Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.

What is included in due diligence when buying a house?

In real estate, due diligence is the period of time between an accepted offer and closing. It gives you, the buyer, time to get an appraisal, a title search, perform property inspections and more, so you know you're getting what you're paying for.

What is an example of due diligence in real estate?

An example of the due diligence process in real estate would be a survey of a property for a sale by a professional and registered agent. The findings from the survey would then be given to the buyer so that they can make a fully informed decision as to whether to pursue purchasing the property.

What are due diligence documents in Colorado real estate?

DUE DILIGENCE DOCUMENTS

that may impact the buyer's use/ownership of the property. It could also apply more generally to property records that the seller may possess such as building plans, environmental reports, inspection reports, permits, etc.

What are the 4 due diligence requirements?

The Four Due Diligence Requirements

- Complete and Submit Form 8867. (Treas. Reg. section 1.6695-2(b)(1))

- Compute the Credits. (Treas. Reg. section 1.6695-2(b)(2))

- Knowledge. (Treas. Reg. section 1.6695-2(b)(3))

- Keep Records for Three Years.

What does due diligence mean in real estate?

In real estate, due diligence is the period of time between an accepted offer and closing. It gives you, the buyer, time to get an appraisal, a title search, perform property inspections and more, so you know you're getting what you're paying for.

Legal Due Diligence of Property Title before Investing in any Property is must for every Real Estate Investor. It assures you a Clean Title and saves you from all sorts of future litigation possibilities. Legal Due Diligence process safeguards your Huge Investments. pic.twitter.com/kiUlmPL2kT

— Harshit Goyal (@Advharshitgoyal) December 9, 2020

Why would a seller want due diligence?

While sell-side due diligence is still relatively rare, running due diligence on your own property will likely reduce its time on the market, lower the risk of re-trades, and even improve the overall return.

Frequently Asked Questions

How long does due diligence take?

Fourteen to thirty days

The due diligence period usually lasts from fourteen to thirty days, allowing plenty of time to schedule the home inspection, termite inspection, and appraisals. Due diligence money is a fee that buyers proffer at the time they make an offer on a home. In essence, it is the buyer's good faith payment to the seller.

Is due diligence good or bad?

Bottom Line: Clearly, done properly, due diligence is a painstaking process. The temptation can be to skim over some areas to save time and money. However, the investment in thorough due diligence early on can help prevent costly surprises later on — and increase the chances of M&A success.

What are the 3 examples of due diligence?

Example of due diligence in business

- Researching customer reviews and the seller's reputation.

- Considering the environmental impact of the due diligence transaction.

- Supplementing purchases with insurances or warranties.

- Evaluating price in comparison to competitors.

What does 14 day due diligence mean?

Quick Answer. In real estate, due diligence is the period of time between an accepted offer and closing. It gives you, the buyer, time to get an appraisal, a title search, perform property inspections and more, so you know you're getting what you're paying for.

What is the shortest due diligence period?

The due diligence period can be as short as 1 day and longer than 21 days for more complex transactions. Once you have a clear picture of the condition of the home, you can negotiate with the seller to either make the repairs, lower the agreed upon price, or request a monetary seller credit in lieu of repairs.

What is the standard due diligence?

Standard due diligence is the level that will most likely apply to any client. Involving a detailed analysis of the new client, standard due diligence recognizes that there is a potential risk of criminal money laundering or terrorist financing, but it is considered unlikely that such risks will be realized.

FAQ

- What is the due diligence process in real estate?

- In real estate, due diligence is the period of time between an accepted offer and closing. It gives you, the buyer, time to get an appraisal, a title search, perform property inspections and more, so you know you're getting what you're paying for.

- How to do due diligence process?

- Listed are general due diligence process steps.

- Evaluate Goals of the Project. As with any project, the first step delineating corporate goals.

- Analyze of Business Financials.

- Thorough Inspection of Documents.

- Business Plan and Model Analysis.

- Final Offering Formation.

- Risk Management.

- What is a due diligence checklist real estate?

- Post-offer due diligence includes hiring a building inspector, checking zoning laws, researching the title, getting an appraisal, and obtaining financing. If everything continues to check out with the property, the buyer can move to close the deal.

- Does due diligence come before or after offer?

- Due diligence in real estate is the period of time between an accepted offer and closing. It is during this time that the buyer and seller agree to allow the buyer to inspect the property before closing the sale.

- What is the due diligence period in a purchase contract?

- In California, a due diligence or contingency period is allowed for sellers to deliver disclosures in seven days. The buyer has 17 days to complete any inspections and apply for financing. At the end of the 17 days, the contingency must be released by the buyer to proceed with the real estate sale.

- Does due diligence start the day after binding?

- The period of due diligence begins at the time the contract goes binding. That happens once the buyer and the seller agree to the terms and have both signed the contract. The length of the due diligence period can vary from contract to contract, but it is typically 7-14 days and is negotiated as part of the contract.

