One other way to earn an exemption on capital gains is to buy a “like-kind” house or property. What this means is a house of equal or greater value than the property that you've sold. There are often restrictions that require you to have purchased the new home within 180 days of selling your older house.

How do I avoid long term capital gains tax on real estate?

Fortunately, the IRS gives homeowners and real estate investors ways to save big. You can avoid capital gains tax by buying another house and using the 121 home sale exclusion. In addition, the 1031 like-kind exchange allows investors to defer taxes.

Do you have to pay capital gains when you sell your house in NY?

What is the 6 year rule for capital gains tax?

Here's how it works: Taxpayers can claim a full capital gains tax exemption for their principal place of residence (PPOR). They also can claim this exemption for up to six years if they moved out of their PPOR and then rented it out.

Do I have to buy another house to avoid capital gains?

Do I have to pay taxes on gains from selling my house in NY?

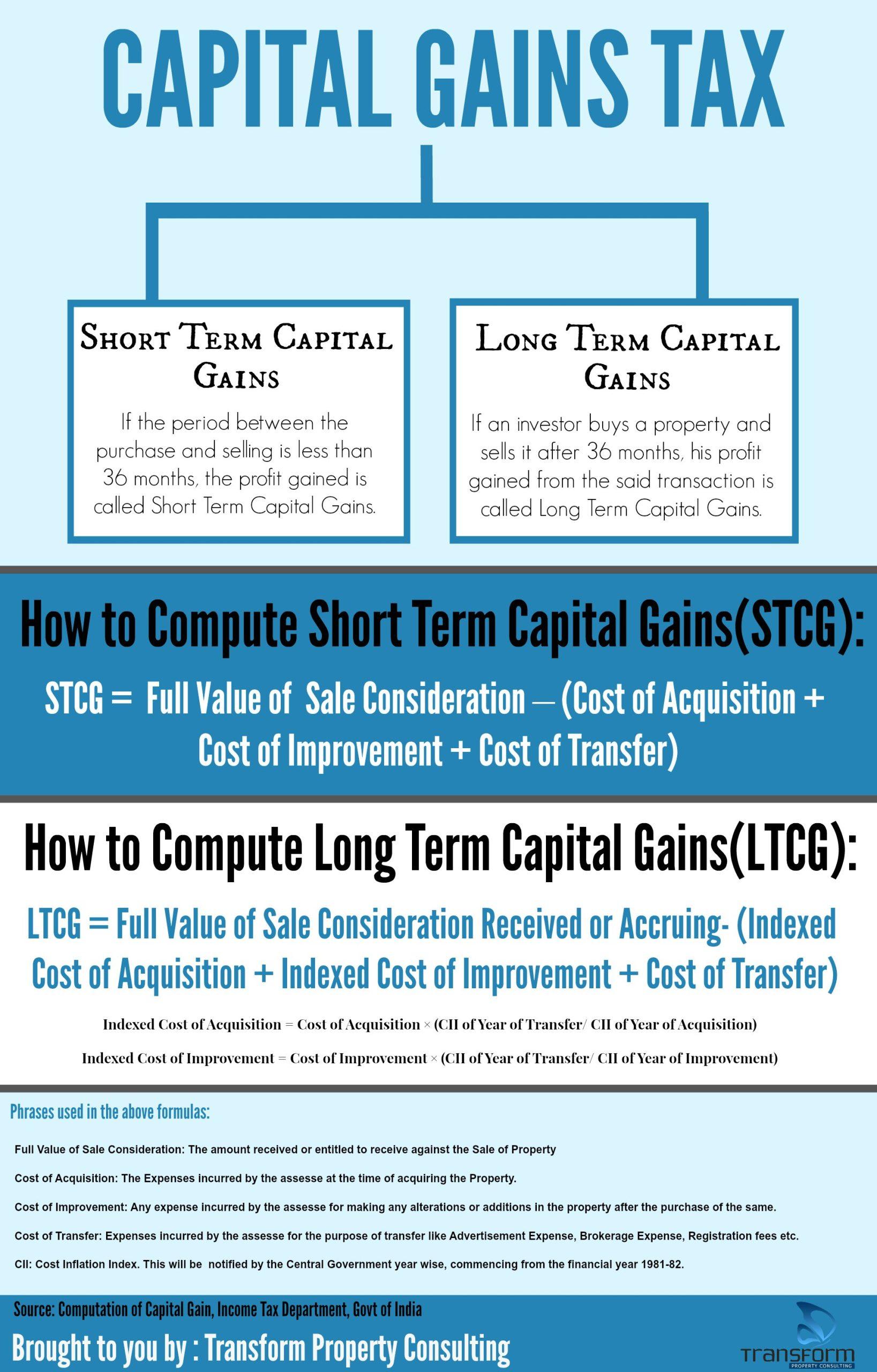

How do I calculate capital gains tax on sale of home?

- Determine your basis.

- Determine your realized amount.

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference.

- Review the descriptions in the section below to know which tax rate may apply to your capital gains.

Frequently Asked Questions

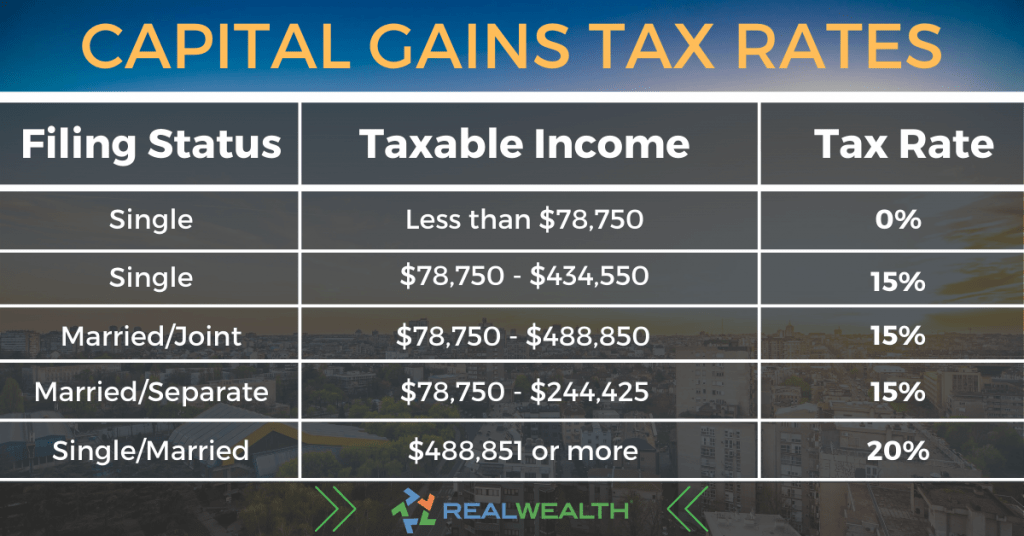

What is the capital gains tax rate for 2023?

For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

Do I have to pay taxes on the sale of my home in New York City?

In NYC, both buyers and sellers are subject to transfer taxes. These taxes are imposed when property ownership is transferred from one party to another. The transfer tax rates are calculated based on the property's sale price and are typically expressed as a percentage of the total transaction amount.

What taxes are paid when selling a property that was transferred in NYC?

The tax is usually paid as part of closing costs at the sale or transfer of property. Residential Type 1 or Type 2 sales or transfers: If the consideration is $500,000 or less, the rate is 1% of the consideration. If the consideration is more than $500,000 the rate is 1.425%

How is capital gains calculated on sale of rental property?

What are current capital gains rates?

It is owed for the tax year during which the investment is sold. The long-term capital gains tax rates for the 2022 and 2023 tax years are 0%, 15%, or 20% of the profit, depending on the income of the filer.1 The income brackets are adjusted annually.

What is the capital gains tax on $200 000?

= $

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

What is the current capital gains tax in NY?

New York taxes capital gains as income and the rate reaches 8.82%.

FAQ

- What are the taxes on buying property in New York?

