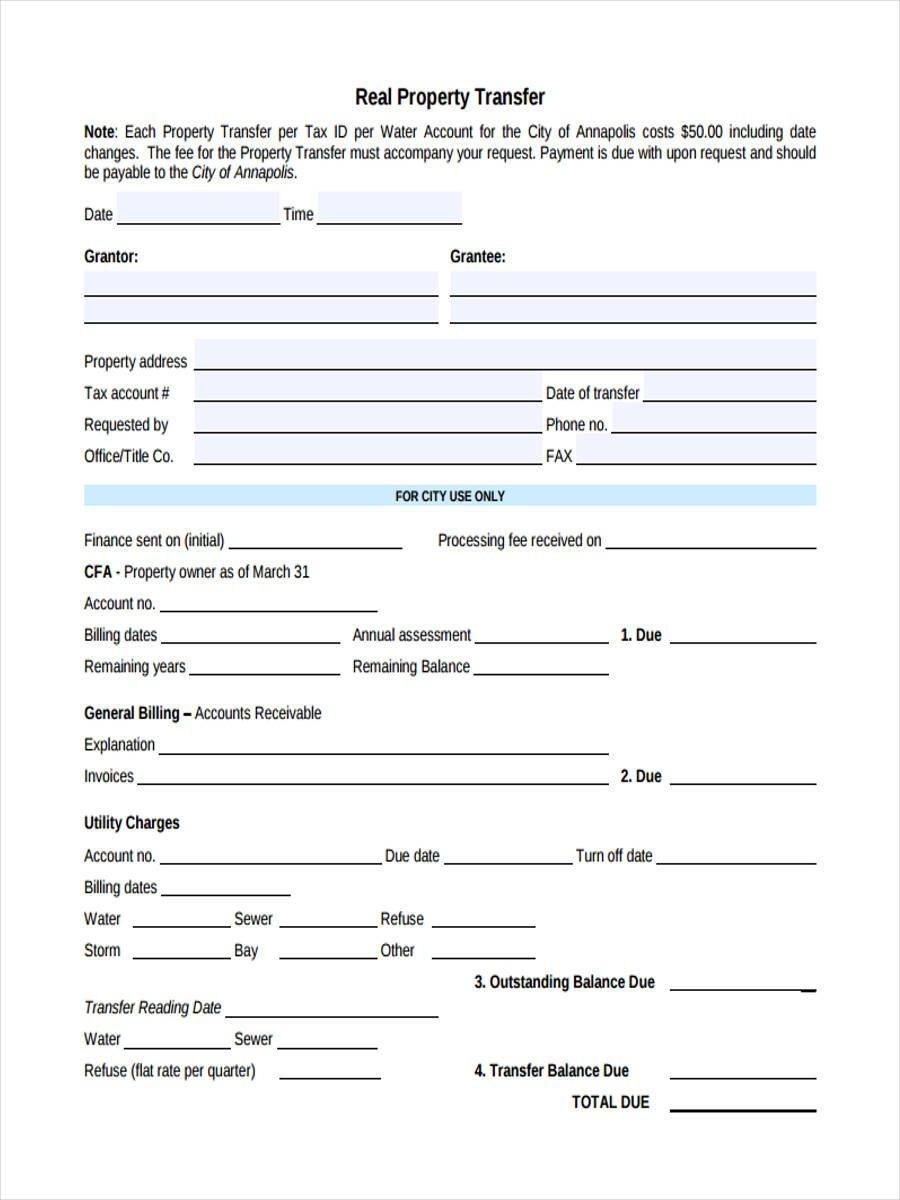

The real property transfer report (RP-5217) fee is $125.00 for residential or farm properties. The real property transfer report (RP-5217) fee is $250.00 for commercial properties. The transfer tax affidavit (TP-584) fee is $5.00 or $10.00, depending on the county.

What is the most common way to transfer ownership?

General warranty deed

The most common way to transfer property is through a general warranty deed (sometimes called a "grant deed"). A general warranty deed guarantees good title from the beginning of time.

How to do a deed transfer in New York?

To change a deed in New York City, you will need a deed signed and notarized by the grantor. The deed must also be filed and recorded with the Office of the City Register. Transfer documents identifying if any taxes are due must also be filed and recorded with the City Register.

What form do I need to transfer a deed in NY?

The signed original RP-5217-PDF must accompany all deeds and correction deeds upon filing with the Recording Officer. A filing fee is also required. Limited data items (date of Sale, full sale price, spelling error, etc) may require a change AFTER the form is filled and signed.

How do I transfer property to a family member tax free in the USA?

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

What is process during which the title to the property is transferred to the buyer?

Legal document used to transfer ownership of real estate?

— Taylor Smalley Real Estate (@TaylorSmalley20) April 11, 2022

Bill of Sale

Contract

Trust

Deed

Affidavit pic.twitter.com/ctJaosYS8s

How long does house title transfer take in Texas?

Also, you will receive the deed of the property and title insurance policy after the transaction is completed. So, you might be wondering, how long does it take to clear a title? The entire process of clearing a property's title takes roughly two weeks.

Frequently Asked Questions

How much does it cost to transfer a house title in Texas?

How much does it cost to transfer a house title in Texas? All property deeds – $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas. Please contact your local County Clerk's office for more information.

Which of the following is a document which transfers ownership of real estate?

