A short sale is a transaction in which the lender, or lenders, agree to accept less than the mortgage amount owed by the current homeowner. In some cases, the difference is forgiven by the lender, and in others the homeowner must make arrangements with the lender to settle the remainder of the debt.

What is the downside of a short sale on a home?

The disadvantages of a short sale: You need to take responsibility for the sale of your home vs walking away in a foreclosure. The approval process can be time-consuming (we take care of that for you). There are potential tax ramifications for either a short sale or foreclosure.

What is the process of short selling?

Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then buy the same stock back later, hopefully for a lower price than you initially sold it for, and pocket the difference after repaying the initial loan.

How fast can you short sell a house?

A short sale can take up to six months to be approved because many factors can slow the process down. You might be able to reduce the time it takes to be approved by asking your agent for some information before making an offer.

Is it a good idea to short sell?

Short sellers bet on, and profit from, a drop in a security's price. This can be contrasted with long investors who want the price to go up. Short selling has a high risk/reward ratio: It can offer big profits, but losses can mount quickly and infinitely due to margin calls.

Is a short sale bad for the buyer?

Although the short sale property will be priced according to market value, the lender is highly motivated to sell in order to cut the bank's losses. As a result, buyers can often get a better deal on the home than they would if it was purchased through a typical sale.

Here's how to buy after a short sale or foreclosure https://t.co/ZNsScV7uDm pic.twitter.com/r561sSMXy9

— Realtor.com (@realtordotcom) March 26, 2017

Why are short sales so cheap?

A lot of times, a short sale property is priced lower than similar houses because the homeowner is in a hurry to get out of their mortgage and avoid a foreclosure. So you could save some money. But short sales take a long time to close and often fall through because the lender won't agree to sell the home at a loss.

Why is a short sale risky?

For a short sale to close, everyone who is owed money must agree to take less, or possibly no money at all. That makes short sales complex transactions that move slowly and often fall through. If you're a seller, a short sale is likely to damage your credit — but not as badly as a foreclosure.

What is the purpose of a short sale of a home?

A short sale is when a mortgage lender agrees to accept a mortgage payoff that's less than the outstanding balance, usually in order to facilitate a sale of the property. The lender forgives the owner — typically someone in financial distress — the remaining balance of the loan.

Who benefits from a short sale?

Short sales allow a homeowner to dispose of a property that is losing value. Although they do not recoup the costs of their mortgage, a short sale allows a buyer to escape foreclosure, which can be much more damaging to their credit score.

What is the process for a short sale?

