Best ways to invest in real estate

- Buy REITs (real estate investment trusts)

- Use an online real estate investing platform.

- Think about investing in rental properties.

- Consider flipping investment properties.

- Rent out a room.

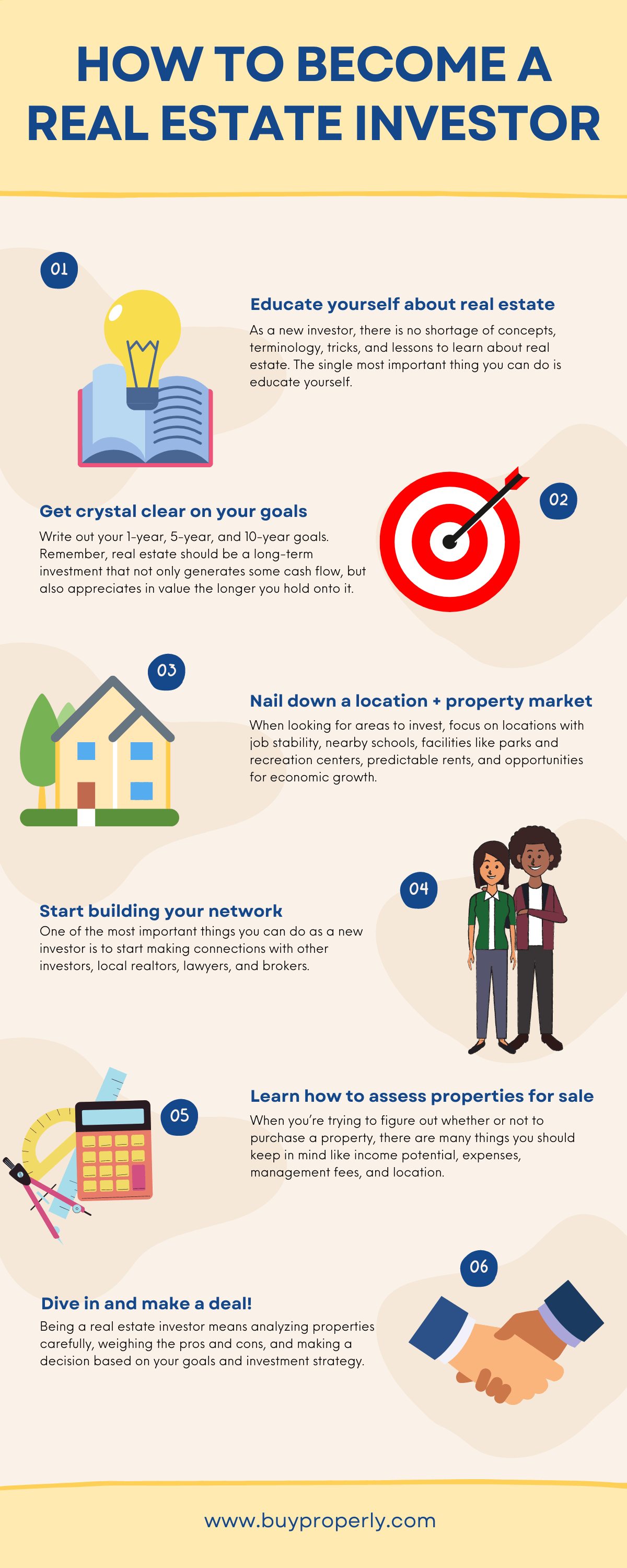

How do I become a small real estate investor?

10 Best Ways to Invest in Real Estate With Little or No Money

- Purchase Money Mortgage/Seller Financing.

- Investing In Real Estate Through Lease Option.

- Hard Money Lenders.

- Microloans.

- Forming Partnerships to Invest in Real Estate With Little Money.

- Home Equity Loans.

- Trade Houses.

- Special US Govt.

Is real estate investor a good career?

Real estate investing can be lucrative, but you must have a plan. Successful real estate investors understand three critical aspects of the business: They understand what the market needs.

What are 3 ways real estate investors make money?

Let's dive in and see how you, too, can become a lucrative real estate investor.

- Leverage Appreciating Value. Most real estate appreciates over time.

- Buy And Hold Real Estate For Rent.

- Flip A House.

- Purchase Turnkey Properties.

- Invest In Real Estate.

- Make The Most Of Inflation.