Property deed

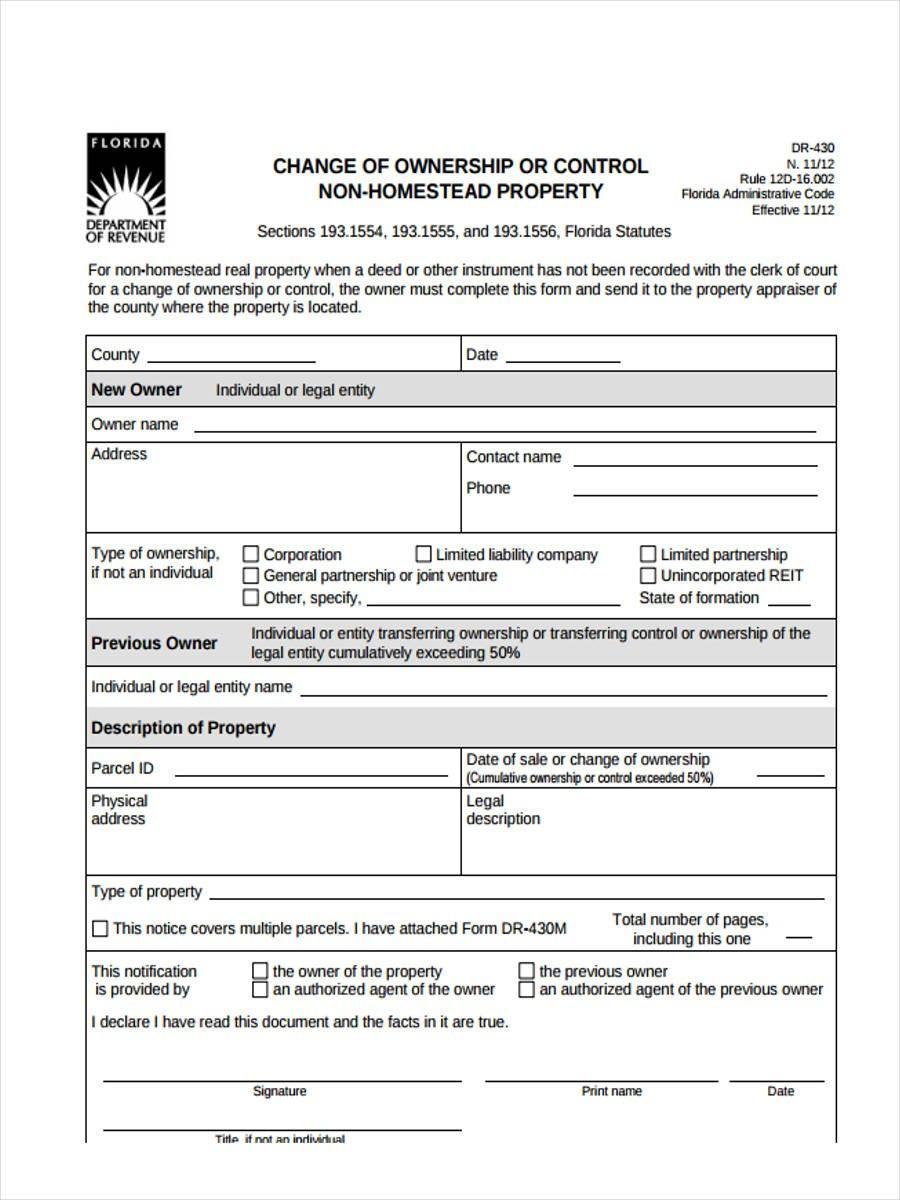

A property deed is a legal document that transfers the ownership of real estate from a seller to a buyer. For a deed to be legal it must state the name of the buyer and the seller, describe the property that is being transferred, and include the signature of the party that is transferring the property.What is the process of transferring real property from one individual to another called?

What is the most common type of estate transferred in a deed?

The most common type of ownership is called fee simple ownership, where the property owner has full rights to use the land or building as they choose provided they pay property taxes and abide by local laws. Deed: A deed is a legal document that transfers the title between parties.

FAQ

- What is the best deed to transfer property?

- Warranty deeds offer the highest-possible level of protection for buyers. If you are buying a home, then you will certainly want to push for a warranty deed when possible. However, they are not widely-used in some states, which is why some buyers end up with a grant deed instead.

- What form of ownership is easiest to transfer?

Corporation Corporations

Transferring Ownership of a Corporation

Corporations are by far, the easiest to types of incorporated structures to transfer, whether this is part or the whole company. As we discussed earlier in this guide, C Corporations have no legal limit on the number or types of shareholders.- Which document transfers property to the buyer?

Property deed

A property deed is a legal document that transfers the ownership of real estate from a seller to a buyer. For a deed to be legal it must state the name of the buyer and the seller, describe the property that is being transferred, and include the signature of the party that is transferring the property.

How to transfer ownership of real estate

| How to transfer property title to family member in California after death? | California's TOD deed requirements include:

|

| What are the ways that real property ownership can be transferred? | There are three ways you can voluntarily transfer or grant an interest in real property while you are living: by sale, gift or dedication. |

| How to transfer a house deed to a family member in Illinois? | If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends. |

- How long does a transfer of ownership take?

You should allow between 4-6 weeks for this. That said, transferring equity will take more time if there is a mortgage on the property. After all, the mortgage provider must approve the transfer and make sure the new owner can make the repayments.

- Is transfer of ownership the same as a sale?

As we have seen, when we talk about a transfer, we are referring to the transfer of the right to operate the business to a third party. In contrast, the sale of a business means the change of ownership of the property where the business is located. They are, to all intents and purposes, two different situations.

- How to transfer a real estate title

Step #1. Identify the type of deed you will use · Step #2. Identify the grantee · Step #3. Hire a real estate attorney to prepare the deed · Step#4. Review the