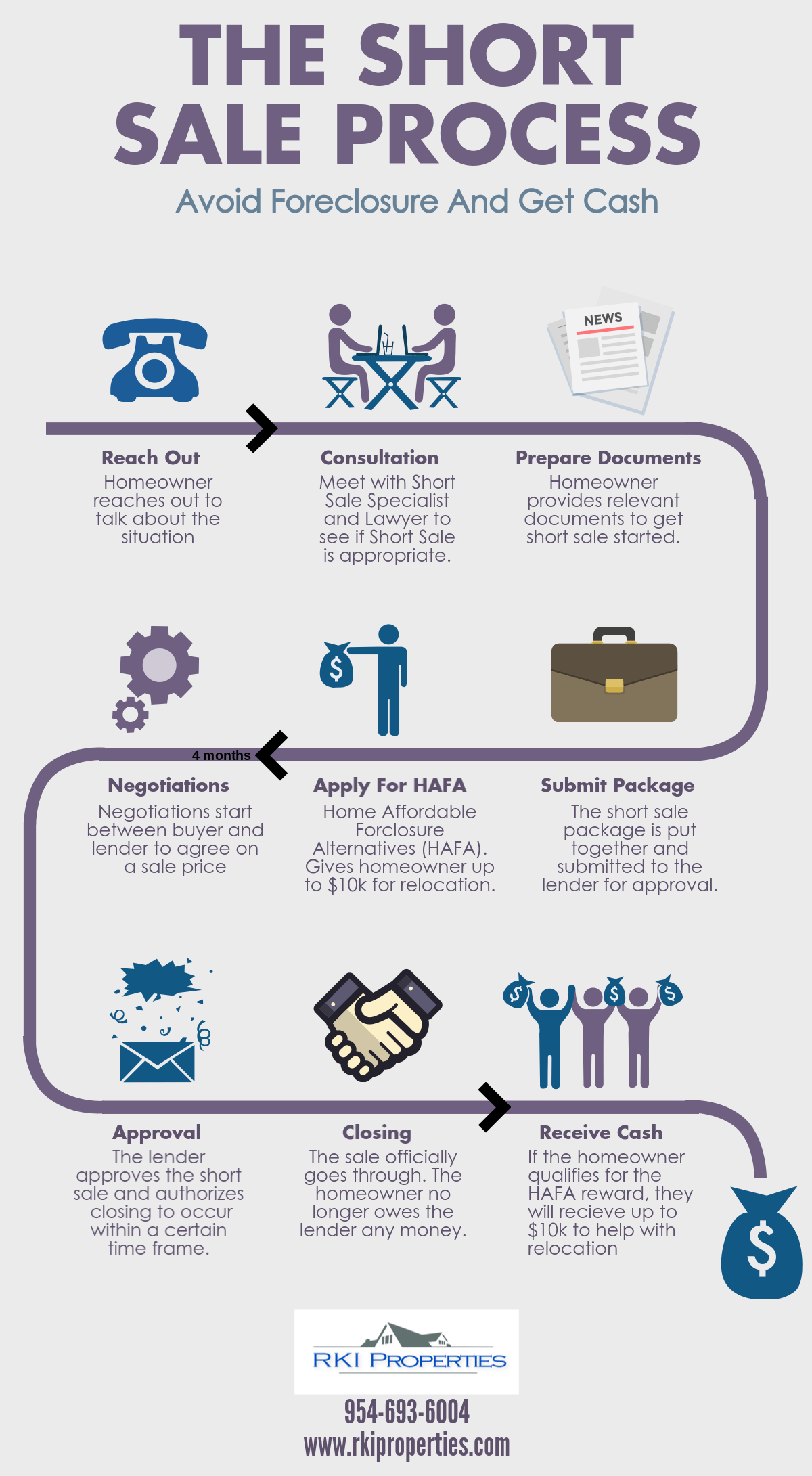

How The Short Sale Process Works

- Get Your Initial Approval. Initial approval from your mortgage lender is crucial because it states how much you can borrow to purchase a home.

- Find A Real Estate Agent.

- Make An Offer.

- Have A Home Inspection.

- Wait For Lender Approval.

- Close On The Home.

What are the basics of a short sale?

A short sale is a transaction in which the lender, or lenders, agree to accept less than the mortgage amount owed by the current homeowner. In some cases, the difference is forgiven by the lender, and in others the homeowner must make arrangements with the lender to settle the remainder of the debt.

What makes a short sale risky?

For a short sale to close, everyone who is owed money must agree to take less, or possibly no money at all. That makes short sales complex transactions that move slowly and often fall through. If you're a seller, a short sale is likely to damage your credit — but not as badly as a foreclosure.

What are the steps in a short sale?

Here's how to short sale your home in California

- Qualify for a California short sale.

- Begin the short sale process.

- List your house on the market.

- First level offer review begins.

- Proceed to the Second Level Offer Review.

- Negotiate.

- Close on the house.

- If required, get help with the short sale process in California.

Can a owner make money on a short sale?

The popular belief was that sellers couldn't profit from a short sale. However, there are actually a few ways that sellers can get paid to do a short sale. Not all of them are legal, though, so it's important to do your homework.

Can you negotiate short sale price?

While it is possible to negotiate the purchase price for a home that is being sold via short sale, there is no guarantee that the mortgage lender will approve the price. And because the final price requires approval of the lender, it can be more time consuming to negotiate the price.

What is a short sale and why is it bad?

