired if the closing date did not occur; at the very least, the contract was in jeopardy.

- Can a buyer back out of a contract before closing California?

For the buyer who wants to get out of a contract, a failure of any one of the contingencies may release the buyer from going through with the deal. For the seller, a failure of the buyer to complete the conditions within the specifically provided time may release the seller from the contract.

- What happens when escrow does not close on time?

Escrow not closing on time can cause various issues for the buyer. A major problem with purchase contracts is that they include acceptance and closing dates. The contract may have expired if the closing date did not occur; at the very least, the contract was in jeopardy.

- Why is escrow taking so long?

The timeline can vary depending on the agreement of the buyer and seller, who the escrow provider is, and more. Ideally, however, the escrow process should not take more than 30 days. If an escrow process lasts longer than 30 days, then there might have been some issues in the process.

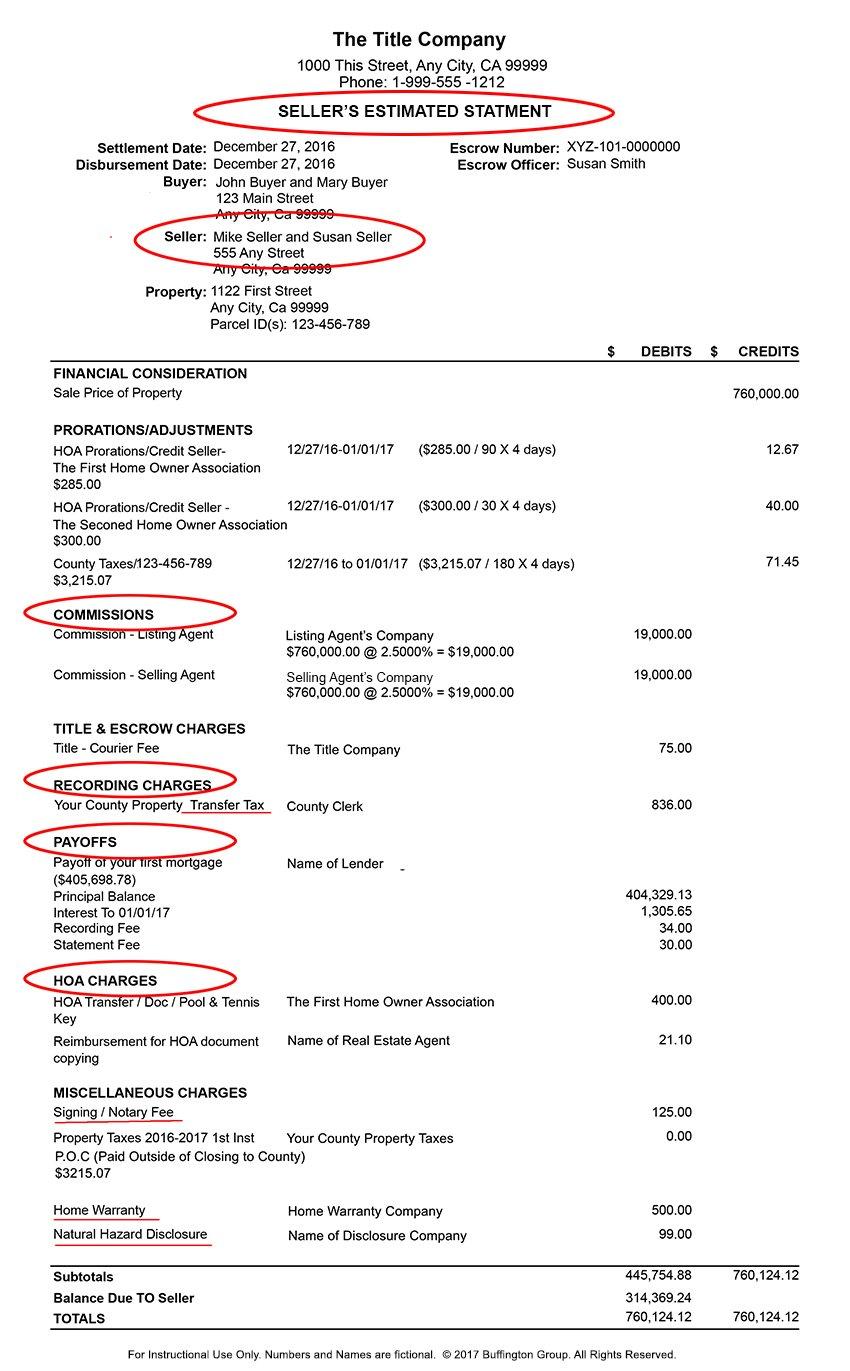

What is the typical financial penalty for late closing of home sale

| Why does escrow take so long to close? | Many things affect how long it takes to close escrow, but this time can vary quite a bit. A “typical” escrow is 30-45 days but could take as long as 60. That gives the title company time to pull up the title report and search for any liens, easements, lawsuits or other clouds on title. |

| Is a 60 day escrow normal? | The average escrow timeline is 30 to 60 days in California. In general, the purchase agreement signed by the buyer and seller includes a timeframe for escrow and the closing date. |

| What happens if buyer doesn't close by closing date? | A firm purchase agreement is a binding contract, and if the buyer fails to close, they are responsible for compensating the seller. The seller is entitled to be reimbursed for the price difference if the home is eventually sold for a lower amount or for the market value if the home is not sold. |

| What happens if seller doesn t respond to offer by deadline? | For example, the standard California residential purchase agreement states that the offer “shall be deemed revoked and the deposit, if any, shall be returned to Buyer” if the seller fails to accept the offer by 5 p.m. on the third day after the buyer signed the offer. |

| What happens if a buyer doesn't complete? | If, however, the buyer cannot complete for any reason, the seller can retain the buyer's deposit and resell the property. The seller can then claim for any losses he may have suffered due to the failure to complete. |

| How long does it take for a contract to close? | In closing… Every real estate transaction is different — but if your buyer is using a mortgage, there will be a waiting period between signing the purchase contract and receiving your sale proceeds. This period averages around 50 days in today's market. |

- Why does the buyer's lender keep delaying closing?

A closing delayed due to lender issues could be because the buyer is having trouble obtaining all the documents required to complete a mortgage application. The lender may also request additional information or documentation from the buyer.

- Can a buyer walk away from a deal?

Can A Buyer Back Out Of An Accepted Offer? As a home buyer, you can back out of a home purchase agreement. However, with no contingencies written in the contract, you may face costly consequences such as losing your earnest money deposit. As a buyer, the ability to back out of an accepted house offer is good news.

- What happens if my buyer pulls out?

You can relist your house and look for another buyer. However, if your buyer pulls out after the exchange of contract, there will be some financial implications. First, the buyer may lose their deposit, and non-refundable costs can't be recovered by either side (including you).

- Can a buyer change their mind after closing?

- Yes. For certain types of mortgages, after you sign your mortgage closing documents, you may be able to change your mind. You have the right to cancel, also known as the right of rescission, for most non-purchase money mortgages. A non-purchase money mortgage is a mortgage that is not used to buy the home.

- Can a deal fall through after closing?

While loans falling through after closing may not be the norm, it does happen. And unfortunately, some things will be out of your hands, like title issues.

- What happens if the buyer discovers after closing that the seller failed to disclose?

Disclosing Home Defects: Sellers' Responsibilities

If they forget or refuse, the sale is not valid. If a new home buyer discovers a material defect that the seller failed to disclose before the close of the sale, the law may give them the right to cancel the transaction.