Are property records public in Texas?

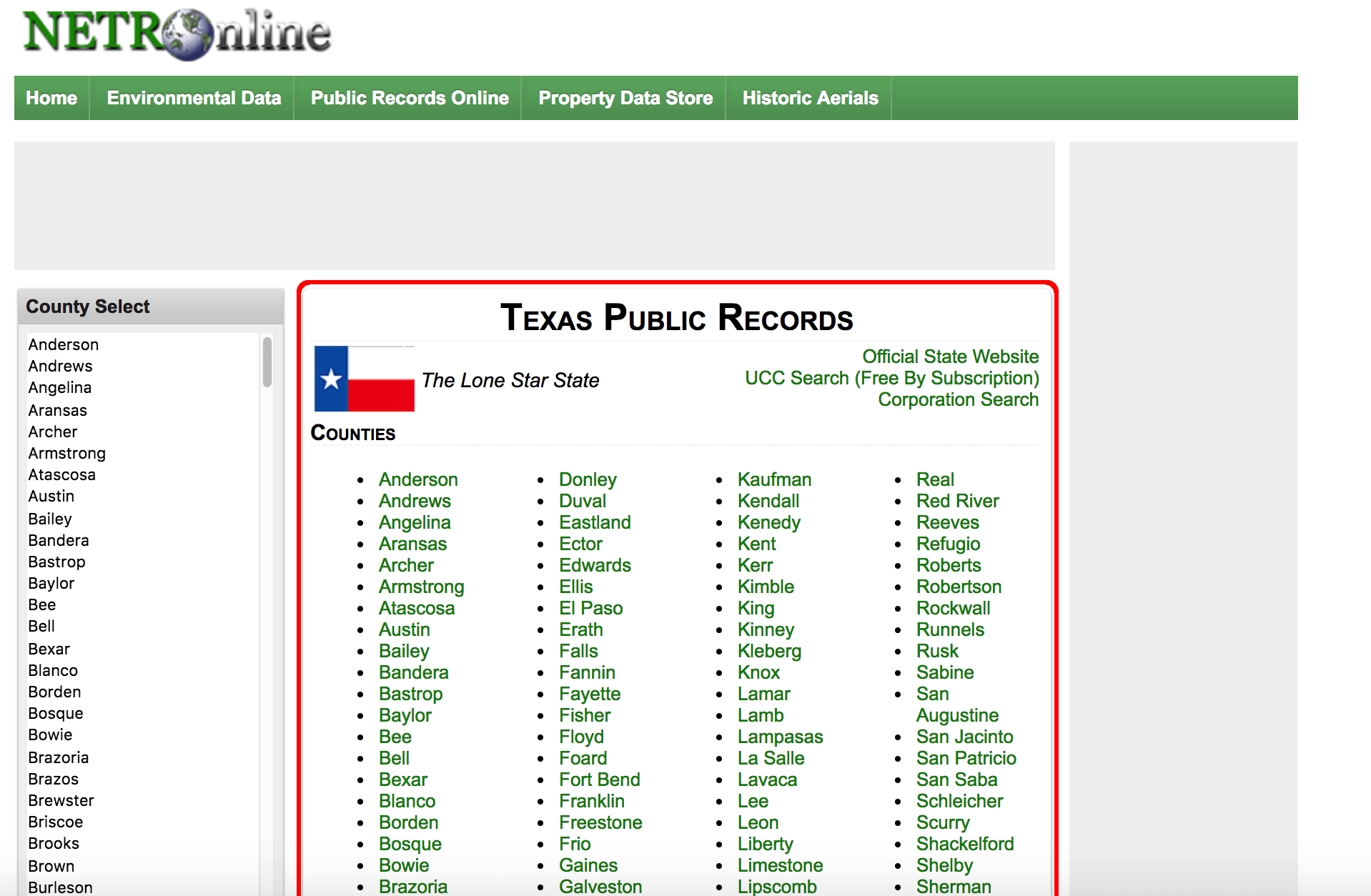

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records".

How do I find information on a property in Texas?

In order to conduct a property title search on your own without paying a lawyer or a title company, you should head to your county clerk's office. In Texas, each county clerk's office is responsible for keeping detailed property records – these records are public, and therefore available for you to view.

What is the difference between market value and appraised value in Texas?

Appraised value and market value are different because of who determines the value in each case. A professional appraiser's analysis is much more objective and detailed, while market value is subjective. For this reason, it's expected that appraised value and market value won't be the same.

What are property tax values in Texas?

Texas Property Taxes

Property taxes in Texas are the seventh-highest in the U.S., as the average effective property tax rate in the Lone Star State is 1.60%. Compare that to the national average, which currently stands at 0.99%. The typical Texas homeowner pays $3,797 annually in property taxes.