New York Property Taxes

The average effective property tax rate in the Big Apple is just 0. 88% – more than half the statewide average rate of 1.6 9%. In fact, many New York counties (outside of New York City) have rates exceeding 2.50%, which is more than double the national average of 1.07%.

- Who is exempt from transfer tax in NY?

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada).

- How to sell your own home in New York State?

- Step 1: Price Your Home for Sale. Listing price is the single most important factor that will help you sell your house fast in New York.

- Step 2: Prep Your Home for Sale.

- Step 3: Market Your Home.

- Step 4: Manage Showings.

- Step 5: Review, Compare, and Negotiate Offers.

- Step 6: Close the Sale with a Professional.

- How often can you exclude gain on sale of home?

Once every two years

You're only allowed to exclude gain on the sale of a home once every two years. This is true unless the reduced gain exclusion rules apply. You usually can't exclude the gain on the sale of a home if both of these apply: You sold another home at a gain within the past two years.

- How do you calculate capital gains tax on the sale of a home?

Capital Gains Taxes on Property

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains.

- How much capital gains tax on $200,000?

= $

Jan 11, 2023Single Taxpayer Married Filing Jointly Capital Gain Tax Rate $0 – $44,625 $0 – $89,250 0% $44,626 – $200,000 $89,251 – $250,000 15% $200,001 – $492,300 $250,001 – $553,850 15% $492,301+ $553,851+ 20%

How to reduce long term capital gains tax from real estate sale in ny

| What is the $250000 $500000 home sale exclusion? | The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9. |

| How much will I owe in capital gains tax? | How the capital gain is taxed depends on filing status, taxable income and how long the asset was owned before selling. The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. |

| What is the tax on selling an apartment in NYC? | Combined NYC and NYS Transfer Taxes for sellers in New York City is between 1.4% and 2.075% of the sale price. Both NYC and New York State charge a separate transfer tax. Calculate Seller Transfer Taxes in NYC: Purchase Price: … |

| Do you have to pay capital gains when you sell your house in New York? | Generally speaking, capital gains taxes are around 15 percent for U.S. residents living in the State of New York. If the hose is located within New York City, you have to account for another 10% in NYC taxes. However, it's possible that you qualify for an exemption. |

| How capital gains tax is figured on sale of rental property? | If you own the investment property for more than a year, the long-term federal capital gains tax can be 0%, 15%, or 20%, depending on your income bracket. On top of that, California will charge another 1% to 13.3% when you sell. So, if you're a millionaire, your total capital gains taxes will be 33.3%. |

| How much is capital gains tax on real estate in NYC? | Between 15% and 20% The federal capital gains tax rate can vary depending on several factors, including the time the property was owned and the seller's income level. The capital gains tax rate for real estate sales in New York is between 15% and 20%. |

- How much does IRS take from home sale?

If you sell a house or property in one year or less after owning it, the short-term capital gains is taxed as ordinary income, which could be as high as 37 percent. Long-term capital gains for properties you owned for over a year are taxed at 0 percent, 15 percent or 20 percent depending on your income tax bracket.

- How much tax do I pay on a home sale in NYC?

The federal capital gains tax rate can vary depending on several factors, including the time the property was owned and the seller's income level. The capital gains tax rate for real estate sales in New York is between 15% and 20%.

- Does the IRS track home sales?

- Whenever others participate in a transaction, there is a good chance that they will report the dealing to the IRS. Even if you decide not to do so, the disclosure from other folks who are involved would be enough for the IRS to track down enough information to potentially engage in an audit or open a case against you.

- How much do you pay in taxes when you sell a house in New York?

The capital gains tax rate for real estate sales in New York is between 15% and 20%.

- What are real estate taxes in NY?

The average effective property tax rate in New York City is 0.88%, which is more than half the statewide average of 1.69%. In fact, several counties in New York (outside of New York City) have rates that surpass 2.5%, which is more than double the national average of 1.07%.

- Do sellers pay closing costs in NY?

While you and the buyer can be liable to pay the closing costs, it is almost always the buyer who pays it. In New York, closing costs for sellers range from 8% to 10%, although this is if you have paid the 6% agent commission. Your closing costs are also typically higher than that of buyers.