What are due diligence documents in real estate

| When to do due diligence? | A due diligence check is needed for all companies and organizations if they engage in company mergers or acquire stakes, property, real estate, investment, investors or insurance transactions in other companies, or If they work with business partners, especially in an international context. |

| What is the standard due diligence timeline? | A starting point is 60-90 days, depending on the complexity of the business. For good cause and if both parties agree, you may extend it. The due diligence period should be long enough to allow for the buyer to: review voluminous documentation. |

| What do you do in due diligence? | Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party. |

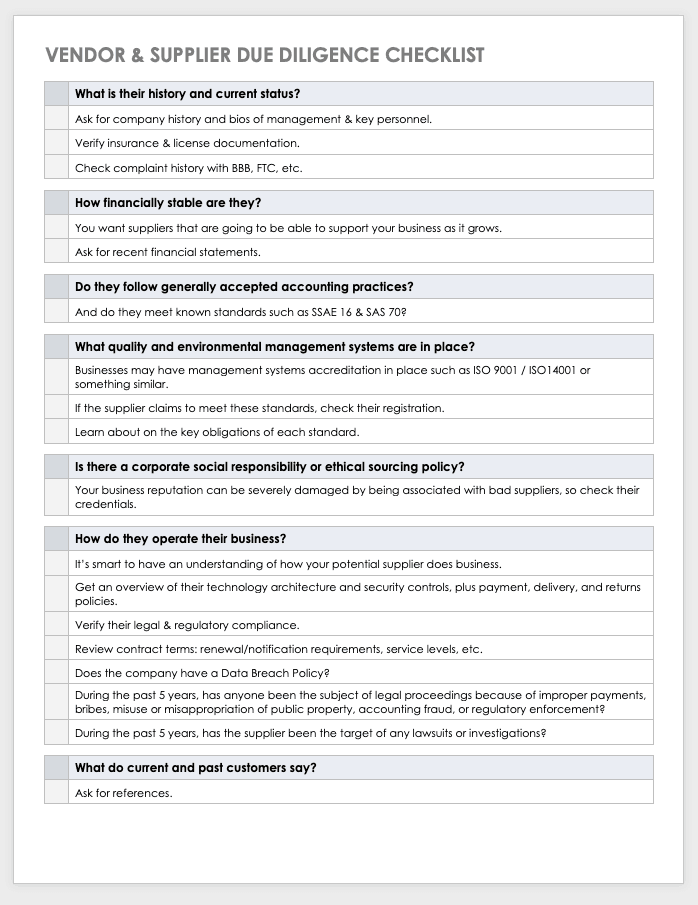

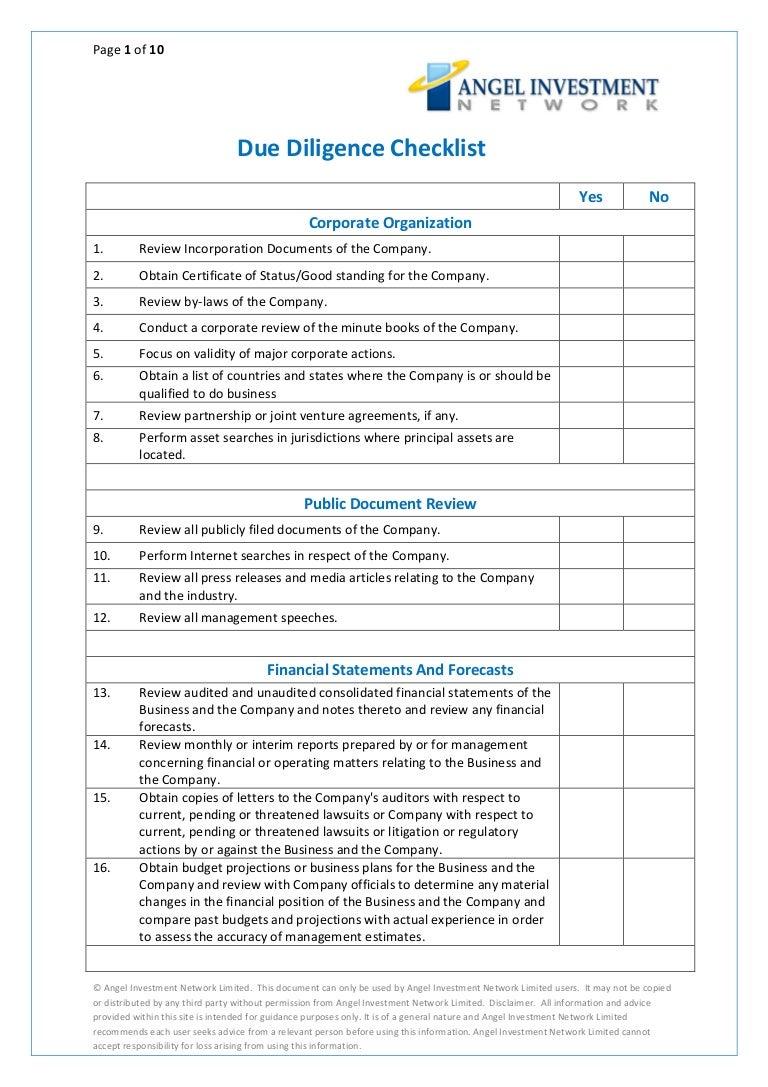

| What do you check during due diligence? | Due diligence checklist

|

| Is the buyer responsible for due diligence? | During the due diligence period, it is the responsibility of the buyer to conduct all necessary inspections and review all important documentation to ensure that the property they are looking to purchase is without major defects and that they are getting their money's worth. |

- Who is responsible for due diligence?

- Due Diligence meaning is primarily carried out by equity research firms, fund managers, individual investors, risk and compliance analyst and firms and broker-dealers. At the same time, individual investors are free to conduct their own Due Diligence.

- Who has the most responsibility to perform due diligence in a real estate purchase?

- Buyers Typically, buyers have the right to inspect the property during the due diligence period. Professional home inspectors can assess the overall condition of the house and its most important components, including roof, plumbing, electrical, appliances, and heating and air conditioning.

- Do sellers do due diligence?

- Prior to allowing buyers to review and investigate your business, you should conduct your own due diligence. Conducting seller-side due diligence should begin even before a transaction is contemplated.

- Who bears the cost of due diligence?

- The due diligence fee is a nonrefundable fee that a potential buyer pays directly to the seller.

- What is due diligence in real estate transaction

- Oct 2, 2021 — In short, due diligence means investigating facts about the physical and financial condition of the property and the area the property is