Capital gain calculation in four steps

- Determine your basis.

- Determine your realized amount.

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference.

- Review the descriptions in the section below to know which tax rate may apply to your capital gains.

What is the $250000 $500000 home sale exclusion?

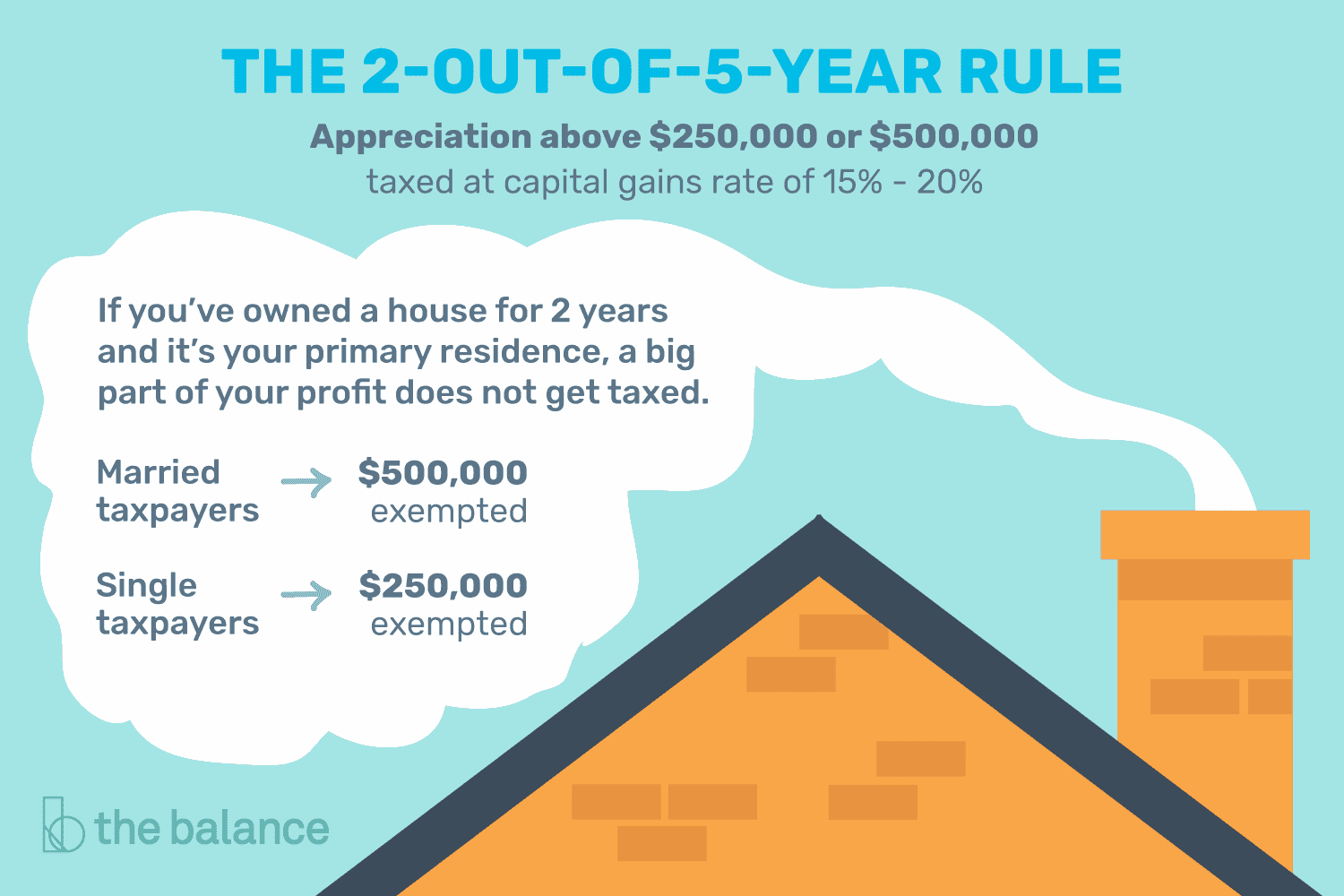

The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9.

How much capital gains tax on $200,000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

How do I avoid capital gains on sale of primary residence?

Eligibility: To be eligible for the exclusion, you must have owned and used the property as your primary residence for at least 2 of the 5 years preceding the sale.

How much capital gains tax on $90,000?

A capital gains tax example

Your taxable income is $90,000 in the same year you sell your home, so your tax rate is 15%. You'll pay an estimated $7,500 in capital gains tax.

What is the $250000 / $500,000 home sale exclusion?

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

5) Primary Residence Exclusion (Section 121):

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) April 19, 2023

Homeowners can exclude $250,000 of capital gains from the sale of their home ($500,000 if married).

If you sell your primary residence for a profit, you don't pay taxes on the gain, up to these amounts.

How long do I have to buy another house to avoid capital gains?