A short sale is when a homeowner sells their house for less than they owe on their mortgage. A short sale usually takes longer than a normal transaction because the homeowner's lender must approve the sale. A short sale is better for a homeowner than a foreclosure, but you really want to try to avoid either situation.

What is the downside of buying a short sale home?

The main downside of buying and selling a short sale home is that the deal often falls through. The seller's lender may not agree to list it as short sale. As the buyer, short sale homes are usually fixer-uppers, meaning you'll likely have a lot on your plate once the deal goes through.

How is a short sale actually beneficial for the homeowner?

Short sales allow a homeowner to dispose of a property that is losing value. Although they do not recoup the costs of their mortgage, a short sale allows a buyer to escape foreclosure, which can be much more damaging to their credit score.

What a buyer needs to know in a short sale?

5. Get a home inspection. A short sale home is likely to be sold as-is, meaning the seller won't make repairs, so it's vital that you know its condition. Order the home inspection from a licensed home inspector right after the seller's lender has approved the sale.

What are the risks to a buyer of a short sale?

Buyers of a short sale should be prepared for the possibility of structural problems, pest infestations, or any number of potential issues that might end up driving up the home's cost over time. Keep in mind that there's also no guarantee you'll know what the home's problems are upfront.

Can you negotiate price on short sale?

The answer is an emphatic “Yes!” It is very much possible to negotiate a short sale. However, short sale negotiations are usually more time-consuming and more complicated compared to traditional sales.

How to negotiate a short sale house?

The key is to find out how much the bank will need to part ways with the home. More often than not, your initial offer will never be accepted. Most short sales come with a lot of back-and-forth negotiations. Therefore, you should focus more on why the bank should sell the home—not how much.

Can you negotiate a lower price on a short sale?

While it is possible to negotiate the purchase price for a home that is being sold via short sale, there is no guarantee that the mortgage lender will approve the price. And because the final price requires approval of the lender, it can be more time consuming to negotiate the price.

Can you offer under asking on a short sale?

If the list price is too low, the bank will reject the short sale. Moreover, a low list price could be a strategy used by the listing agent and seller to entice multiple offers on the short sale. In short, the list price of a short sale could mean nothing at all.

What is the lowest you can offer on a house?

“The rule I've always followed is to never go more than 25% below the listed price,” he says. “Chances are, after fees, commission, and sentimental value, the sellers are already hurting. If you dip below that point, they may disregard your offer entirely.”

How does a short sale affect the buyer?

Although the short sale property will be priced according to market value, the lender is highly motivated to sell in order to cut the bank's losses. As a result, buyers can often get a better deal on the home than they would if it was purchased through a typical sale.

What is the short sales rule?

What is the Short-Sale Rule? The short-sale rule was a trading regulation in place between 1938 and 2007 that restricted the short selling of a stock on a downtick in the market price of the shares.

What is the quickest a house sale can go through?

It's fairly simple. A cash buyer has no searches! How long to complete with the average cash buyer is a bit dependent upon them. Typically you can expect the sale to happen between fourteen days and a month after the two of you have made the agreement.

What happens when you short sell a house?

In a short sale, the home sells for less than the seller owes, so the lender won't get all their money back. As a result, the original lender must agree to the sale. The seller must prove they have no other option. The seller needs to show some sort of hardship.

Is a quick sale and short sale the same thing?

A short sale, or a quick sale, is when a homeowner decides to sell the property for an amount significantly lower than the mortgage debt. In many cases, homeowners struggling to keep up with their mortgage payments want to avoid foreclosure and often prefer a short sale.

At what point do most house sales fall through?

But when is a house sale most likely to fall through? It can happen early on due to mortgage issues, In the middle after the survey, Or at the last minute due to gazumping or a sudden change of heart.

What are the consequences of a short sale?

In the end, short sales are almost always damaging to your credit, but they do less harm than foreclosures or bankruptcies. A short sale might block you from a mortgage on a new home for two years or so, but a foreclosure or bankruptcy could keep you out of the market for as long as seven to 10 years.