How do delinquent tax sales work in South Carolina?

The Delinquent Tax Collector must take possession of the delinquent property, and then may sell such property in order to satisfy the outstanding delinquent liability after a series of notices as described in S.C. Title 12 of the S.C.

President @realDonaldTrump welcomes @LouisVuitton to the great state of Texas! pic.twitter.com/f86UkGxTof

— The White House 45 Archived (@WhiteHouse45) October 18, 2019

How many years can you be behind on property taxes in Missouri?

Per Missouri Statutes, real estate properties with three or more years of delinquent property taxes are offered at the Collector of Revenue's annual tax sale on the fourth Monday in August. The 2023 tax sale has ended, and the auction books will be posted on this page after all processing has concluded.

Frequently Asked Questions

How long can property taxes go unpaid in South Carolina?

Thirty days

Once a tax bill is delinquent, an execution notice is issued upon the property for which the tax bill is assessed. If the tax bill remains unpaid thirty days after the execution notice is mailed, a Notice of Seizure is issued upon the property. This notice is required to be mailed "Certified-Restricted Delivery."

What is the adjusted area of a property?

Adjusted-square-feet are measured from the outside of the building and include garages, open patios, covered entries, and carports. These parts of a building are calculated using a fraction of their actual square feet.

What does effective year built mean?

The effective year generally represents the tax year the building value was extended on the tax roll for the first time. It is normally the year after the certificate of occupancy was issued for the building. In some instances, the effective year is adjusted when the property was significantly renovated or remodeled.

How long does a California real estate broker have to keep records?

Three years

How long. The DRE requires that transaction files be retained for three years. This retention period begins as of the date of the closing of the transaction, or if there is no closing from the date of the listing.

What types of records must a California brokerage retain for at least three years?

A licensed broker must retain for three years copies of all listings, deposit receipts, canceled checks, trust account records, and other documents executed by or obtained by the broker in connection with any transaction for which a license is required.

How long do real estate brokers have to keep records in Texas?

According to TREC reasonable record retention for the following documents is four years: Closing Statements, Contracts, Leases, Lease Applications, Inspections, Financial Records for the License Holder's clients, Financial Records for the License Holder's operations, Seller's Disclosure Notices, Notes within the

What is the statute of limitations on real estate disclosure in California?

3 years

If a seller fails to disclose defects, it would be considered fraud. Under California law the statute of limitations for fraud cases is 3 years. Generally the cause of action for failing to disclose is for fraud. When you assert fraud you have 3 years to bring forth your cause of action.

Who can prepare a deed in Texas?

Attorney

To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed. Be prepared to provide basic information about both the property in question and the individuals who need to be listed on the title.

FAQ

- What are the requirements for a deed in New Jersey?

- Preparing and Recording Requirements for a New Jersey Deed

- The deed and related documents must be prepared in black, legible type so it can easily be read and scanned or photocopied.

- The name of the Grantors (e.g., sellers) as they appeared on the prior deed must be on the first page.

- How do I get a property deed in California?

- Property ownership information can be requested from the County Registrar-Recorder/County Clerk. For more information, please visit their website to Request a Real Estate Record.

- What are the requirements for a deed in NY?

- A deed must be notarized before it is recorded or delivered to the new owner. A deed that is not notarized may be, as an alternative, signed by at least one witness who attests that the deed was signed by the owner and delivered to the new owner. New York has statutory model notary certificates for deeds.

- How do I make a deed in Texas?

- Requirements For A Valid Deed In Texas

- The Form of the Deed. In Texas, a deed must be in writing and signed by the person transferring the land.

- Identifying the Parties to the Transfer.

- Describing the Land in the Deed.

- Executing or Signing the Deed.

- Delivery and Acceptance of the Deed by the Grantee.

- Are property records public information in New York?

This web page provides information about using the City Register Office. Please contact the Richmond County Clerk for properties on Staten Island. Property records are public. People may use these records to get background information on purchases, mortgages, asset searches and other legal and financial transactions.

- How do I find property records in New York?

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

- How do I find out who owns a property in New York State?

- Each city has an office or agency where people may search for data when it comes to any residential or commercial property in New York. The documents are typically kept at the town hall, the county's courthouse, or the county recorder's office.

- What is NYC Acris?

The Automated City Register Information System (ACRIS) allows you to search property records and view document images for Manhattan, Queens, Bronx, and Brooklyn from 1966 to the present. Find a Property Borough, Block and Lot (BBL) or Address. Access Deeds and Other Recorded Documents.

