Here are a few:

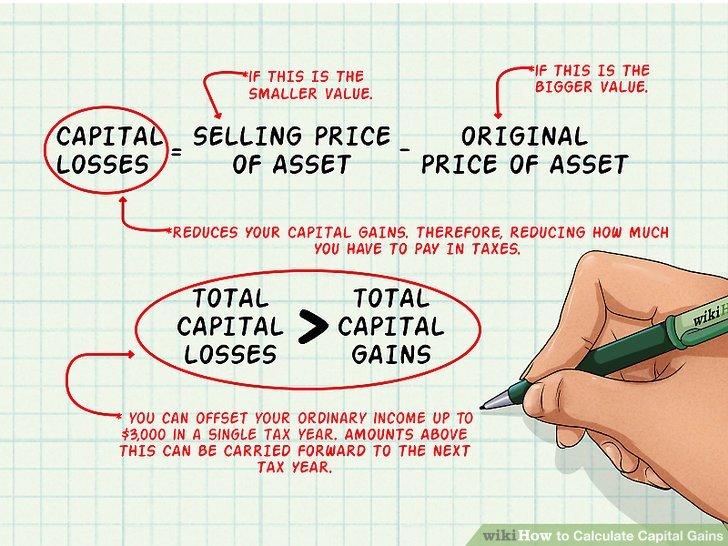

- Offset your capital gains with capital losses.

- Use the Internal Revenue Service (IRS) primary residence exclusion, if you qualify.

- If the home is a rental or investment property, use a 1031 exchange to roll the proceeds from the sale of that property into a like investment within 180 days.13.

How long do I have to buy another property to avoid capital gains?

Within 180 days

How Long Do I Have to Buy Another House to Avoid Capital Gains? You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

Can you write off capital gains tax on real estate?

Capital gains taxes can apply to the profit made from the sale of homes and residential real estate. The Section 121 exclusion, however, allows many homeowners to exclude up to $500,000 of the gain from their taxable income. Homeowners must meet certain ownership and home use criteria to qualify for the exemption.

What is a simple trick for avoiding capital gains tax on real estate investments?

One of the easiest ways to evade paying capital gains tax after selling your rental property is to invest in a retirement plan. You can invest in a 401(K) or an individual retirement account (IRA). Retirement plans enable you to buy and sell property within the retirement account without attracting capital gains tax.

What are the rules for offsetting capital gains?

To begin offsetting within the same tax year, you must subtract any capital losses from any capital gains you have in the year in question. Accordingly, if you have both capital gains and losses in a given year, you should use the losses to reduce or completely wipe out your taxable capital gains for that year.

How can I reduce my taxes when selling my rental property?

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

Real estate is one of the most tax advantaged investment strategies out there.

— Melanie Baldridge (@recostseg) March 23, 2023

Real estate pros buy property using leverage and bonus depreciate to perpetually defer taxes.

Making millions a year and often paying $0 in taxes.

Short Term Rentals supercharge this:

RE pros use…

How to calculate the capital gains of a rental property when it is sold?

Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

Do buyers pay realtor fees in PA?

Once the sale is final, both realtors will split a commission fee which is calculated by the purchase price of the home. This fee is paid by the seller, but it is calculated into the overall cost of the home. So, once you make the transaction on the home or property sale, you've done your part in “paying” the agents.

Do buyers pay realtor fees in Michigan?

Who pays realtor fees in Michigan? In Michigan, home sellers pay real estate commission fees out of the final sale proceeds for both agents involved in a deal. Offering to pay for the buyer's agent's commission is an incentive for agents to show your home to their clients.

Do buyers pay closing costs in PA?

Both the seller and the buyer each pay their share of closing costs in Pennsylvania, as they do in all states. Often, sellers pay more in closing costs than buyers because they typically cover real estate commissions, which can run up to 6 percent of the final sale price.

Do tenants pay for water in NJ?

Property owners are responsible for any and all water, sewer, and refuse charges incurred by tenants occupying their property. While owners can make tenant payment of utilities part of their rental or lease agreement, the owner will be responsible for any outstanding charges left by the tenant.

What are the renters rights in Texas?

Your rights as a tenant include the right to "quiet enjoyment," a legal term. This means your landlord cannot evict you without cause or otherwise disturb your right to live in peace and quiet. If other tenants in your building are disturbing you, you should complain to the landlord.

What do most apartments include in rent?

What's typically covered by rent

- Natural gas:

- Internet and cable TV:

- Furnishings:

- Insurance:

- Damage:

- Maintenance:

- Cleaning: Unless you live in a luxury apartment, house-cleaning services generally aren't covered as part of the rent.

- Storage: More and more apartments are offering on-site storage—for an additional cost.

Why you should not overprice your home?