- Refinance Your Mortgage.

How to start real estate with $1,000 dollars?

How to Invest $1,000 in Real Estate

- Fractional Ownership in Properties. Several platforms let you buy fractional shares of individual properties.

- Publicly-Traded REITs.

- Real Estate Crowdfunding: Private REITs.

- Real Estate Crowdfunding: Loans.

- Private Notes.

- Real Estate Wholesaling.

- Invest in Land.

- House Hack.

Does it still make sense to invest in real estate?

With all the headlines circulating about home prices and rising mortgage rates, you may wonder if it still makes sense to invest in homeownership right now. A recent poll from Gallup shows the answer is yes.

I run a real estate investment business with no partners. It spins off enough cash to cover my living expenses with enough left over to travel, go to sporting events/concerts, etc. and pretty much do what I want (aside from flying private - still can't afford that).

— Chris Stanley (@Stanley_Tweets) October 9, 2023

I love the…

What is better investment than real estate?

Stock investing may be a more effective approach for those wanting higher returns over a shorter period. Real estate may be ideal for those who want a stable flow of income who can wait to see a return on their investment. Risk tolerance. Stock and real estate investing carry various levels of risk.

Will 2023 or 2024 be a good time to buy a house?

Zillow has a similar forecast, as it expects home values to rise by 6.5% from July 2023 through July 2024, despite “despite persistent affordability challenges.” Likewise, Freddie Mac is forecasting prices rising by 0.8% between August 2023 and August 2024, followed by another 0.9% gain in the following 12 months.

What is the main difference between realtors and other real estate practitioners?

The Major Differences Between Real Estate Agents and Realtors. A real estate agent is a licensed sales professional who helps clients buy, sell, and lease property. A Realtor (or REALTOR®) is a real estate agent who is also a member of the National Association of REALTORS® (NAR).

How do real estate agents stand out?

8 Ways Realtors Can Stand Out From Their Competitors

- Enhance The Client Experience.

- Be Professional When Approaching Prospects.

- Find Your Speciality & Excel At It.

- Build A Formidable Online Presence.

- Get On Google My Business.

- Invest In Branding.

- Build Your Network And Connections.

- Sponsor Local Events.

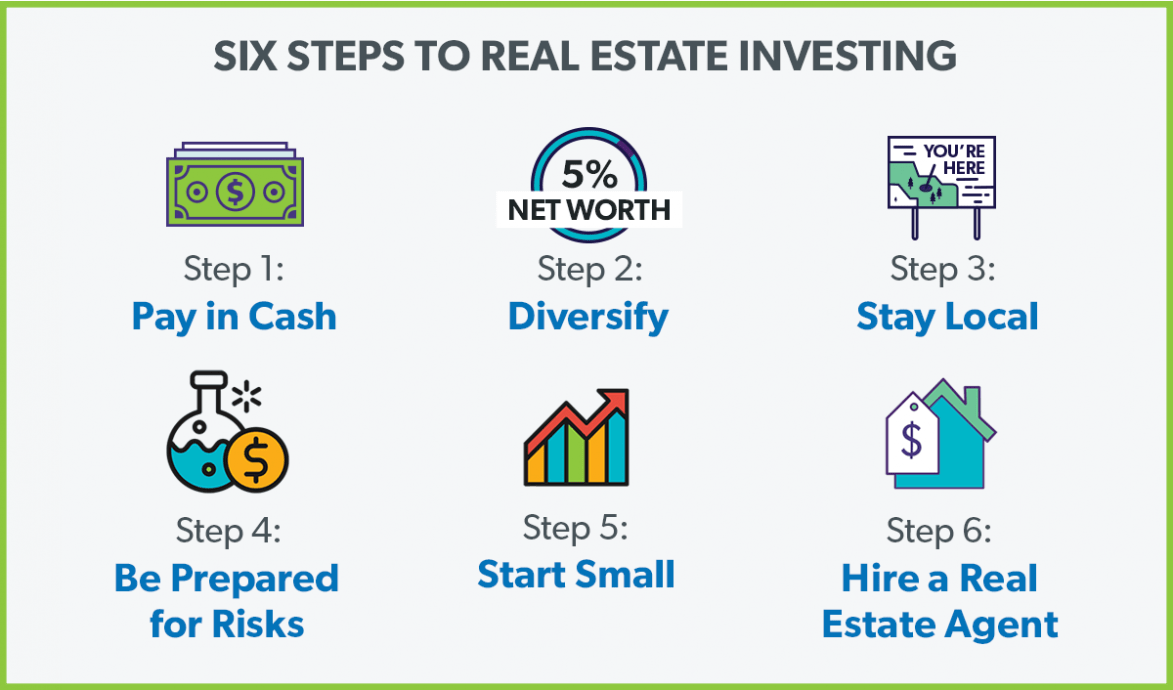

How does a beginner invest in real estate?