Within 180 days

How Long Do I Have to Buy Another House to Avoid Capital Gains? You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

What is the $250000 / $500,000 home sale exclusion for 2023?

Generally, people who qualify for the home sale capital gain exclusion can exclude: $250,000 of capital gains if single. $500,000 of capital gains if married and filing jointly.

What is the average gain on the sale of a house?

According to ATTOM Data's year-end 2022 Home Sales Report, the average home seller earned real profit on their sale to the tune of $112,000, up 21% from 2021 and 78% from two years ago.

How is capital gains tax calculated on real estate?

Capital gains tax is the tax owed on the profit (aka, the capital gain) you make on an investment or asset when you sell it. It is calculated by subtracting the asset's original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price.

What is the 2023 capital gains tax rate?

For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

How do I avoid paying taxes on profit from selling a house?

Sale of your principal residence. We conform to the IRS rules and allow you to exclude, up to a certain amount, the gain you make on the sale of your home. You may take an exclusion if you owned and used the home for at least 2 out of 5 years. In addition, you may only have one home at a time.

How long do you have to live in a house to avoid capital gains tax IRS?

You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods.

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.

How long to own a house before selling to avoid capital gains?

The 121 home sale exclusion comes with specific restrictions: Eligibility: To be eligible for the exclusion, you must have owned and used the property as your primary residence for at least 2 of the 5 years preceding the sale.

What is the 2 out of 5 year rule?

When selling a primary residence property, capital gains from the sale can be deducted from the seller's owed taxes if the seller has lived in the property themselves for at least 2 of the previous 5 years leading up to the sale. That is the 2-out-of-5-years rule, in short.

How do I report the sale of my house to the IRS?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

What IRS forms do I need when I sell my house?

File the following forms with your return:

- Federal Capital Gains and Losses, Schedule D (IRS Form 1040 or 1040-SR)

- California Capital Gain or Loss (Schedule D 540) (If there are differences between federal and state taxable amounts)

Who sends 1099-s for home sale?

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return.

What is a Form 8949 for a house sale?

Anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete Form 8949. Both short-term and long-term transactions are documented on the form. Details about the transaction must be filled in including the date of acquisition and disposition, the proceeds of the sale, and the gain or loss.

Do I have to tell the IRS I sold my house?

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

How do I claim capital gains exclusion?

To claim the exclusion, you must meet the ownership and use tests. This means that during the 5-year period ending on the date of the sale, you must have: Owned the home for at least two years (the ownership test) Lived in the home as your main home for at least two years (the use test)

How do I claim Section 121 exclusion?

The Ownership and Use Test for Section 121 Exclusions

This requires that the taxpayer has owned the home and used it as a primary residence for at least 24 months out of the previous 60 months. The 60-month period ends on the date the home is sold. The 24 months do not have to be consecutive.

What is the tax exclusion on sale of primary residence?

Key Takeaways

You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly.

Is 250 000 capital gains exempt?

Not All Gain Is Taxable

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

Do I have to pay capital gains tax immediately?

Do I Have to Pay Capital Gains Taxes Immediately? In most cases, you must pay the capital gains tax after you sell an asset.

What is 15 tax bracket capital gains?

Long-term capital gains tax rates for the 2023 tax year

For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

Is capital gains tax based on income bracket?

The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% or 37%.

How do you calculate capital gains tax on the sale of a house?

Capital gain calculation in four steps

- Determine your basis.

- Determine your realized amount.

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference.

- Review the descriptions in the section below to know which tax rate may apply to your capital gains.

What tax bracket to avoid capital gains?

Here's your capital gains tax bracket

For 2023, you may qualify for the 0% long-term capital gains rate with taxable income of $44,625 or less for single filers and $89,250 or less for married couples filing jointly.

Is long term capital gains tax 15%?

The FM proposes to restrict the surcharge for AOPs having only companies as its members to 15%. IT is applicable to AOPs whose total income during the financial year exceeds Rs 2 crores. Also, the surcharge on long term capital gains(LTCG) on listed equity shares, units, etc., has been capped at 15%.

How can you avoid capital gains tax on the sale of your home?

Avoiding capital gains tax on your primary residence

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.

How can I avoid paying taxes when selling my house?

Home sales can be tax free as long as the condition of the sale meets certain criteria: The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify.

What is the 36 month rule for capital gains tax?

This Rule establishes that selling or transferring a property within 36 months of its acquisition may trigger capital gains tax (CGT) liabilities.

How much tax do I pay on $50000 capital gains?

Capital gains tax rate – 2022 thresholds

| Rate | Single | Married Filing Jointly |

|---|---|---|

| 0% | Up to $41,675 | Up to $83,350 |

| 15% | $41,675 to $459,750 | $83,350 to $517,200 |

| 20% | Over $459,750 | Over $517,200 |

What is the capital gains threshold for home sales?

Key Takeaways. You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly.