Understanding Comparables

The use of comparables involves comparing the characteristics of a recently sold asset with the characteristics of a similar asset that is being valued. This can help to determine the value of the asset based on its similarities to the recently sold asset or set of assets.

What are the 3 types of appraisal reports?

Appraisal reports that communicate either complete or limited appraisals may be presented in three formats: self-contained reports, summary reports, and restricted reports.

What does an appraisal tell about the value of a property?

An appraisal is the best way to estimate your property's fair market value based on the location, condition and recent sales of similar homes in the surrounding area. Beyond an estimate of how much your property is worth, an appraisal also indicates the amount a lender will let you borrow for a property.

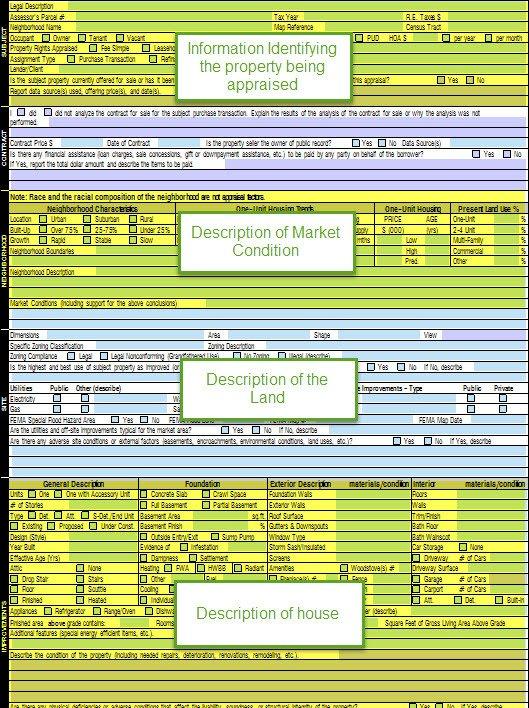

How to read a 1004 appraisal?

For a 1004 appraisal report, it is six pages. Page one contains the subject, contract, neighborhood, site, and improvement sections. Page two contains the sales comparables, with the reconciliation at the bottom. The following page may include additional comparables (Which are not counted in the page count).

What is the rule of three comparables in real estate?

The Rule Of Three

These three homes should be as similar and located as closely together as possible. Once at least three comps are selected, each one is thoroughly examined to pinpoint how it differs from the home in question.What is the next step after the appraisal?

After the appraisal, the next step is underwriting. The mortgage lender reviews the loan file to ensure that everything is in order, assesses the risk, and either approves or denies the application. Some borrowers might receive conditional approval, meaning that some item needs to be resolved or explained.

Congrats to our MS in Real Estate Analysis & Development program for being recently approved by @TheAppraisalFdn! The #SmealMSREAD program now meets the real property appraiser qualification criteria.

— Penn State Smeal (@SmealCollege) February 4, 2021

Read the full story: https://t.co/EgFx0rIMp6 pic.twitter.com/S307yZS4Ft

What happens in the final appraisal?

The appraiser will consider the home's overall condition, any upgrades or improvements made to the property and do market research into similar homes in the area to calculate a final appraised value, which is then compiled into an appraisal report and sent back to your mortgage lender.

Frequently Asked Questions

What happens in underwriting after appraisal?

After a professional appraiser places a value on the property, the underwriter compares the appraisal to the amount of your mortgage. If the home is worth much less than the mortgage, your underwriter may suspend your application.

When an appraiser estimates the value of a property using the cost approach the appraiser should?

Under the cost approach, the appraiser first estimates the value of the land, as if the land were vacant. He then estimates how much it would cost to rebuild, at today's prices, all of the improvements on the property.

What is a certified opinion or estimate of value of a particular property as of a particular date?

Definition of Appraisal

An appraisal report is usually a written statement of the appraiser's opinion of value of an adequately described property as of a specified date.Which type of appraisal report is the most comprehensive?

Self-contained appraisal report

Self-contained appraisal reportThis is the most detailed report of the three and will also be the most thorough.

What is the most common type of appraisal report?

There are four home appraisal types for the mortgage loan process. The four types are the full appraisal, exterior-only appraisal, the rental analysis, and the broker price opinion. A full appraisal is the most common type of appraisal.

Which type of report provides the most comprehensive explanation of the appraiser’s reasoning?

It is written for court cases and out-of-town clients who need all of the factual data. It gives the comprehensive reasoning of the appraiser as well as the value opinions. These reports are often classified as Self-Contained Reports, which are governed by Standards Rule 2-2(a) of USPAP.

What is a comprehensive appraisal report?

An appraisal report is a comprehensive report outlining a property's estimated value based on multiple factors, for example, its quality, location, and condition.

What is the formula for real estate comps?

This is done by dividing the selling price of each comp on your list by its square footage. Then, add them up and divide the total by the number of comps. To get a reasonable estimate of the price of the subject investment property for sale, you simply multiply the average price per square foot by its square footage.

FAQ

- What is the number one rule of adjusting comparables?

As a rule, the fewer the total number of adjustments, the smaller the adjustment amounts, and the less the total adjustment amount, the more reliable the comparable.