You'll Lose Potential Buyers

As a general rule, overpricing your home may lead to buyers not even considering it. Walker says that pricing on the high side should only be considered - even in a strong seller's market - when the seller is willing to be patient with the days on market it may take to sell.

What to do if the house you want is overpriced?

Present Evidence to Show That the Home Is Overpriced

The best way to justify a lower offer is to use objective market data. When making an offer on a house, be sure to include a detailed comparative market analysis report that you used to base your offer price on.

How do you know if a house is overpriced?

5 Signs That A House Is Overpriced

- It Doesn't Match The Price Of Similar Listings.

- It's Been On The Market For A Long Time.

- The List Price Doesn't Align With The State Of The Home.

- The Price Doesn't Match Your Calculations.

- The Home Hasn't Received Much Attention.

How do you get a seller to come down on price?

Top eight phrases to use when negotiating a lower price

- All I have in my budget is X.

- What would your cash price be?

- How far can you come down in price to meet me?

- What? or Wow.

- Is that the best you can do?

- Ill give you X if we can close the deal now.

- Ill agree to this price if you.

- Your competitor offers.

Should I list my house higher than value?

Don't overprice

If you believe your appraisal came back too high, don't be tempted to list your home for that inflated price. Overpricing can lead to a price cut or a stale listing, both of which can be red flags for buyers.

What to do after you pass the real estate exam Illinois?

Now that you have passed your Illinois broker real estate exam your next step should be to find a managing broker to work under. Once you have been hired by an Illinois license broker, you can submit your license application.

How long do you have to take real estate exam after course in Florida?

The course completion is good for two (2) years from the date of completion. An expired course will not be accepted at the exam site and you will not be able to sit for your exam without proof of a valid course completion slip.

What happens after you pass real estate exam Ohio?

Once you pass the exam, you can apply for a license. Requirements vary by state, but you'll likely need to submit proof of completing a real estate course and a passing grade on the exam. You also will need to submit to fingerprinting and a background check during this process.

What is the hardest part of the real estate exam?

The area of the exam that is considered the most challenging varies from person to person, but many people find that the Practice of Real Estate and Disclosures section is the most difficult. This section takes up 25% of the exam and has between 37-38 questions to answer.

How long do you have to take real estate exam after course in Illinois?

Two years

Within two years of completing your pre-license education, register for and take the real estate licensing exam with PSI (the license exam administrator). It is recommended that you thoroughly review the Illinois Real Estate Examination Program Candidate Handbook before registering.

Are you taxed on proceeds or gains?

Gains and losses from investment sales. You typically only have to pay taxes on the sale of investments when you receive a gain. To figure this out, you have to subtract the cost basis of your investment, which is normally what you paid, from the sale price to see if you had a gain or a loss.

What is the $250000 $500000 home sale exclusion?

The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9.

How do you calculate taxable gains on sale of property?

Determine your realized amount. This is the sale price minus any commissions or fees paid. Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

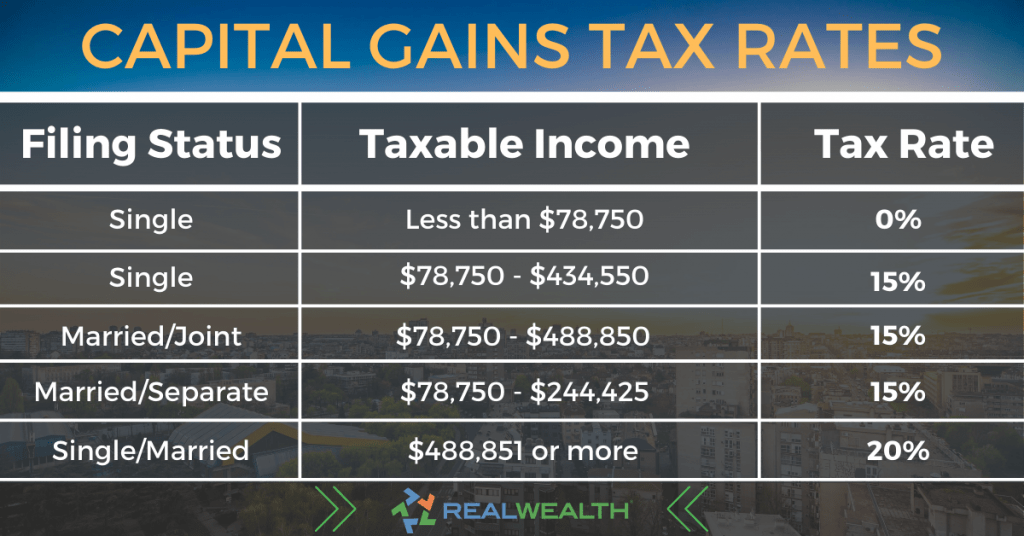

How much capital gains tax on $200,000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

Are you taxed on proceeds from sale of house?