You can invest $10,000 dollars in real estate by flipping houses, becoming a landlord, crowdfunding sites, REITs, and more. Most real estate investing platforms require less than $10,000 to start investing in single-family rental properties, individual properties, and venture funds.

Why do realtors ask for proof of funds?

Sellers will ask for POF in addition to a preapproval or prequalification when they want to see evidence that a buyer has enough money to cover closing costs and their down payment. Sellers may also require a POF even if a bank or lender does not require it to approve you for a mortgage.

Is it normal for a realtor to ask for bank statements?

It's part of the qualifying process to see your ability to get a mortgage. The statements should show that there is enough funds for downpayment, closing costs and any reserves left back after closing. They usually show your monthly or weekly deposits from employment and a record of not bouncing checks written by you.

Why do realtors leave their card after a showing?

It's a way of letting you and your realtor know that the realtor actually showed up, it shows others the house is showing (if you leave them out), and provides a certain amount of tracking.

Why is a realtor calling me?

The answer to that is simple: that Realtor or other real estate sales person thinks of you as either a client or a potential client (a prospective client or prospect or a “lead”), so is following up to get your business.

Do you have to show proof of funds?

Proof of funds is typically required for a large transaction, such as the purchase of a house. Basic information, such as the bank name and address, bank statement, total balance amounts, a bank personnel's signature, is required on the proof of funds document.

What to make sure when renting an apartment?

Throughout the apartment

- Walls. Check for cracks, structural holes or evidence of water leaks, especially around windows and vents.

- Electrical outlets. Make sure every plug in the apartment works.

- Cable hookups.

- Smoke detectors.

- Lighting.

- Thermostat.

- Blinds and shades.

- Windows and doors.

How can I be smart about renting an apartment?

- Use Real Estate Websites.

- Evaluate Personal Finances.

- Be Prepared to Negotiate.

- Know the Rent Before You Tour.

- Tour Properties in Person.

- Reevaluate Your Feature List.

Which is better renting or owning?

Renting offers flexibility, predictable monthly expenses, and someone to handle repairs. Homeownership brings intangible benefits, such as a sense of stability and pride of ownership, along with the tangible ones of tax deductions and equity.

How much should you save for an apartment?

That said, according to Capital One, a good rule of thumb is that rent should generally be three times your monthly income – which could be a guide for how much to save. Most advisors also recommend having a few months' expenses in savings as a cushion.

How can I make the most money renting?

Here are six tips on how to make money renting out houses.

- Purchase an Investment Property.

- Determine Your Operating Expenses.

- Set a Competitive Rent Price and Rental Fees.

- Invest in Landlord Software.

- Find Reliable Tenants.

- Reduce Tenant Turnover.

What not to tell your real estate agent?

- 10: You Won't Settle for a Lower Price. Never tell your agent you won't reduce the sale price on your house.

- 6: You are Selling the Home Because of a Divorce.

- 5: You Have to Sell Because of Financial Problems.

- 2: You're Interested in a Certain Type of Buyer.

- 1: Anything -- Before You've Signed an Agreement.

How to find a buyers agent?

Here are 10 different ways to find a buyer's agent.

- Use online tools.

- Use agent associations.

- Get a referral.

- Ask your lender or loan originator.

- Do some driving where you want to buy.

- Dig into online reviews.

- Find a brokerage first and ask them to help you out.

- Browse social media.

What is a dual agent?

A dual agent is an individual who acts as both the buyer's and seller's agent in a transaction. It is easy to confuse dual agents with designated agents. But unlike a dual agent, designated agents are two separate individuals representing the buyer or the seller.

Are estate agents untrustworthy?

Second, estate agents are often seen as being dishonest and untrustworthy. There have been many instances of estate agents exaggerating the value of properties or hiding defects in order to make a sale. This has led to a general perception that estate agents cannot be trusted.