- What is an example of a comparable in real estate?

Typically, comps also come from the same area and the same, recent time period. For example, if you're trying to sell a two-bedroom, one-bathroom house, your comps would include other two-bed, one-bath houses in your neighborhood that have sold in the past several months.

- What do appraisers look for in comps?

Essentially, it all boils down to finding the most similar, most recent, and closest in proximity comparables for your house. These are the comparables that should be the most similar and the best at helping the appraiser determine the value of your home.

- Who determines the form format and style of an appraisal report?

The appropriate appraisal report format is determined by the appraiser and the client, considering the appraisal's intended use and specific requirements of the client and regulatory agencies.

- What is the difference between a 1004 and a 1004C appraisal?

1004 - (URAR) Uniform Residential Appraisal Report - One Unit (Single Family) appraisal with an interior and exterior inspection. 1004C - Manufactured Home Appraisal Report - One Unit manufactured homes (mobile home) based on an interior and exterior property inspection.

- What is the standard appraisal form?

A URAR form, also known as Fannie Mae Form 1004, contains information needed to complete a full appraisal of a property using three primary approaches to determine value: cost approach, sales comparison approach and income approach.

- What are the appraisal forms?

What is a Performance Appraisal Form? A performance appraisal form, also called an employee performance appraisal form, is a tool used by people managers and HR teams to measure and benchmark the performance of employees. It helps evaluate the contributions and achievements of employees during a specific timeline.

- Who should fill the appraisal form?

- Most employers fill out a new appraisal form for each performance review. Highlight the employee's greatest achievements during the review period. Include what projects the employee successfully completed or what they did well.

How to read a property appraiser

| What is the land value ratio for Fannie Mae? | – Land Value exceeding 30% of market value The site value is typically required in an appraisal report, with or without the cost approach being included. If this land to market value percentage/ratio exceeds 30% a comment is warranted. This is often the situation on large parcels of land or water front lots. |

| What are the sections for the Uniform Residential Appraisal Report? | Common sections featured on a URAR form include: Basic information including address, legal description, owner's and/or borrower's names. Information on the contract for sale. Information pertaining to the size, shape, zoning and access to utilities as well as FEMA flood-zone information. |

| When appraisers look past how a property is being used? | When appraisers look past how a property is being used to determine a more optimal function, what are they determining? Highest and best use looks past the current use (if there is one) to determine if there is another use that provides a higher value. |

| What are the rules for Fannie Mae appraisals? | Fannie Mae permits an appraisal to be based on the “as-is” condition of the property as long as any minor conditions, such as deferred maintenance, do not affect the safety, soundness, or structural integrity of the property, and the appraiser's opinion of value reflects the existence of these conditions. |

| Does Fannie Mae have a limit on acreage? | No, Fannie Mae does not have a strict acreage limit. However, it emphasizes that the property's value must be primarily attributed to the residential dwelling rather than the land. |

| What are the 4 steps of the appraisal process? | Appraisal Process

|

| What is the appraisal steps in real estate? | The appraiser will visit the property and spend an hour or two inspecting the interior and exterior, measuring the square footage, and evaluating the home's features and fixtures. Additional research will include a comparison of other similar homes that have been sold recently (known as "comps"). |

- What are the 8 steps in the appraisal process?

- Q-Chat

- Define appraisal problem.

- Determine the scope of work.

- Collect and verify the data.

- Analyze the data.

- Estimate the value of the site.

- Apply three approaches to value.

- Reconcile various value indicators to reach final value estimate.

- Prepare and deliver appraisal report.

- Q-Chat

- How does an appraisal work in California?

How do home appraisers in California determine the value of a house? The short answer is, they compare each property to similar homes that have sold recently in the same area (subtracting or adding value as needed). Based on this evaluation, the appraiser will determine an estimate value for the home.

- How is property value calculated in Texas?

Property value is determined by the county appraisal district and is based on factors such as size, location, condition, and any improvements or changes made to the property. Tax rates vary based on the taxing entities associated with each property, including the city, school, and water district.

- What is the 10 percent property tax rule in Texas?

Texas Property Tax Code Sec 23.23 limits increases of the total assessed value to 10% from year to year if the property is under homestead exemption. This 10% increase excludes any improvements added by the property owner. This section does not limit market value increases.

- Are Texas property taxes based on market value or appraised value?

Per the Texas Property Tax Code, all taxable property must be valued at 100% of market value as of January 1 each year.

- How much can appraisal district increase property value in Texas?

A Texas county appraisal distict may not increase the appraised value of a homestead by more than 10% in a given tax year. The homeowner's property tax is based on the county appraisal district's appraised value of the home.

- What is the formula to find the value of a property?

- Property Value Formula

- Property Value, Capitalization Approach = Net Operating Income (NOI) ÷ Cap Rate (%)

- Net Operating Income (NOI) = Effective Gross Income (EGI) – Direct Operating Expenses.

- Effective Gross Income (EGI) = Potential Gross Income (PGI) – Vacancy and Credit Losses.

- Property Value Formula