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years. But it can, in effect, render the capital gains tax moot.

Should I buy a house now or wait for recession?

However, the Forbes Advisor suggests that waiting for a recession to buy a house may not be the best idea. The article states that home prices generally fall during recessions, but they can rise or fall depending on various factors such as supply and demand dynamics, geography, and outlook for the labor market 2.

Where is the best place to find real estate news?

The 10 Best Real Estate Sources in 2023

- Zillow. First on the list of best real estate news sources is Zillow.

- Realtor.com. Next on the list of the best real estate news websites, we have the well-known Realtor.com.

- Trulia. The third best source for real estate news is Trulia.

- Redfin.

- Mashvisor.

- Movoto.

- Homes.com.

- Remax.

Why is location important when buying a house?

One of the reasons why location is so important in real estate is that buyers often want and need close access to amenities and transportation options. This means relatively close proximity to restaurants, grocery stores, dry cleaners, shopping and entertainment.

Is location important when investing in real estate?

Location is one of the most important factors when it comes to investing in real estate. Location determines the demand and price of the property, which directly affects the return on investment.

Will 2023 or 2024 be a good time to buy a house?

Zillow has a similar forecast, as it expects home values to rise by 6.5% from July 2023 through July 2024, despite “despite persistent affordability challenges.” Likewise, Freddie Mac is forecasting prices rising by 0.8% between August 2023 and August 2024, followed by another 0.9% gain in the following 12 months.

What is the pass rate for the Nebraska real estate exam?

75%

The passing rate for the Nebraska Real Estate Salesperson Exam is 75%.

What is the pass rate for the Wisconsin real estate exam?

If it is marked “Fail,” then you will see a breakdown of your score in the different areas of the exam. If you decide to retake the exam, use this as a guide for your studies. The passing rate for the Wisconsin Real Estate Salesperson Exam is 75%.

What is the pass rate for the Missouri real estate exam?

The passing rate for the Missouri Real Estate Salesperson Exam is 70%.

What is the passing score for the Illinois real estate exam?

75%

What score do I need to pass the Illinois real estate exam? In order to pass the Illinois real estate exam, you'll need a score of at least 75%. Passing the exam is much easier (and less stressful) for anyone who has completed an Exam Prep course.

How hard is it to pass the Nebraska real estate exam?

We know you have a busy life, and sometimes, it's not realistic to study for hours every day in the weeks leading up to your Nebraska Real Estate licensing exam. That's okay, even just a few hours with our prep guide will mean you are able to pass your NE exam confidently – first try. Average pass rate is only 64%.

What scares a real estate agent the most?

1) Fear of rejection.

This is often the first thing to come to mind when realtors are asked to share their biggest fear, especially for those agents who are new to the industry. It's a scary thing to put yourself out there—to go door-knocking or cold-calling.

What not to tell a real estate agent?

Here are the 7 most important things to not tell your realtor when selling.

- What you think your home is worth.

- Your need to sell quickly.

- Plans for upgrades before selling.

- Non-mandatory legal information about your property.

- You're okay with an inflated history of dual agency.

- Your lowest acceptable selling price.

What is the biggest complaint about realtors?

High Commission Rates

The commission rate agents charge is often one of the biggest complaints against them. Many homebuyers and sellers feel that agents are charging too much for their services and that their fees are often not commensurate with the value of the services they provide.

Why do real estate agents not respond?

A good real estate agent could be working with several clients at a time, at different stages of a home sale transaction. When an agent is with a client showing homes or hosting an open house, it can be difficult to answer the phone because they want to be present and value that client's time and yours.

What is the biggest lie in real estate?

The biggest lie in real estate is that when you buy a property you actually own it. That's right. Real estate ownership in the United States is a lie. It doesn't matter if you have a mortgage against the property or you own it free and clear.

Are real estate taxes deductible IRS?

State and local real property taxes are generally deductible. Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare.

How do you report the sale of a house on your tax return?

Reporting the Sale

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

Is property insurance tax deductible?

Generally, homeowners insurance is not tax-deductible, nor are premiums, even though your premiums may be included in your mortgage payments. Why? Because homeowners insurance is not considered nondeductible expenses by the Internal Revenue Service (IRS).

Which of the following taxes will not qualify as an itemized deduction?

Answer and Explanation: The gasoline taxes paid on personal travel cannot be itemized.

What can a homeowner write off on taxes?

8 Tax Breaks For Homeowners

- Mortgage Interest. If you have a mortgage on your home, you can take advantage of the mortgage interest deduction.

- Home Equity Loan Interest.

- Discount Points.

- Property Taxes.

- Necessary Home Improvements.

- Home Office Expenses.

- Mortgage Insurance.

- Capital Gains.