How to read real estate property records texas

| What records are public in New York? | These include vital records (birth and death certificates, marriage and divorce licenses), criminal records, court records, professional licenses (such as medical, law, and driver's licenses), tax and property records, reports on publicly-traded companies, and FOIA or FOIL-able documents related to the operations of |

| How do I check for tax liens in Maryland? | Go to Maryland Case Search to search for court judgments against the property's owner. Unpaid taxes on the property may result in a lien. Visit your local county or city's finance office to find property tax or other municipal liens. |

| At what age do seniors stop paying property taxes in Maryland? | The Senior Tax Credit is available to homeowners at least 65 for whom the property is their principal residence (see the HOTC page for details); Interested homeowners must submit the Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation (SDAT). |

| How do I buy tax delinquent property in Virginia? | Delinquent Tax Sale at Public Auction Information is posted on the County calendar as soon as a list of properties is finalized and an auction date is set. Lists are not available until 3 weeks prior to the auction. You may sign up to be notified of upcoming auctions by emailing the Collections Division. |

| How do I pay my Talbot County property taxes online? | If paying online, visit https://paylocalgov.com/talbotcounty-md and follow the instructions, or over the phone, call 1-888-877-0450. Value Payment Systems charges a fee for the service. |

| Do liens expire in Maryland? | (2) If the property is subject to a special valuation under § 7-211 of this article, a lien: (i) arises on the date on which the interest in the property vests in possession; and (ii) continues for 20 years. |

| Can you look up who owns a house in Florida? | Contact the County Clerks Office

As long as you know a property's location, you can contact the county clerk's office to learn more about the owner. Florida has 67 counties. It's fairly easy to narrow down a property's county even when you have limited information about the location and tenants. |

| How do I look up property records in Florida? | Most records are searchable and accessible through the internet from the Board of Trustees Land Document System (BTLDS). A mapping component of BTLDS also provides a graphical depiction of parcel locations. These documents are stored in a climate-controlled vault. |

- How do I find the owner of a specific property?

- 9 Ways To Find Out Who Owns A Property You Want

- Visit The Local Assessor's Office.

- Check With The County Recorder.

- Ask A Title Company.

- Talk With A Real Estate Agent.

- Contact A Real Estate Attorney.

- Search The Internet.

- Visit Your Local Library.

- Knock On The Door.

- 9 Ways To Find Out Who Owns A Property You Want

- How to find out if someone owns property in the United States?

- Public resources for finding a property owner

- Consult the county clerk's office.

- Try the tax assessor.

- Pay a visit to the library.

- Consult a title search company.

- Talk to a real estate attorney.

- Engage a real estate agent.

- Professional record-finding resources.

- Public resources for finding a property owner

- Who owns the property in Florida when there is a mortgage?

A mortgage is a document that conveys title (legal ownership interest) to a buyer (the mortgagor) and gives the lender (the mortgagee, usually a bank) a security interest in the property being sold (the collateral), which in turn guarantees the payment of the home loan debt.

- What are the disadvantages of a lady bird deed in Texas?

- Disadvantages

- Not Ideal for Multiple Beneficiaries: A lady bird deed is not ideal if you want to leave the property to multiple beneficiaries.

- Title Insurance Can Be Tricky: Title insurance companies may not want to insure a property subject to a lady bird deed, especially if there are multiple beneficiaries.

- Disadvantages

- What are the benefits of a ladybird deed in Texas?

- Lady Bird Deeds

- The right to a life estate in the property, including rights to use, possess and collect income from it for life;

- The right to sell the property and keep the proceeds;

- The right to mortgage the property and to use the equity for yourself; and.

- The right to revoke or amend the deed.

- Lady Bird Deeds

- What are the tax implications of the Lady Bird deed in Texas?

Tax Consequences of Ladybird Deeds

This can allow the beneficiary to sell the property without incurring income taxes on the sale. The deeds also do not trigger Federal gift taxes. They are not completed gifts for gift tax purposes. The property does remain in the decedent's taxable estate for estate tax purposes.

- Does a lady bird deed need to be recorded in Texas?

In order for a Transfer on Death Deed to be valid, it must be signed, notarized, and recorded in the property records of the county where the property is located. In contrast, a Lady Bird Deed does not have a recording requirement. All that is required for a deed to be valid in Texas is delivery to the Grantee.

- What are the limitations of a ladybird deed?

Disadvantages of a lady bird deed

Lady bird deeds are currently used only in Florida, Texas, Michigan, Vermont and West Virginia. Insurance companies in other states won't insure property that passes through a lady bird deed, so if you live in any of the other 45, you'll need a different estate planning method.