What scares a real estate agent the most?

1) Fear of rejection.

This is often the first thing to come to mind when realtors are asked to share their biggest fear, especially for those agents who are new to the industry. It's a scary thing to put yourself out there—to go door-knocking or cold-calling.

How long do I have to reinvest money from the sale of a house?

Within 180 days

If the home is a rental or investment property, use a 1031 exchange to roll the proceeds from the sale of that property into a like investment within 180 days.13.

What should I do with large lump sum of money after sale of house?

Depending on your financial circumstances, it might make sense to pay down debt, invest for growth, or supplement your retirement. You might also consider purchasing products to protect yourself and your loved ones, including annuities, life insurance, or long-term care coverage.

Are proceeds from home sale taxed as income?

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

How long do you have to live in a house to avoid capital gains tax IRS?

You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods.

What is the 2 out of 5 year rule?

When selling a primary residence property, capital gains from the sale can be deducted from the seller's owed taxes if the seller has lived in the property themselves for at least 2 of the previous 5 years leading up to the sale. That is the 2-out-of-5-years rule, in short.

Why is real estate the least liquid?

Rental real estate is not viewed as a liquid asset because it takes time to liquidate an asset and have the cash in hand. Most investors do not buy these types of properties for short-term cash gains.

Is real estate least liquid?

The next investment with the least liquidity is real estate. It is another lucrative investment but can be time-consuming when the goal is converting to cash quickly. The process involves multiple stages, including finding a buyer, agreeing on a price, conducting inspections, and closing procedures.

Why is real estate so illiquid?

Selling property is a deeply involved process. Compared to buying and selling stocks, real estate moves very slowly. Because of the many considerations that must be considered during their sale, real estate assets are inherently grounded as illiquid assets.

Does real estate have liquidity?

To summarize, real estate liquidity is defined as the ability to convert a property into a fair amount within a specific time frame. Liquidity risk occurs when there is a high level of uncertainty and unquantifiable risk. Liquidity in real estate and the risk connected with it are affected by several factors.

Why is real estate less risky than stocks?

It is a tangible asset that you can see, feel, and make changes to, unlike stocks that are just a piece of paper. There is less risk involved in real estate as compared to stocks. You don't have to worry about the ups and downs of the stock market to reflect on real estate, as both investments have less correlation.

How do I start a real estate business from scratch?

Here's what you'll need to do.

- Get a real estate license. Obtaining a real estate license is an important first step in your real estate career.

- Find a brokerage.

- Join the National Association of Realtors (NAR).

- Pay your dues.

- Find a mentor.

- Get crystal clear on who your ideal customer is.

- Build your personal brand.

Is it a good idea to start a real estate business?

Investing in real estate is one of the best ways to build wealth over time. Real estate prices have a remarkable history of increasing over time ─ and that's all money in your pocket.

Which real estate business is most profitable?

In conclusion, there are several types of real estate that can be profitable for investors. The most profitable types of real estate include commercial properties, rental properties, vacation rental properties, development opportunities, and REITs.

What is the easiest way to start in real estate?

One of the fastest ways to get started in real estate is by wholesaling. This unique strategy involves securing a property under market value and assigning an end buyer to purchase the contract. Wholesalers never own the property and instead make money by adding a fee to the final contract.

What score do I need to pass Colorado real estate exam?

What score do I need to pass the Colorado real estate exam? In order to pass the Colorado real estate examination, students will need at least a 75% on the National portion and a 71.5% or higher on the State portion.

What is the minimum score on the Florida real estate exam?

75%

There are 100 multiple choice questions on the exam. Test takers get three and a half hours to complete it. Applicants must score at least a 75%, or 75/100 questions, correct to pass.

What score do I need to pass Texas real estate exam?

What Score Do You Need to Pass the Texas Real Estate Exam? In order to pass your test, you will need to get a score of 70% or higher. This means you will need to answer 56 out of the 80 questions correctly.

Is the Louisiana real estate test hard?

Upon follow up after the test, most do not consider the exam "easy." The best way to alleviate your nerves and pass the test is to work hard and prepare as much as possible.

How many times can I fail Colorado real estate exam?

How many times can you retake real estate exam in Colorado? You can take the state broker license exam as many times as necessary to pass both the national and state portions. The fee to retake both sections or a single section is $42.50.